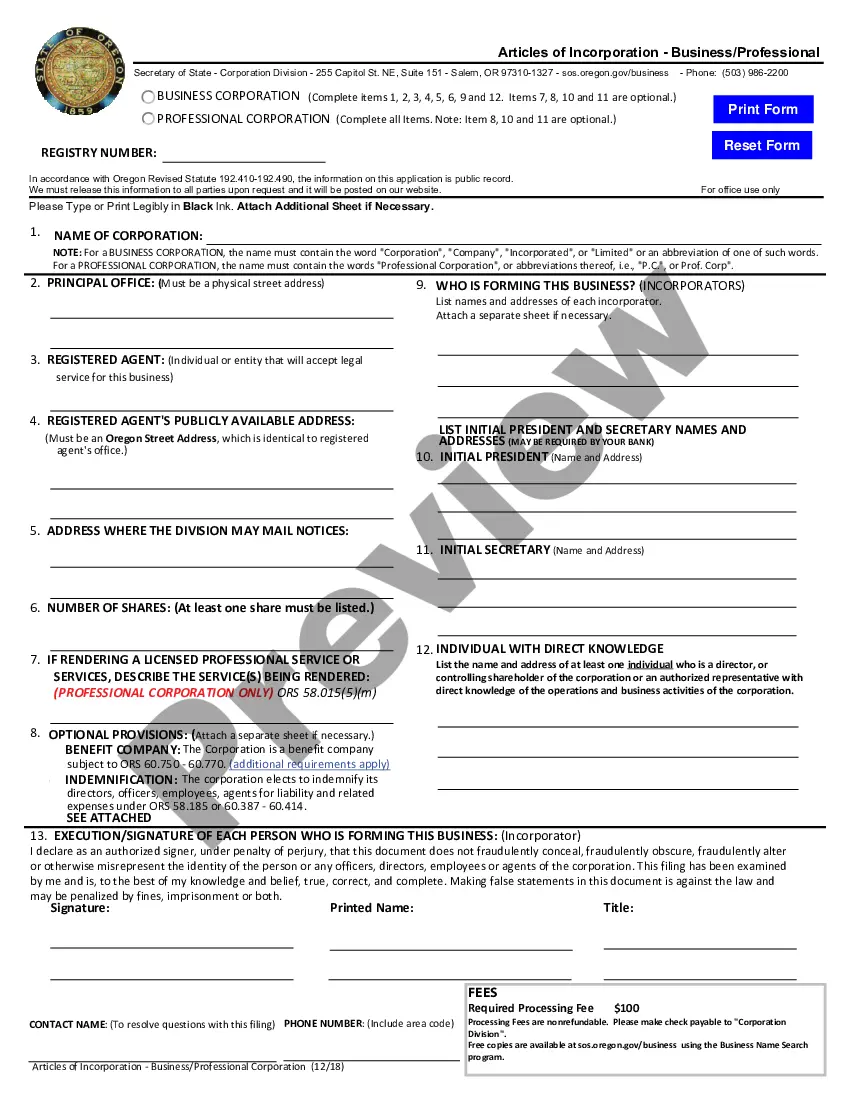

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Title: Understanding Eugene Oregon Articles of Incorporation for Domestic Nonprofit Corporation Introduction: The Eugene Oregon Articles of Incorporation for Domestic Nonprofit Corporation play a crucial role in establishing and legally organizing nonprofit entities within the state. This detailed description will explore the key elements and requirements of these articles, shedding light on the various types available and their purpose. I. Definition and Purpose: The Eugene Oregon Articles of Incorporation for Domestic Nonprofit Corporation is a legal document that serves as the foundation for creating a nonprofit organization within the state of Oregon. This document outlines the essential information necessary for the incorporation process, ensuring compliance with state laws and regulations. II. Key Elements: The articles typically contain the following elements: 1. Name of the Corporation: The nonprofit organization must choose a unique name that distinguishes it from other entities. The name should reflect the purpose or nature of the organization while abiding by the naming rules established by the Oregon Secretary of State. 2. Registered Agent: A nonprofit corporation must have a registered agent listed on the articles. The registered agent must have a physical address in Oregon and serve as the official point of contact for legal matters. 3. Purpose of the Corporation: The articles should clearly state the purpose of the organization and explain its charitable, educational, religious, or scientific objective. This section must align with the IRS regulations to establish tax-exempt status. 4. Duration: Nonprofit corporations can be established for a specific duration or as perpetual entities. This section defines the intended lifespan of the organization and can be specified as "perpetual" without a stated end date. 5. Members, Directors, and Officers: The articles may outline the structure and roles within the organization, including membership criteria, board of directors, and officer positions. These roles may vary based on the nonprofit's nature and the desired governance structure. 6. Distribution of Assets: This section addresses the nonprofit's charitable purpose and declares that in the event of dissolution, assets will be distributed solely for tax-exempt purposes. III. Different Types of Eugene Oregon Articles of Incorporation for Domestic Nonprofit Corporation: While the articles generally follow a standardized format, there are specific types: 1. Public Benefit Corporation: This type of incorporation focuses on benefiting the public or a specific group, addressing social, educational, environmental, or humanitarian needs. 2. Mutual Benefit Corporation: Mutual benefit corporations serve the interests of their members rather than the public at large. Such organizations may be recreational clubs, professional associations, or advocacy groups. 3. Religious Corporation: Religious corporations exist to carry out religious or spiritual activities and may include churches, religious societies, or missionary organizations. Conclusion: The Eugene Oregon Articles of Incorporation for Domestic Nonprofit Corporation are essential for establishing a legally recognized nonprofit organization. Understanding the key elements and the various types available is crucial for nonprofits to navigate the incorporation process smoothly and ensure compliance with state laws and regulations.Title: Understanding Eugene Oregon Articles of Incorporation for Domestic Nonprofit Corporation Introduction: The Eugene Oregon Articles of Incorporation for Domestic Nonprofit Corporation play a crucial role in establishing and legally organizing nonprofit entities within the state. This detailed description will explore the key elements and requirements of these articles, shedding light on the various types available and their purpose. I. Definition and Purpose: The Eugene Oregon Articles of Incorporation for Domestic Nonprofit Corporation is a legal document that serves as the foundation for creating a nonprofit organization within the state of Oregon. This document outlines the essential information necessary for the incorporation process, ensuring compliance with state laws and regulations. II. Key Elements: The articles typically contain the following elements: 1. Name of the Corporation: The nonprofit organization must choose a unique name that distinguishes it from other entities. The name should reflect the purpose or nature of the organization while abiding by the naming rules established by the Oregon Secretary of State. 2. Registered Agent: A nonprofit corporation must have a registered agent listed on the articles. The registered agent must have a physical address in Oregon and serve as the official point of contact for legal matters. 3. Purpose of the Corporation: The articles should clearly state the purpose of the organization and explain its charitable, educational, religious, or scientific objective. This section must align with the IRS regulations to establish tax-exempt status. 4. Duration: Nonprofit corporations can be established for a specific duration or as perpetual entities. This section defines the intended lifespan of the organization and can be specified as "perpetual" without a stated end date. 5. Members, Directors, and Officers: The articles may outline the structure and roles within the organization, including membership criteria, board of directors, and officer positions. These roles may vary based on the nonprofit's nature and the desired governance structure. 6. Distribution of Assets: This section addresses the nonprofit's charitable purpose and declares that in the event of dissolution, assets will be distributed solely for tax-exempt purposes. III. Different Types of Eugene Oregon Articles of Incorporation for Domestic Nonprofit Corporation: While the articles generally follow a standardized format, there are specific types: 1. Public Benefit Corporation: This type of incorporation focuses on benefiting the public or a specific group, addressing social, educational, environmental, or humanitarian needs. 2. Mutual Benefit Corporation: Mutual benefit corporations serve the interests of their members rather than the public at large. Such organizations may be recreational clubs, professional associations, or advocacy groups. 3. Religious Corporation: Religious corporations exist to carry out religious or spiritual activities and may include churches, religious societies, or missionary organizations. Conclusion: The Eugene Oregon Articles of Incorporation for Domestic Nonprofit Corporation are essential for establishing a legally recognized nonprofit organization. Understanding the key elements and the various types available is crucial for nonprofits to navigate the incorporation process smoothly and ensure compliance with state laws and regulations.