This form is a generic example. It is for illustrative purposes only.

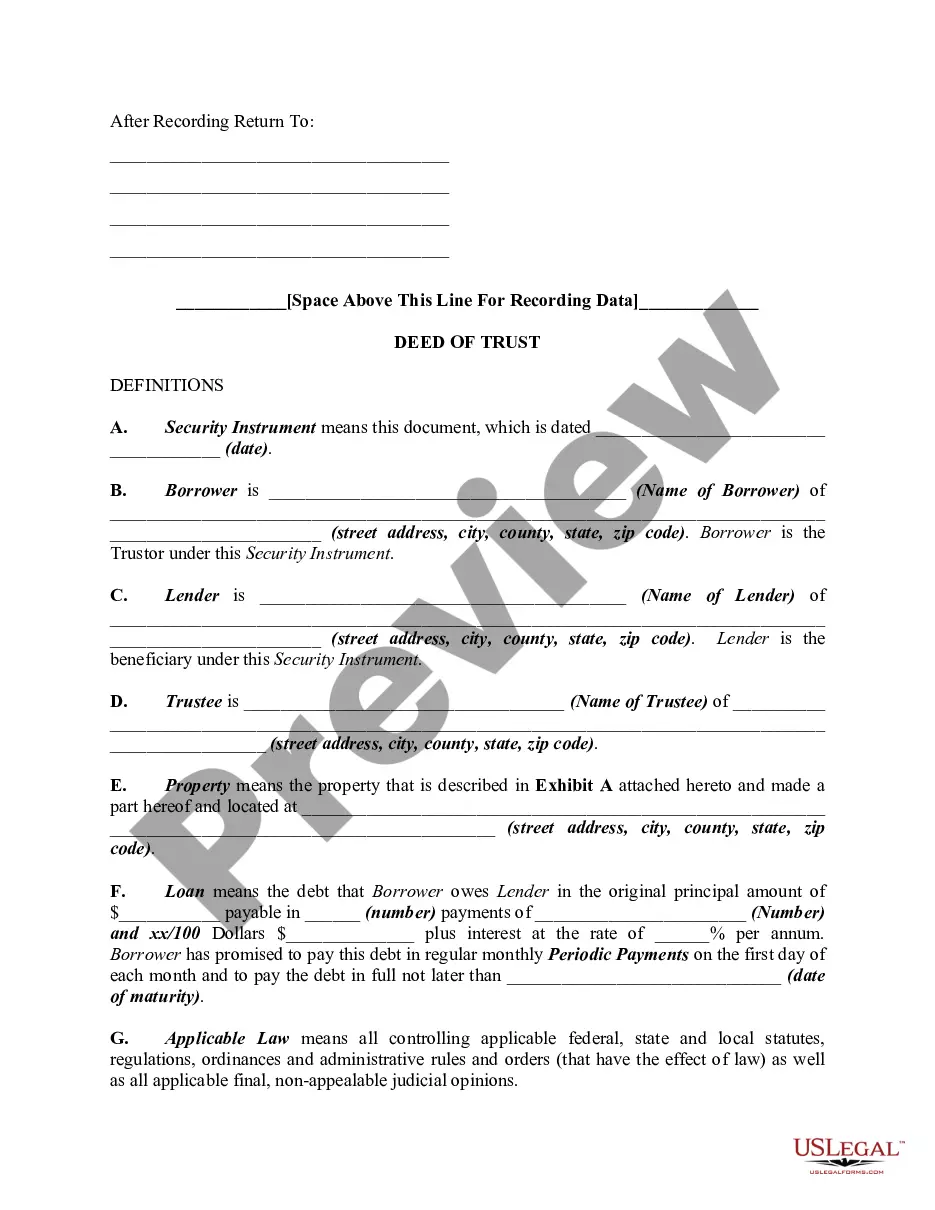

A Gresham Oregon Deed of Trust on Residential Property Securing Loan Made by an Individual to Another Individual or Individuals is a legally binding document that establishes a lien on a residential property in Gresham, Oregon. This deed of trust ensures that the individual or individuals lending money (the lender) are protected by having a legal claim to the property as collateral in case the borrower fails to repay the loan. There are a few different types of Gresham Oregon Deed of Trust on Residential Property Securing Loan Made by an Individual to Another Individual or Individuals, including: 1. Traditional Deed of Trust: This is the most common type of deed of trust used for securing loans made by one individual to another individual or a group of individuals. It outlines the terms of the loan, including the loan amount, interest rate, repayment schedule, and any other conditions agreed upon by the parties involved. 2. Deed of Trust with Power of Sale: This type of deed of trust allows the lender to initiate a non-judicial foreclosure process in case of default by the borrower. It gives the lender the authority to sell the property to recoup the outstanding loan balance without having to go through a lengthy court process. 3. Deed of Trust Subordination Agreement: In some cases, there may be multiple loans secured by the same property. A subordination agreement outlines the order of priority in which these loans will be repaid if the property is sold or foreclosed upon. It ensures that the primary lender will be paid before any subordinate lenders. 4. Deed of Trust Release: Once the loan has been fully repaid, the lender will issue a deed of trust release, effectively releasing their claim on the property. This document is important for the borrower as it confirms that the property is free and clear of any liens. It's crucial to consult with a qualified real estate attorney or mortgage professional when drafting or entering into a Gresham Oregon Deed of Trust on Residential Property Securing Loan Made by an Individual to Another Individual or Individuals, as it involves legal complexities and adherence to state-specific regulations.

A Gresham Oregon Deed of Trust on Residential Property Securing Loan Made by an Individual to Another Individual or Individuals is a legally binding document that establishes a lien on a residential property in Gresham, Oregon. This deed of trust ensures that the individual or individuals lending money (the lender) are protected by having a legal claim to the property as collateral in case the borrower fails to repay the loan. There are a few different types of Gresham Oregon Deed of Trust on Residential Property Securing Loan Made by an Individual to Another Individual or Individuals, including: 1. Traditional Deed of Trust: This is the most common type of deed of trust used for securing loans made by one individual to another individual or a group of individuals. It outlines the terms of the loan, including the loan amount, interest rate, repayment schedule, and any other conditions agreed upon by the parties involved. 2. Deed of Trust with Power of Sale: This type of deed of trust allows the lender to initiate a non-judicial foreclosure process in case of default by the borrower. It gives the lender the authority to sell the property to recoup the outstanding loan balance without having to go through a lengthy court process. 3. Deed of Trust Subordination Agreement: In some cases, there may be multiple loans secured by the same property. A subordination agreement outlines the order of priority in which these loans will be repaid if the property is sold or foreclosed upon. It ensures that the primary lender will be paid before any subordinate lenders. 4. Deed of Trust Release: Once the loan has been fully repaid, the lender will issue a deed of trust release, effectively releasing their claim on the property. This document is important for the borrower as it confirms that the property is free and clear of any liens. It's crucial to consult with a qualified real estate attorney or mortgage professional when drafting or entering into a Gresham Oregon Deed of Trust on Residential Property Securing Loan Made by an Individual to Another Individual or Individuals, as it involves legal complexities and adherence to state-specific regulations.