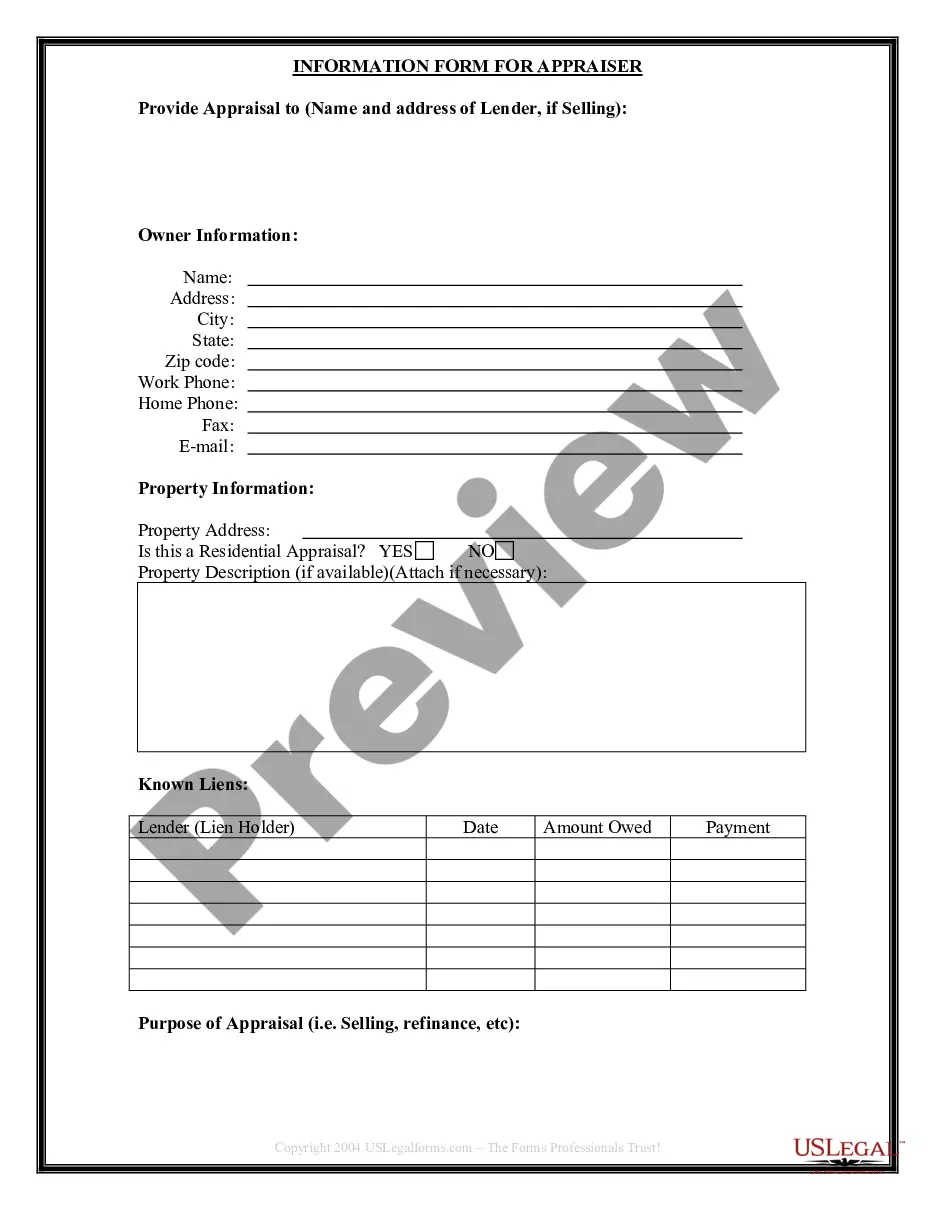

This Seller's Information for Appraiser provided to Buyer form is used by the Buyer in Oregon to provide information required by an appraiser in order to conduct an appraisal of the property prior to purchase. The Seller provides this completed form to the Buyer, who furnishes it to the appraiser. This form is designed to make the transaction flow more efficiently.

Title: Eugene Oregon Seller's Information for Appraiser: Essential Insights for Homebuyers Introduction: When purchasing a property in Eugene, Oregon, it is crucial for buyers to have access to accurate and comprehensive seller's information. Providing this data to the appraiser is essential to ensuring a transparent and informed property evaluation process. In Eugene, various types of seller's information cater to different aspects of the appraisal process, offering vital insights to the appraiser. Read on to discover the critical elements that make up Eugene Oregon Seller's Information for Appraiser provided to the buyer. 1. Property Details: The seller's information package typically includes detailed property information. This covers the property's address, legal description, lot size, zoning classification, and any special features or characteristics that may influence its value (e.g., waterfront access, proximity to amenities, or scenic views). 2. Sales History: Understanding the property's sales history is crucial for appraisers as it helps establish an accurate valuation. This information includes the previous purchasing price, dates of previous sales, and the length of time the current seller has owned the property. Additionally, any major renovations or improvements made since the last sale can influence the appraisal process. 3. Comparable Sales: Comparative sales data is vital for appraisers to analyze market trends in a specific area. Sellers can provide recent sales of similar properties within Eugene, including the sale price, property size, dates of sales, and any unique characteristics. This information helps appraisers determine the property's value within the local market context. 4. Property Tax Assessment: Sellers can include the most recent property tax assessment in the seller's package, which provides valuable information regarding the property's tax assessed value, current tax rate, and any tax exemptions or abatement applicable. Appraisers consider this information while estimating the market value of the property. 5. Maintenance and Repair History: Buyers benefit from accessing the property's maintenance and repair history as it provides insights into how well the property has been maintained. Sellers can provide documentation of past repairs, upgrades, or renovations, including associated costs and dates. This information helps appraisers assess the property's overall condition and its long-term value. 6. Utilities and Energy Efficiency: Information regarding utility providers, average utility costs, and energy-saving features (e.g., energy-efficient appliances, solar panels, insulation) can be useful in evaluating the property's operational expenses and long-term sustainability. Sellers can provide this information to appraisers, providing a holistic understanding of the property's cost-efficiency. Conclusion: In Eugene, Oregon, seller's information for appraisers plays a crucial role in a transparent and accurate property valuation process. By providing comprehensive data on property details, sales history, comparable sales, property tax assessments, maintenance and repair history, and utility information, sellers empower appraisers and homebuyers alike. This collaborative effort ensures that buyers make informed decisions when purchasing property in Eugene's vibrant real estate market.