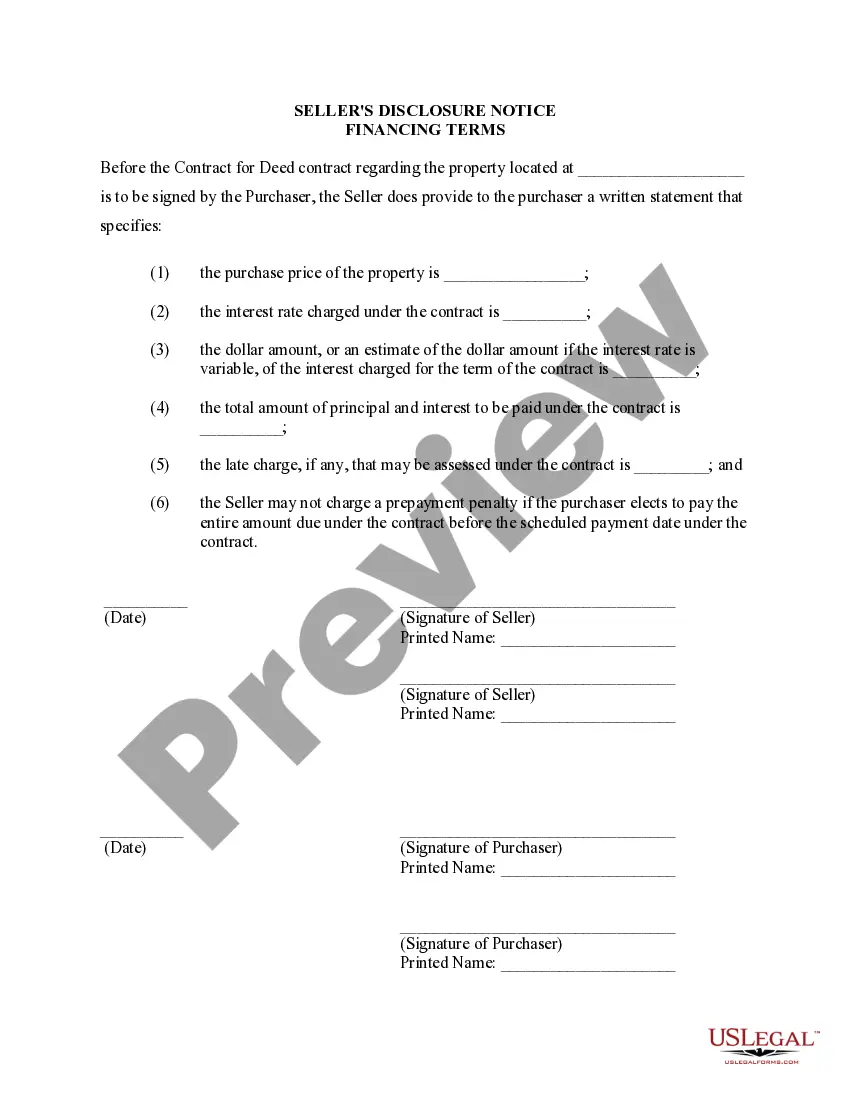

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Bend Oregon Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the details and terms related to the financing arrangement between the seller and the buyer. This disclosure is crucial for both parties involved in the transaction, as it provides transparency and clarity regarding the financial aspects of the property purchase. Below, we will discuss the key elements of this disclosure, outlining the different types available: 1. Interest Rate and Loan Terms: The seller's disclosure includes the interest rate that will be applied to the financing arrangement, along with the specific loan terms, such as the duration of the contract and any potential balloon payment or prepayment penalties. 2. Purchase Price and Down Payment: The disclosure will clearly state the agreed-upon purchase price of the property and the amount that the buyer is required to pay as a down payment at the time of signing the contract. 3. Monthly Payment Amount: This element specifies the monthly payment that the buyer is obligated to make to the seller. It typically includes the principal amount, interest, and any additional fees or charges applied to the loan. 4. Closing Costs: The disclosure will outline whether the buyer or seller is responsible for paying the closing costs. This may include fees associated with document preparation, title insurance, and escrow services. 5. Default and Remedies: This section explains the consequences of defaulting on the contract, including the remedies available to the seller in such a scenario, such as the right to retain any payments made by the buyer or initiate foreclosure proceedings. 6. Maintenance Responsibilities: The disclosure may include information regarding the buyer's responsibilities for property maintenance and repairs during the term of the agreement. 7. Assumption or Transferability: If the seller allows for the assumption or transfer of the land contract, this aspect will be clearly stated in the disclosure, including any associated fees or requirements. It is important to note that while the above elements are common in most Bend Oregon Seller's Disclosures of Financing Terms for Residential Properties, individual contracts may vary. It is crucial for both sellers and buyers to review and understand the specific terms outlined in the disclosure before signing any agreement for a deed or land contract. Consulting with a legal professional or real estate agent experienced in Bend, Oregon transactions is advisable to ensure compliance with local laws and regulations.The Bend Oregon Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the details and terms related to the financing arrangement between the seller and the buyer. This disclosure is crucial for both parties involved in the transaction, as it provides transparency and clarity regarding the financial aspects of the property purchase. Below, we will discuss the key elements of this disclosure, outlining the different types available: 1. Interest Rate and Loan Terms: The seller's disclosure includes the interest rate that will be applied to the financing arrangement, along with the specific loan terms, such as the duration of the contract and any potential balloon payment or prepayment penalties. 2. Purchase Price and Down Payment: The disclosure will clearly state the agreed-upon purchase price of the property and the amount that the buyer is required to pay as a down payment at the time of signing the contract. 3. Monthly Payment Amount: This element specifies the monthly payment that the buyer is obligated to make to the seller. It typically includes the principal amount, interest, and any additional fees or charges applied to the loan. 4. Closing Costs: The disclosure will outline whether the buyer or seller is responsible for paying the closing costs. This may include fees associated with document preparation, title insurance, and escrow services. 5. Default and Remedies: This section explains the consequences of defaulting on the contract, including the remedies available to the seller in such a scenario, such as the right to retain any payments made by the buyer or initiate foreclosure proceedings. 6. Maintenance Responsibilities: The disclosure may include information regarding the buyer's responsibilities for property maintenance and repairs during the term of the agreement. 7. Assumption or Transferability: If the seller allows for the assumption or transfer of the land contract, this aspect will be clearly stated in the disclosure, including any associated fees or requirements. It is important to note that while the above elements are common in most Bend Oregon Seller's Disclosures of Financing Terms for Residential Properties, individual contracts may vary. It is crucial for both sellers and buyers to review and understand the specific terms outlined in the disclosure before signing any agreement for a deed or land contract. Consulting with a legal professional or real estate agent experienced in Bend, Oregon transactions is advisable to ensure compliance with local laws and regulations.