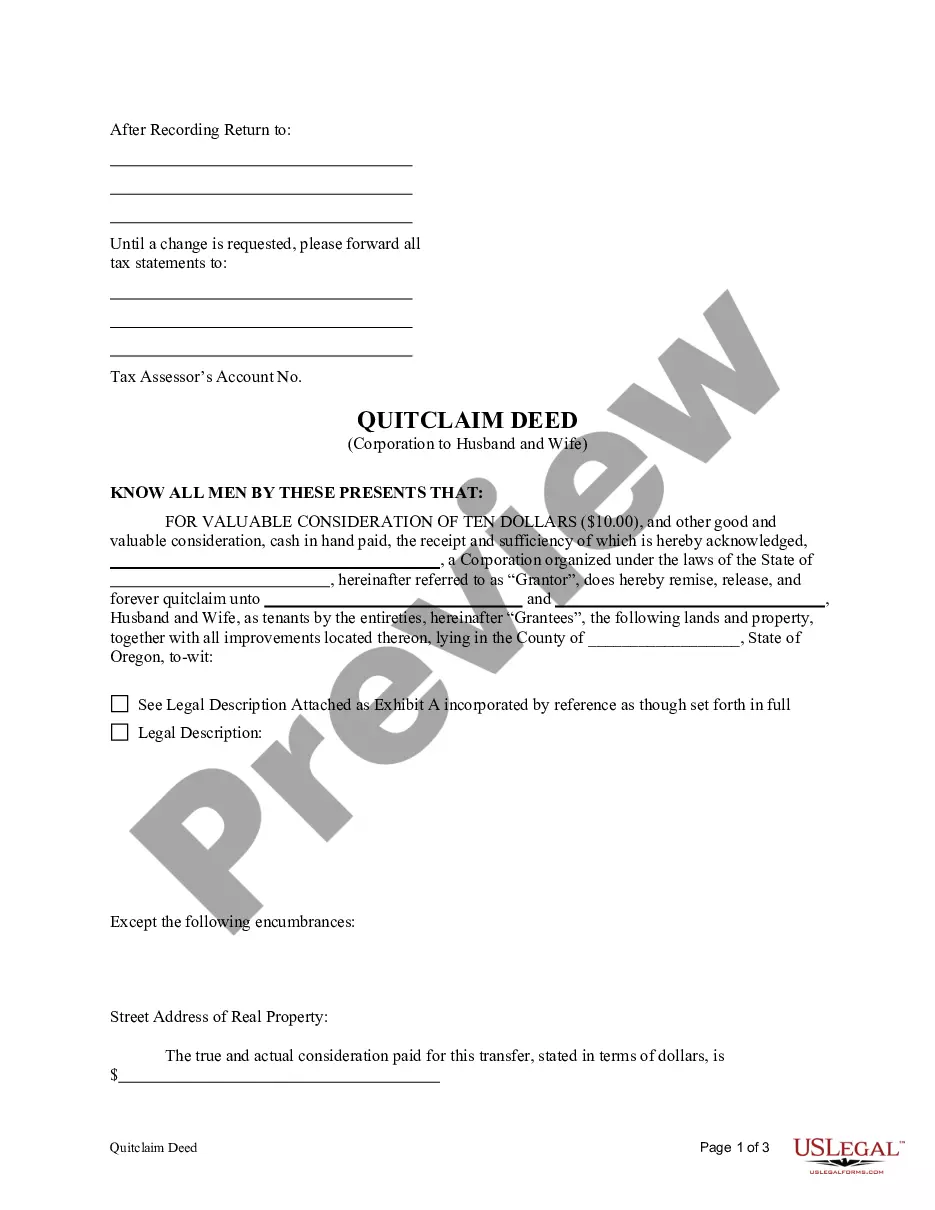

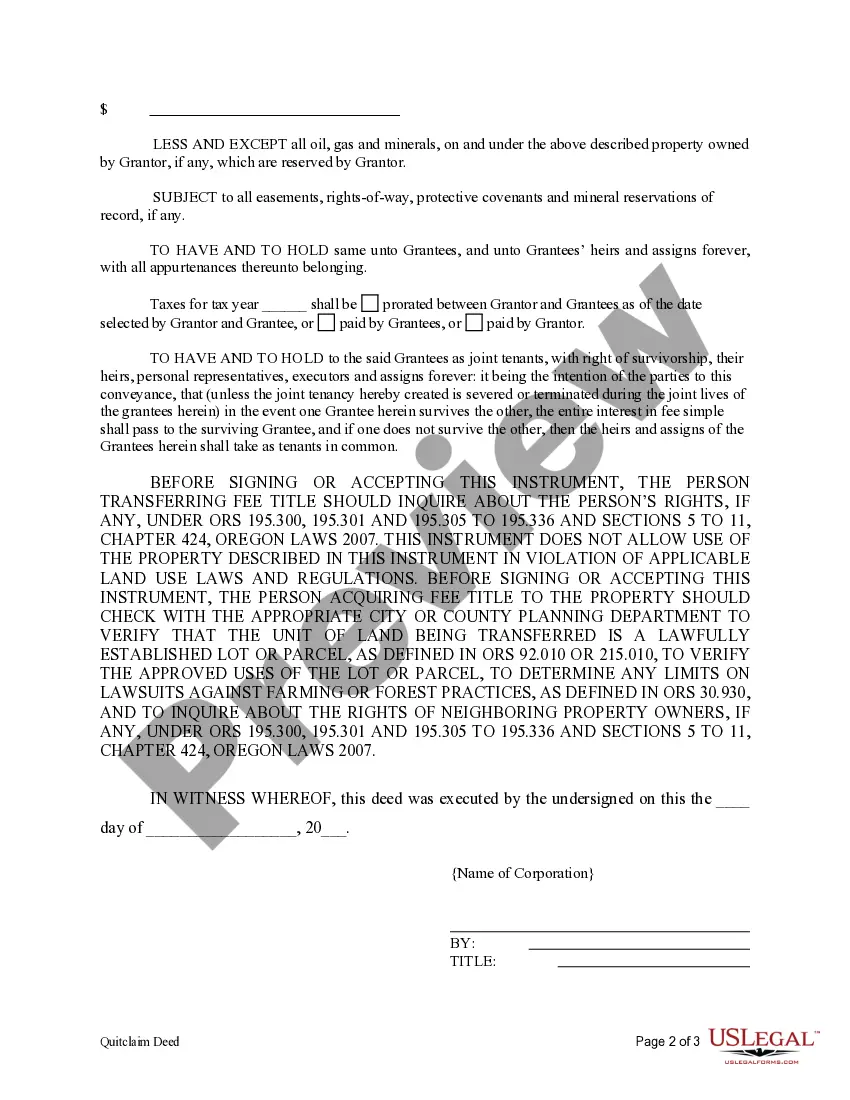

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

Gresham Oregon Quitclaim Deed from Corporation to Husband and Wife: A Comprehensive Overview A Gresham Oregon Quitclaim Deed from Corporation to Husband and Wife refers to a legal document that transfers the ownership or interest of a property from a corporation to a married couple in Gresham, Oregon. This type of transfer allows a corporation to transfer its rights, title, or interest in a property to a husband and wife without making any warranties or guarantees about the property's condition, liens, or encumbrances. Types of Gresham Oregon Quitclaim Deeds from Corporation to Husband and Wife: 1. Standard Gresham Oregon Quitclaim Deed from Corporation to Husband and Wife: This refers to the typical agreement where a corporation transfers its real estate ownership to a married couple using a quitclaim deed. The corporation relinquishes any claim or interest it may have in the property, while the husband and wife become the new legal owners. 2. Divorce-Related Gresham Oregon Quitclaim Deed from Corporation to Husband and Wife: In cases where a corporation and a married couple are undergoing divorce proceedings, this type of quitclaim deed is utilized to transfer the corporation's interest in the property to one spouse. This ensures that the property is solely owned by one of the former spouses after the divorce is finalized. 3. Estate Planning Gresham Oregon Quitclaim Deed from Corporation to Husband and Wife: This type of quitclaim deed is commonly employed for estate planning purposes. A corporation may transfer its real estate assets to a married couple to facilitate the smooth transfer of ownership after the death of one or both spouses. This allows for an efficient and well-organized estate distribution process. 4. Tax Planning Gresham Oregon Quitclaim Deed from Corporation to Husband and Wife: Sometimes, a corporation may choose to transfer a property's ownership to a husband and wife as a tax planning strategy. By doing so, the corporation can potentially benefit from certain exemptions or reductions in property taxes or other tax incentives available to individuals. In summary, a Gresham Oregon Quitclaim Deed from Corporation to Husband and Wife is a legal document used to transfer ownership from a corporation to a married couple in Gresham, Oregon. Different types of quitclaim deeds may exist, including standard transfers, divorce-related transfers, estate planning transfers, and tax planning transfers. The specific type of quitclaim deed used depends on the circumstances and objectives of the parties involved.