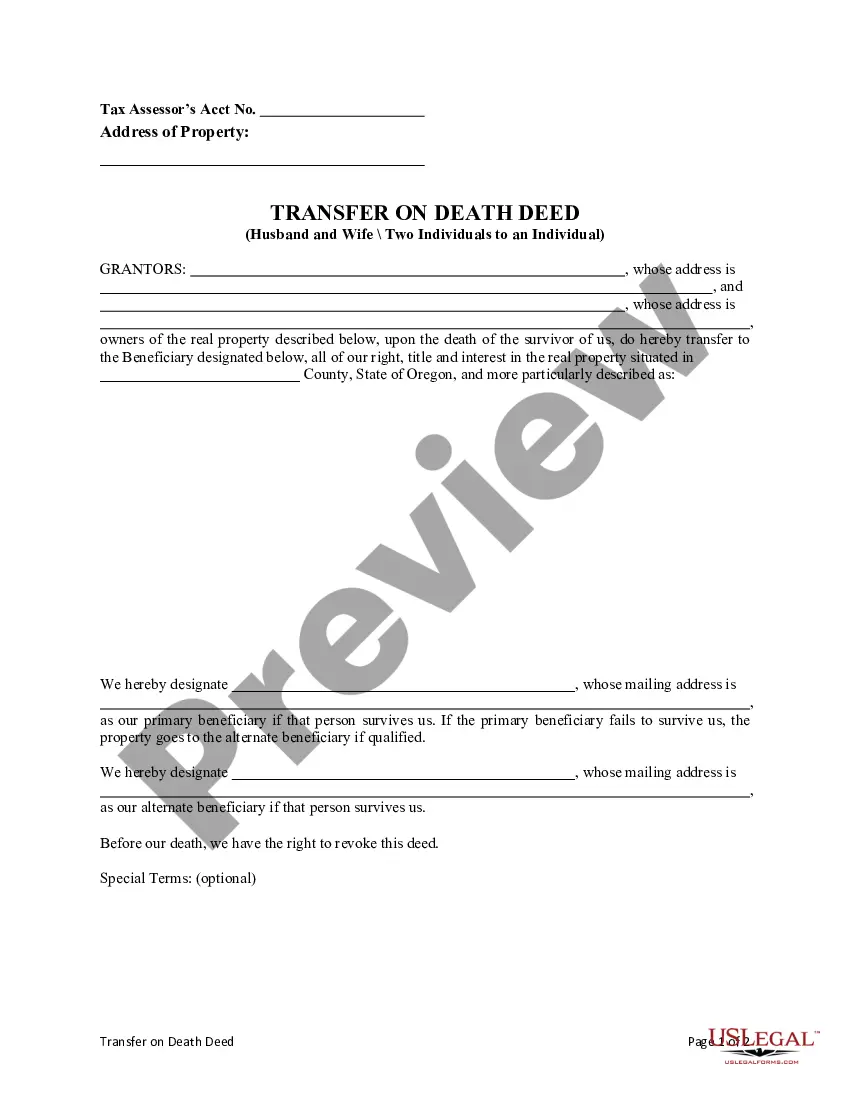

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantee / Beneficiary is an individual. This transfer is revocable until Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary / Grantee takes the property if the primary beneficiary survives the Grantors. If the primary beneficiary fails to survive Grantors, the property would go to the secondary beneficiary if qualified. This deed complies with all state statutory laws.

The Eugene Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary is a legal document that allows property owners in Eugene, Oregon to designate a specific individual as the beneficiary of their property upon their death. This type of deed can be particularly useful for individuals or couples seeking to transfer their property directly to a single person while also providing a contingency plan in case the designated beneficiary is unable or unwilling to accept the property. There are two main types of Eugene Oregon Transfer on Death Deeds from Two Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary: 1. Joint Transfer on Death Deed: This type of deed allows two individuals, whether they are spouses or not, to jointly designate an individual as the beneficiary of their property. In the event that both owners pass away simultaneously or within a specific time frame, the property will be transferred to the designated beneficiary. 2. Individual Transfer on Death Deed with Alternative Beneficiary Provision: This type of deed allows an individual property owner to designate an individual as the primary beneficiary of their property. However, it also provides the option to name an alternative beneficiary who will receive the property if the primary beneficiary is unable or unwilling to accept the transfer. In both cases, the Eugene Oregon Transfer on Death Deed offers flexibility and control over the distribution of property after death, without the need for probate or creating a trust. It allows property owners to ensure that their property passes to their chosen beneficiary smoothly and efficiently. By utilizing a Eugene Oregon Transfer on Death Deed, individuals or couples can establish a clear plan for the transfer of their property while also providing peace of mind knowing that there is a backup plan in place with the appointment of an alternative beneficiary. It is a useful tool for estate planning, enabling property owners to maintain control over the legacy they leave behind.