The Oregon Limited Liability Company Act provides in part as follows:

63.249 Assignment of membership interest; effect of assignment. Except as provided in the articles of organization or any operating agreement:

(1) A membership interest is assignable in whole or in part.

(5) The assignor of all or a portion of a membership interest ceases to be a member with respect to the interest assigned, but is not released from liability as a member accruing or arising prior to assignment solely as a result of the assignment, and is not relieved of any fiduciary duties the assignor otherwise may continue to owe the limited liability company or its remaining members.

(6) Any otherwise permissible assignment of a membership interest shall be effective as to and binding on the limited liability company only after reasonable notice of and proof of the assignment have been provided to the managers of the limited liability company.

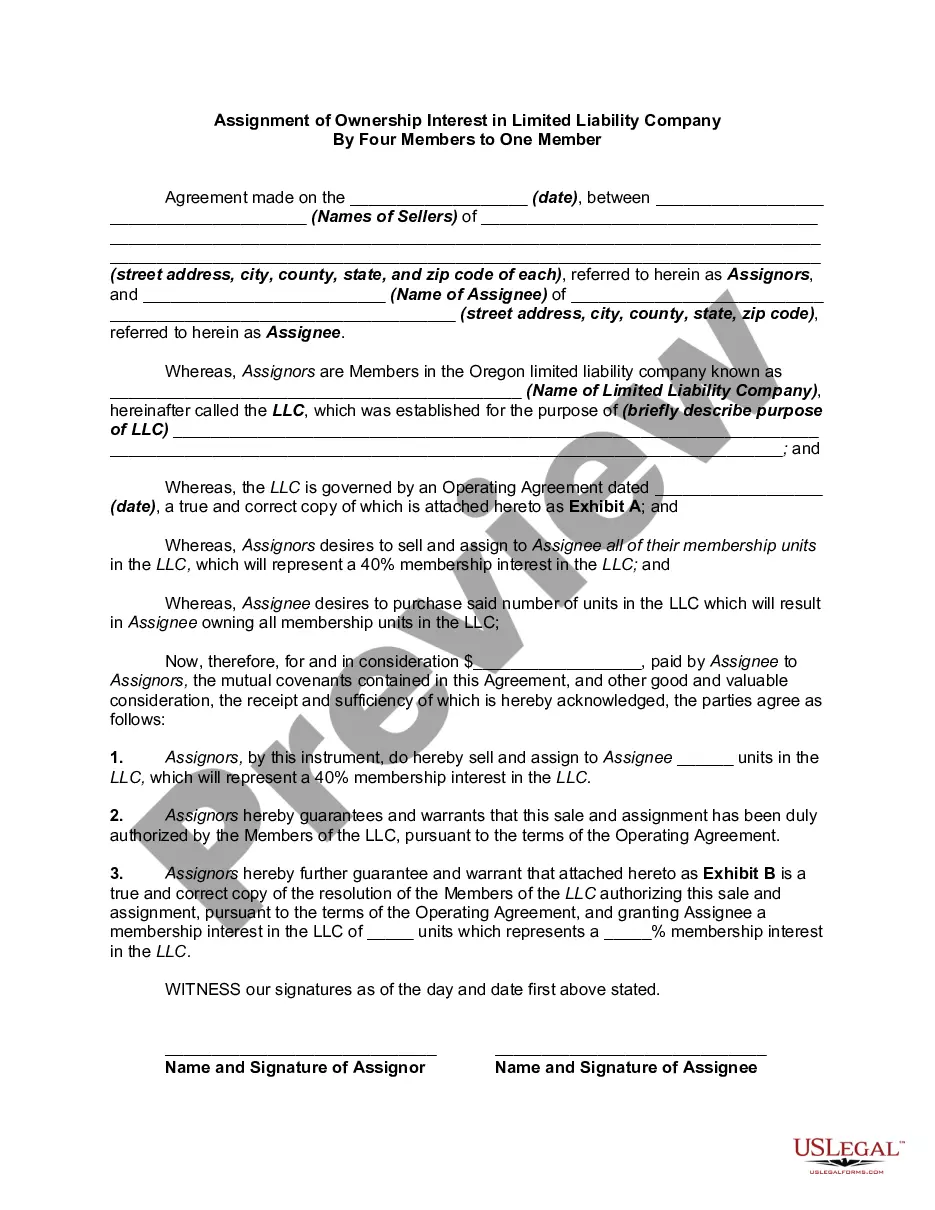

Title: Gresham Oregon Assignment of Ownership Interest in Limited Liability Company by Four Members to One Member: Explained Introduction: In Gresham, Oregon, the Assignment of Ownership Interest in a Limited Liability Company (LLC) by Four Members to One Member is a common process that involves the transfer of ownership rights within the company. This article aims to provide a detailed description of this assignment, outlining its procedure, legal considerations, and potential types. 1. Understanding the Assignment of Ownership Interest: The Assignment of Ownership Interest refers to the legal transfer of a member's ownership rights, shares, and associated benefits within an LLC to another member. It typically involves the movement of multiple members' interests towards a single member, consolidating control or restructuring the LLC's ownership structure. 2. Procedure for Gresham Oregon Assignment of Ownership Interest: The process of Assignment of Ownership Interest in an LLC comprises several crucial steps. These may include: a. Drafting an Assignment Agreement: All parties involved must create a legally binding document — the Assignment Agreement – to outline the assignment terms, including the percentage of ownership interest being transferred, consideration, effective date, and any conditions. b. Obtaining Consent: In Gresham, Oregon, LLC operating agreements often require the unanimous or majority consent of members for an assignment to take place. Members should review the operating agreement and obtain necessary approvals before initiating the transfer. c. Filing with the State: After completion, the Assignment Agreement should be filed with the Oregon Secretary of State and any other relevant local agencies to ensure proper acknowledgment of the change in ownership. d. Updating Records and Documents: The LLC's records, such as the company's operating agreement, member roster, and ownership interest ledger, should be updated to reflect the change in ownership and ensure accuracy. 3. Legal Considerations: The Assignment of Ownership Interest in an LLC holds legal significance, demanding attention to various factors, including: a. Taxes and Financial Implications: The assignment may trigger tax consequences for both the transferring and acquiring members. Consulting with a tax professional can assist in understanding the potential tax liabilities associated with the assignment. b. Compliance with LLC Operating Agreement: Before proceeding with the assignment, members must review the LLC's operating agreement to ensure compliance with any provisions related to the assignment process, consent requirements, and transfer of ownership. 4. Types of Gresham Oregon Assignment of Ownership Interest: While the general process remains the same, there can be variations in the Assignment of Ownership Interest in Gresham, Oregon. Some common types include: a. Full Assignment: The transfer of an individual's entire ownership interest to a single member, resulting in a consolidation of the company's control. b. Partial Assignment: Instead of transferring 100% ownership interest, a member assigns only a portion of their interest to another member, allowing for diversification or redistribution of control within the LLC. c. Vesting Assignment: This type of assignment may involve the transfer of ownership interests over a designated time period, subject to specific conditions agreed upon by the members involved. Conclusion: In Gresham, Oregon, the Assignment of Ownership Interest in an LLC by Four Members to One Member can significantly impact the company's structure and control. Proper understanding of the procedure, legal considerations, and potential variations in assignment types is crucial to ensure a smooth and compliant transfer of ownership. Seeking legal guidance throughout the process is advisable to protect the interests of all parties involved.Title: Gresham Oregon Assignment of Ownership Interest in Limited Liability Company by Four Members to One Member: Explained Introduction: In Gresham, Oregon, the Assignment of Ownership Interest in a Limited Liability Company (LLC) by Four Members to One Member is a common process that involves the transfer of ownership rights within the company. This article aims to provide a detailed description of this assignment, outlining its procedure, legal considerations, and potential types. 1. Understanding the Assignment of Ownership Interest: The Assignment of Ownership Interest refers to the legal transfer of a member's ownership rights, shares, and associated benefits within an LLC to another member. It typically involves the movement of multiple members' interests towards a single member, consolidating control or restructuring the LLC's ownership structure. 2. Procedure for Gresham Oregon Assignment of Ownership Interest: The process of Assignment of Ownership Interest in an LLC comprises several crucial steps. These may include: a. Drafting an Assignment Agreement: All parties involved must create a legally binding document — the Assignment Agreement – to outline the assignment terms, including the percentage of ownership interest being transferred, consideration, effective date, and any conditions. b. Obtaining Consent: In Gresham, Oregon, LLC operating agreements often require the unanimous or majority consent of members for an assignment to take place. Members should review the operating agreement and obtain necessary approvals before initiating the transfer. c. Filing with the State: After completion, the Assignment Agreement should be filed with the Oregon Secretary of State and any other relevant local agencies to ensure proper acknowledgment of the change in ownership. d. Updating Records and Documents: The LLC's records, such as the company's operating agreement, member roster, and ownership interest ledger, should be updated to reflect the change in ownership and ensure accuracy. 3. Legal Considerations: The Assignment of Ownership Interest in an LLC holds legal significance, demanding attention to various factors, including: a. Taxes and Financial Implications: The assignment may trigger tax consequences for both the transferring and acquiring members. Consulting with a tax professional can assist in understanding the potential tax liabilities associated with the assignment. b. Compliance with LLC Operating Agreement: Before proceeding with the assignment, members must review the LLC's operating agreement to ensure compliance with any provisions related to the assignment process, consent requirements, and transfer of ownership. 4. Types of Gresham Oregon Assignment of Ownership Interest: While the general process remains the same, there can be variations in the Assignment of Ownership Interest in Gresham, Oregon. Some common types include: a. Full Assignment: The transfer of an individual's entire ownership interest to a single member, resulting in a consolidation of the company's control. b. Partial Assignment: Instead of transferring 100% ownership interest, a member assigns only a portion of their interest to another member, allowing for diversification or redistribution of control within the LLC. c. Vesting Assignment: This type of assignment may involve the transfer of ownership interests over a designated time period, subject to specific conditions agreed upon by the members involved. Conclusion: In Gresham, Oregon, the Assignment of Ownership Interest in an LLC by Four Members to One Member can significantly impact the company's structure and control. Proper understanding of the procedure, legal considerations, and potential variations in assignment types is crucial to ensure a smooth and compliant transfer of ownership. Seeking legal guidance throughout the process is advisable to protect the interests of all parties involved.