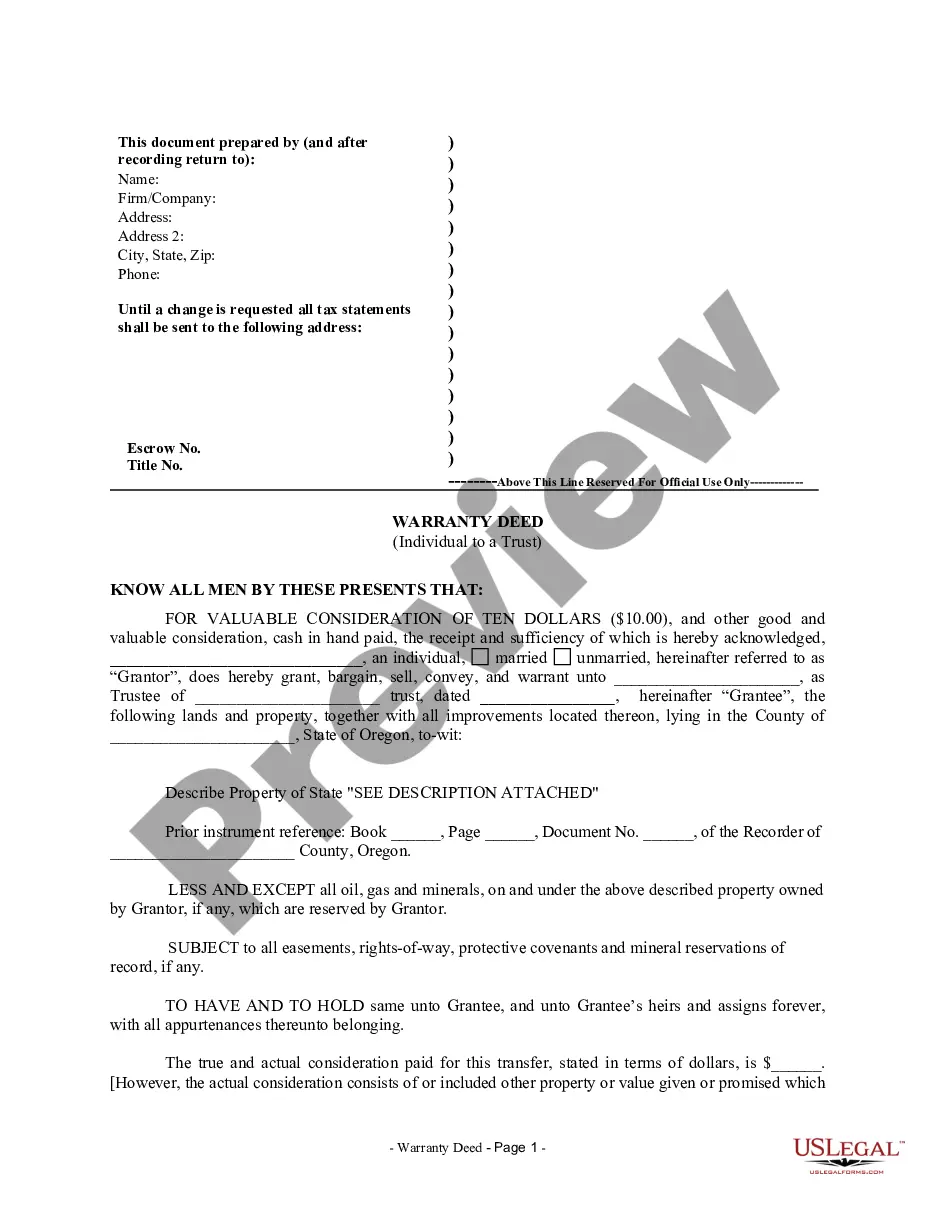

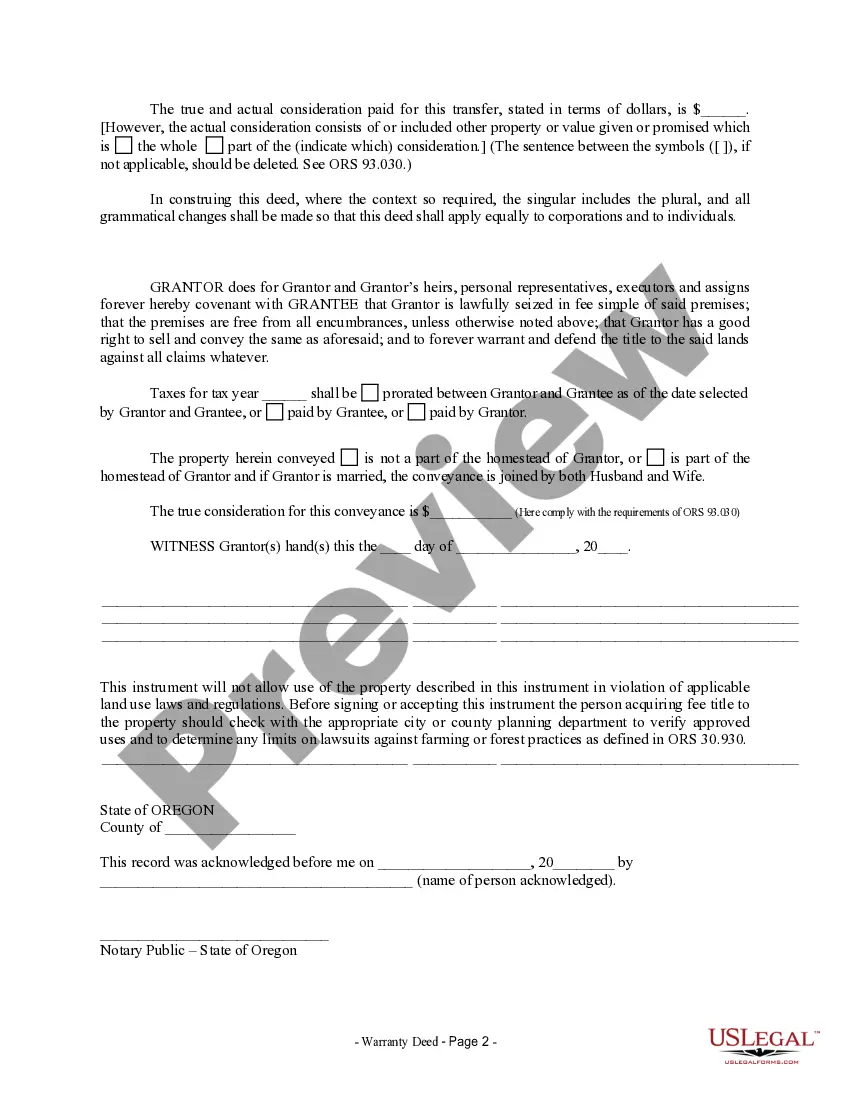

This form is a Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Gresham Oregon Warranty Deed from Individual to a Trust is a legally binding document that transfers the ownership of a property from an individual to a trust. This deed ensures that the property's title is clear and free of any encumbrances, providing added security and protection for the trust. A warranty deed is a common type of deed used in real estate transactions, guaranteeing that the individual transferring the property has legal ownership and the right to sell it. This deed also guarantees that the property is free from any undisclosed liens or claims, protecting the trust from any future legal disputes. There are different types of Gresham Oregon Warranty Deeds from Individual to a Trust: 1. General Warranty Deed: This type of deed provides the highest level of protection for the trust. It assures that the individual transferring the property has clear ownership and will defend the title against any claims that may arise, even if the claim is based on events that occurred before the individual acquired the property. 2. Special Warranty Deed: This deed guarantees that the individual transferring the property has not personally encumbered or harmed the title, but it does not provide protection against claims that may arise before the individual owned the property. 3. Quitclaim Deed: While not a warranty deed per se, a quitclaim deed is another type of deed that can be used to transfer property to a trust. However, it offers the least protection for the trust as it only transfers the individual's ownership rights, if any, without guaranteeing the status of the title. To complete a Gresham Oregon Warranty Deed from Individual to a Trust, various information and documents are needed. This includes the legal description of the property, the name of the individual transferring the property, the name and details of the trust, and the notarized signatures of both parties involved. It is advisable to consult with a real estate attorney or a trusted legal professional to ensure all the necessary requirements and legal obligations are met. In summary, a Gresham Oregon Warranty Deed from Individual to a Trust is a crucial legal document that facilitates the transfer of a property's ownership from an individual to a trust, ensuring a clear and unencumbered title. By using a warranty deed, the trust gains additional protection against any future claims or disputes relating to the property. However, it is important to understand the different types of warranty deeds available and consult legal professionals to ensure compliance with state and local laws.

Gresham Oregon Warranty Deed from Individual to a Trust is a legally binding document that transfers the ownership of a property from an individual to a trust. This deed ensures that the property's title is clear and free of any encumbrances, providing added security and protection for the trust. A warranty deed is a common type of deed used in real estate transactions, guaranteeing that the individual transferring the property has legal ownership and the right to sell it. This deed also guarantees that the property is free from any undisclosed liens or claims, protecting the trust from any future legal disputes. There are different types of Gresham Oregon Warranty Deeds from Individual to a Trust: 1. General Warranty Deed: This type of deed provides the highest level of protection for the trust. It assures that the individual transferring the property has clear ownership and will defend the title against any claims that may arise, even if the claim is based on events that occurred before the individual acquired the property. 2. Special Warranty Deed: This deed guarantees that the individual transferring the property has not personally encumbered or harmed the title, but it does not provide protection against claims that may arise before the individual owned the property. 3. Quitclaim Deed: While not a warranty deed per se, a quitclaim deed is another type of deed that can be used to transfer property to a trust. However, it offers the least protection for the trust as it only transfers the individual's ownership rights, if any, without guaranteeing the status of the title. To complete a Gresham Oregon Warranty Deed from Individual to a Trust, various information and documents are needed. This includes the legal description of the property, the name of the individual transferring the property, the name and details of the trust, and the notarized signatures of both parties involved. It is advisable to consult with a real estate attorney or a trusted legal professional to ensure all the necessary requirements and legal obligations are met. In summary, a Gresham Oregon Warranty Deed from Individual to a Trust is a crucial legal document that facilitates the transfer of a property's ownership from an individual to a trust, ensuring a clear and unencumbered title. By using a warranty deed, the trust gains additional protection against any future claims or disputes relating to the property. However, it is important to understand the different types of warranty deeds available and consult legal professionals to ensure compliance with state and local laws.