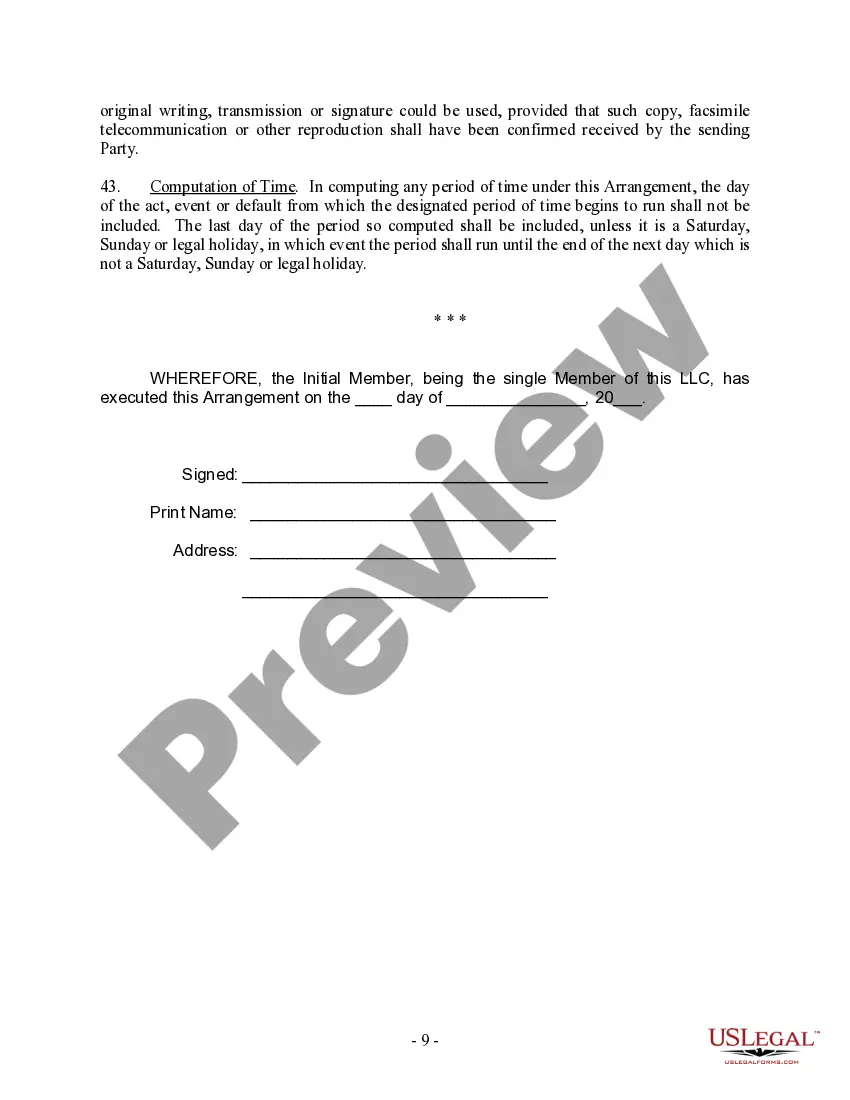

This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

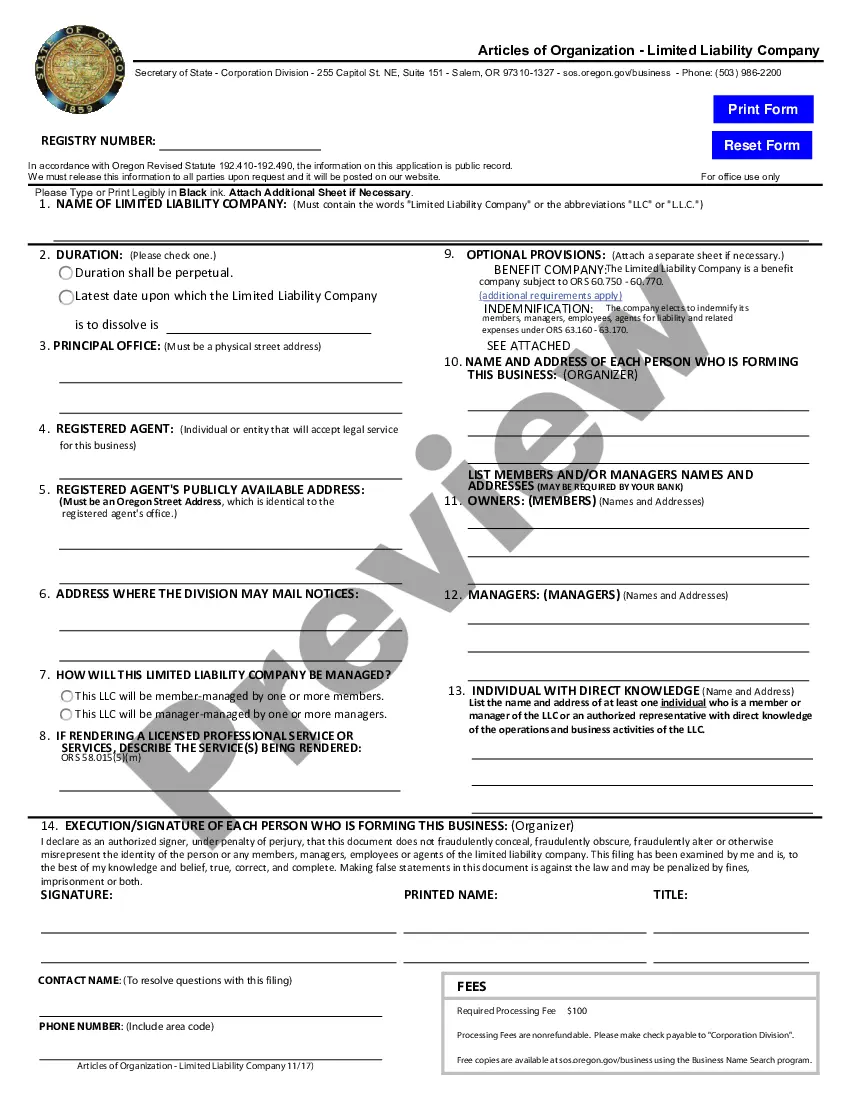

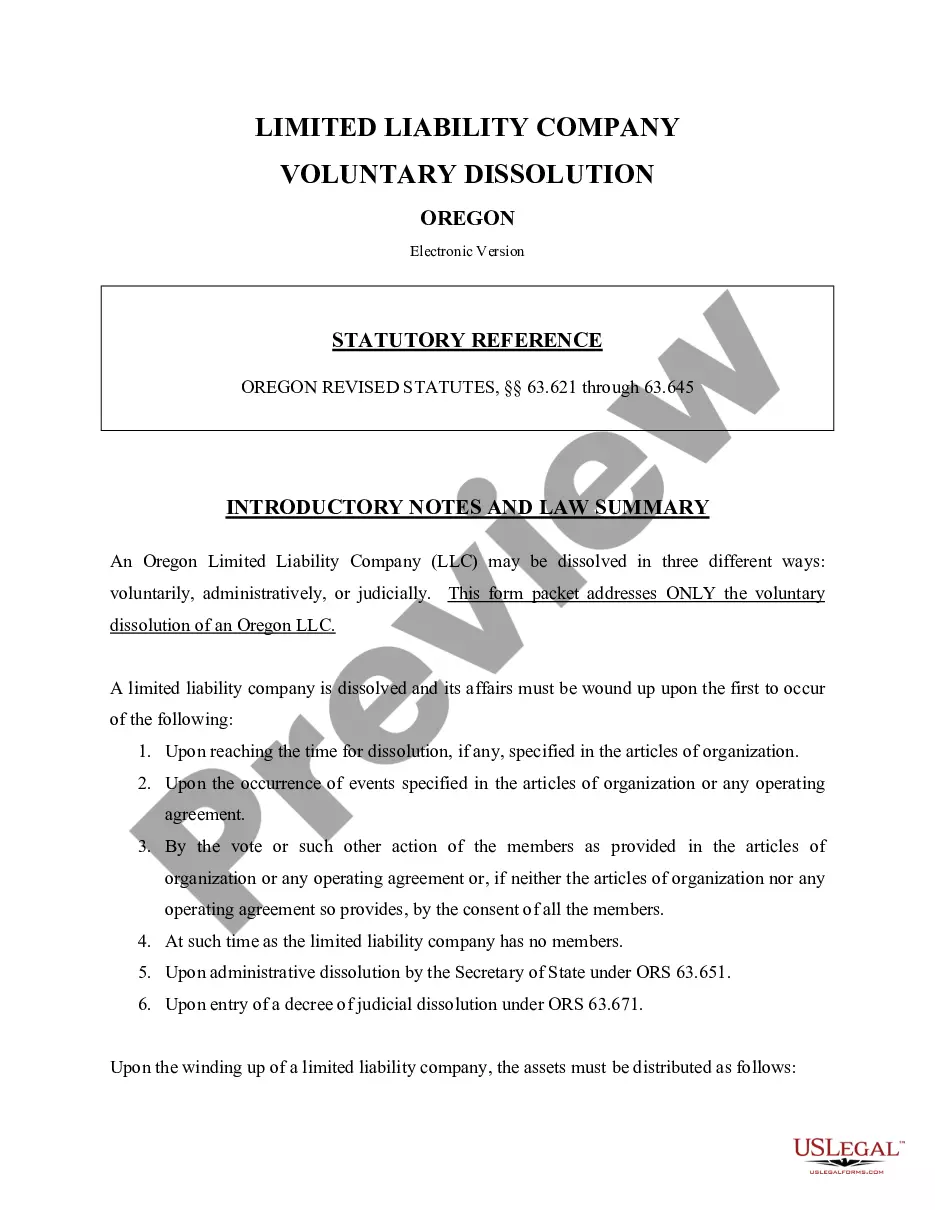

The Bend Oregon Single Member Limited Liability Company LLC Operating Agreement is a legal document that outlines the rules, regulations, and operating procedures for a single-member limited liability company (LLC) based in Bend, Oregon. This agreement serves as a crucial tool for establishing the rights and responsibilities of the single member, as well as outlining the company's governance structure. The Bend Oregon Single Member Limited Liability Company LLC Operating Agreement covers various aspects of the LLC's operations, including management, ownership, taxation, decision-making, and financial matters. It is designed to protect the interests and liabilities of the LLC's single member, offering them a clear understanding of their rights and responsibilities within the company. This operating agreement serves as a crucial tool for ensuring that the LLC operates smoothly, reduces the risk of disputes, and provides a solid legal framework for business operations. It establishes rules for decision-making processes, the allocation of profits and losses, capital contributions, and membership transfer restrictions, among other important provisions. While specific provisions may vary depending on the preferences and business needs of the single member, common elements included in the Bend Oregon Single Member Limited Liability Company LLC Operating Agreement may include: 1. Company Information: This section typically includes the LLC's name, purpose, principal place of business in Bend, Oregon, and duration. 2. Formation and Membership: Details on how the LLC was formed, the single member's name and address, and any membership rights and restrictions. 3. Management: Specifies if the LLC will be managed by the single member or if an appointed manager will oversee operations. 4. Financial Matters: Outlines the initial capital contributions, profit and loss allocations, and accounting procedures. 5. Decision-Making: Clarifies how decisions will be made, whether through unanimous consent or a specified voting percentage. 6. Distributions: Sets guidelines for the distribution of profits and losses among the single member and any tax considerations. 7. Transfer of Interest: Addresses restrictions and procedures for transferring membership interests. 8. Dissolution: Outlines the circumstances and procedures for dissolving the LLC. It is important to note that while there may be different variations or modifications to the Bend Oregon Single Member Limited Liability Company LLC Operating Agreement, the primary goal remains the same: to establish a comprehensive framework for the operation and management of a single-member LLC in Bend, Oregon.