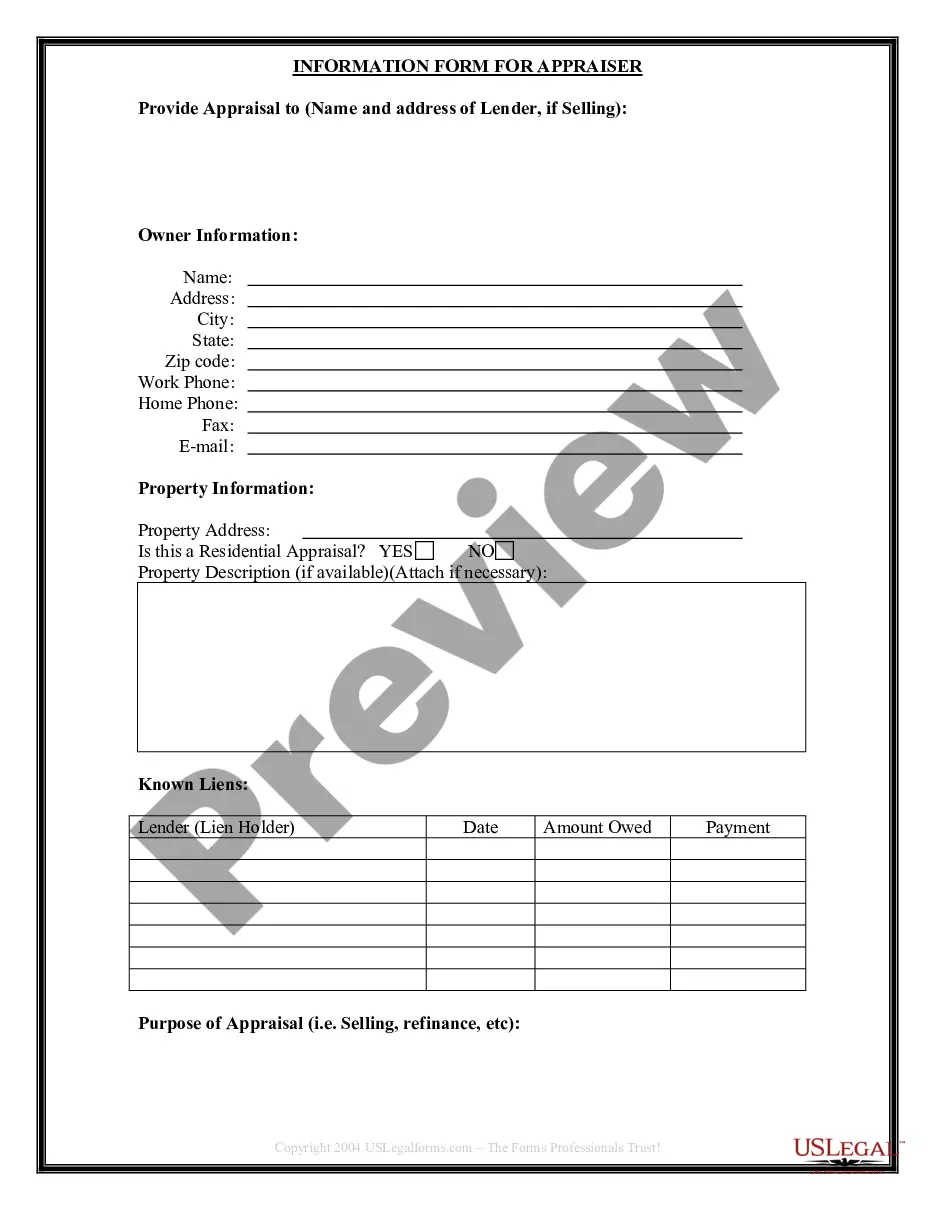

This Seller's Information for Appraiser provided to Buyer form is used by the Buyer in Oregon to provide information required by an appraiser in order to conduct an appraisal of the property prior to purchase. The Seller provides this completed form to the Buyer, who furnishes it to the appraiser. This form is designed to make the transaction flow more efficiently.

Title: Detailed Description of Bend Oregon Seller's Information for Appraiser Provided to Buyer Keywords: Bend Oregon, seller's information, appraiser, detailed description, buyer Introduction: When it comes to real estate transactions in Bend, Oregon, providing accurate and comprehensive seller's information to the appraiser is crucial for both the buyer and the seller. By offering a detailed overview of the property, its features, condition, and any relevant details, sellers contribute to accurate appraisals and facilitate a smooth buying process. Here, we will discuss the various types of Bend Oregon Seller's Information for Appraiser provided to the Buyer, outlining their significance and the importance of each category. 1. Property Description: As part of Bend Oregon Seller's Information for Appraiser, a detailed property description is essential. This includes the property's physical address, legal description, lot size, number of bedrooms and bathrooms, square footage, architectural style, property type (single-family, condo, town home, etc.), and any attached or detached structures (garage, shed, pool, etc.). Highlighting unique features and recent upgrades can help appraisers understand the property's value accurately. 2. Property Condition: Buyers rely on accurate information about a property's condition when making informed decisions. Sellers should provide a comprehensive overview of the property's condition, highlighting any repairs, renovations, or significant maintenance work undertaken, along with associated dates and receipts, if available. Identifying any current or past structural issues, pest problems, or water damage is essential to ensure appraisers have a clear understanding of the property's condition. 3. Upgrades and Improvements: Listing all significant upgrades and improvements made to the property can positively influence its appraised value. Sellers should provide detailed information on renovations, including kitchen or bathroom remodels, new flooring, roofing, HVAC system upgrades, energy-efficient features, landscaping enhancements, and any other notable improvements. These details help appraisers differentiate the property from others in the area and justify a higher value. 4. Comparative Market Analysis (CMA): A Comparative Market Analysis, also known as a CMA, provides crucial information to help appraisers assess a property's market value accurately. Sellers can compile a list of recently sold properties in the same neighborhood or subdivision with comparable features such as size, bedrooms, bathrooms, and condition. Including details about the sale price, sale date, and any special considerations (e.g., distressed sales) can assist appraisers in establishing a fair market value. 5. Disclosure Documents: Sellers should provide any relevant disclosure documents that disclose known issues or potential concerns about the property, such as water damage, lead-based paint, or environmental hazards. These documents protect both the buyer and the seller and ensure transparency throughout the transaction. Conclusion: By providing a detailed Bend Oregon Seller's Information for Appraiser, sellers facilitate a comprehensive appraisal process, enabling buyers to make well-informed purchase decisions. Property description, condition, upgrades, a comparative market analysis, and proper disclosure documents all play a crucial role in ensuring a fair appraisal and a smooth real estate transaction in Bend, Oregon. Precise, accurate, and comprehensive information benefits all parties involved, making for a successful and transparent buying experience.