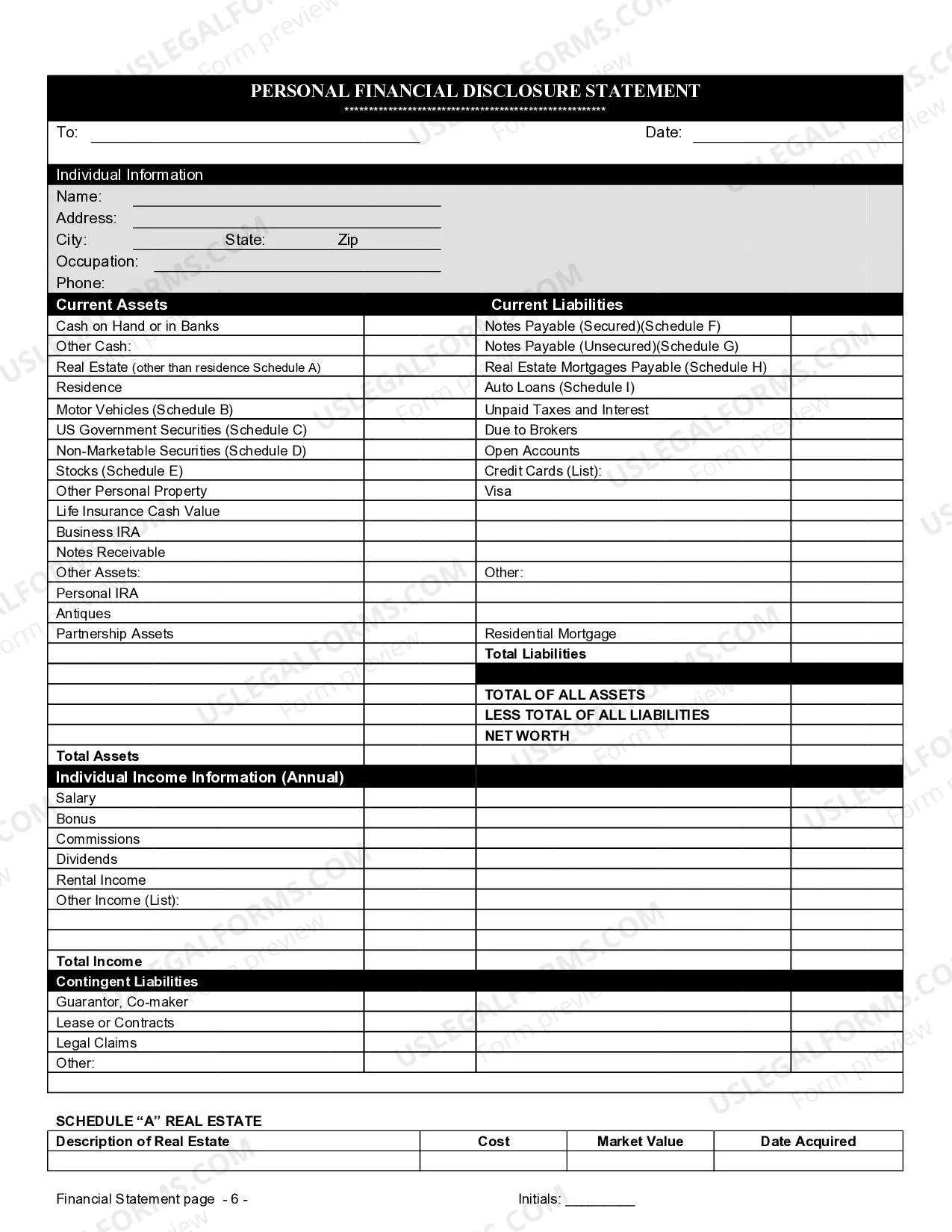

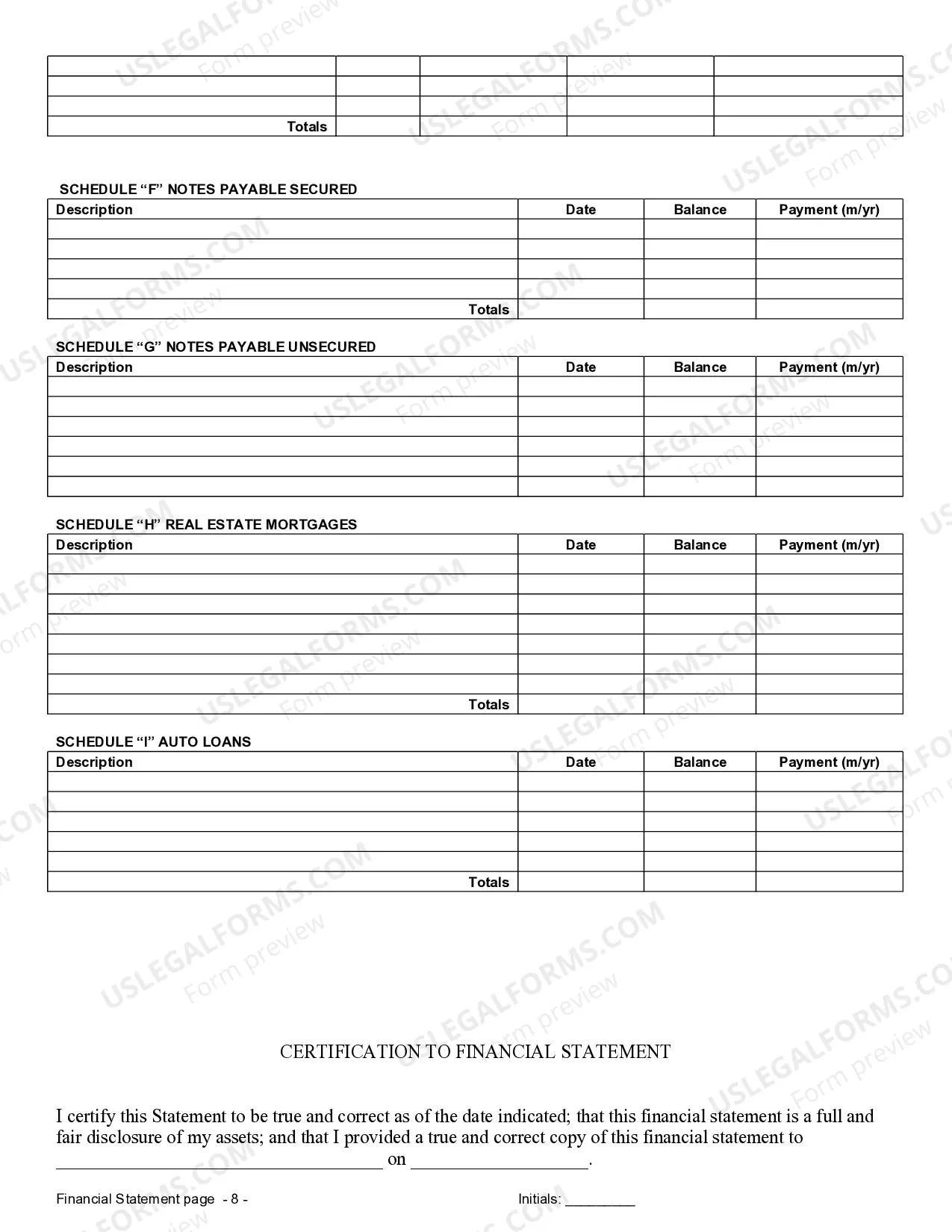

This financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

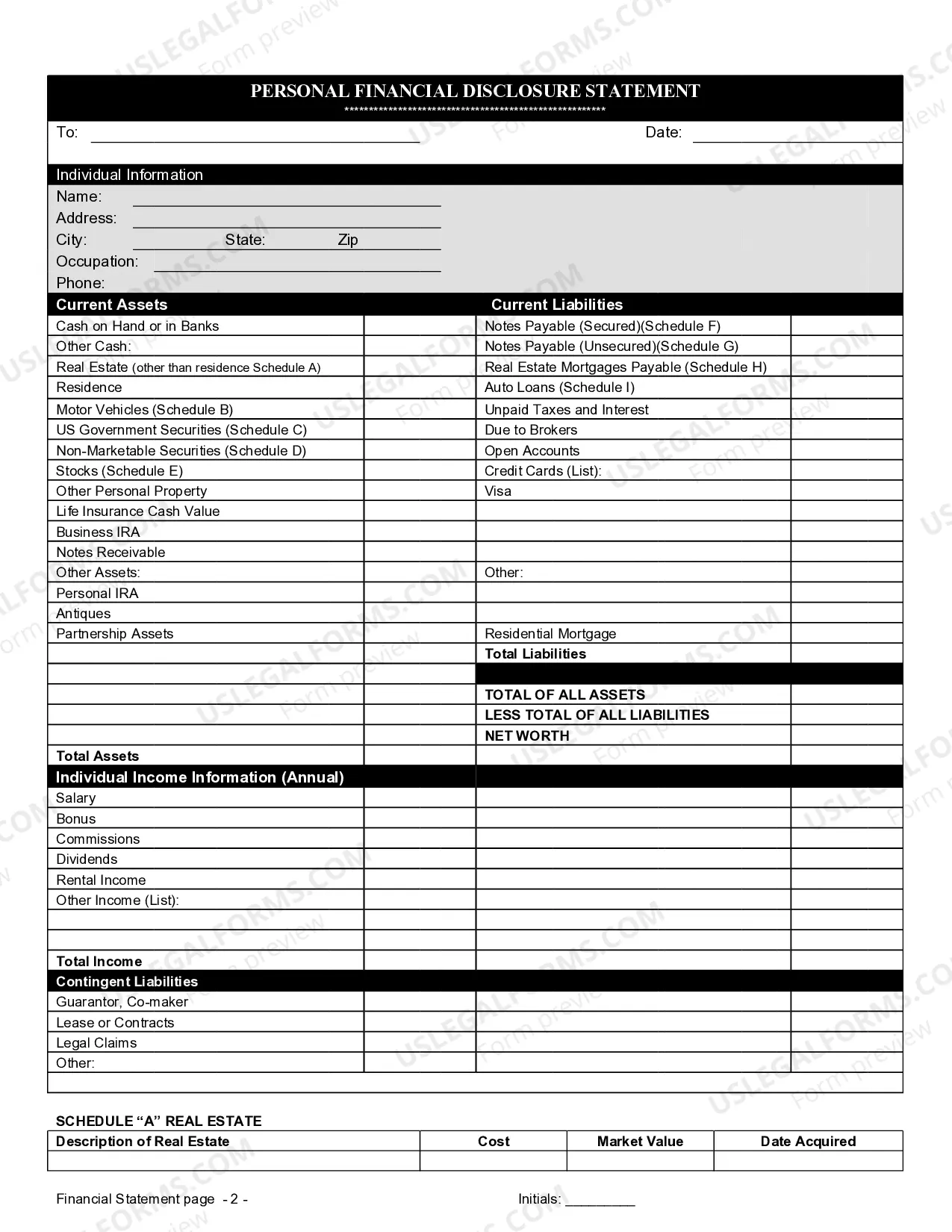

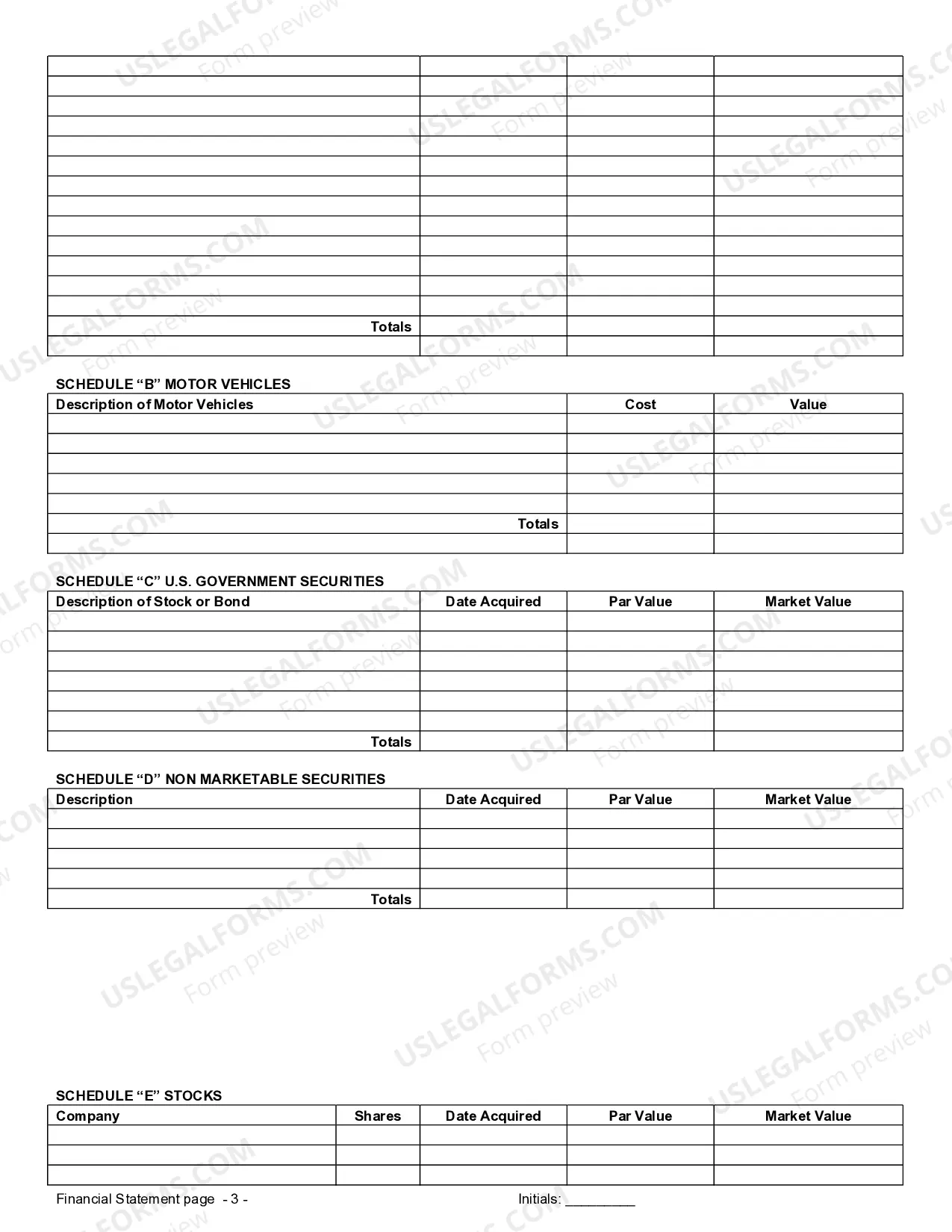

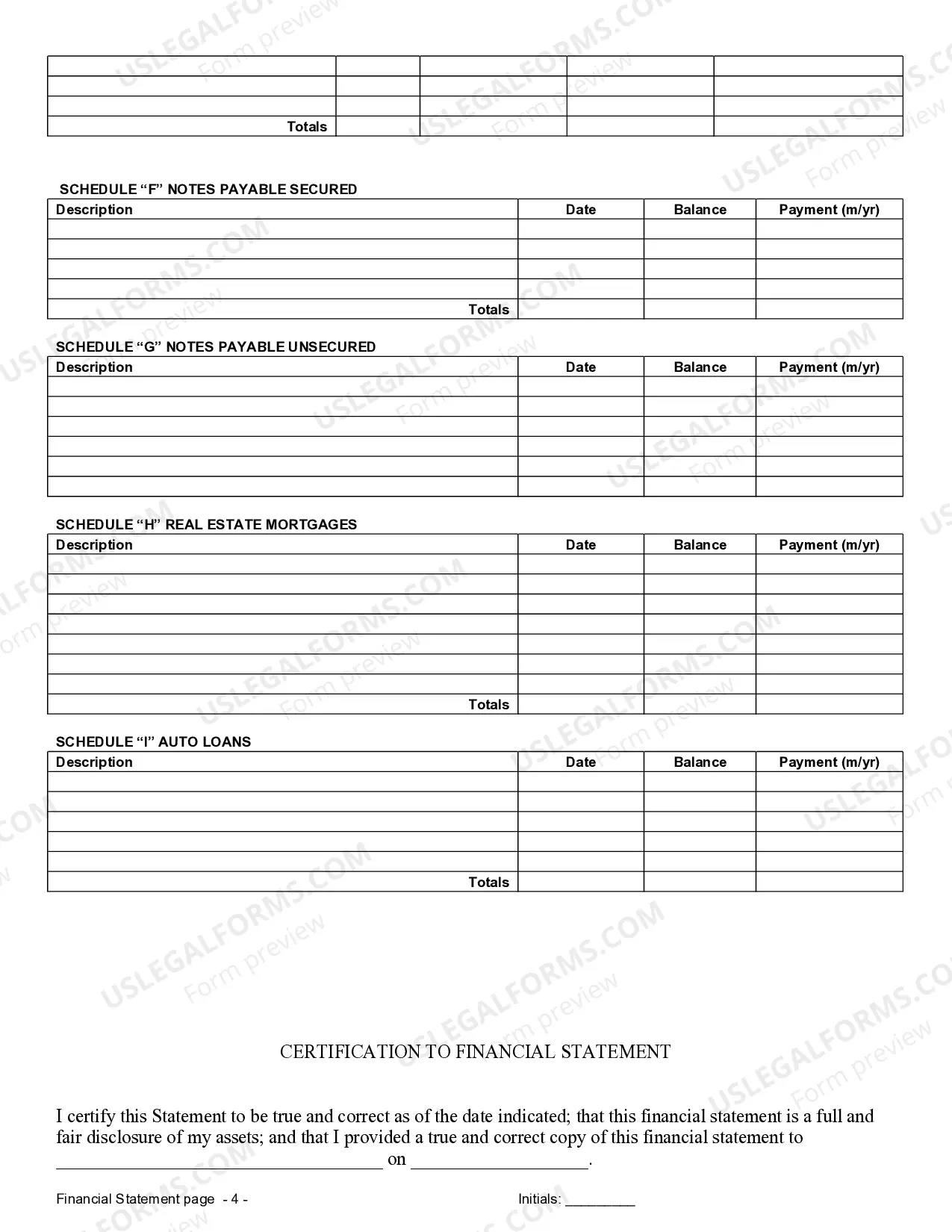

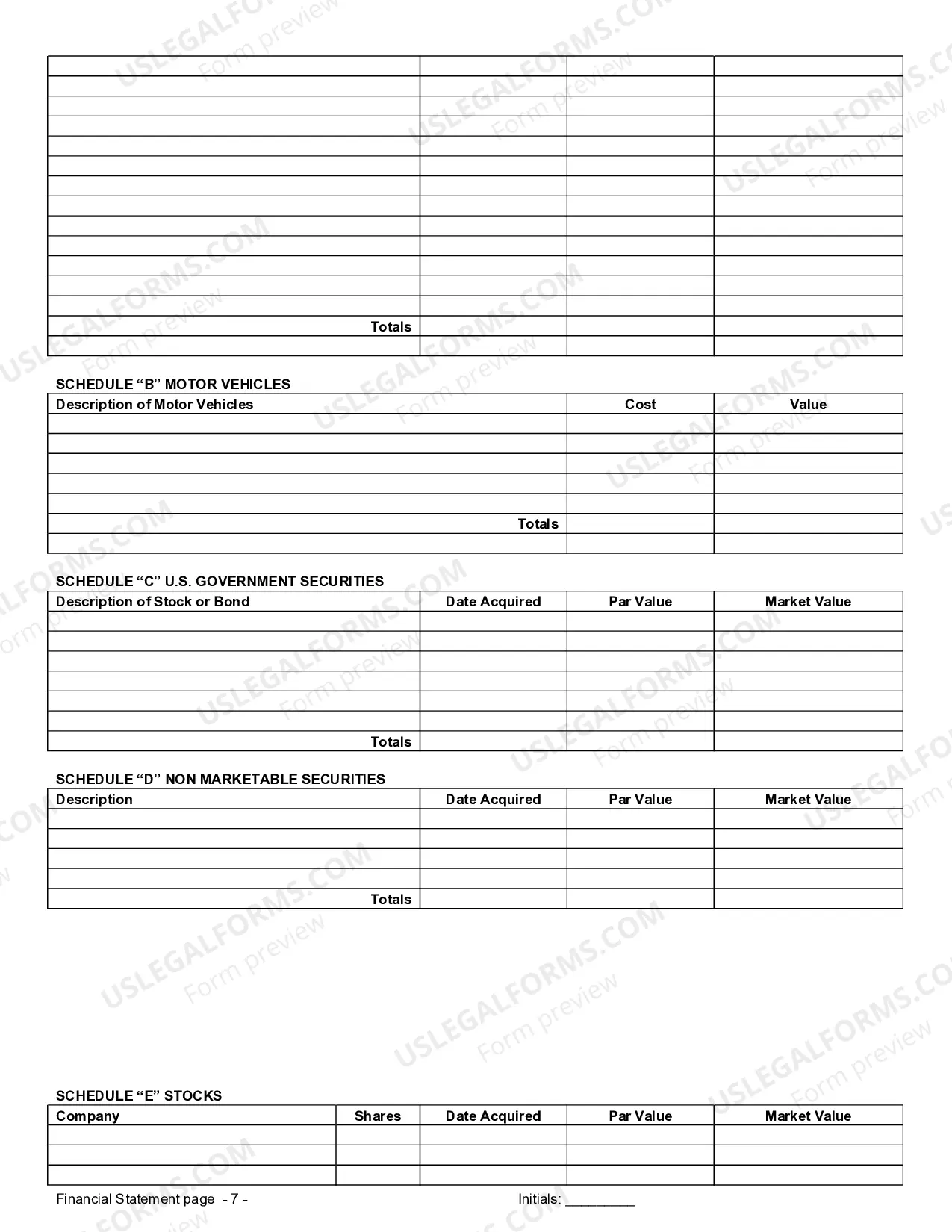

Eugene Oregon Financial Statements only in Connection with Prenuptial Premarital Agreement: A Detailed Overview In the context of prenuptial or premarital agreements, Eugene, Oregon residents are often required to submit financial statements. These statements play a significant role in documenting and protecting the financial interests of both parties entering into the agreement. By providing a comprehensive picture of their assets, liabilities, and income, individuals can ensure transparency, clarity, and fairness in financial matters during their marriage or potential separation down the line. There are several types of Eugene Oregon Financial Statements that may be required within the context of a prenuptial or premarital agreement. These could include: 1. Personal Financial Statement: This statement captures an individual's net worth, including their assets, such as real estate properties, investments, vehicles, and personal belongings. It also details liabilities, such as mortgages, loans, and credit card debt. 2. Income Statement: This type of financial statement highlights an individual's income from various sources, including employment, self-employment, investments, or any other revenue streams. It allows both parties to understand each other's earning capabilities and potential financial contributions to the marriage. 3. Tax Returns: Submitting previous years' tax returns can provide a clear picture of an individual's income, deductions, and overall financial situation. This helps ensure that both parties understand the potential tax implications and obligations they may face as a couple. 4. Bank Statements: Banks statements from various accounts, including checking, savings, and investment accounts, show an individual's financial transactions and account balances. These statements can provide crucial insights into an individual's spending habits, debt obligations, and overall financial stability. 5. Business Financial Statements: If either party owns a business or is self-employed, they might need to submit financial statements related to their enterprise. These statements can shed light on the business's assets, liabilities, revenue, expenses, and profit, helping determine how the potential separation or divorce might affect the business's value and financial impact on the marriage. When it comes to Eugene Oregon Financial Statements only in Connection with Prenuptial Premarital Agreement, accuracy and completeness are essential. Both parties must disclose their financial information truthfully and thoroughly. Deliberately withholding or misrepresenting information can lead to legal complications and potentially invalidate the prenuptial agreement. It's crucial to consult with a qualified attorney specializing in family law in Eugene, Oregon, to understand the specific requirements and legal implications surrounding financial statements in prenuptial or premarital agreements. An experienced attorney can help draft an agreement that protects both parties' interests and ensures compliance with the law, giving the couple peace of mind and security in their future endeavors.