Broken Arrow Oklahoma UCC1 Financing Statement is a legal document used to create a security interest in personal property as collateral for a loan or other financial transaction in Broken Arrow, Oklahoma. The Uniform Commercial Code (UCC) regulates this type of financing statement, providing a standardized process for lenders and borrowers. Keywords: Broken Arrow, Oklahoma, UCC1 Financing Statement, legal document, security interest, personal property, collateral, loan, financial transaction, Uniform Commercial Code, lenders, borrowers. Types of Broken Arrow Oklahoma UCC1 Financing Statements: 1. General UCC1 Financing Statement: This type of financing statement is used when a lender wants to establish a security interest in a wide range of personal property owned by the borrower. It covers all assets belonging to the debtor, including inventory, equipment, accounts receivable, and other tangible and intangible properties. 2. Specific Collateral UCC1 Financing Statement: When a lender wants to secure a loan with a specific asset or group of assets, such as a vehicle, machinery, or intellectual property, a specific collateral UCC1 financing statement is utilized. This statement describes the specific item(s) being used as collateral, providing the lender with a priority claim in case of non-payment or default by the borrower. 3. Fixture Filing UCC1 Financing Statement: In cases where personal property is permanently affixed to real estate, a fixture filing UCC1 financing statement is filed to establish the lender's security interest. These may include items like heating and cooling systems, machinery, or shelving units installed in a commercial property. This type of statement ensures that the lender's interest is protected in case of default or if the property is sold. 4. Farm Products UCC1 Financing Statement: When a borrower is engaged in farming or agricultural activities, a farm product UCC1 financing statement is used to secure loans related to farming operations. This statement covers crops, livestock, and other farm-related assets, providing lenders with a priority interest. It is essential for lenders and borrowers in Broken Arrow, Oklahoma, to understand the different types of UCC1 Financing Statements available and ensure their compliance with the appropriate regulations when securing loans or transactions involving personal property.

Broken Arrow Oklahoma UCC1 Financing Statement

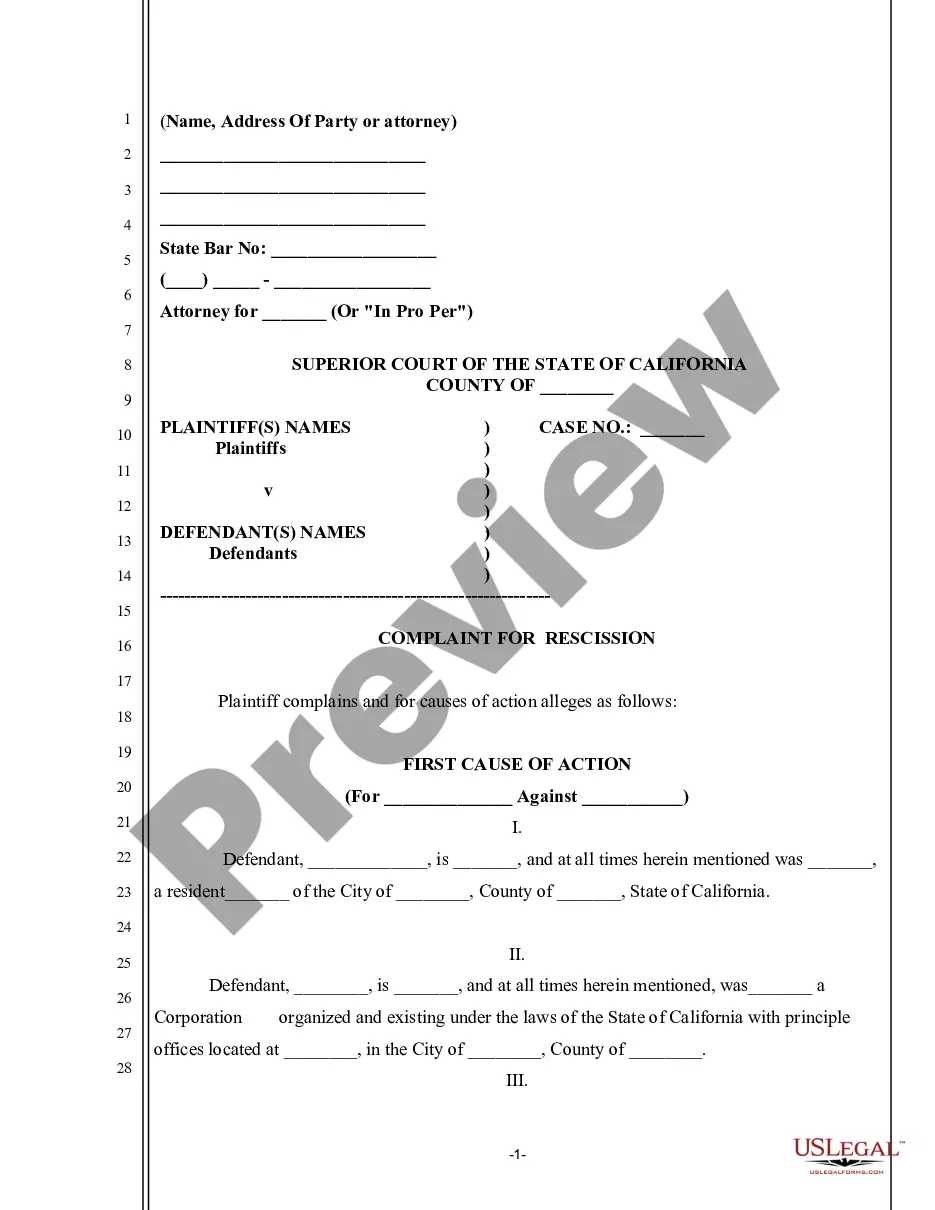

Description

How to fill out Broken Arrow Oklahoma UCC1 Financing Statement?

If you’ve already used our service before, log in to your account and download the Broken Arrow Oklahoma UCC1 Financing Statement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make certain you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Broken Arrow Oklahoma UCC1 Financing Statement. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!

Form popularity

FAQ

The second method Article 9 provides for dealing with unauthorized filings involves Section 9-518. This section, entitled ?Claim Concerning Inaccurate or Wrongfully Filed Record?, provides a non-judicial means for a debtor to correct a UCC record that was inaccurate or wrongfully filed.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

The proper place to file a financing statement in order to perfect a security interest is the UCC Central Filing Office, located in the Offices of the Oklahoma County Clerk. Transmitting Utilities and EFS Forms are filed at the Secretary of State.

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

A uniform commercial code (UCC) filing is a notice registered by a lender when a loan is taken out against a single asset or a group of assets. A UCC filing creates a lien against the collateral a borrower pledges for a business loan. The uniform commercial code is a set of rules governing commercial transactions.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

Box 2 ? Termination ? This is a termination of the effectiveness of the financing statement by the secured party. However, it is important to note that for a UCC1 filing a termination is only an amendment and that the UCC1 filing may be amended further, even after a termination has been filed.

1 filing is good for five years. After five years, it is considered lapsed and no longer valid. Should your debtor remain in debt to you and encounter financial difficulty or file for bankruptcy, you have no secured interest if your UCC1 filing has lapsed.