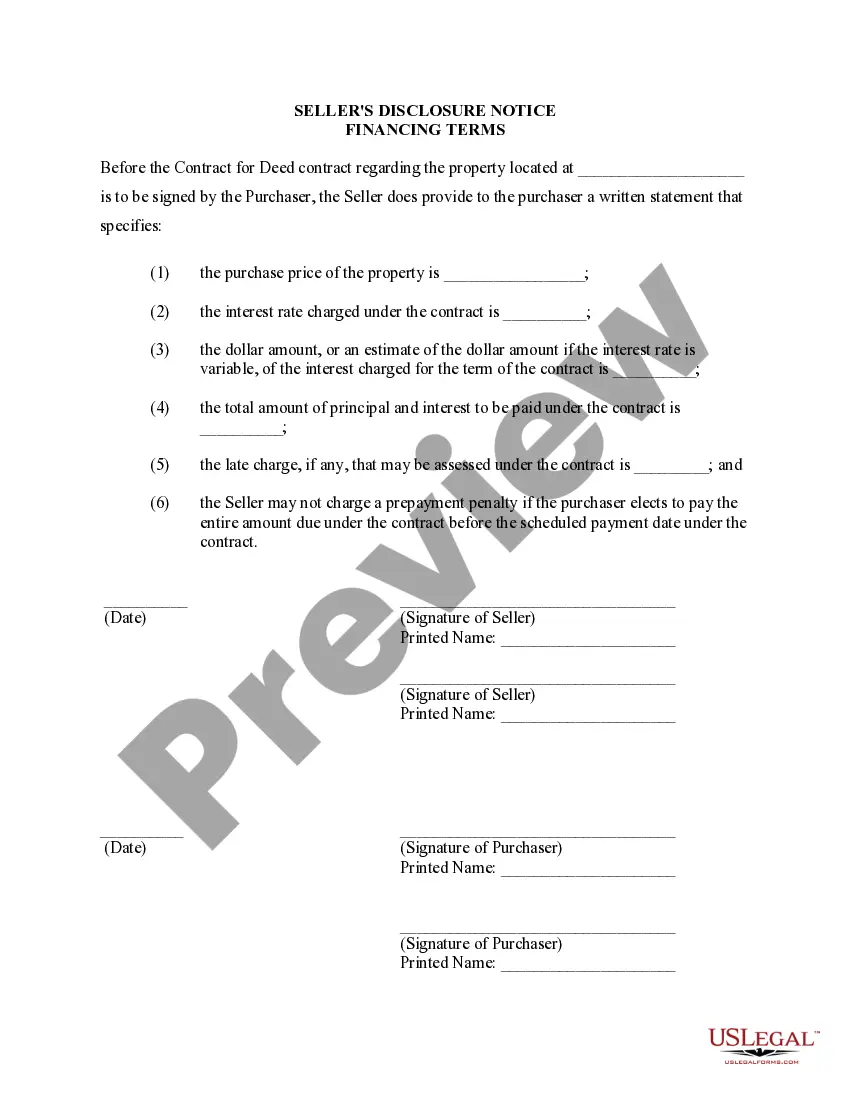

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Gresham Oregon Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that outlines the specific financing terms agreed upon between the seller and buyer in a real estate transaction. This transparent disclosure ensures that both parties are fully aware of the monetary aspects and responsibilities involved in the purchase of the residential property. Key Keywords: Gresham Oregon, Seller's Disclosure, Financing Terms, Residential Property, Contract or Agreement for Deed, Land Contract There are several types of Gresham Oregon Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, including: 1. Basic Financing Terms Disclosure: This type of disclosure focuses on providing fundamental financial details to the buyer. It may include the purchase price, down payment amount, interest rate, loan duration, and any other relevant terms related to the land contract agreement. 2. Payment Structure Disclosure: Sellers may choose to disclose the payment structure of the land contract, specifying the frequency and amount of payments required. This disclosure ensures that the buyer is aware of their financial obligations on a monthly or periodic basis. 3. Prepayment or Early Repayment Disclosure: In some cases, sellers may want to include details regarding prepayment or early repayment options. This disclosure clarifies whether the buyer has the option to pay off the land contract before the agreed-upon term without any penalties or if there are specific terms associated with early repayment. 4. Late Payment and Default Terms Disclosure: This type of disclosure highlights the consequences of late or missed payments and outlines the penalties, fees, and potential remedies that may be employed by the seller in such situations. It ensures potential buyers understand the repercussions of failing to fulfill their financial obligations. 5. Property Condition Disclosure: Alongside the financial terms, sellers may need to provide information about the property's condition. This type of disclosure outlines any known defects, structural issues, or other factors that may affect the property's value or its ability to secure financing. 6. Contract Termination and Forfeiture Disclosure: This disclosure elaborates on the conditions under which the land contract may be terminated by either party, including circumstances that may lead to the buyer forfeiting their payments or potential legal consequences. 7. Legal and Title Disclosure: It is essential to include a disclosure related to legal matters and title insurance. This disclosure highlights the importance of conducting a title search, acquiring title insurance, and any legal implications associated with the land contract. In summary, the Gresham Oregon Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, commonly known as a Land Contract, encompasses a range of essential financial and legal information. Different types of disclosures may focus on various aspects, including financing specifics, payment structure, prepayment options, default terms, property condition, contract termination, and legal requirements, ensuring transparency and protecting the interests of both buyers and sellers.

Gresham Oregon Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is a crucial document that outlines the specific financing terms agreed upon between the seller and buyer in a real estate transaction. This transparent disclosure ensures that both parties are fully aware of the monetary aspects and responsibilities involved in the purchase of the residential property. Key Keywords: Gresham Oregon, Seller's Disclosure, Financing Terms, Residential Property, Contract or Agreement for Deed, Land Contract There are several types of Gresham Oregon Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, including: 1. Basic Financing Terms Disclosure: This type of disclosure focuses on providing fundamental financial details to the buyer. It may include the purchase price, down payment amount, interest rate, loan duration, and any other relevant terms related to the land contract agreement. 2. Payment Structure Disclosure: Sellers may choose to disclose the payment structure of the land contract, specifying the frequency and amount of payments required. This disclosure ensures that the buyer is aware of their financial obligations on a monthly or periodic basis. 3. Prepayment or Early Repayment Disclosure: In some cases, sellers may want to include details regarding prepayment or early repayment options. This disclosure clarifies whether the buyer has the option to pay off the land contract before the agreed-upon term without any penalties or if there are specific terms associated with early repayment. 4. Late Payment and Default Terms Disclosure: This type of disclosure highlights the consequences of late or missed payments and outlines the penalties, fees, and potential remedies that may be employed by the seller in such situations. It ensures potential buyers understand the repercussions of failing to fulfill their financial obligations. 5. Property Condition Disclosure: Alongside the financial terms, sellers may need to provide information about the property's condition. This type of disclosure outlines any known defects, structural issues, or other factors that may affect the property's value or its ability to secure financing. 6. Contract Termination and Forfeiture Disclosure: This disclosure elaborates on the conditions under which the land contract may be terminated by either party, including circumstances that may lead to the buyer forfeiting their payments or potential legal consequences. 7. Legal and Title Disclosure: It is essential to include a disclosure related to legal matters and title insurance. This disclosure highlights the importance of conducting a title search, acquiring title insurance, and any legal implications associated with the land contract. In summary, the Gresham Oregon Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, commonly known as a Land Contract, encompasses a range of essential financial and legal information. Different types of disclosures may focus on various aspects, including financing specifics, payment structure, prepayment options, default terms, property condition, contract termination, and legal requirements, ensuring transparency and protecting the interests of both buyers and sellers.