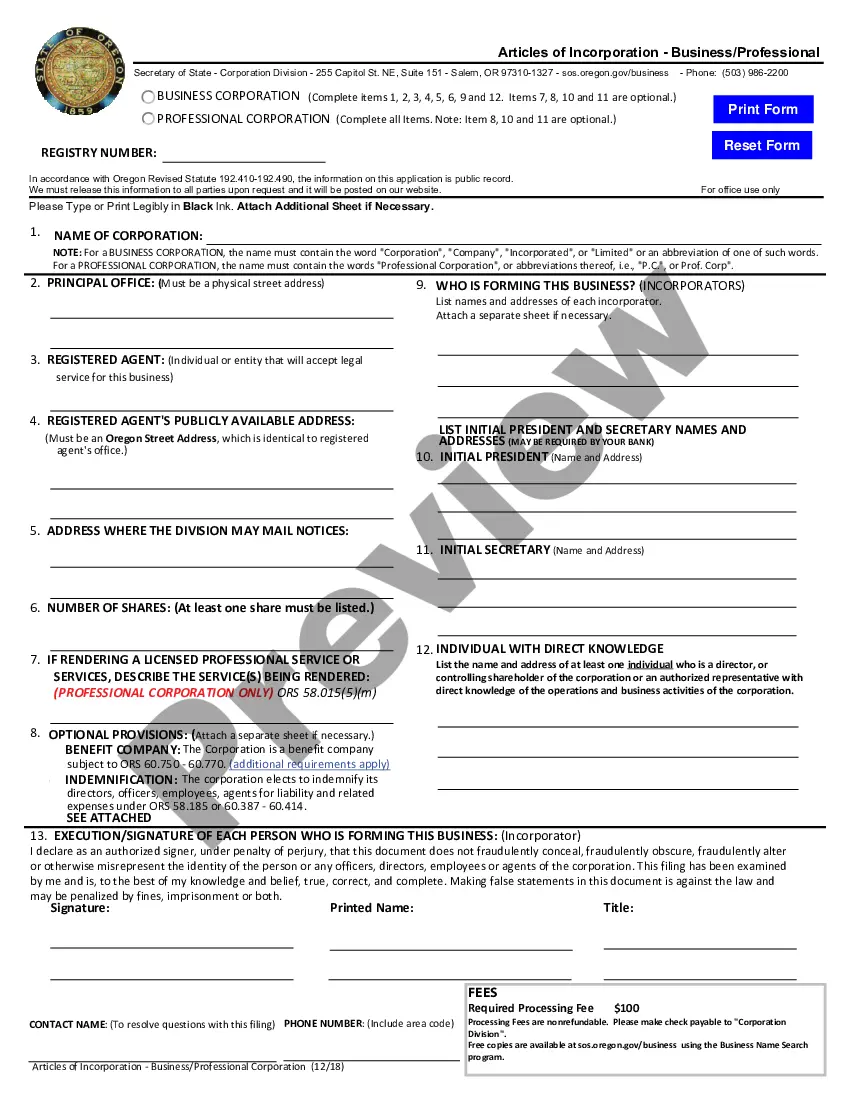

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

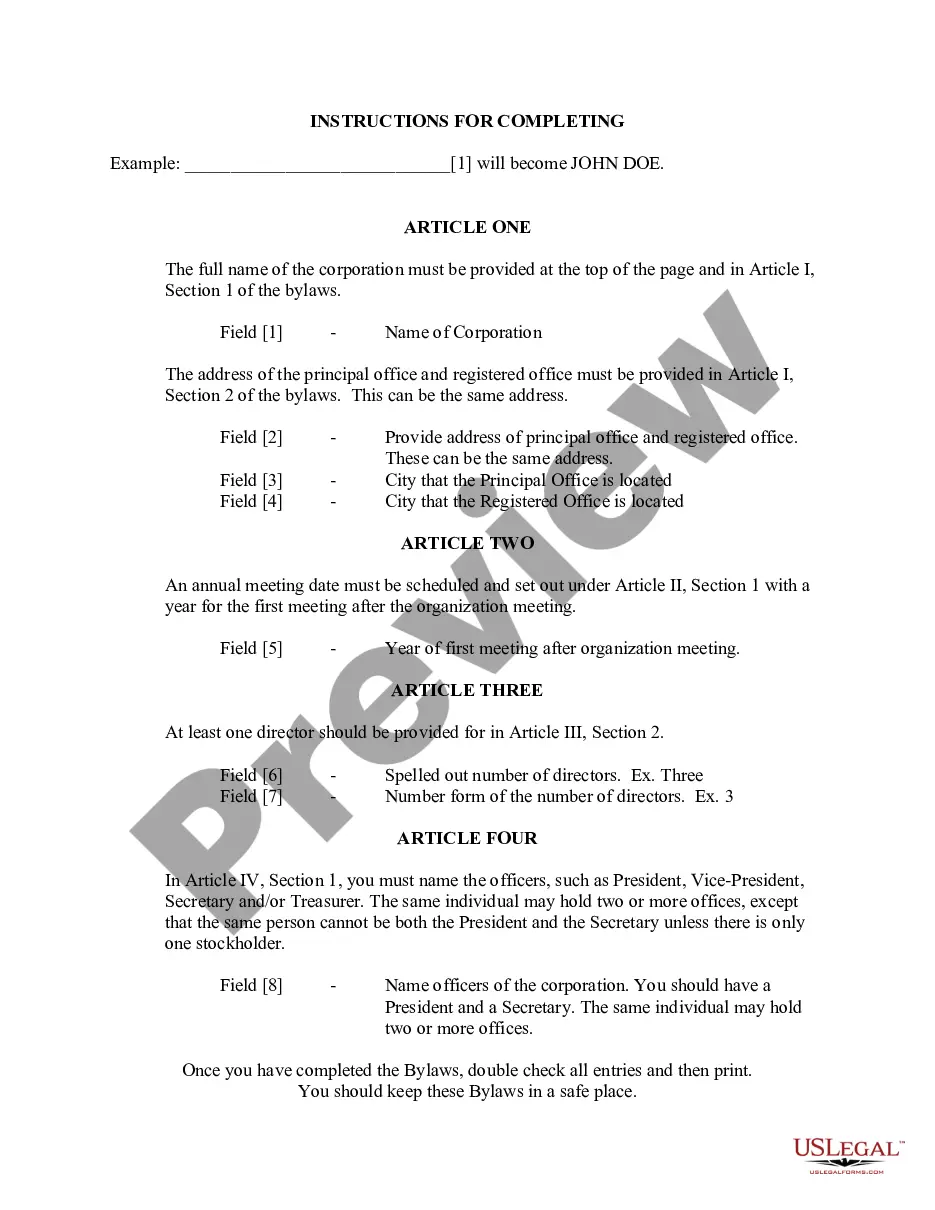

Keywords: Portland Oregon, Articles of Incorporation, Domestic Nonprofit Corporation Detailed description: The Portland Oregon Articles of Incorporation for Domestic Nonprofit Corporation is a legal document that serves as the foundation for creating a nonprofit organization in the state of Oregon. These articles outline the essential details required by the Oregon Secretary of State to establish a domestic nonprofit corporation in Portland. The Articles of Incorporation document consists of several important sections that need to be filled out accurately and completely. These sections include: 1. Name of the Corporation: The articles should clearly state the proposed legal name for the nonprofit corporation. The name must comply with the regulations set forth by the Oregon Secretary of State, including the use of appropriate designations like "Corporation," "Incorporated," or an abbreviation thereof. 2. Purpose: This section describes the specific objectives and activities that the nonprofit corporation intends to undertake. It should outline the charitable, educational, religious, scientific, or any other non-profitable goals that the organization aims to achieve. 3. Duration: Here, the nonprofit corporation must state whether it plans to have a perpetual existence or a specified period of operation. Most nonprofits opt for perpetual duration to ensure stability and continuity. 4. Registered Agent: The articles must include the name, address, and contact information of the registered agent who will act as the corporation's point of contact for legal matters. The registered agent must be based in Oregon and have a physical address within the state. 5. Directors: The articles should list the initial directors of the nonprofit corporation. Typically, a minimum of three directors is required, and their names and addresses must be provided. Directors play a crucial role in overseeing the organization's affairs and governing its activities. 6. Members: Although not always mandatory, if the nonprofit corporation intends to have members, their rights and responsibilities should be outlined in this section. Members may have voting rights and actively participate in the corporation's activities or decision-making processes. Variations or specific types of nonprofit corporations within Portland, Oregon may include: 1. Public Benefit Corporations: These nonprofit corporations are formed for the purpose of benefiting the public or specific communities. Their activities primarily focus on charitable, educational, or community service-oriented objectives. 2. Religious Corporations: Nonprofit organizations formed for religious or spiritual purposes fall under this category. Such organizations may seek tax-exempt status and have specific rules and regulations applicable to their religious activities. 3. Mutual Benefit Corporations: Unlike public benefit corporations, mutual benefit corporations aim to benefit their members rather than the public at large. These organizations typically serve a specific group of individuals with shared interests or mutual goals. In conclusion, the Portland Oregon Articles of Incorporation for Domestic Nonprofit Corporation is a crucial legal document that establishes a nonprofit organization's existence in the state. It outlines essential details such as the organization's name, purpose, registered agent, directors, and potentially, its members. Different types of nonprofit corporations in Portland, Oregon can include public benefit corporations, religious corporations, and mutual benefit corporations.Keywords: Portland Oregon, Articles of Incorporation, Domestic Nonprofit Corporation Detailed description: The Portland Oregon Articles of Incorporation for Domestic Nonprofit Corporation is a legal document that serves as the foundation for creating a nonprofit organization in the state of Oregon. These articles outline the essential details required by the Oregon Secretary of State to establish a domestic nonprofit corporation in Portland. The Articles of Incorporation document consists of several important sections that need to be filled out accurately and completely. These sections include: 1. Name of the Corporation: The articles should clearly state the proposed legal name for the nonprofit corporation. The name must comply with the regulations set forth by the Oregon Secretary of State, including the use of appropriate designations like "Corporation," "Incorporated," or an abbreviation thereof. 2. Purpose: This section describes the specific objectives and activities that the nonprofit corporation intends to undertake. It should outline the charitable, educational, religious, scientific, or any other non-profitable goals that the organization aims to achieve. 3. Duration: Here, the nonprofit corporation must state whether it plans to have a perpetual existence or a specified period of operation. Most nonprofits opt for perpetual duration to ensure stability and continuity. 4. Registered Agent: The articles must include the name, address, and contact information of the registered agent who will act as the corporation's point of contact for legal matters. The registered agent must be based in Oregon and have a physical address within the state. 5. Directors: The articles should list the initial directors of the nonprofit corporation. Typically, a minimum of three directors is required, and their names and addresses must be provided. Directors play a crucial role in overseeing the organization's affairs and governing its activities. 6. Members: Although not always mandatory, if the nonprofit corporation intends to have members, their rights and responsibilities should be outlined in this section. Members may have voting rights and actively participate in the corporation's activities or decision-making processes. Variations or specific types of nonprofit corporations within Portland, Oregon may include: 1. Public Benefit Corporations: These nonprofit corporations are formed for the purpose of benefiting the public or specific communities. Their activities primarily focus on charitable, educational, or community service-oriented objectives. 2. Religious Corporations: Nonprofit organizations formed for religious or spiritual purposes fall under this category. Such organizations may seek tax-exempt status and have specific rules and regulations applicable to their religious activities. 3. Mutual Benefit Corporations: Unlike public benefit corporations, mutual benefit corporations aim to benefit their members rather than the public at large. These organizations typically serve a specific group of individuals with shared interests or mutual goals. In conclusion, the Portland Oregon Articles of Incorporation for Domestic Nonprofit Corporation is a crucial legal document that establishes a nonprofit organization's existence in the state. It outlines essential details such as the organization's name, purpose, registered agent, directors, and potentially, its members. Different types of nonprofit corporations in Portland, Oregon can include public benefit corporations, religious corporations, and mutual benefit corporations.