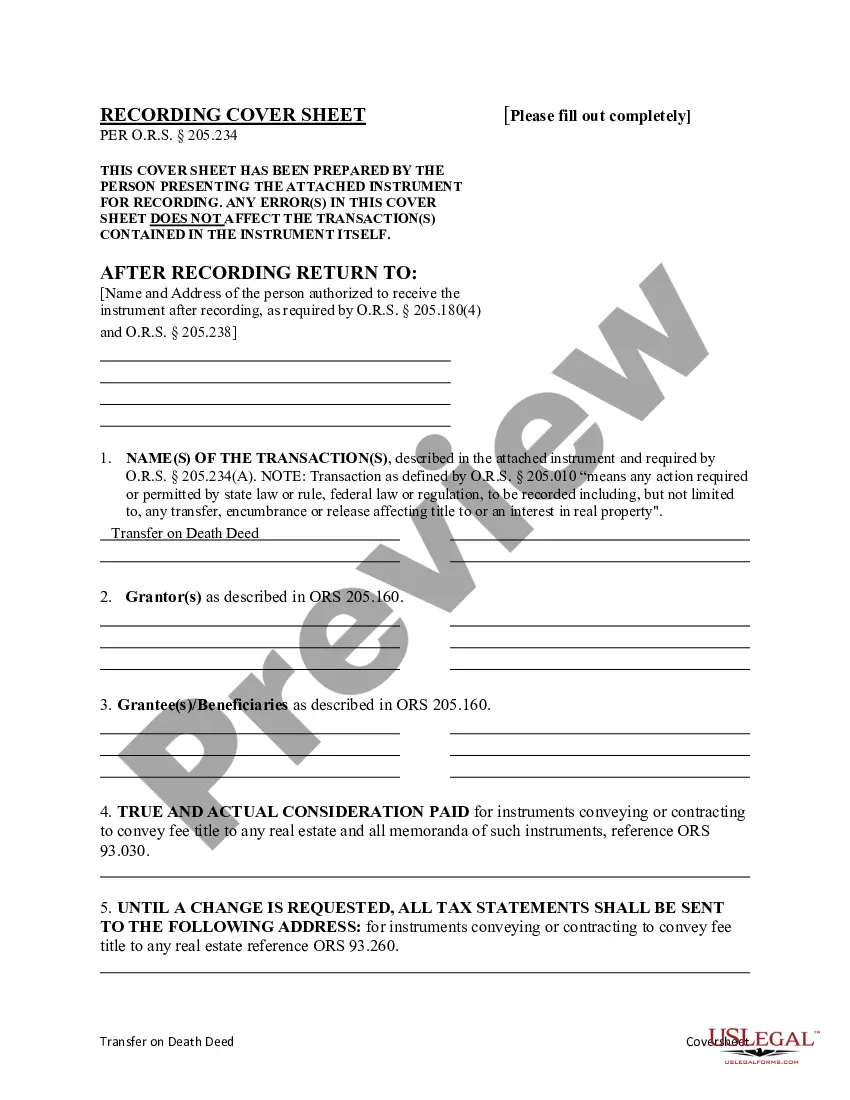

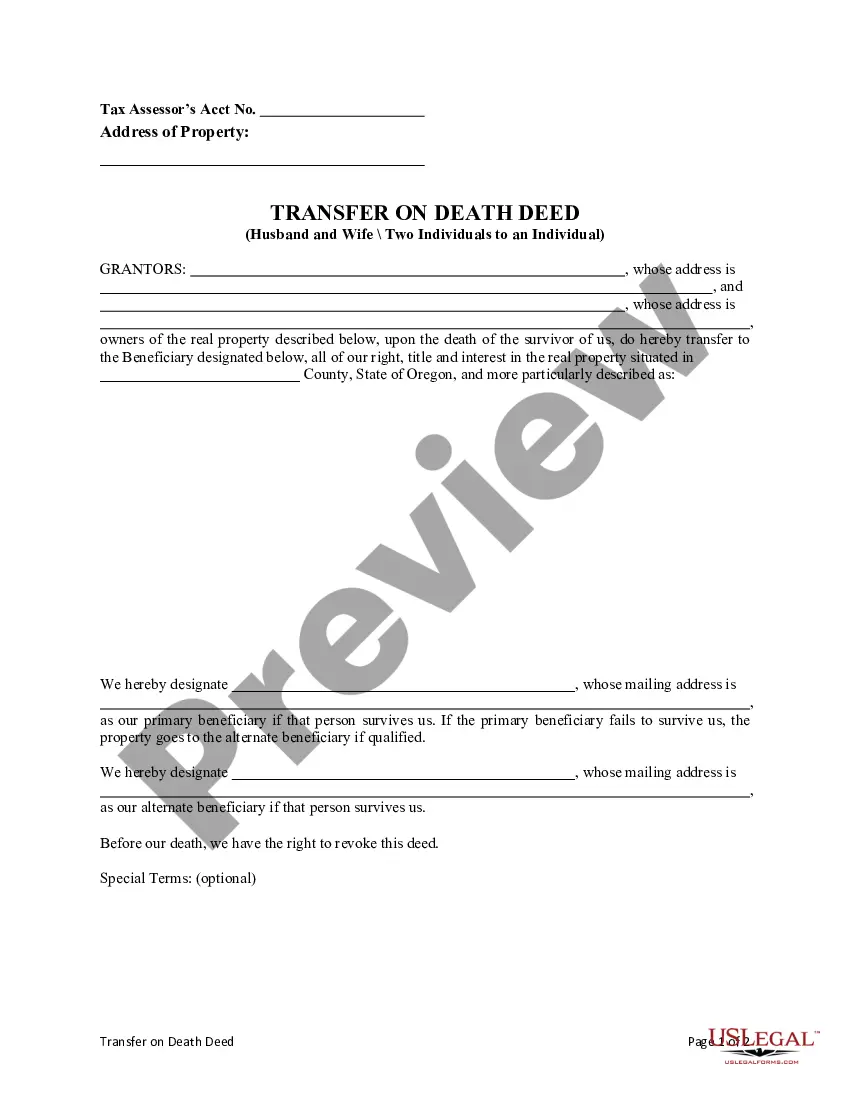

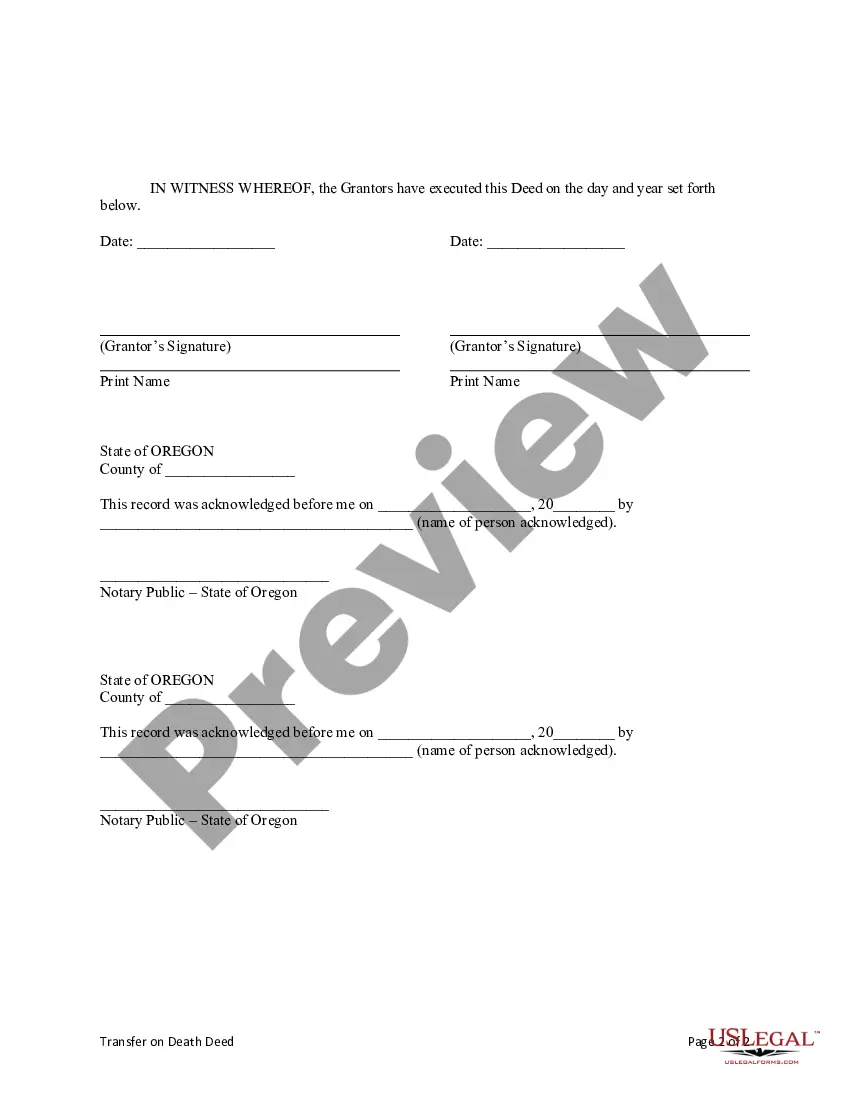

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantee / Beneficiary is an individual. This transfer is revocable until Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary / Grantee takes the property if the primary beneficiary survives the Grantors. If the primary beneficiary fails to survive Grantors, the property would go to the secondary beneficiary if qualified. This deed complies with all state statutory laws.

A Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with a provision for the appointment of an Alternative Beneficiary is a legal document that allows two individuals or a married couple to designate an individual as the recipient of their property upon their death. This type of deed is specifically designed to streamline the transfer of real estate assets without the need for probate. In Bend, Oregon, there are two main types of Transfer on Death Deeds (Odds) available for individuals or couples looking to ensure the seamless transfer of their property to a chosen beneficiary. The first type is the joint deed, which can be executed by two individuals who jointly own a property. It allows the co-owners to pass the property to an individual beneficiary upon both of their deaths. This is a suitable option for unmarried partners, friends, or business partners looking to protect their property rights. The second type is the spousal deed, which enables a married couple to direct the transfer of their property to an individual beneficiary upon both of their deaths. This type of deed is specifically tailored for married couples who wish to designate a specific person as the ultimate recipient of their property, regardless of who survives longer. When drafting a Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with a provision for the appointment of an Alternative Beneficiary, careful attention should be paid to include a provision for the appointment of an alternative beneficiary. This provision allows the granter(s) to identify a second beneficiary who will receive the property if the initial designated individual beneficiary predeceases them or is no longer able to accept the property. This alternative beneficiary provision adds a layer of protection and ensures that the property does not end up in probate or pass to unintended heirs. By clearly indicating who will receive the property if the primary beneficiary is unable to, the granter(s) can maintain control over their assets and provide peace of mind to their loved ones. In summary, a Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with a provision for the appointment of an Alternative Beneficiary is a powerful estate planning tool that allows property owners to determine the destiny of their assets after their passing. By using relevant keywords such as "Bend Oregon Transfer on Death Deed," "Alternative Beneficiary," "Joint Deed," and "Spousal Deed," individuals can ensure their search for more information leads them to the specific details they require.A Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with a provision for the appointment of an Alternative Beneficiary is a legal document that allows two individuals or a married couple to designate an individual as the recipient of their property upon their death. This type of deed is specifically designed to streamline the transfer of real estate assets without the need for probate. In Bend, Oregon, there are two main types of Transfer on Death Deeds (Odds) available for individuals or couples looking to ensure the seamless transfer of their property to a chosen beneficiary. The first type is the joint deed, which can be executed by two individuals who jointly own a property. It allows the co-owners to pass the property to an individual beneficiary upon both of their deaths. This is a suitable option for unmarried partners, friends, or business partners looking to protect their property rights. The second type is the spousal deed, which enables a married couple to direct the transfer of their property to an individual beneficiary upon both of their deaths. This type of deed is specifically tailored for married couples who wish to designate a specific person as the ultimate recipient of their property, regardless of who survives longer. When drafting a Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with a provision for the appointment of an Alternative Beneficiary, careful attention should be paid to include a provision for the appointment of an alternative beneficiary. This provision allows the granter(s) to identify a second beneficiary who will receive the property if the initial designated individual beneficiary predeceases them or is no longer able to accept the property. This alternative beneficiary provision adds a layer of protection and ensures that the property does not end up in probate or pass to unintended heirs. By clearly indicating who will receive the property if the primary beneficiary is unable to, the granter(s) can maintain control over their assets and provide peace of mind to their loved ones. In summary, a Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with a provision for the appointment of an Alternative Beneficiary is a powerful estate planning tool that allows property owners to determine the destiny of their assets after their passing. By using relevant keywords such as "Bend Oregon Transfer on Death Deed," "Alternative Beneficiary," "Joint Deed," and "Spousal Deed," individuals can ensure their search for more information leads them to the specific details they require.