This form is a generic example. It is for illustrative purposes only.

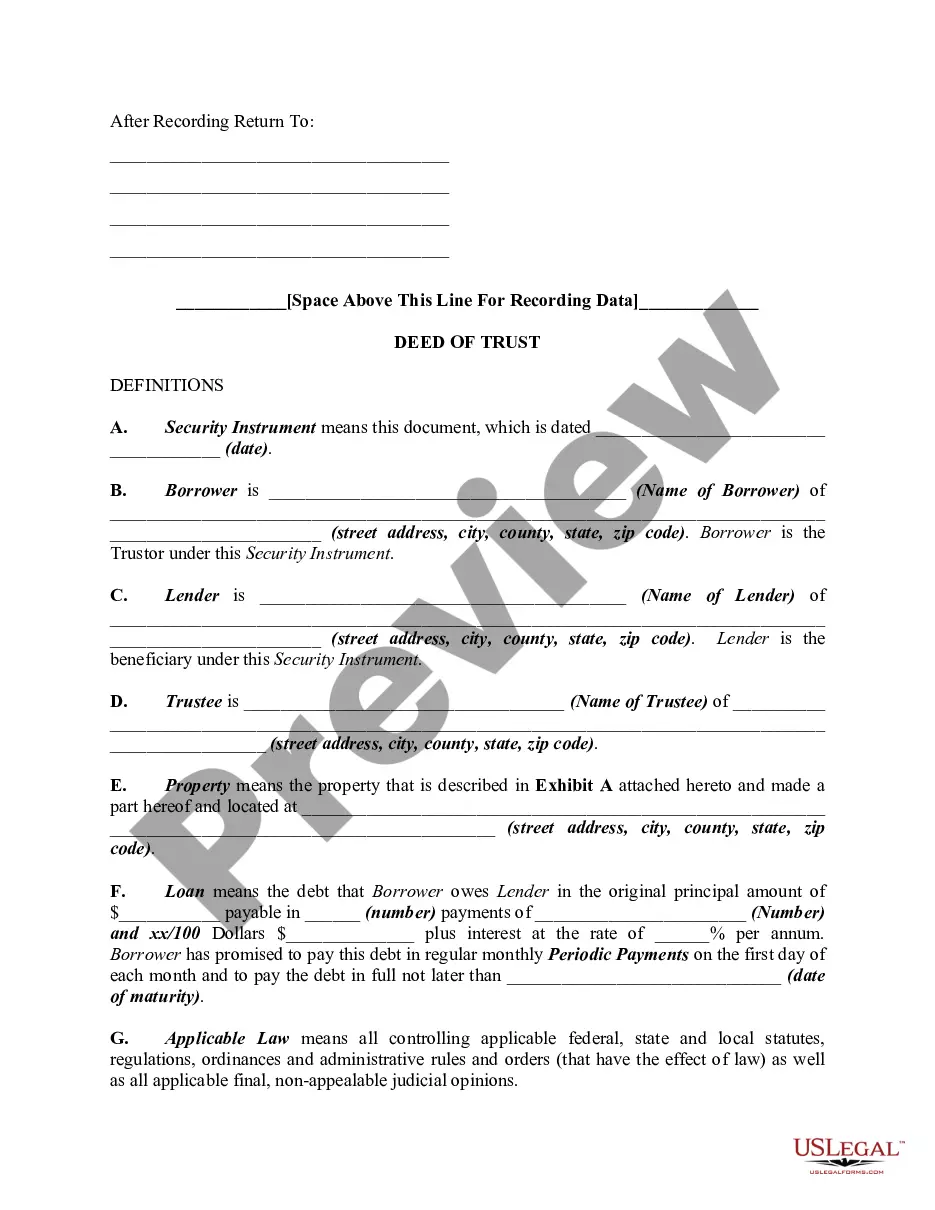

A Eugene Oregon Deed of Trust on Residential Property is a legal document that serves as security for a loan made by one individual to another individual or individuals for the purpose of purchasing a residential property in Eugene, Oregon. This document outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment terms, and the rights and responsibilities of both the borrower and lender. The Eugene Oregon Deed of Trust on Residential Property is an essential element of the loan transaction, as it establishes the lender's legal right to foreclose on the property and sell it to recover the outstanding debt in case of loan default. By creating a lien on the property, the lender gains a level of protection against potential loss. Different types of Eugene Oregon Deed of Trust on Residential Property Securing Loan Made by an Individual to Another Individual or Individuals can include: 1. Fixed-Rate Deed of Trust: This type of deed of trust secures a loan with a predetermined interest rate that remains constant throughout the loan term. This provides stability to both the borrower and lender, ensuring predictable monthly payments. 2. Adjustable-Rate Deed of Trust: With this type of deed of trust, the interest rate on the loan is subject to change during the loan term. Adjustable-rate mortgages typically have a fixed interest rate for an initial period, after which the rate adjusts periodically based on prevailing market rates. 3. Balloon Deed of Trust: A balloon loan features a short-term repayment period with regular monthly payments that do not fully amortize the loan. At the end of the loan term, a large final payment (the balloon payment) is required. This type of deed of trust allows borrowers to make lower monthly payments during the loan term, but they must be prepared for the significant balloon payment at the end. 4. Reverse Mortgage Deed of Trust: This specialized type of loan is available to homeowners aged 62 or older and allows them to convert a portion of their home equity into cash. The reverse mortgage does not require monthly payments; instead, the loan becomes due when the borrower no longer occupies the property or fails to meet specific obligations. Regardless of the specific type of Eugene Oregon Deed of Trust on Residential Property, it is crucial for both the borrower and lender to thoroughly review the terms of the loan before signing the document. Seeking legal advice or guidance from a real estate professional is highly recommended ensuring the agreement meets all legal requirements and safeguards the interests of all parties involved.A Eugene Oregon Deed of Trust on Residential Property is a legal document that serves as security for a loan made by one individual to another individual or individuals for the purpose of purchasing a residential property in Eugene, Oregon. This document outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment terms, and the rights and responsibilities of both the borrower and lender. The Eugene Oregon Deed of Trust on Residential Property is an essential element of the loan transaction, as it establishes the lender's legal right to foreclose on the property and sell it to recover the outstanding debt in case of loan default. By creating a lien on the property, the lender gains a level of protection against potential loss. Different types of Eugene Oregon Deed of Trust on Residential Property Securing Loan Made by an Individual to Another Individual or Individuals can include: 1. Fixed-Rate Deed of Trust: This type of deed of trust secures a loan with a predetermined interest rate that remains constant throughout the loan term. This provides stability to both the borrower and lender, ensuring predictable monthly payments. 2. Adjustable-Rate Deed of Trust: With this type of deed of trust, the interest rate on the loan is subject to change during the loan term. Adjustable-rate mortgages typically have a fixed interest rate for an initial period, after which the rate adjusts periodically based on prevailing market rates. 3. Balloon Deed of Trust: A balloon loan features a short-term repayment period with regular monthly payments that do not fully amortize the loan. At the end of the loan term, a large final payment (the balloon payment) is required. This type of deed of trust allows borrowers to make lower monthly payments during the loan term, but they must be prepared for the significant balloon payment at the end. 4. Reverse Mortgage Deed of Trust: This specialized type of loan is available to homeowners aged 62 or older and allows them to convert a portion of their home equity into cash. The reverse mortgage does not require monthly payments; instead, the loan becomes due when the borrower no longer occupies the property or fails to meet specific obligations. Regardless of the specific type of Eugene Oregon Deed of Trust on Residential Property, it is crucial for both the borrower and lender to thoroughly review the terms of the loan before signing the document. Seeking legal advice or guidance from a real estate professional is highly recommended ensuring the agreement meets all legal requirements and safeguards the interests of all parties involved.