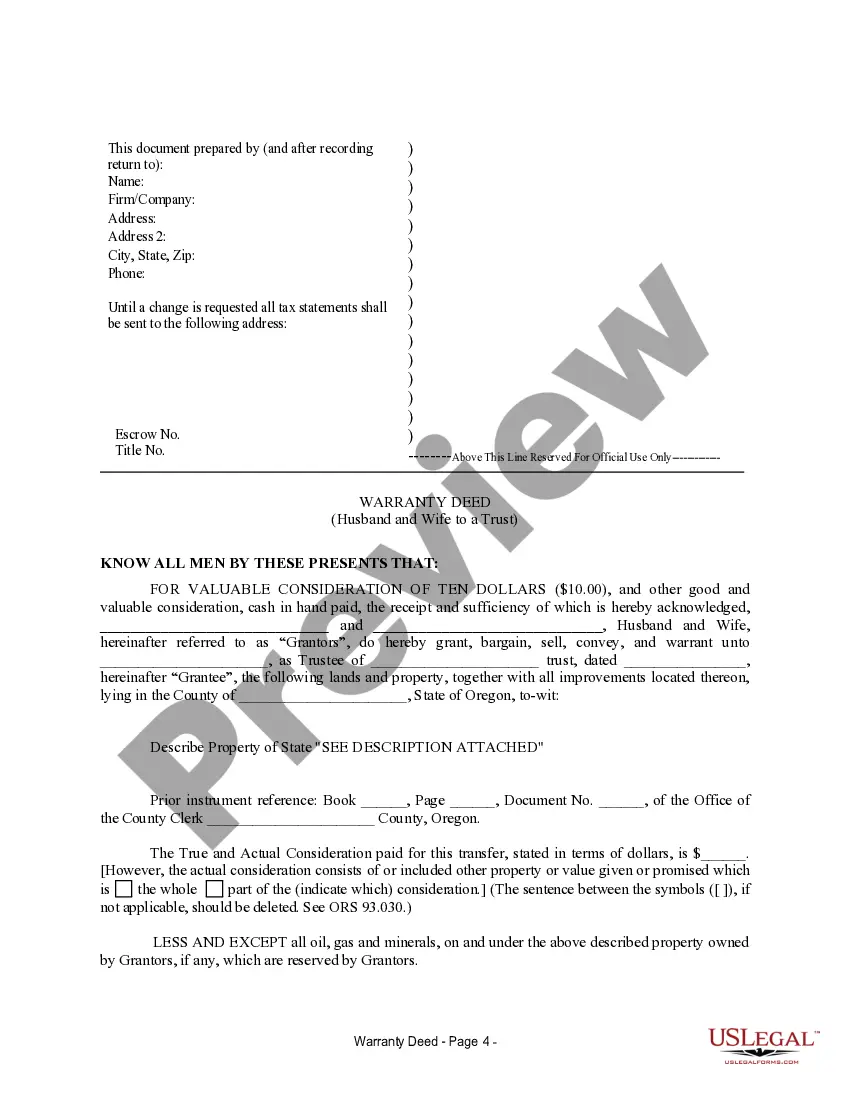

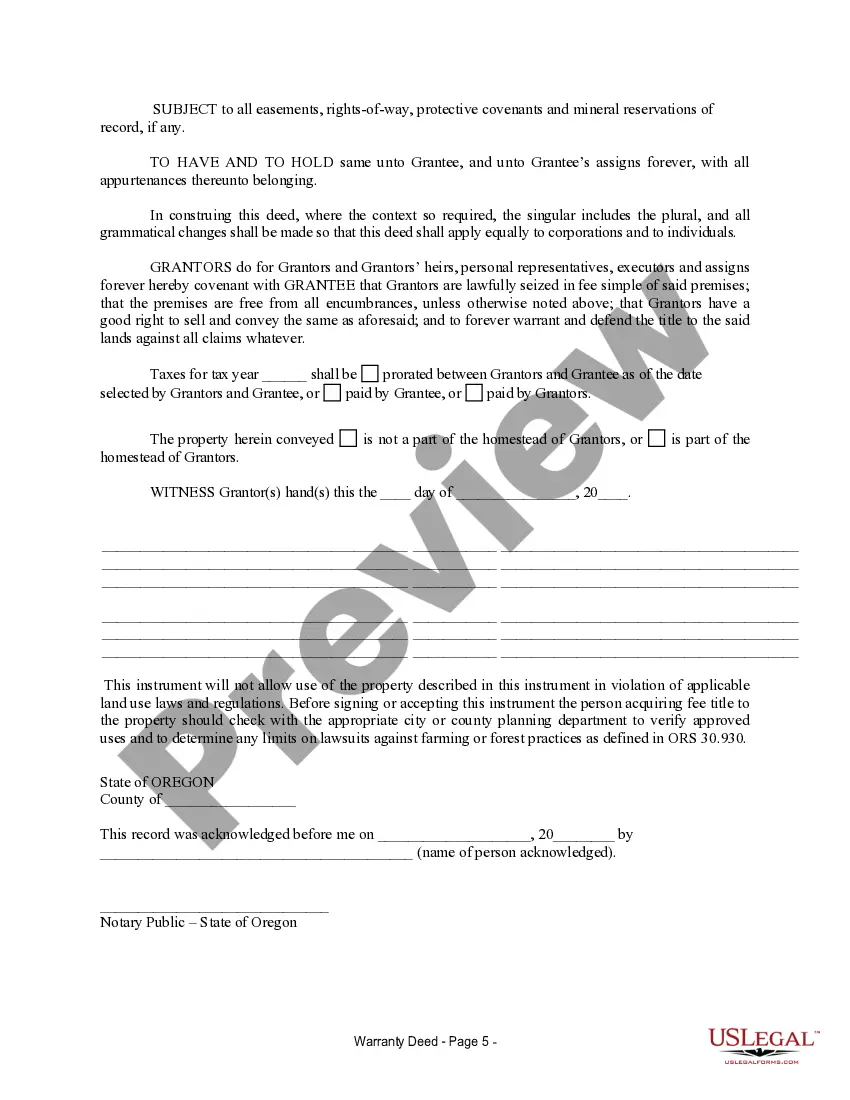

This form is a Warranty Deed where the grantors are husband and wife and the grantee is a trust. Grantors convey and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Eugene Oregon Warranty Deed from Husband and Wife to a Trust is a legal document that transfers ownership of real property from a married couple to a trust entity. This type of deed provides assurance and protection to the trust against any potential claims or assertions on the property. The primary purpose of this deed is to transfer the title of the property to the trust, often known as the grantee, as per the wishes of the husband and wife, the granters. The transfer is usually done with the intention of estate planning, asset protection, or to streamline the management and distribution of the property in the future. The Eugene Oregon Warranty Deed from Husband and Wife to a Trust typically includes important information such as: 1. Granter Information: This includes the full legal names of the husband and wife who are transferring the property to the trust. Their marital status should be mentioned to establish their joint ownership. 2. Trust Information: The name of the trust and its date of establishment should be clearly stated. This ensures that the property is being transferred to the correct trust and helps in proper identification. 3. Property Description: A thorough and accurate description of the property being transferred is included. This may include the property's address, legal description, lot number, and any other relevant details necessary for identification. 4. Warranty Clause: The deed will contain warranty clauses to protect the trust's ownership rights. This typically includes a statement that the granters have the legal right to transfer the property, and that they guarantee the property is free from any liens, encumbrances, or claims, except as explicitly mentioned in the deed. Different types of Eugene Oregon Warranty Deed from Husband and Wife to a Trust may include variations such as: 1. Joint Tenancy with Right of Survivorship: In this type of deed, the husband and wife jointly own the property, and upon the death of one spouse, the surviving spouse automatically assumes full ownership without the need for probate. 2. Tenancy in Common: This type of deed allows the husband and wife to own the property in equal or unequal shares. In the event of a spouse's death, their share does not automatically transfer to the surviving spouse, but instead passes according to their will or the laws of intestate succession. 3. Community Property: If the property is considered community property, both the husband and wife hold an equal interest in the property, and their ownership rights cannot be individually transferred without the consent of the other spouse. It is important to consult a qualified attorney or real estate professional when preparing and executing a Eugene Oregon Warranty Deed from Husband and Wife to a Trust to ensure compliance with local laws and individual circumstances. Proper legal advice can help protect the interests of both the granters and the trust, and ensure a smooth transfer of property ownership.