Payments on the loan secured by this deed of trust are to be interest only with accrued interest and principal to be paid on a certain date with interest to compound on a yearly basis.

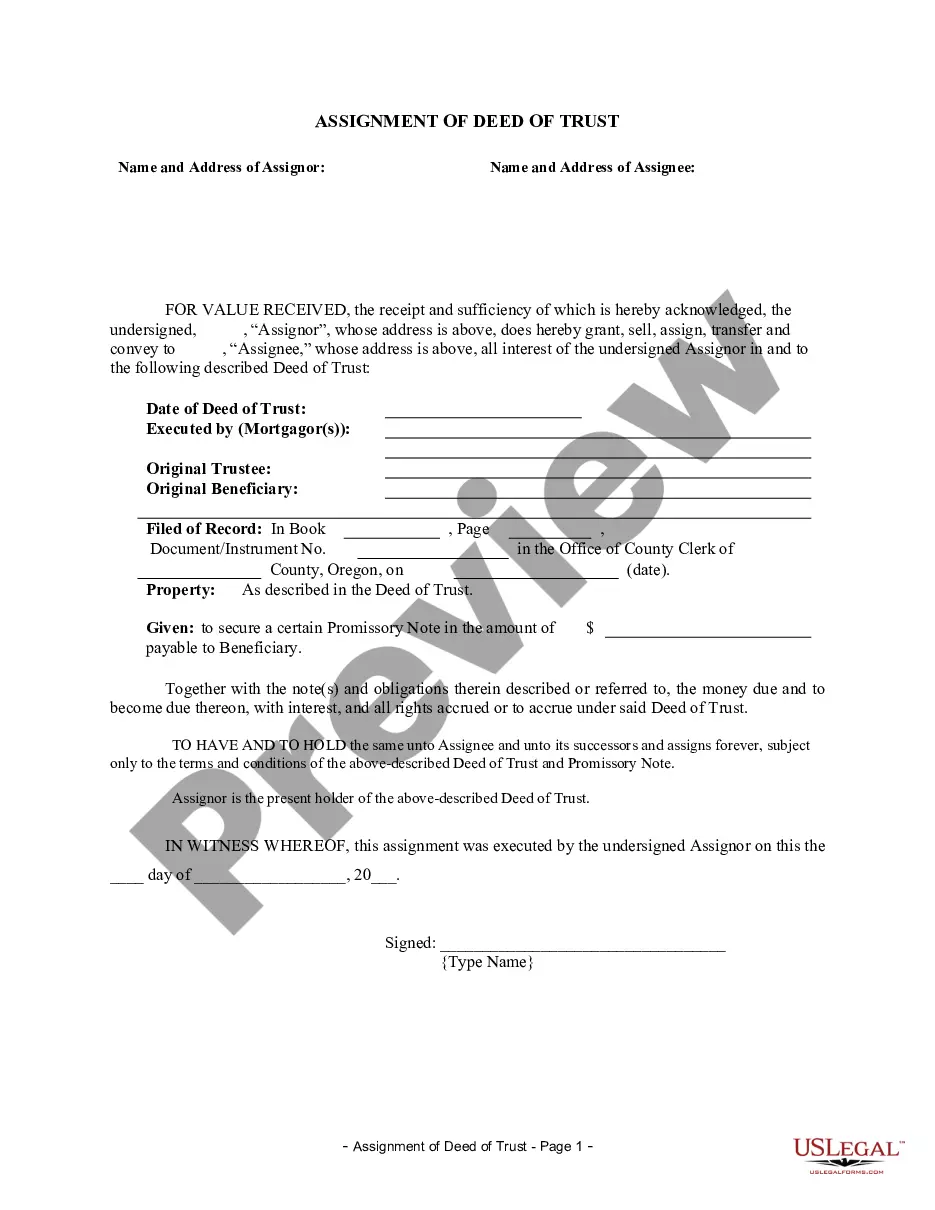

Portland Oregon Deed of Trust on Residential Property Securing Loan made by One Individual to Another Individual

Description

How to fill out Oregon Deed Of Trust On Residential Property Securing Loan Made By One Individual To Another Individual?

Are you seeking a trustworthy and affordable supplier of legal forms to obtain the Portland Oregon Deed of Trust on Residential Property Securing Loan executed by One Individual to Another Individual? US Legal Forms is your ideal option.

Whether you need a straightforward agreement to establish rules for living together with your partner or a package of documents to facilitate your divorce in court, we've got you covered. Our platform provides over 85,000 current legal document templates for personal and business purposes. All templates we offer are not generic and are tailored based on the specific requirements of various states and counties.

To download the document, you must Log In to your account, find the required form, and click the Download button next to it. Please note that you can access your previously purchased form templates at any time from the My documents tab.

Is this your first visit to our website? No problem. You can set up an account in just a few minutes, but before doing so, ensure that you.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is completed, download the Portland Oregon Deed of Trust on Residential Property Securing Loan executed by One Individual to Another Individual in any available file format. You can revisit the site when needed and re-download the document at no additional cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms today and stop wasting your valuable time searching for legal papers online.

- Confirm if the Portland Oregon Deed of Trust on Residential Property Securing Loan executed by One Individual to Another Individual aligns with the laws of your state and local area.

- Review the form’s specifics (if available) to understand who and what the document is designed for.

- Start the search anew if the form does not suit your legal situation.

Form popularity

FAQ

Both are dictated by state laws. In some states, only a mortgage is legal. In others, lenders can only use a deed of trust. A few states (like Alabama and Michigan) allow both. If your state allows both types of contracts, it's up to your lender to choose which type you receive.

A mortgage is a legal agreement designed for purchasing homes. In a mortgage, the bank or another creditor lends a borrower money at interest to take the title of the borrower's property....Lien Theory States 2022. StateMortgage TheoryOregonTitleSouth DakotaTitleTennesseeTitleTexasTitle46 more rows

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

Start Deed of Trust StateMortgage allowedDeed of trust allowedOregonYPennsylvaniaYRhode IslandYSouth CarolinaY47 more rows

Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A deed of trust may convey both real property or some interest therein and personal property or only real property or some interest therein or only personal property in order to secure a debt.

The lender gives the borrower the money to buy the home in exchange for one or more promissory notes, while the trustee holds the legal title to the property until the loan is paid off. Some states use this method instead of the traditional mortgage process.

Deed of Trust has how many parties and who are they? 3 Parties - Lender (beneficiary), Borrower (Trustor), Trustee (bank officer that is appointed.

The fee for a Declaration of Trust will be from £600 plus VAT and will depend on the complexity of the document, the number of clauses it incorporates and any additional consultations required during the drafting process. Following an initial meeting the fixed fee will be confirmed.