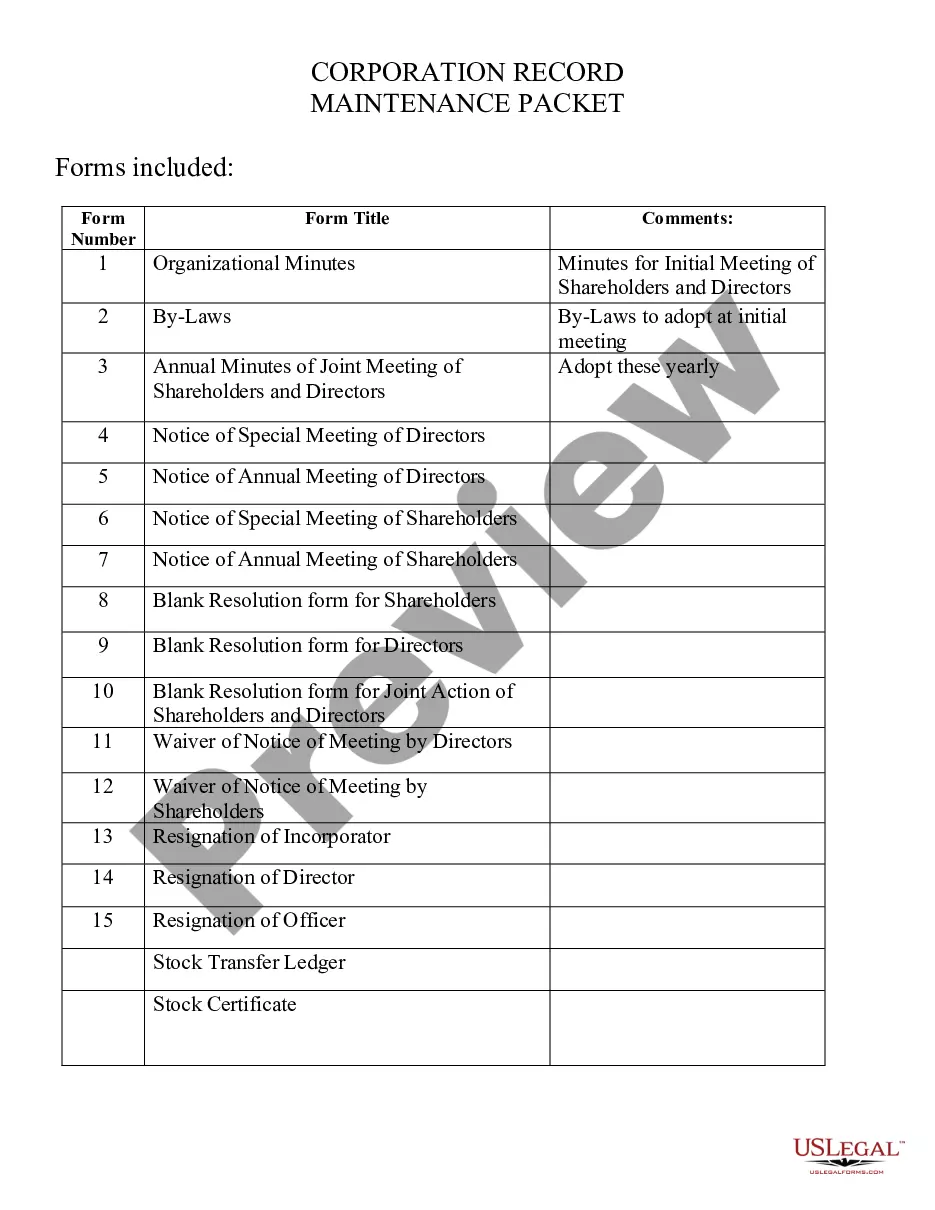

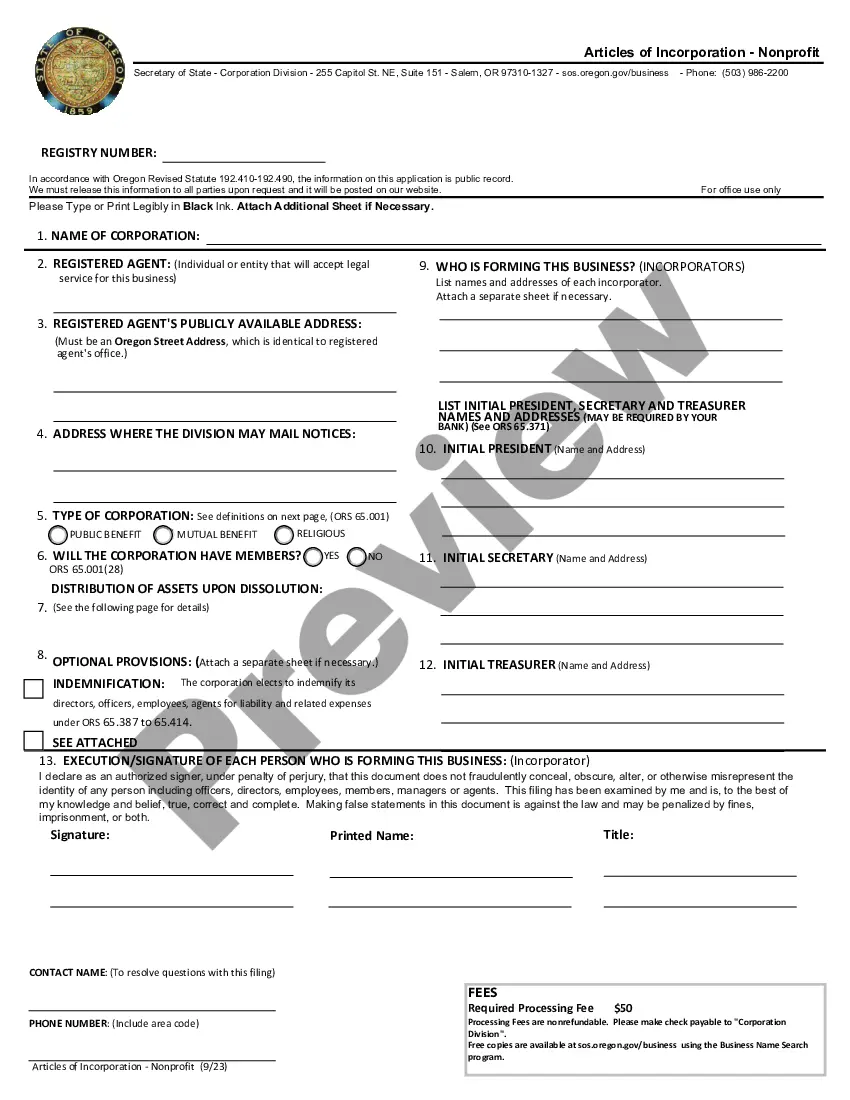

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

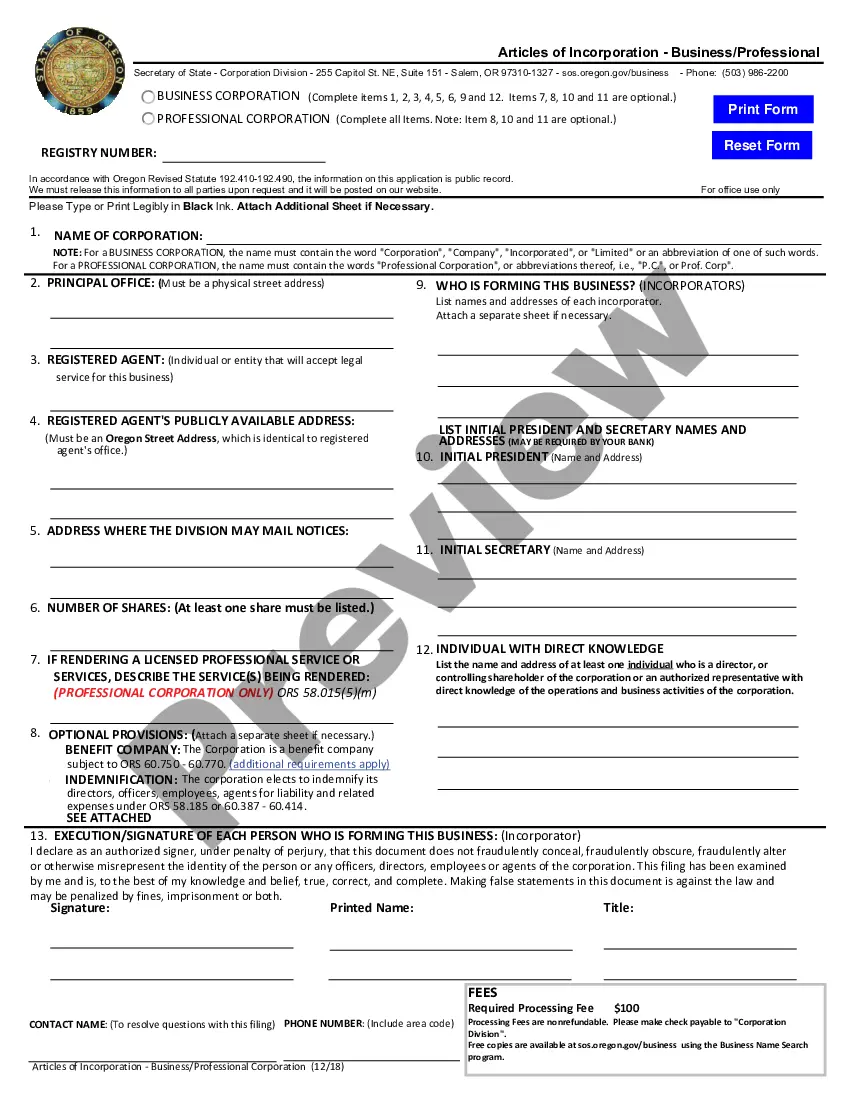

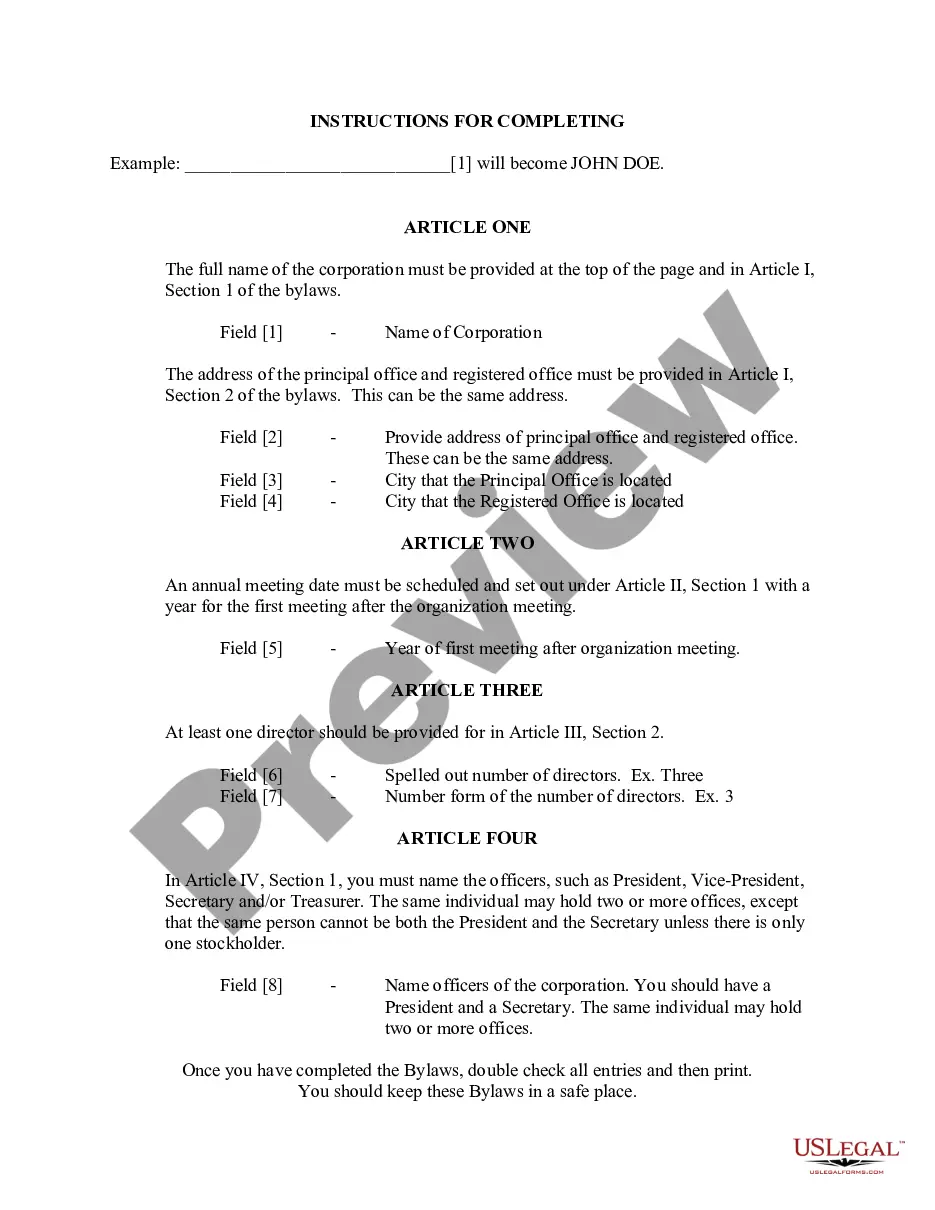

Gresham Oregon Business Incorporation Package provides a comprehensive solution for individuals and entrepreneurs looking to incorporate their corporation in the state of Oregon. This package is specifically tailored to meet the legal requirements and streamline the process of forming a corporation in Gresham, Oregon. When you opt for a Gresham Oregon Business Incorporation Package, you will receive a range of services and benefits that are essential for starting and organizing your corporation. Some key features offered in this package include: 1. Name Reservation: The package includes assistance with reserving a unique and compliant business name for your corporation. This crucial step ensures that your chosen name is available and protects your brand identity. 2. Preparation and Filing of Articles of Incorporation: The package covers the entire process of preparing and filing the necessary legal documents with the Secretary of State's office. These documents officially establish your corporation as a legal entity in Gresham, Oregon. 3. Registered Agent Service: Most incorporation packages include registered agent service for a designated period. A registered agent acts as a point of contact between your corporation and the state, receiving important legal and tax documents on your behalf. 4. Federal Tax ID (EIN) Application: The package may also include assistance in obtaining a Federal Tax Identification Number (EIN) for your corporation. This unique identifier is required for tax purposes and enables your corporation to open bank accounts and hire employees. 5. Corporate Bylaws and Organizational Minutes: Gresham Oregon Business Incorporation Packages often provide templates and guidance for drafting corporate bylaws and organizing initial shareholder and director meetings. These documents outline internal rules, establish decision-making processes, and demonstrate corporate compliance. 6. Compliance Support: The incorporation package may include ongoing compliance support to ensure that your corporation fulfills its legal obligations. This could involve reminders of annual report filing deadlines or assistance in preparing and filing necessary state or federal forms. Different types of Gresham Oregon Business Incorporation Packages may vary in terms of the level of service provided and additional features included. Some packages may offer additional services like obtaining business licenses or permits, conducting name searches, or providing custom legal documents. When considering the right Gresham Oregon Business Incorporation Package for your corporation, it is essential to evaluate your specific needs and budget. It is advisable to choose a package that offers a comprehensive set of services and expert guidance to ensure a smooth and hassle-free incorporation process.