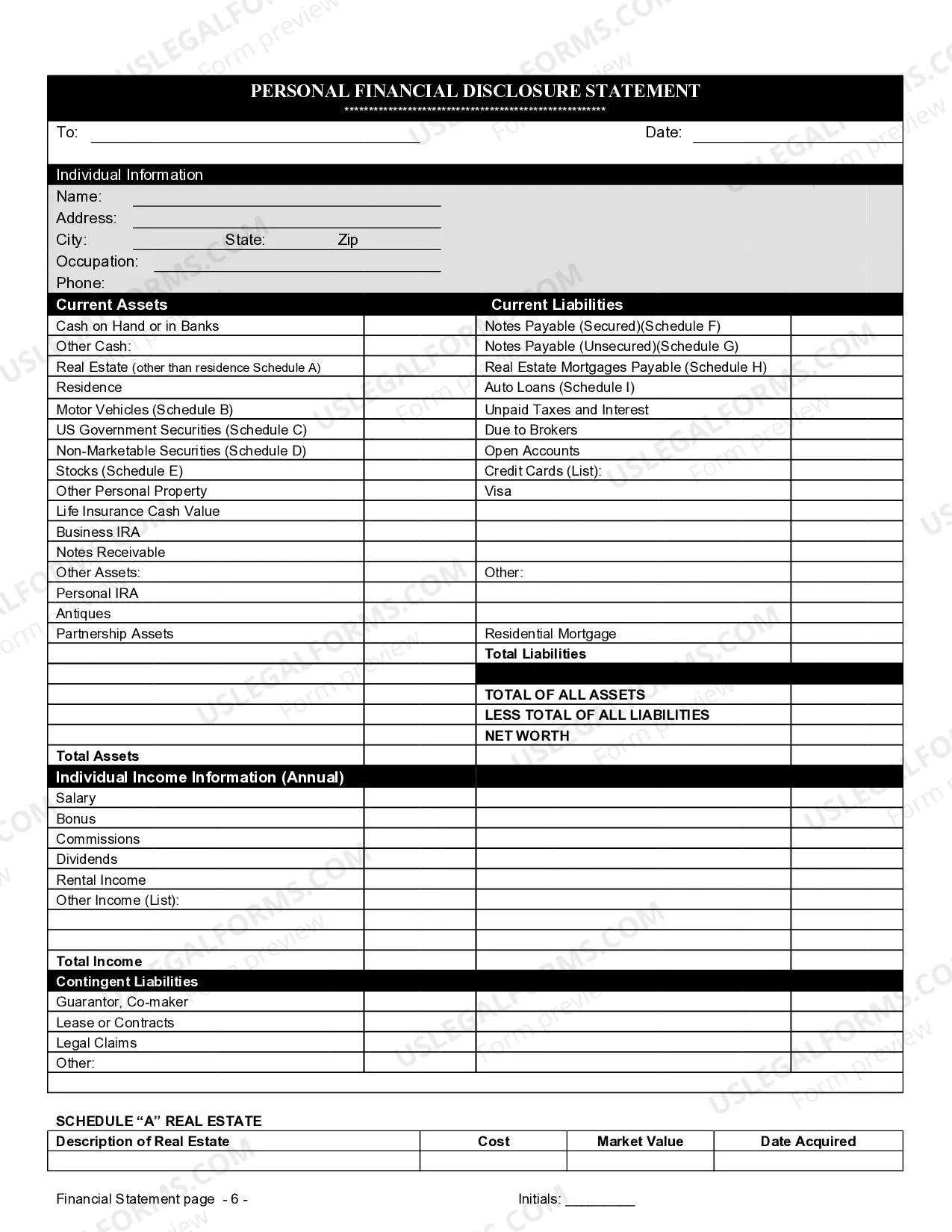

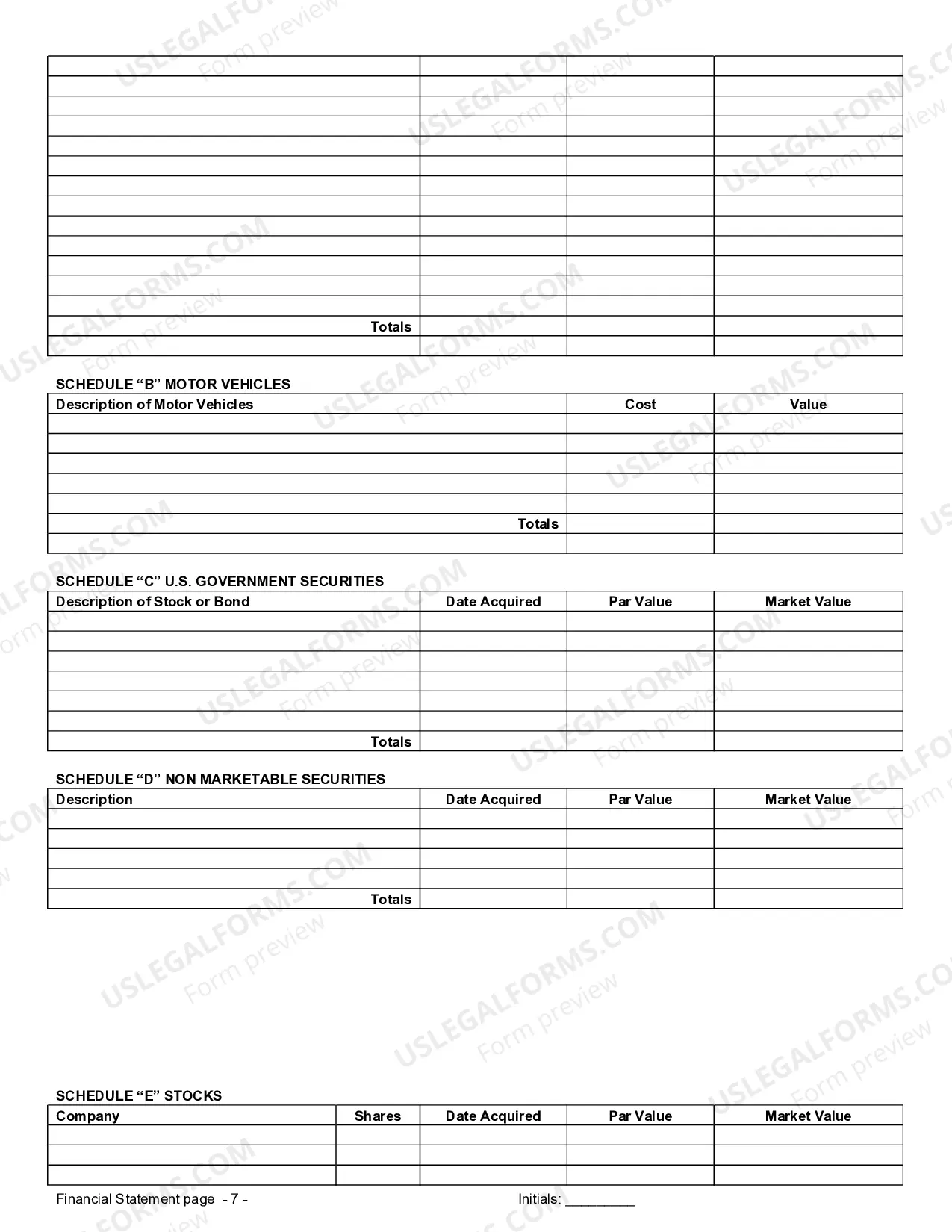

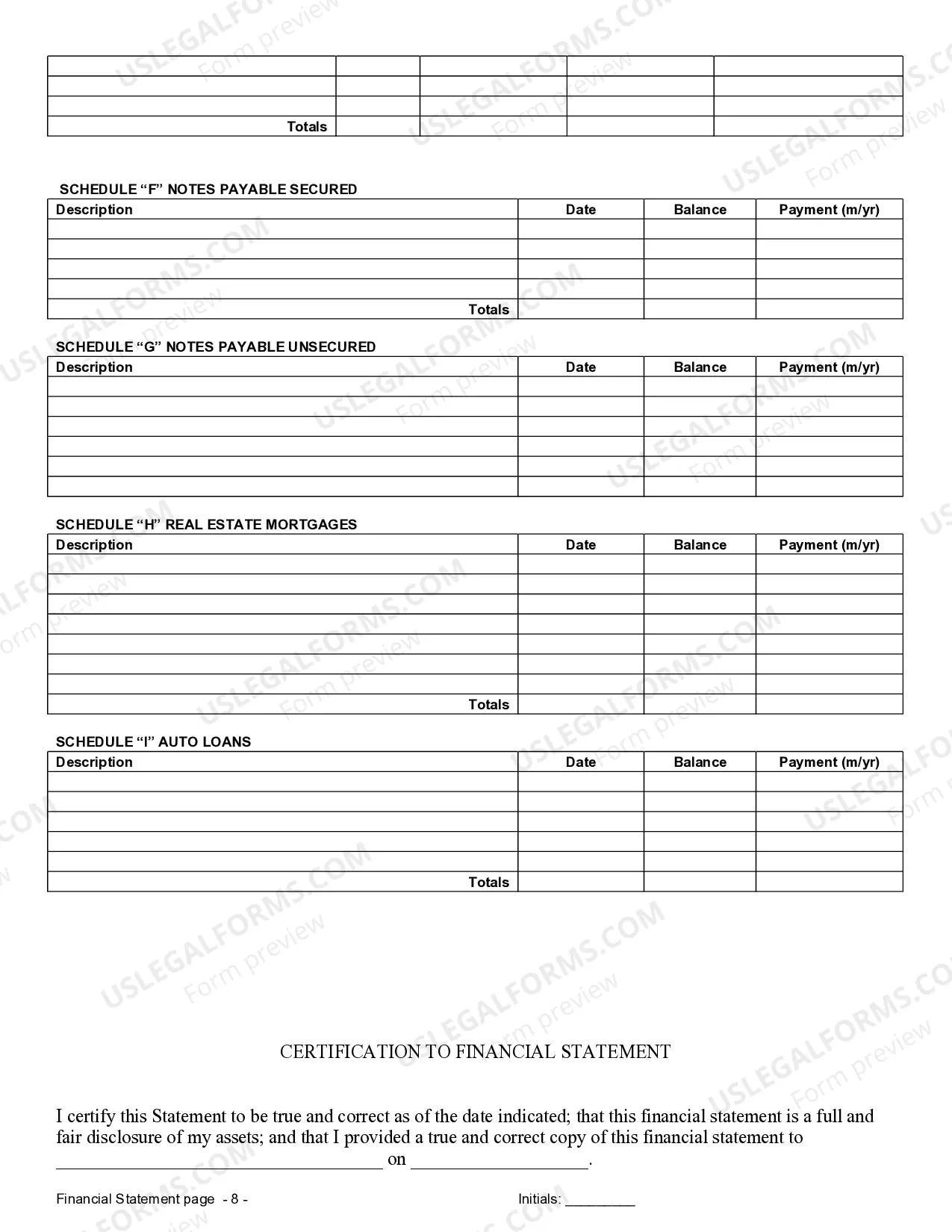

This financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Bend Oregon Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Oregon Financial Statements Only In Connection With Prenuptial Premarital Agreement?

If you are searching for an appropriate form template, it’s incredibly challenging to discover a more suitable location than the US Legal Forms website – one of the most comprehensive online repositories.

Here you can acquire numerous templates for both organizational and personal uses categorized by type and geography, or through keywords.

Utilizing our top-notch search tool, obtaining the latest Bend Oregon Financial Statements exclusively related to Prenuptial Premarital Agreement is as simple as 1-2-3.

Execute the payment transaction. Use your credit card or PayPal account to finalize the registration process.

Access the template. Select your file type and download it to your device. Edit as needed. Complete, modify, print, and sign the acquired Bend Oregon Financial Statements exclusively related to Prenuptial Premarital Agreement.

- Moreover, the accuracy of each record is confirmed by a group of expert lawyers who routinely review the templates on our site and refresh them to align with the most recent state and county standards.

- If you are already familiar with our platform and possess an account, all you need to access the Bend Oregon Financial Statements solely concerning Prenuptial Premarital Agreement is to Log In to your account and click the Download button.

- If this is your first time using US Legal Forms, just follow the instructions outlined below.

- Ensure you have located the sample you need. Review its details and use the Preview feature (if available) to view its contents. If it doesn’t fulfill your requirements, use the Search option located at the top of the screen to find the accurate document.

- Confirm your selection. Click the Buy now button. After that, select your preferred subscription plan and provide the necessary information to create an account.

Form popularity

FAQ

If you choose not to pursue a prenuptial agreement, consider keeping your financial accounts separate. Documenting your assets with Bend Oregon Financial Statements only in Connection with Prenuptial Premarital Agreement can help clarify ownership if disputes arise. Additionally, establishing a will can direct how you want your assets distributed. However, the best protection often involves having a formal agreement, and US Legal Forms can assist you in creating the right documents.

Without a prenuptial agreement, premarital assets may not be fully protected in divorce proceedings. In many jurisdictions, these assets could be subject to division. However, having clear and detailed Bend Oregon Financial Statements only in Connection with Prenuptial Premarital Agreement can provide valuable documentation in case of future disputes. To ensure your assets remain secure, consider consulting US Legal Forms for your prenuptial agreement needs.

A prenup can be crucial for protecting premarital assets. If you have significant individual possessions or debts, a prenuptial agreement clearly establishes ownership and distribution. Including detailed Bend Oregon Financial Statements only in Connection with Prenuptial Premarital Agreement can further reinforce your claims on these assets. By utilizing US Legal Forms, you can easily create a prenup tailored to your needs.

To safeguard your financial interests before marriage, consider drafting a prenuptial agreement. This legal document outlines how assets will be divided in case of a divorce. Additionally, maintaining clear and accurate Bend Oregon Financial Statements only in Connection with Prenuptial Premarital Agreement can help ensure transparency about your financial situation. Using US Legal Forms can guide you through the process of creating a comprehensive prenuptial agreement.

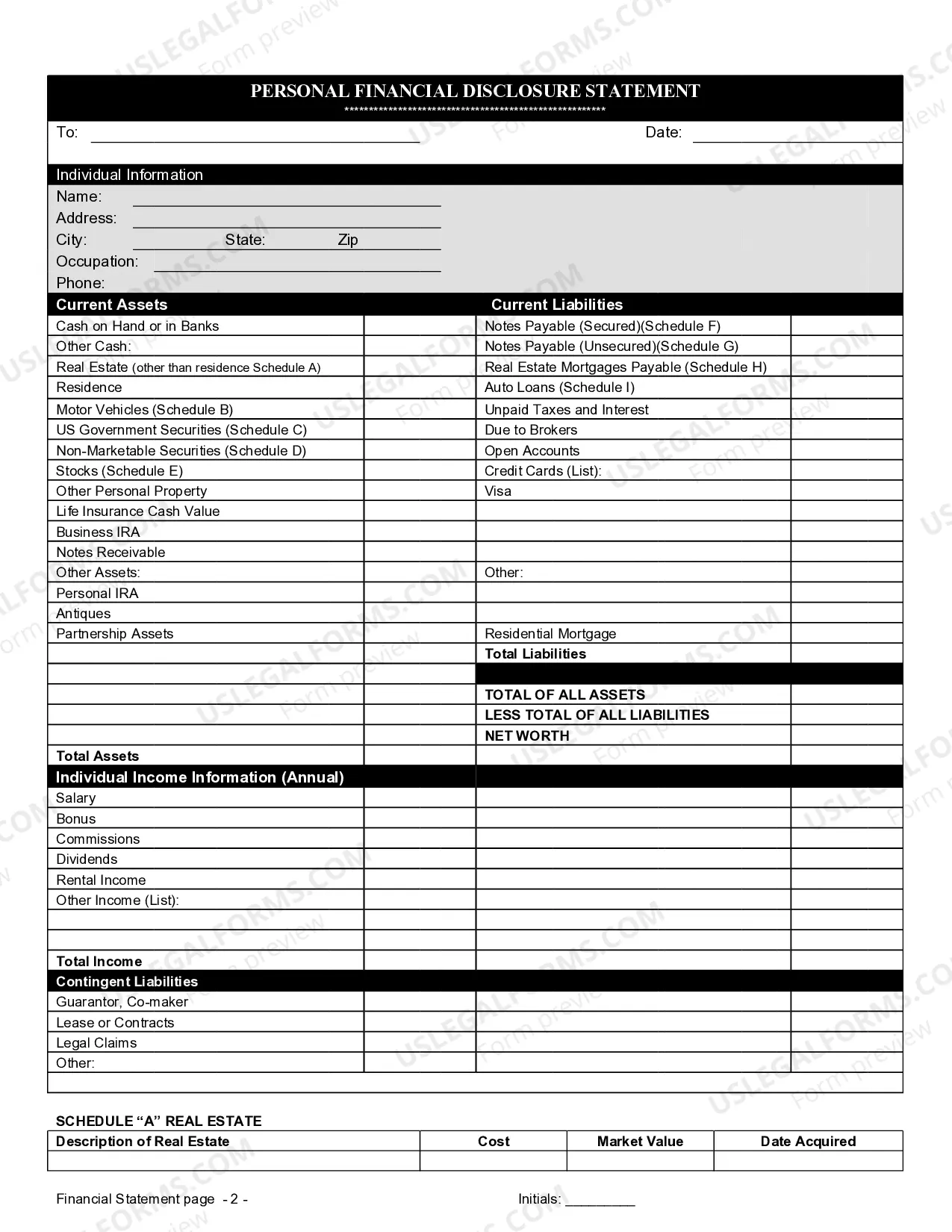

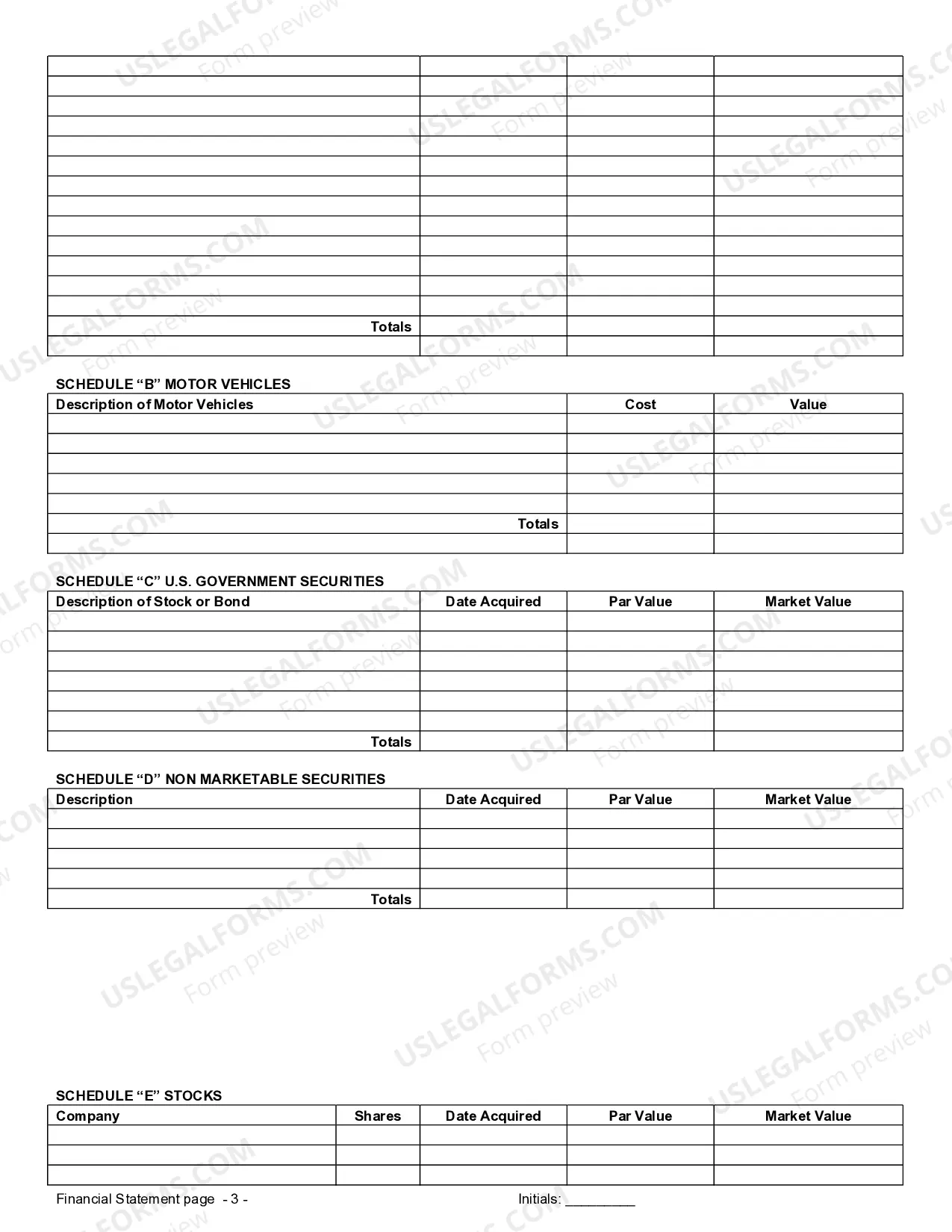

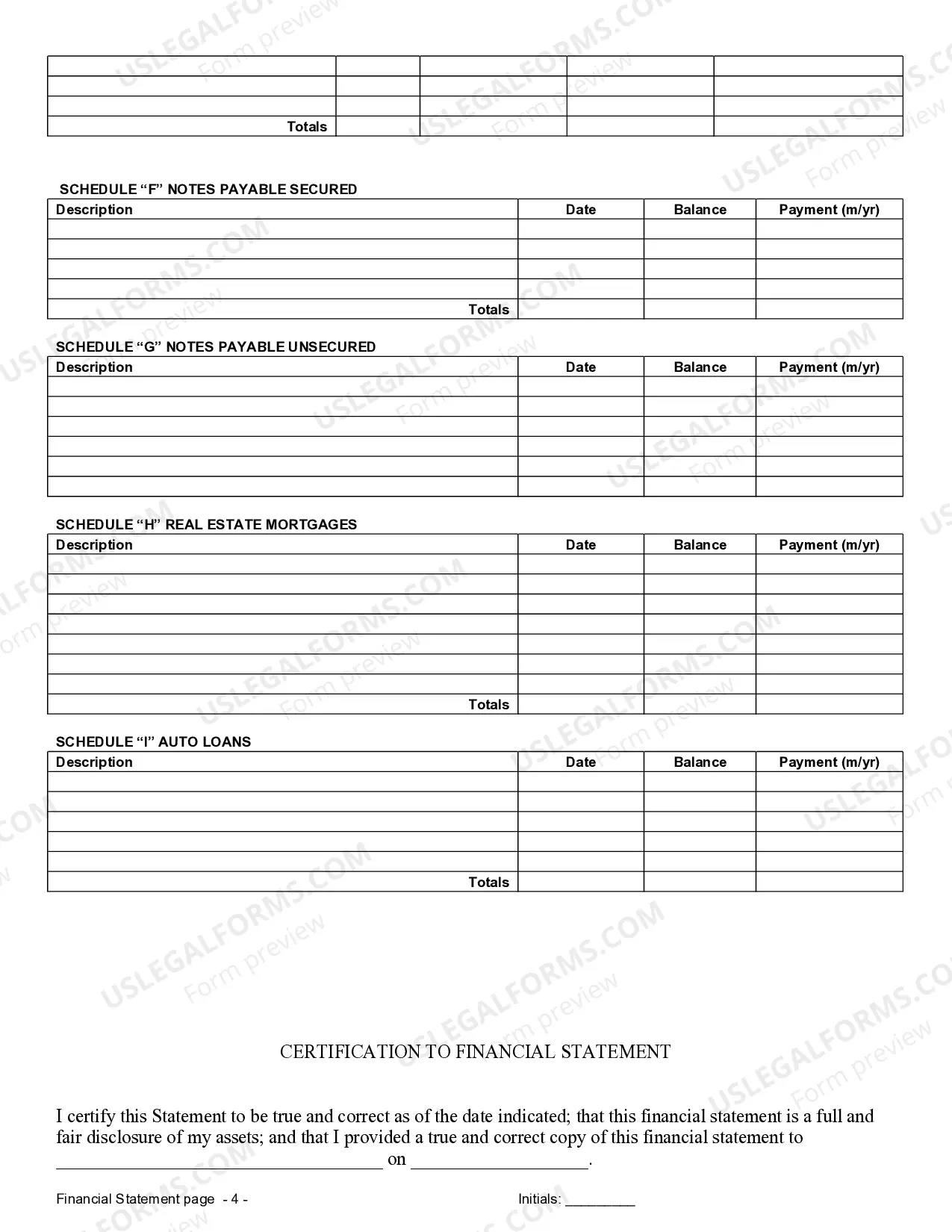

A financial statement for a prenuptial agreement is a detailed document that outlines the assets, debts, income, and expenses of each party entering into the agreement. In Bend Oregon, financial statements only in connection with prenuptial premarital agreements play a crucial role in ensuring transparency and fairness during the negotiation process. These statements help both parties understand each other’s financial situations, thereby facilitating informed decisions about asset division in case of separation. Using a reliable platform like USLegalForms can simplify the creation of these financial statements, ensuring all necessary details are included.

Yes, a prenuptial agreement can stipulate which assets and liabilities remain separate. By outlining specific items, such as property and income, you can ensure that everything stays under your name if the marriage ends. Utilizing Bend Oregon Financial Statements only in Connection with Prenuptial Premarital Agreement will enhance your understanding of each spouse’s financial position. Creating personalized agreements with the help of professionals is a proactive step for financial security.

Prenuptial agreements are enforceable in Oregon, provided they meet certain legal standards. For instance, both parties must fully disclose their financial situations and willingly agree to the terms. By using Bend Oregon Financial Statements only in Connection with Prenuptial Premarital Agreement, you can ensure that your prenup adheres to state laws and remains valid. It is advisable to seek legal help to create a comprehensive and enforceable agreement.

Absolutely, a prenuptial agreement can keep debt separated between spouses. By specifying which debts belong to each spouse, a prenup can prevent one partner from being liable for the other's pre-existing debts. This clarity is crucial when preparing your Bend Oregon Financial Statements only in Connection with Prenuptial Premarital Agreement. Consulting with a legal professional can ensure that your agreement covers all necessary aspects of financial responsibility.

Yes, prenuptial agreements can effectively keep finances separate during marriage. A well-drafted prenup identifies the assets and debts each spouse brings into the marriage, ensuring clarity on ownership. This becomes particularly beneficial in Bend Oregon Financial Statements only in Connection with Prenuptial Premarital Agreement, as it provides a legal framework for maintaining financial independence. Understanding your rights and responsibilities through a prenup can lead to a more secure marriage.

To keep finances separate in marriage, consider creating a prenuptial agreement. This legal document can outline how you and your partner will manage your financial responsibilities and assets. Specifically, Bend Oregon Financial Statements only in Connection with Prenuptial Premarital Agreement can help establish clear boundaries for marital and separate property. Regularly maintaining and updating separate accounts can further support this arrangement.