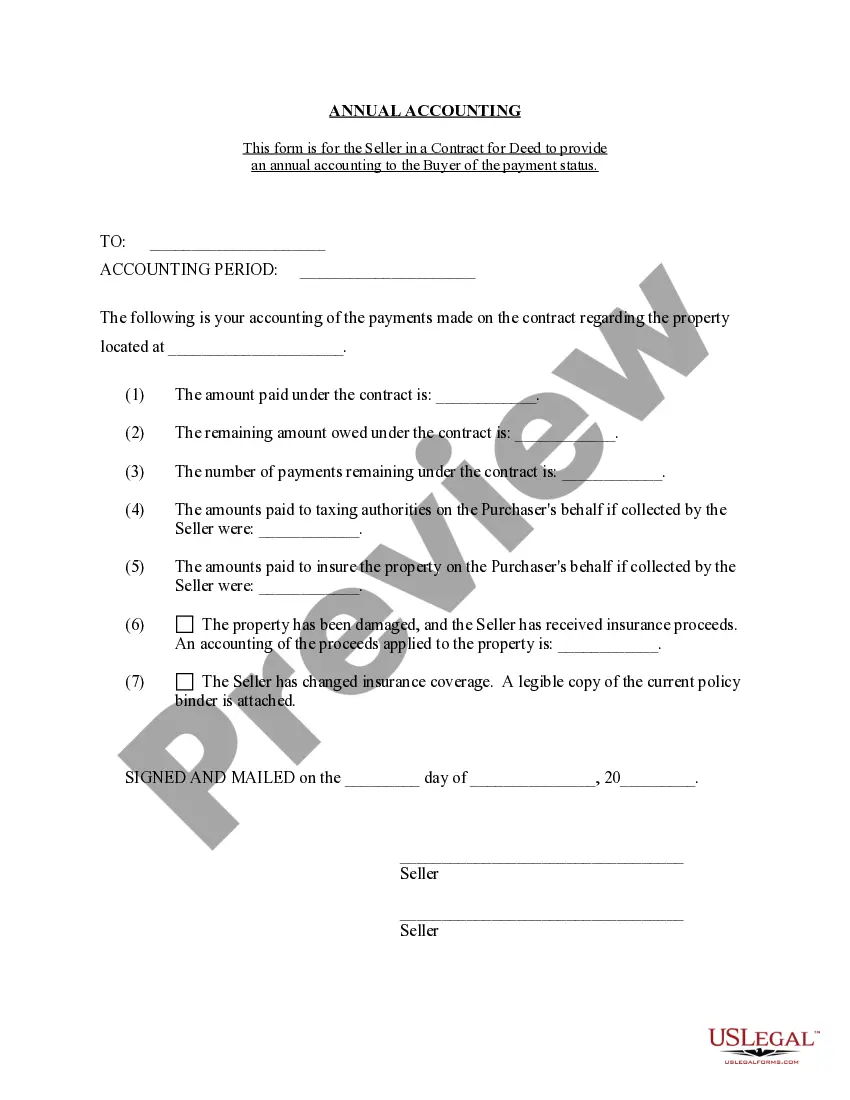

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Eugene Oregon Contract for Deed Seller's Annual Accounting Statement is an essential document that provides a comprehensive summary of financial transactions and obligations between the seller and buyer in a contract for deed agreement. This statement ensures transparency and accountability throughout the course of the contract, providing detailed information on payments, expenses, and balances for both parties. There are various types of Eugene Oregon Contract for Deed Seller's Annual Accounting Statements, each serving a specific purpose in documenting the financial aspects of the contract. Some common types include: 1. Payment Schedule Statement: This statement outlines the agreed-upon payment schedule, including the amount due, due dates, and any penalties or fees for late payments. It helps track payment history and ensures both parties are aware of payment obligations. 2. Interest Calculation Statement: In contracts that involve interest, this statement calculates and presents the interest accrued on the outstanding balance. It provides clarity on how interest is applied and helps both the seller and buyer understand the financial implications. 3. Principal Balance Statement: This statement focuses on the remaining principal balance owed by the buyer. It details the original principal amount, any principal payments made, and the remaining balance. This statement helps track the progress toward full ownership and assists in making informed financial decisions. 4. Expense Summary Statement: This statement itemizes expenses related to the property during the accounting period, such as property taxes, insurance premiums, and maintenance costs. It allows both parties to understand the financial impact of these expenses and ensures proper allocation and payment. 5. Escrow Account Statement: In cases where an escrow account is established, this statement provides a comprehensive overview of the funds held in the account. It includes details of deposits, disbursements, and reconciliations, providing transparency and accountability for both parties. Overall, the Eugene Oregon Contract for Deed Seller's Annual Accounting Statement encompasses various types of statements, each playing an integral role in documenting and tracking financial activities in a contract for deed agreement. These statements ensure that both the seller and buyer have an accurate understanding of their financial responsibilities and maintain trust and transparency throughout the contract period.