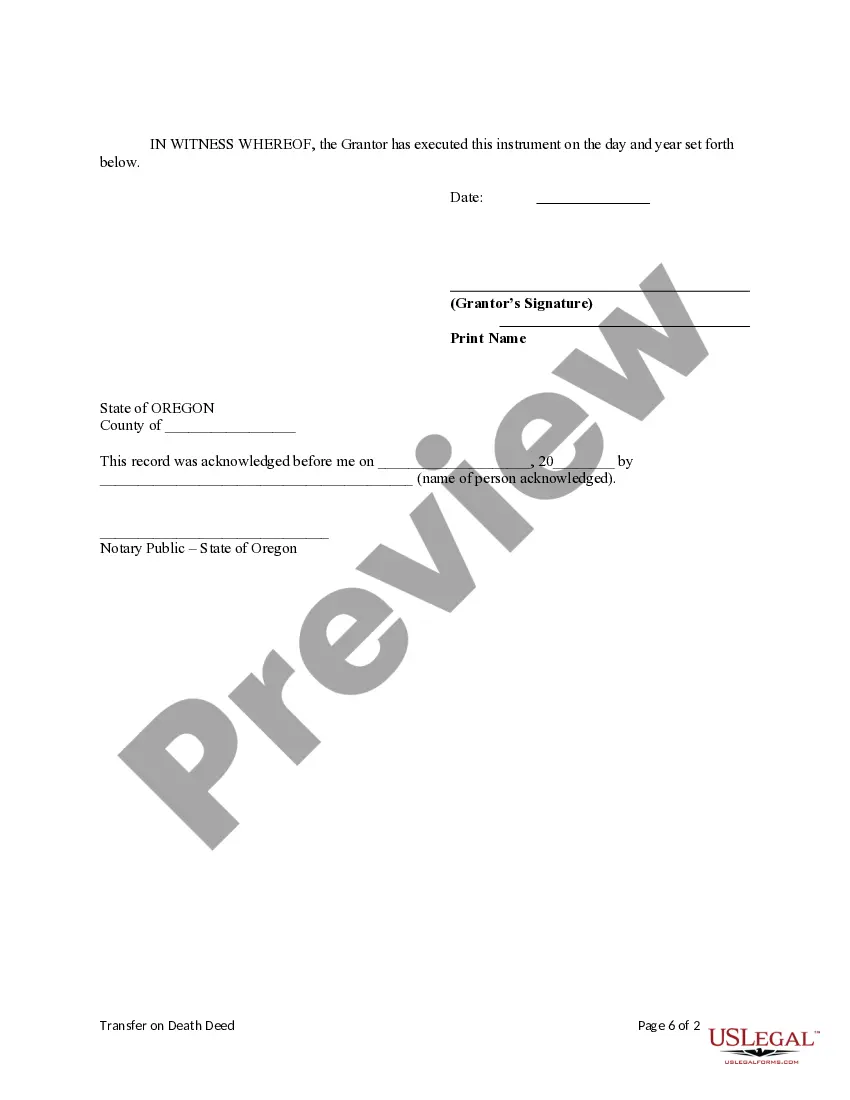

This form is a Transfer on Death Deed where the Grantor/Owner is an individual and the Grantee beneficiary is an individual. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Portland Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary.

Description

How to fill out Oregon Transfer On Death Deed From An Individual Owner/Grantor To An Individual Beneficiary.?

If you have previously utilized our service, Log In to your account and download the Portland Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary. on your device by selecting the Download button. Verify that your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You will have continuous access to all documents you have acquired: you can find it in your profile within the My documents section whenever you wish to use it again. Take advantage of the US Legal Forms service to swiftly find and store any template for your personal or business purposes!

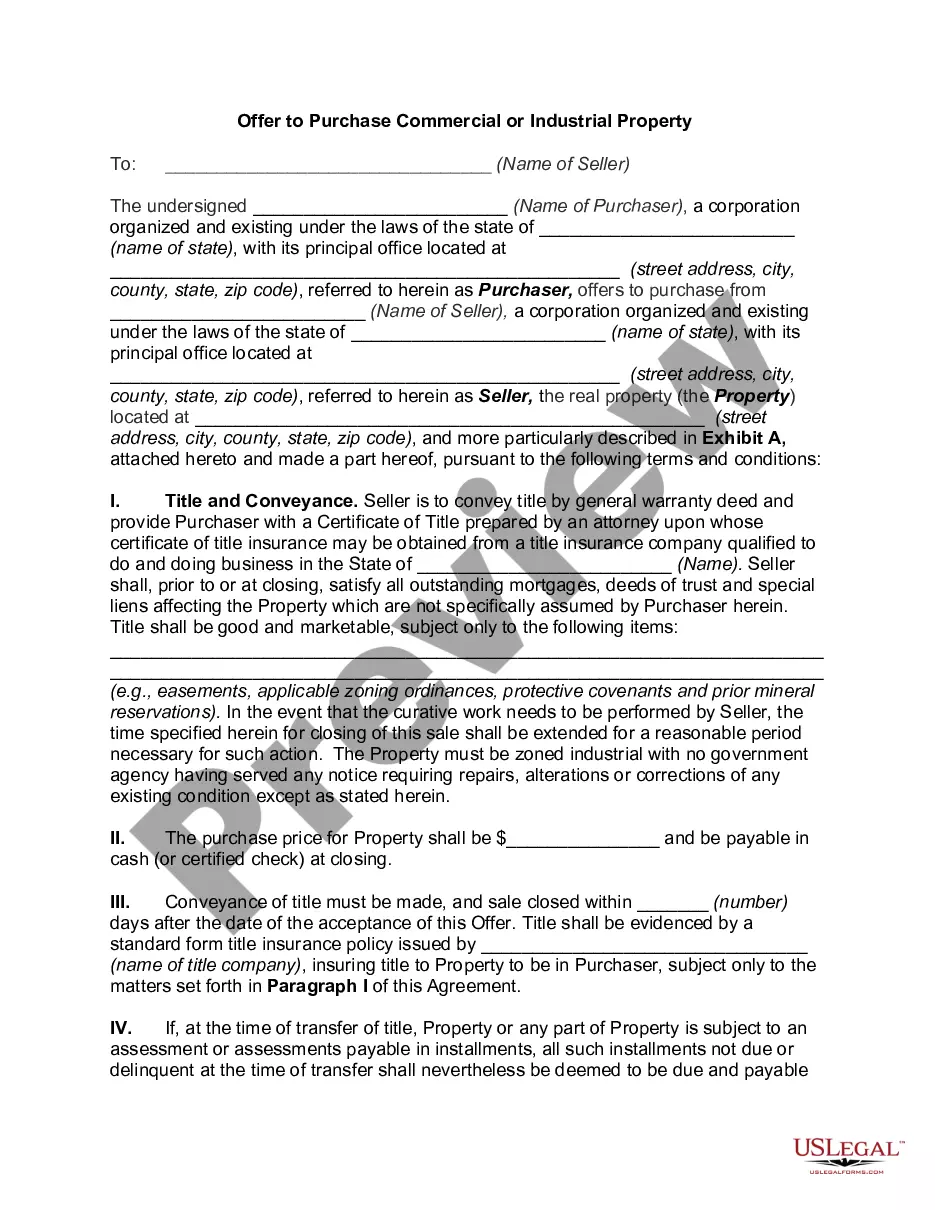

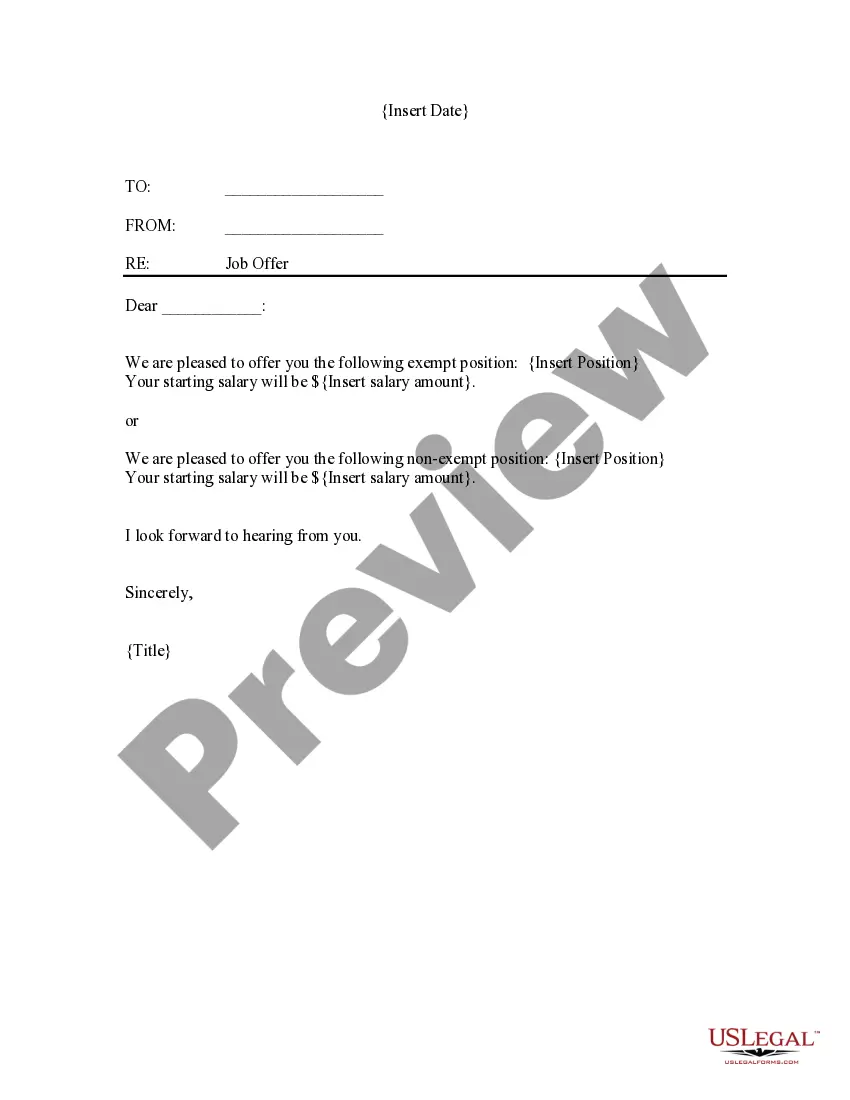

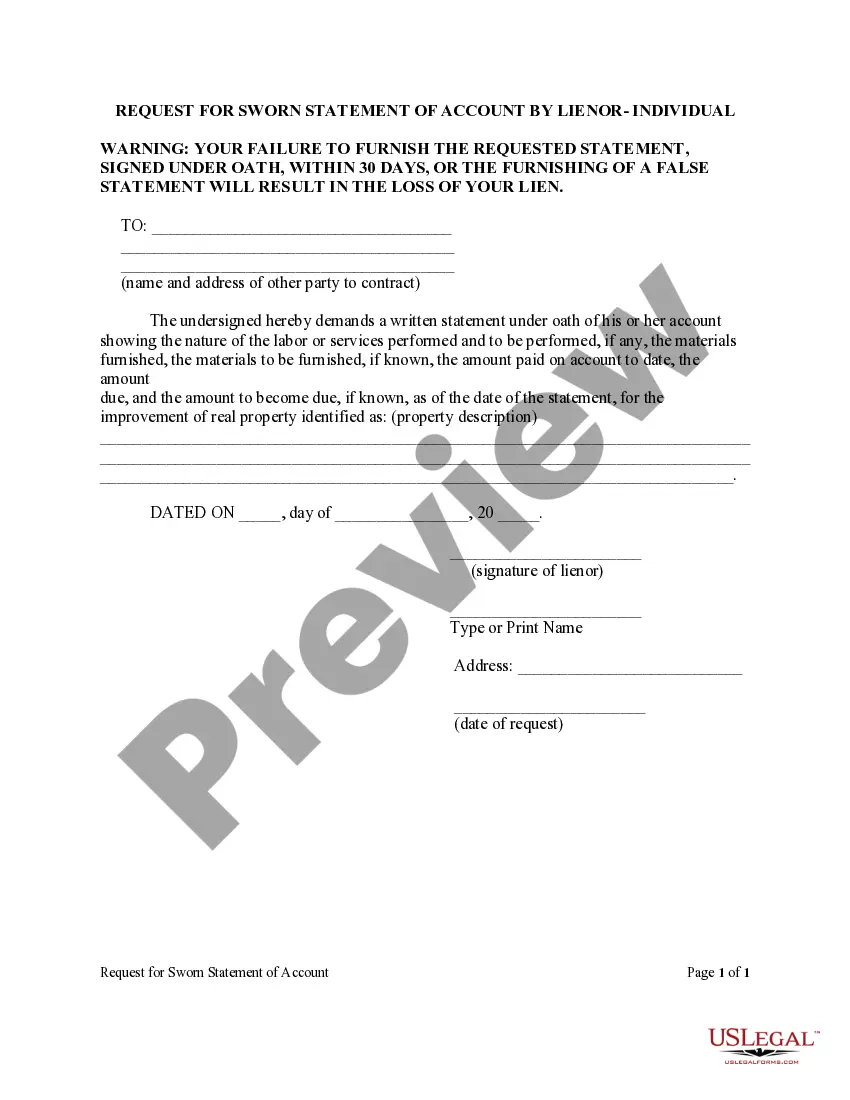

- Confirm you’ve found an appropriate document. Browse through the description and utilize the Preview feature, if available, to determine if it aligns with your needs. If it doesn't fit, utilize the Search tab above to find the correct one.

- Acquire the template. Hit the Buy Now button and select a monthly or yearly subscription option.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Portland Oregon Transfer on Death Deed from an individual Owner/Grantor to an individual Beneficiary. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

The primary advantage of a transfer on death deed is to avoid the probate process. If a property owner has executed a transfer on death deed, then as soon as the property owner dies, that property passes to the person named. The beneficiary does not have to go to court.

Because TOD accounts are still part of the decedent's estate (although not the probate estate that the Last Will establishes), they may be subject to income, estate and/or inheritance tax. TOD accounts are also not out of reach for the decedent's creditors or other relatives.

A POD accounts stands for ?payable on death? and is usually used with bank accounts such as checking, savings or Certificates of Deposit. TOD are ?transfer on death? accounts and are usually used with brokerage accounts, stocks, bonds and other investments.

An original certified death certificate will need to be recorded in our office. This removes the name of the decedent from the County's ownership records. Fees are involved with this process.

Effective January 1, 2012, Oregon law provides for a new form of deed known as a transfer on death (TOD) deed. These deeds allow an owner of real property to designate a beneficiary who will obtain title to that real property when the owner dies, without having to go through probate (subject to some exceptions).

Upon the property owner's death, title to real estate subject to an Oregon TOD deed automatically transfers to the named beneficiary?with no need for probate.

Transfer-on-death (TOD) refers to named beneficiaries that receive assets at the death of the property owner without the need for probate, facilitating the executor's disposition of the property owner's assets after their death.

Effective January 1, 2012, Oregon law provides for a new form of deed known as a transfer on death (TOD) deed. These deeds allow an owner of real property to designate a beneficiary who will obtain title to that real property when the owner dies, without having to go through probate (subject to some exceptions).

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

While naming a TOD beneficiary can help your heirs avoid the probate process, it doesn't confer any tax benefit. It doesn't help you to avoid estate taxes, and your heirs will still have to pay income tax on the earnings of a certificate of deposit (CD) after you pass away.