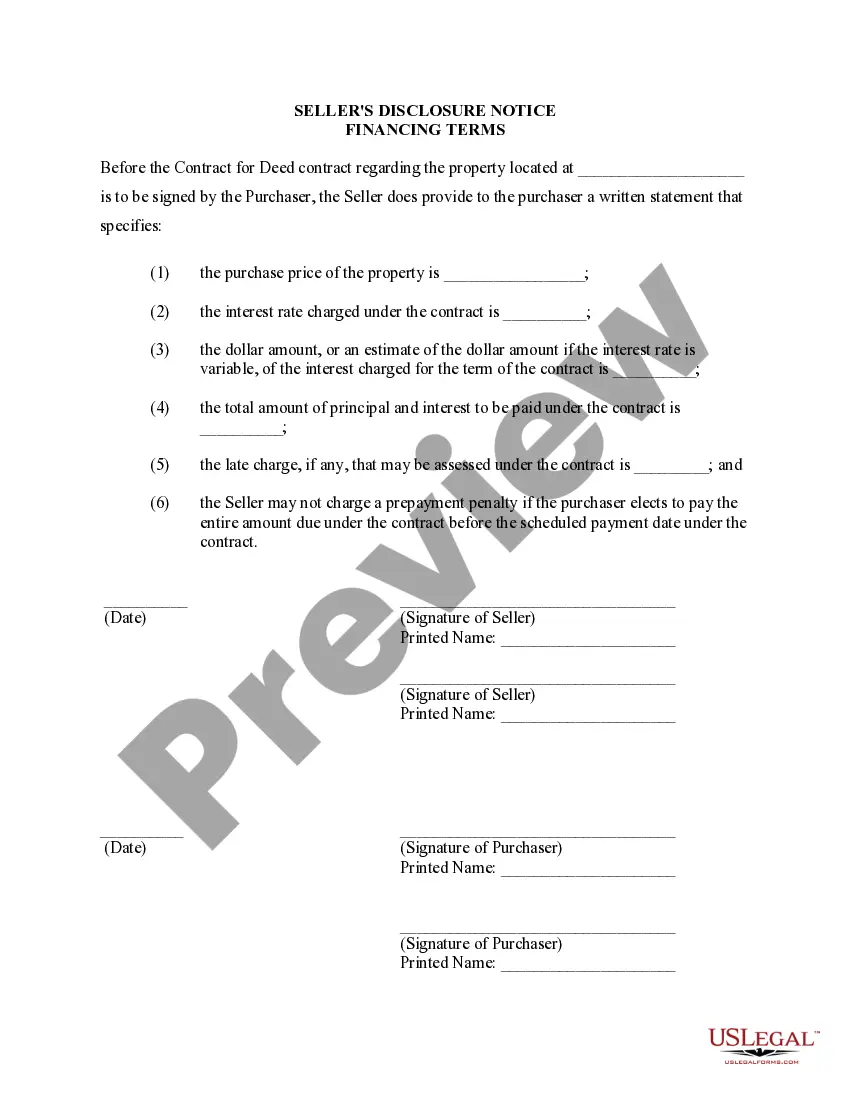

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Hillsboro Oregon Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an important document that outlines the specific terms and conditions of the financing arrangement between a seller and a buyer in a land contract transaction. This disclosure ensures that both parties involved have a clear understanding of the financial obligations and responsibilities associated with the purchase of the property. In Hillsboro, Oregon, there are several types of seller's disclosure of financing terms for residential property in connection with a contract or agreement for deed/land contract. These disclosures may vary based on the specific details of the financing agreement, but they generally cover the following key points: 1. Payment Terms: This section specifies the amount of the down payment, the installment amount, and the frequency of payments (monthly, quarterly, etc.). It also outlines any late payment fees or penalties that may be applicable if the buyer fails to make timely payments. 2. Interest Rate: The disclosure clearly states the interest rate that will be applied to the outstanding balance of the contract. It may include details regarding whether the interest rate is fixed or adjustable, and any potential changes to the rate over time. 3. Duration of the Contract: This section outlines the length of time the buyer has to fulfill their financial obligations under the contract. It may include the total number of months or years needed to complete the payment agreement. 4. Title and Ownership: The disclosure should clarify when the seller will transfer the title and ownership of the property to the buyer. It may outline contingencies, such as the buyer's completion of all payments, before the transfer occurs. 5. Responsibilities and Maintenance: This section outlines the buyer's responsibilities for property maintenance and repairs during the term of the contract. It may specify whether the buyer or seller is responsible for property taxes, insurance, and other related costs. 6. Default and Remedies: This section explains the consequences of defaulting on the contract, such as potential forfeiture of the property or legal actions that may be taken. It may also outline any remedies available to the buyer or seller in the event of default. 7. Additional Terms: This section includes any other relevant terms and conditions agreed upon by both parties. It may cover topics such as prepayment options, insurance requirements, and dispute resolution methods. It's important to note that the specific terminology and format of the Hillsboro Oregon Seller's Disclosure of Financing Terms for Residential Property may vary slightly. Therefore, it is recommended for buyers and sellers to consult with a qualified real estate professional or attorney to ensure compliance with local laws and regulations and to accurately complete the disclosure.The Hillsboro Oregon Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an important document that outlines the specific terms and conditions of the financing arrangement between a seller and a buyer in a land contract transaction. This disclosure ensures that both parties involved have a clear understanding of the financial obligations and responsibilities associated with the purchase of the property. In Hillsboro, Oregon, there are several types of seller's disclosure of financing terms for residential property in connection with a contract or agreement for deed/land contract. These disclosures may vary based on the specific details of the financing agreement, but they generally cover the following key points: 1. Payment Terms: This section specifies the amount of the down payment, the installment amount, and the frequency of payments (monthly, quarterly, etc.). It also outlines any late payment fees or penalties that may be applicable if the buyer fails to make timely payments. 2. Interest Rate: The disclosure clearly states the interest rate that will be applied to the outstanding balance of the contract. It may include details regarding whether the interest rate is fixed or adjustable, and any potential changes to the rate over time. 3. Duration of the Contract: This section outlines the length of time the buyer has to fulfill their financial obligations under the contract. It may include the total number of months or years needed to complete the payment agreement. 4. Title and Ownership: The disclosure should clarify when the seller will transfer the title and ownership of the property to the buyer. It may outline contingencies, such as the buyer's completion of all payments, before the transfer occurs. 5. Responsibilities and Maintenance: This section outlines the buyer's responsibilities for property maintenance and repairs during the term of the contract. It may specify whether the buyer or seller is responsible for property taxes, insurance, and other related costs. 6. Default and Remedies: This section explains the consequences of defaulting on the contract, such as potential forfeiture of the property or legal actions that may be taken. It may also outline any remedies available to the buyer or seller in the event of default. 7. Additional Terms: This section includes any other relevant terms and conditions agreed upon by both parties. It may cover topics such as prepayment options, insurance requirements, and dispute resolution methods. It's important to note that the specific terminology and format of the Hillsboro Oregon Seller's Disclosure of Financing Terms for Residential Property may vary slightly. Therefore, it is recommended for buyers and sellers to consult with a qualified real estate professional or attorney to ensure compliance with local laws and regulations and to accurately complete the disclosure.