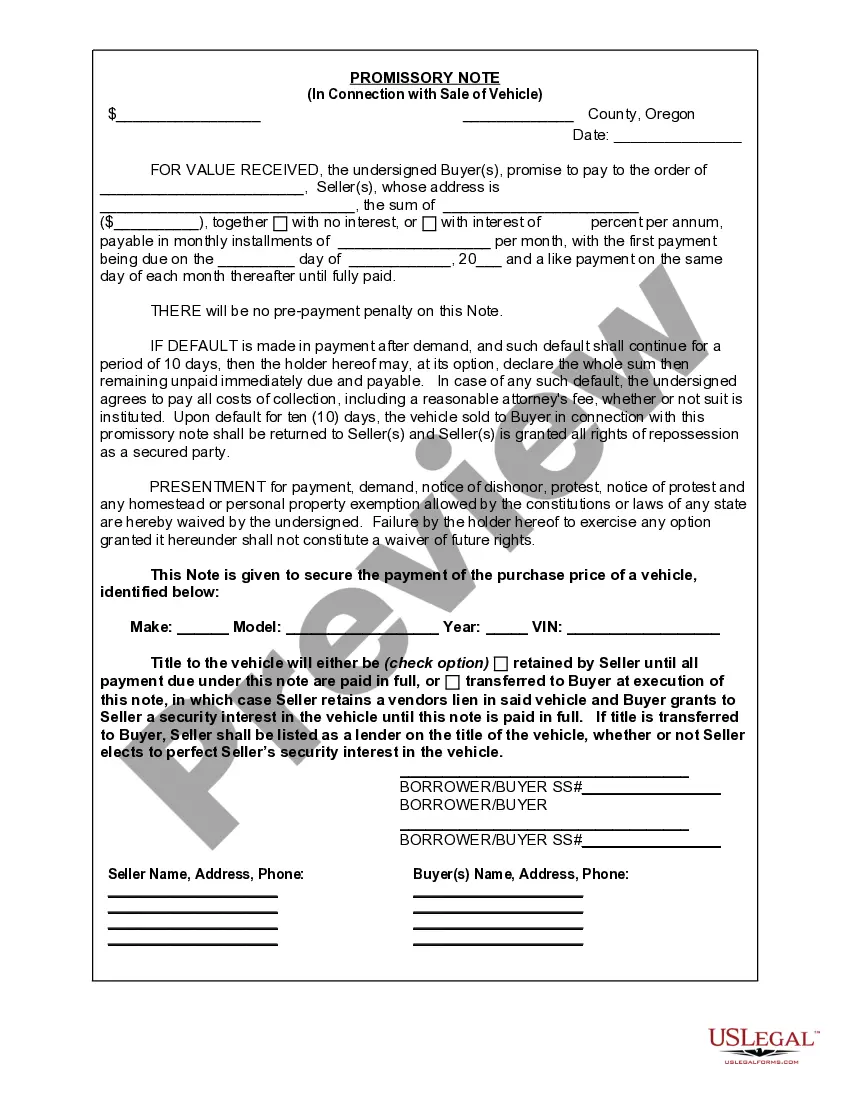

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

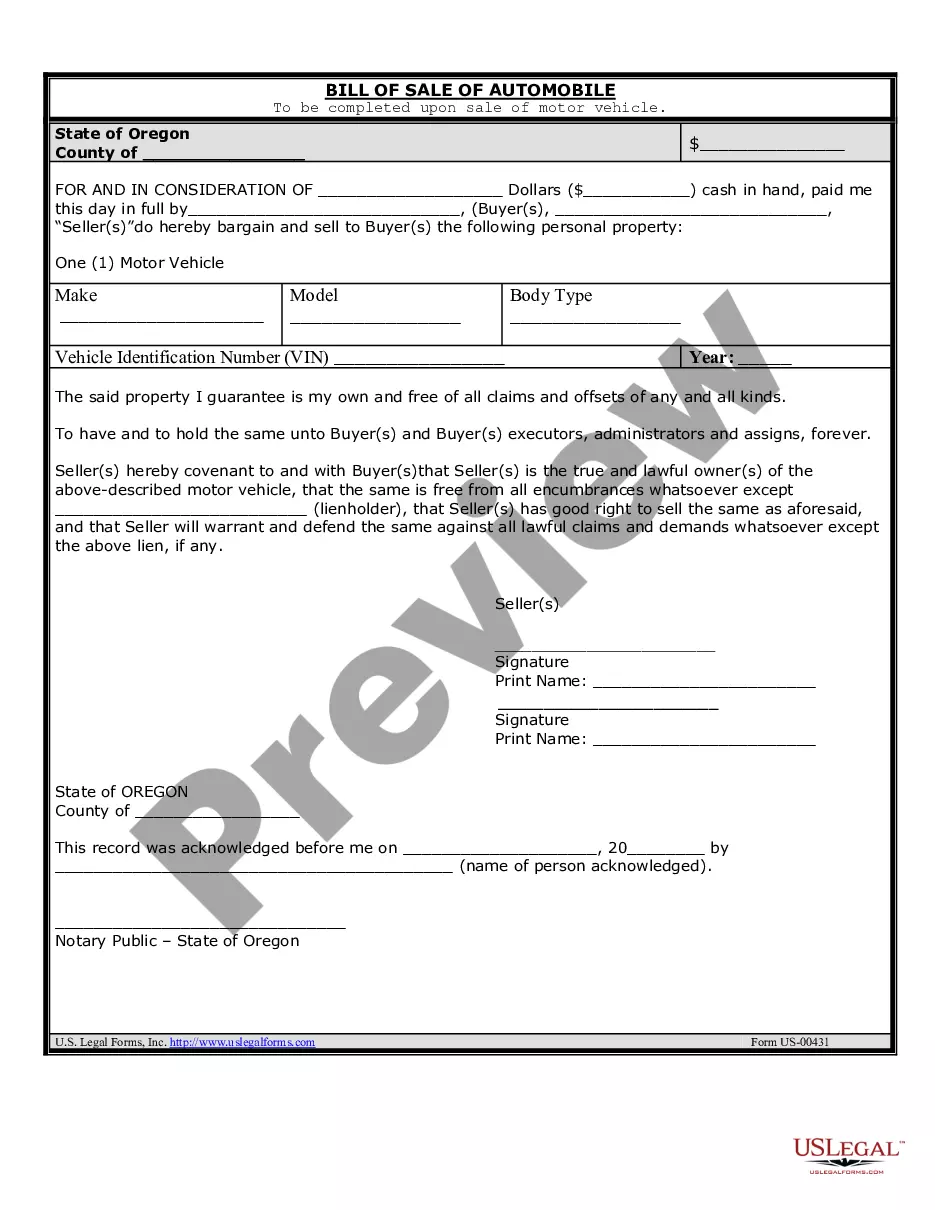

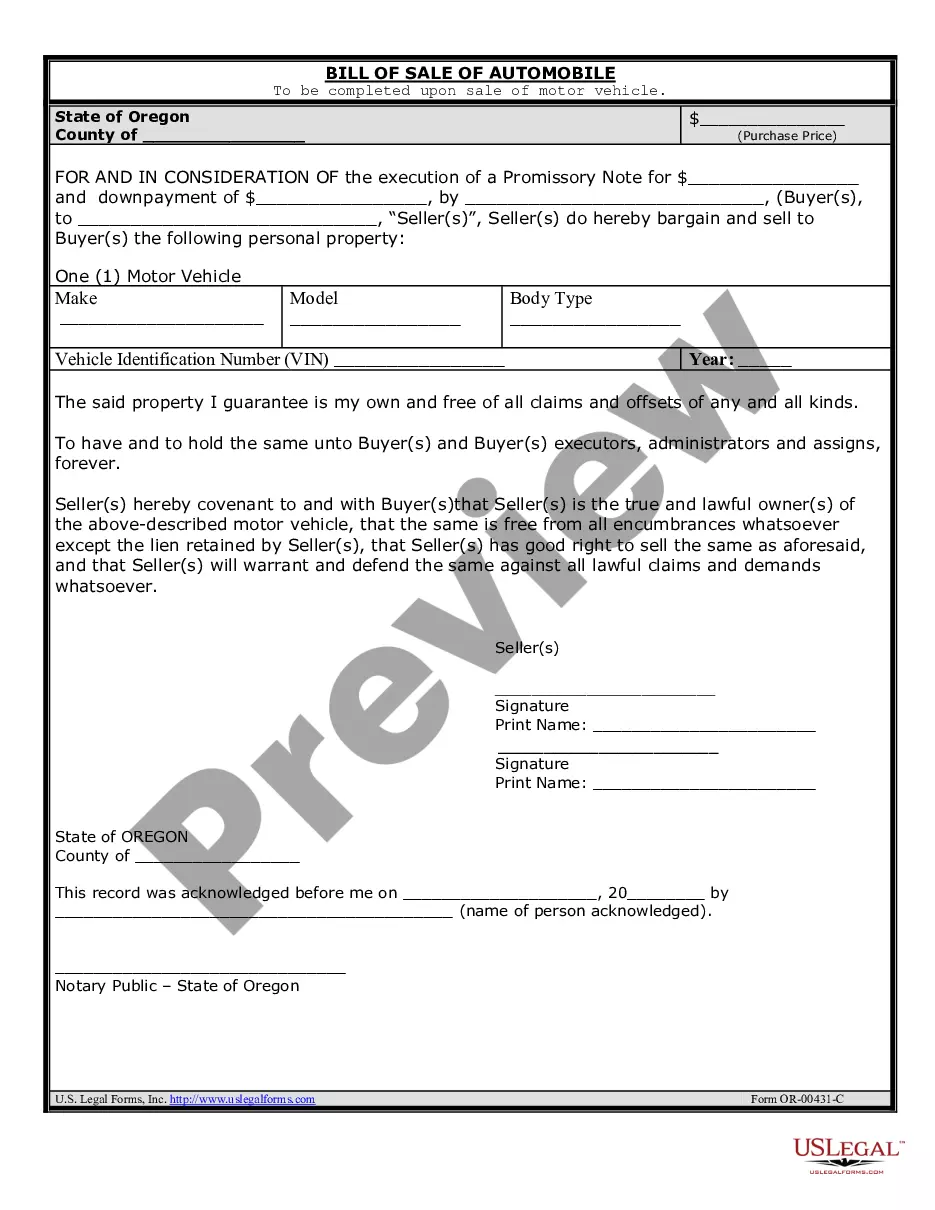

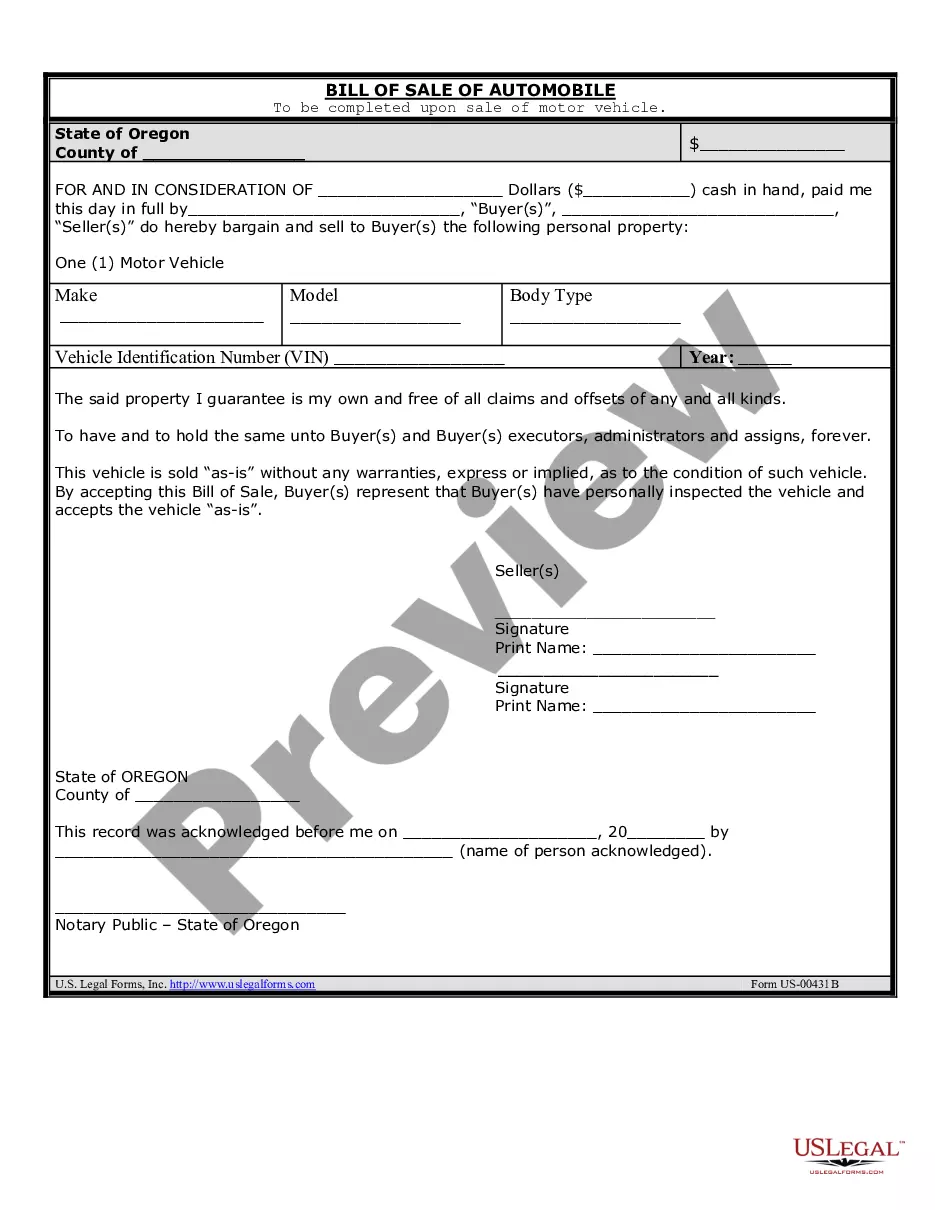

A Gresham Oregon Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and the seller of a vehicle in Gresham, Oregon. This promissory note serves as a binding contract and provides security for the seller, ensuring that the buyer will repay the loan amount in predetermined installments over a specified period of time. Keywords: Gresham Oregon Promissory Note, Sale of Vehicle, Automobile, legal document, loan agreement, buyer, seller, terms and conditions, repayment, installments, security. There are several types of Gresham Oregon Promissory Notes in Connection with Sale of Vehicle or Automobile that can be used based on specific circumstances or preferences: 1. Fixed Installment Promissory Note: This type of promissory note establishes a fixed payment schedule, with predetermined amounts and due dates. Both parties agree upon the number of installments and the interest rate, if applicable, to be paid until the loan is fully repaid. 2. Conditional Promissory Note: In certain situations, a seller may require additional terms and conditions to be met by the buyer before the loan is fully executed. These conditions may include providing collateral, acquiring insurance, or completing certain repairs on the vehicle. Once all conditions are met, the promissory note becomes effective. 3. Balloon Promissory Note: This type of promissory note involves smaller monthly payments over the term of the loan, with a larger "balloon payment" due at the end. The balloon payment allows the buyer to make lower monthly payments while deferring a significant portion of the purchase price to a later date. 4. Secured Promissory Note: A secured promissory note involves the buyer offering collateral, such as the vehicle being purchased, to secure the loan. If the buyer fails to make the scheduled payments, the seller has the right to repossess the vehicle to satisfy the outstanding debt. Before entering into a Gresham Oregon Promissory Note in Connection with Sale of Vehicle or Automobile, it is advisable for both parties to seek legal advice to ensure compliance with state laws and to protect their rights and interests. Additionally, it is essential to clearly outline the terms, payment schedule, interest rate (if applicable), consequences of default, and any other relevant provisions in the promissory note to avoid future disputes or misunderstandings.

A Gresham Oregon Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between the buyer and the seller of a vehicle in Gresham, Oregon. This promissory note serves as a binding contract and provides security for the seller, ensuring that the buyer will repay the loan amount in predetermined installments over a specified period of time. Keywords: Gresham Oregon Promissory Note, Sale of Vehicle, Automobile, legal document, loan agreement, buyer, seller, terms and conditions, repayment, installments, security. There are several types of Gresham Oregon Promissory Notes in Connection with Sale of Vehicle or Automobile that can be used based on specific circumstances or preferences: 1. Fixed Installment Promissory Note: This type of promissory note establishes a fixed payment schedule, with predetermined amounts and due dates. Both parties agree upon the number of installments and the interest rate, if applicable, to be paid until the loan is fully repaid. 2. Conditional Promissory Note: In certain situations, a seller may require additional terms and conditions to be met by the buyer before the loan is fully executed. These conditions may include providing collateral, acquiring insurance, or completing certain repairs on the vehicle. Once all conditions are met, the promissory note becomes effective. 3. Balloon Promissory Note: This type of promissory note involves smaller monthly payments over the term of the loan, with a larger "balloon payment" due at the end. The balloon payment allows the buyer to make lower monthly payments while deferring a significant portion of the purchase price to a later date. 4. Secured Promissory Note: A secured promissory note involves the buyer offering collateral, such as the vehicle being purchased, to secure the loan. If the buyer fails to make the scheduled payments, the seller has the right to repossess the vehicle to satisfy the outstanding debt. Before entering into a Gresham Oregon Promissory Note in Connection with Sale of Vehicle or Automobile, it is advisable for both parties to seek legal advice to ensure compliance with state laws and to protect their rights and interests. Additionally, it is essential to clearly outline the terms, payment schedule, interest rate (if applicable), consequences of default, and any other relevant provisions in the promissory note to avoid future disputes or misunderstandings.