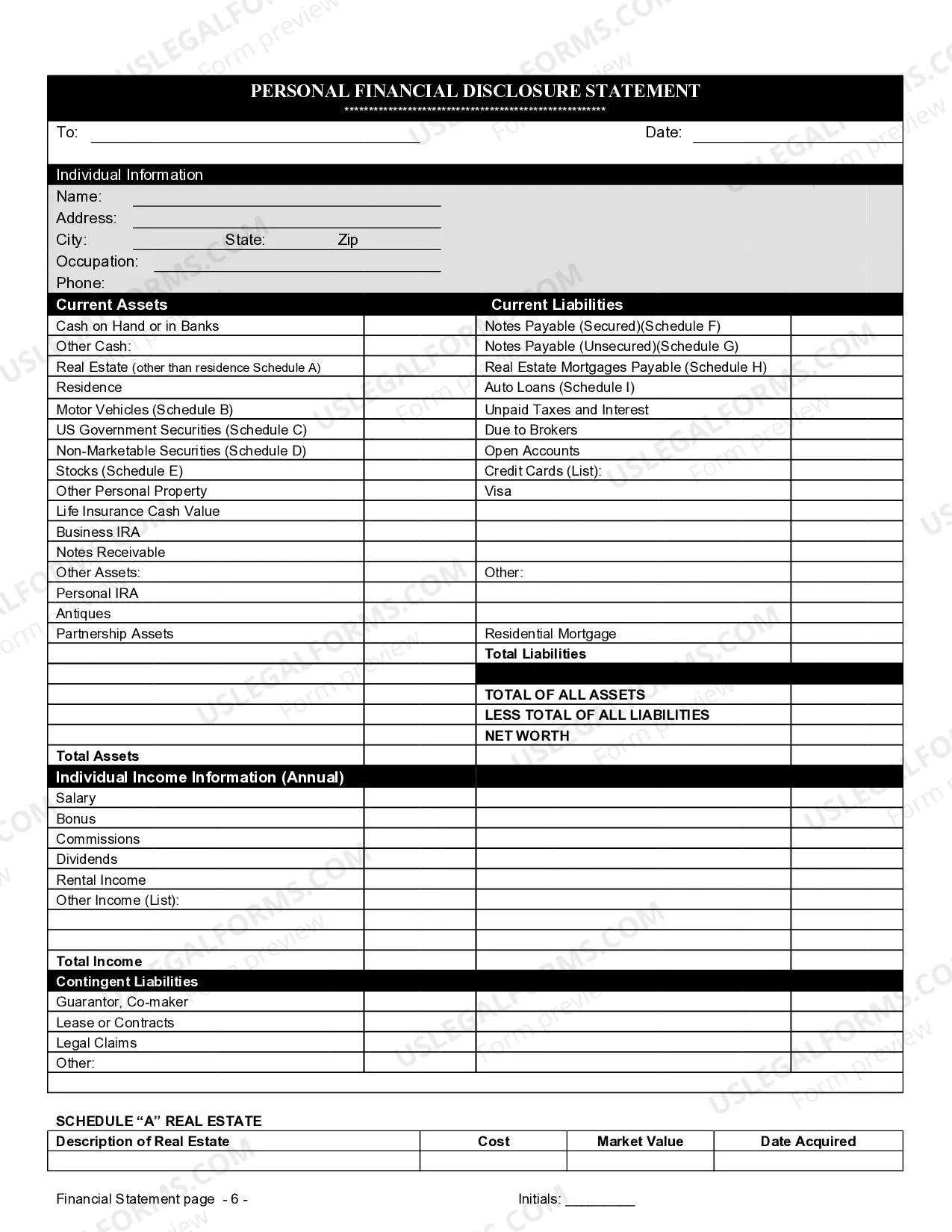

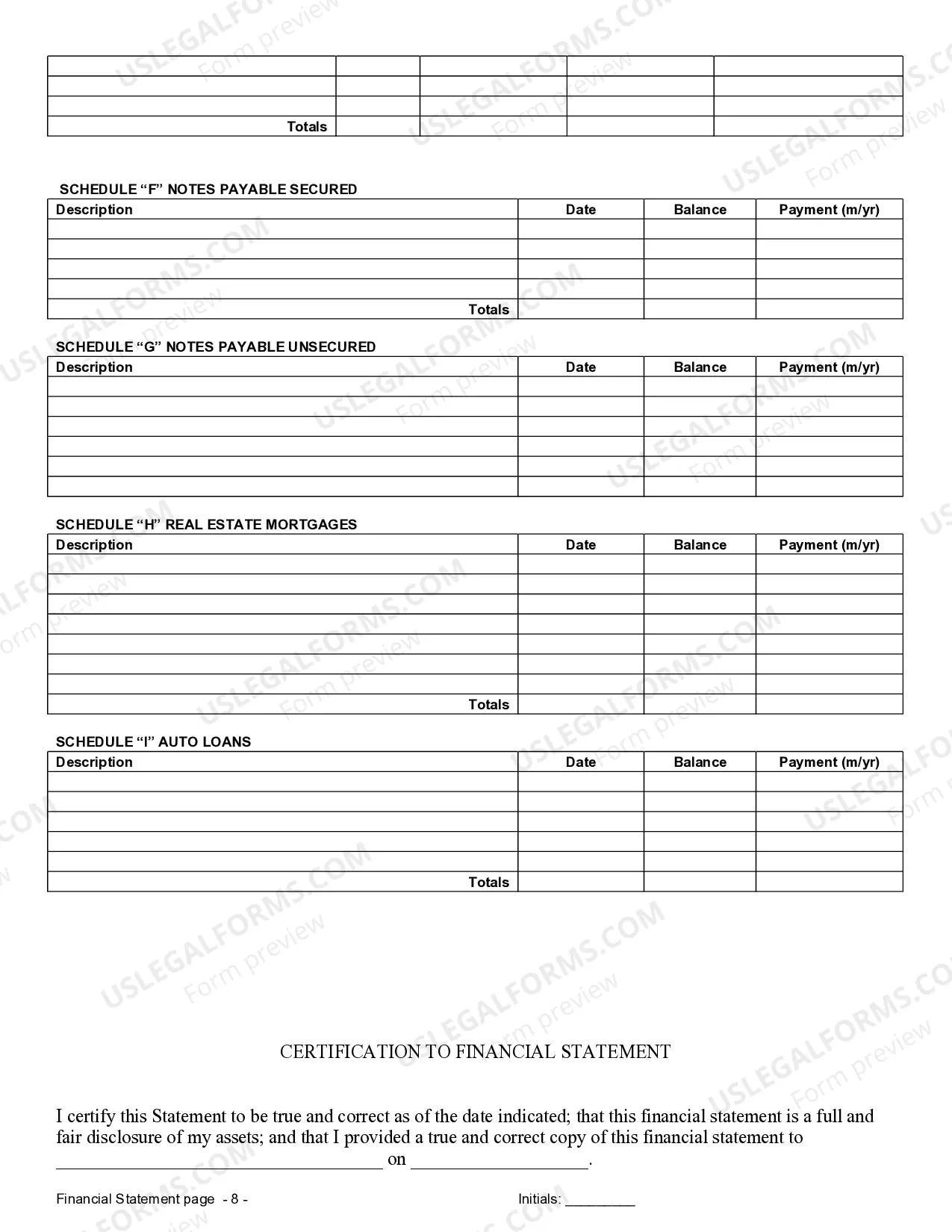

This financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

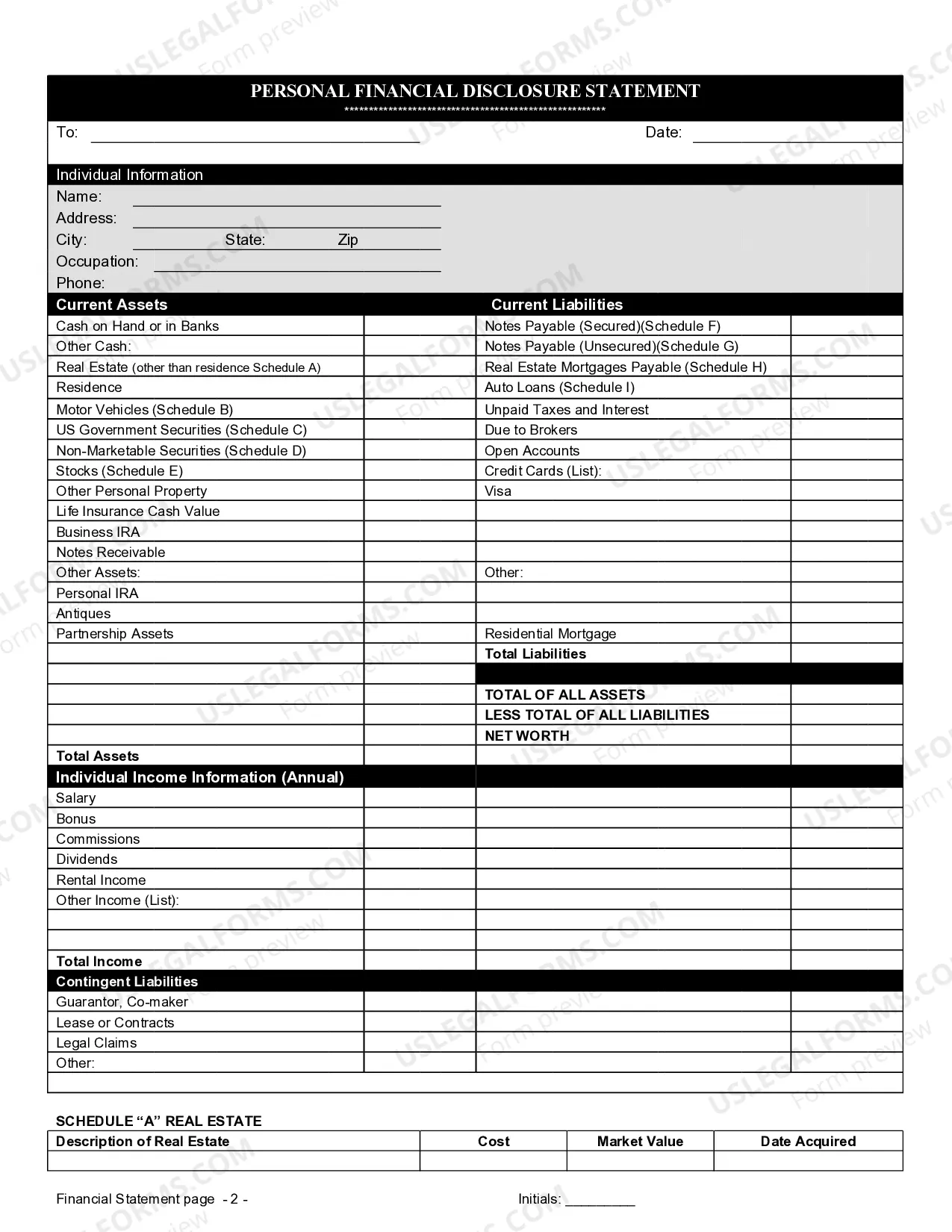

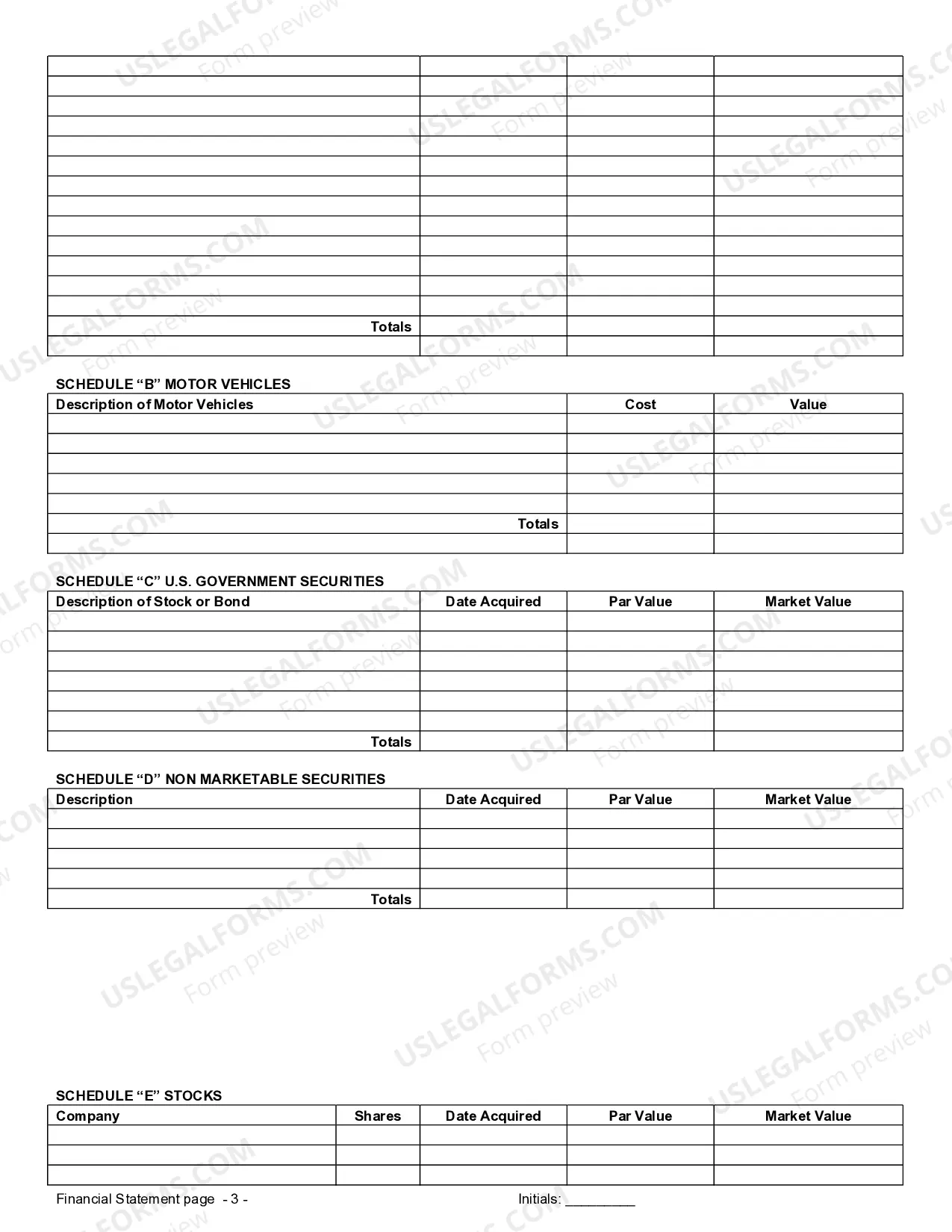

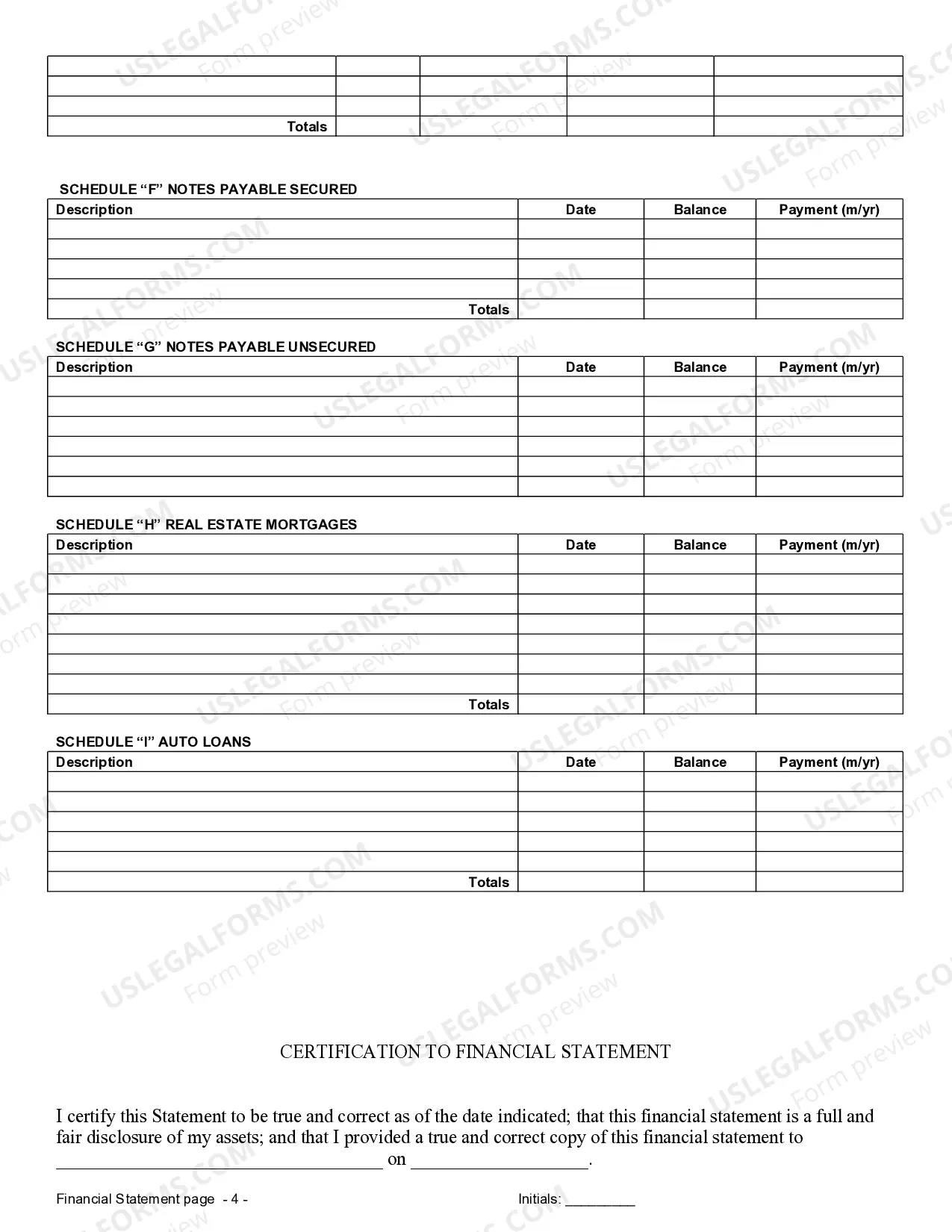

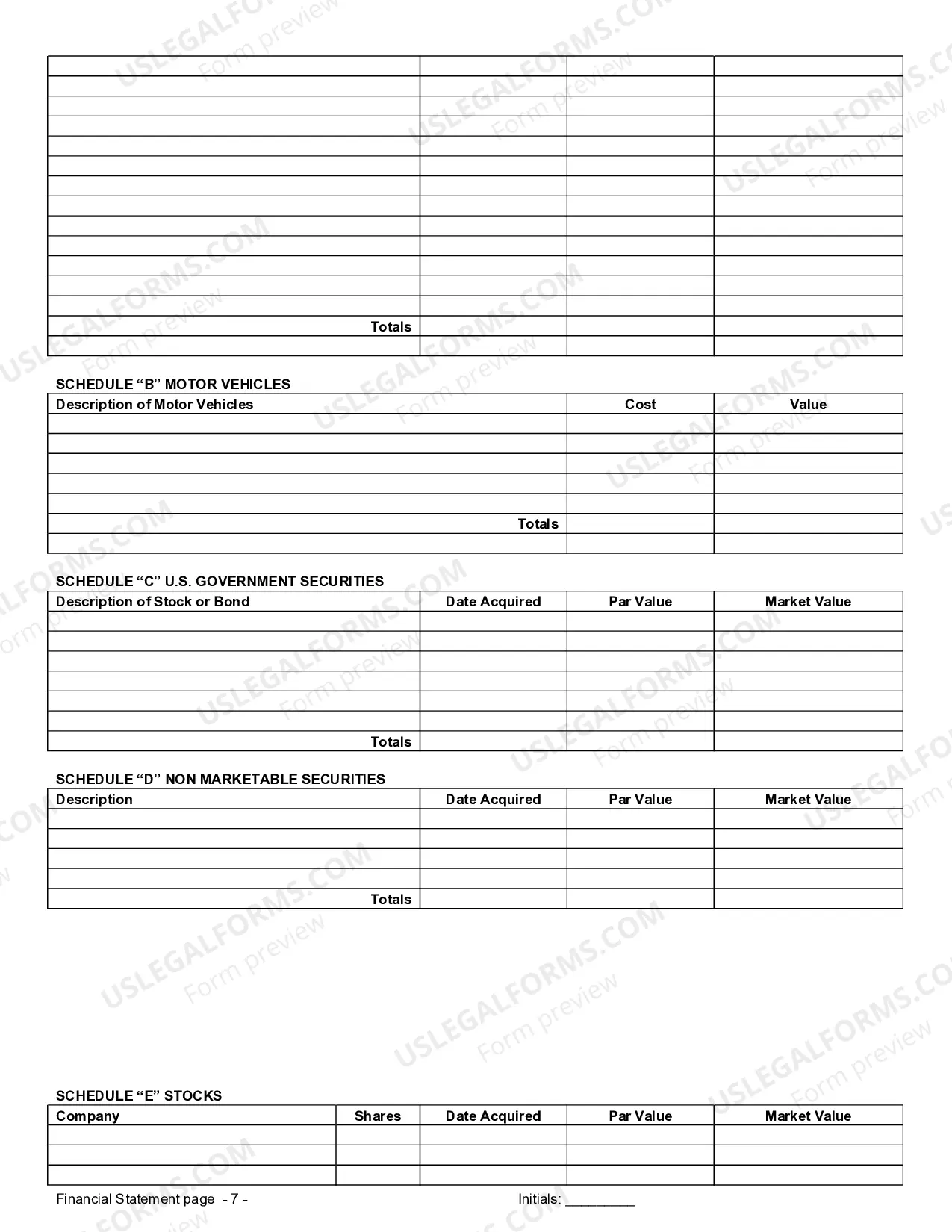

Gresham Oregon Financial Statements Only in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview When planning to enter a prenuptial or premarital agreement in Gresham, Oregon, couples often need to prepare and disclose financial statements to ensure transparency and protection of their respective assets. These financial statements play a crucial role in documenting each individual's financial situation before entering into a legally binding agreement. 1. Gresham Oregon Financial Statements: Overview Gresham Oregon financial statements are comprehensive documents that provide a detailed snapshot of an individual's financial status. These statements serve as crucial evidence in prenuptial or premarital agreements, helping couples maintain transparency and clarity regarding their respective assets, debts, and incomes. 2. Purpose of Gresham Oregon Financial Statements in Prenuptial Premarital Agreements The primary purpose of these financial statements is to establish a clear understanding of each party's financial positions, ensuring fairness and equity in the event of a divorce or separation. By disclosing their financial information, individuals can protect their personal assets, safeguard businesses, clarify debt obligations, and secure their financial futures, thereby promoting a sense of trust and protection in a prenuptial or premarital agreement. 3. Components of Gresham Oregon Financial Statements Gresham Oregon financial statements must contain accurate and up-to-date information about various financial aspects, such as: a) Personal Assets: A comprehensive list of personal assets, including real estate properties, vehicles, investments, savings accounts, retirement accounts, and any other valuable possessions. b) Debts and Liabilities: Detailed information on outstanding debts, loans, mortgages, credit card balances, and other financial obligations. c) Income and Earnings: An individual's income sources, including salary, wages, bonuses, commissions, investments, business profits, and any other revenue streams. d) Expenses and Obligations: A breakdown of regular expenses, such as mortgage or rent payments, utility bills, insurance premiums, educational costs, healthcare expenses, and any other significant financial obligations. e) Business Interests: Disclosure of any ownership interests or involvement in businesses, partnerships, and other ventures. This includes business valuations, profit-sharing agreements, or equity stakes. f) Estate Planning and Inheritance: Documentation of any existing wills, trusts, or inheritance rights that may affect the distribution of assets in the future. 4. Different Types of Gresham Oregon Financial Statements While the content remains consistent, there can be different formats or types of financial statements used in Gresham, Oregon prenuptial or premarital agreements. These might include: a) Sworn Financial Statements: Affidavits that require individuals to affirm the accuracy and truthfulness of the financial information provided. b) Certified Public Accountant (CPA) Certified Statements: Financial statements prepared and certified by a licensed CPA to ensure accuracy and credibility. c) Court-Approved Financial Statements: Financial statements that adhere to specific court requirements and may require additional legal documentation. d) Joint Financial Statements: Statements jointly prepared by both parties, providing a comprehensive overview of their combined finances. In conclusion, Gresham Oregon financial statements hold significant importance in prenuptial or premarital agreements, safeguarding the rights and interests of individuals entering into such agreements. By thoroughly disclosing their financial standing, individuals can establish transparency, accountability, and protect their respective assets in case of future disputes or separation.Gresham Oregon Financial Statements Only in Connection with Prenuptial Premarital Agreement: A Comprehensive Overview When planning to enter a prenuptial or premarital agreement in Gresham, Oregon, couples often need to prepare and disclose financial statements to ensure transparency and protection of their respective assets. These financial statements play a crucial role in documenting each individual's financial situation before entering into a legally binding agreement. 1. Gresham Oregon Financial Statements: Overview Gresham Oregon financial statements are comprehensive documents that provide a detailed snapshot of an individual's financial status. These statements serve as crucial evidence in prenuptial or premarital agreements, helping couples maintain transparency and clarity regarding their respective assets, debts, and incomes. 2. Purpose of Gresham Oregon Financial Statements in Prenuptial Premarital Agreements The primary purpose of these financial statements is to establish a clear understanding of each party's financial positions, ensuring fairness and equity in the event of a divorce or separation. By disclosing their financial information, individuals can protect their personal assets, safeguard businesses, clarify debt obligations, and secure their financial futures, thereby promoting a sense of trust and protection in a prenuptial or premarital agreement. 3. Components of Gresham Oregon Financial Statements Gresham Oregon financial statements must contain accurate and up-to-date information about various financial aspects, such as: a) Personal Assets: A comprehensive list of personal assets, including real estate properties, vehicles, investments, savings accounts, retirement accounts, and any other valuable possessions. b) Debts and Liabilities: Detailed information on outstanding debts, loans, mortgages, credit card balances, and other financial obligations. c) Income and Earnings: An individual's income sources, including salary, wages, bonuses, commissions, investments, business profits, and any other revenue streams. d) Expenses and Obligations: A breakdown of regular expenses, such as mortgage or rent payments, utility bills, insurance premiums, educational costs, healthcare expenses, and any other significant financial obligations. e) Business Interests: Disclosure of any ownership interests or involvement in businesses, partnerships, and other ventures. This includes business valuations, profit-sharing agreements, or equity stakes. f) Estate Planning and Inheritance: Documentation of any existing wills, trusts, or inheritance rights that may affect the distribution of assets in the future. 4. Different Types of Gresham Oregon Financial Statements While the content remains consistent, there can be different formats or types of financial statements used in Gresham, Oregon prenuptial or premarital agreements. These might include: a) Sworn Financial Statements: Affidavits that require individuals to affirm the accuracy and truthfulness of the financial information provided. b) Certified Public Accountant (CPA) Certified Statements: Financial statements prepared and certified by a licensed CPA to ensure accuracy and credibility. c) Court-Approved Financial Statements: Financial statements that adhere to specific court requirements and may require additional legal documentation. d) Joint Financial Statements: Statements jointly prepared by both parties, providing a comprehensive overview of their combined finances. In conclusion, Gresham Oregon financial statements hold significant importance in prenuptial or premarital agreements, safeguarding the rights and interests of individuals entering into such agreements. By thoroughly disclosing their financial standing, individuals can establish transparency, accountability, and protect their respective assets in case of future disputes or separation.