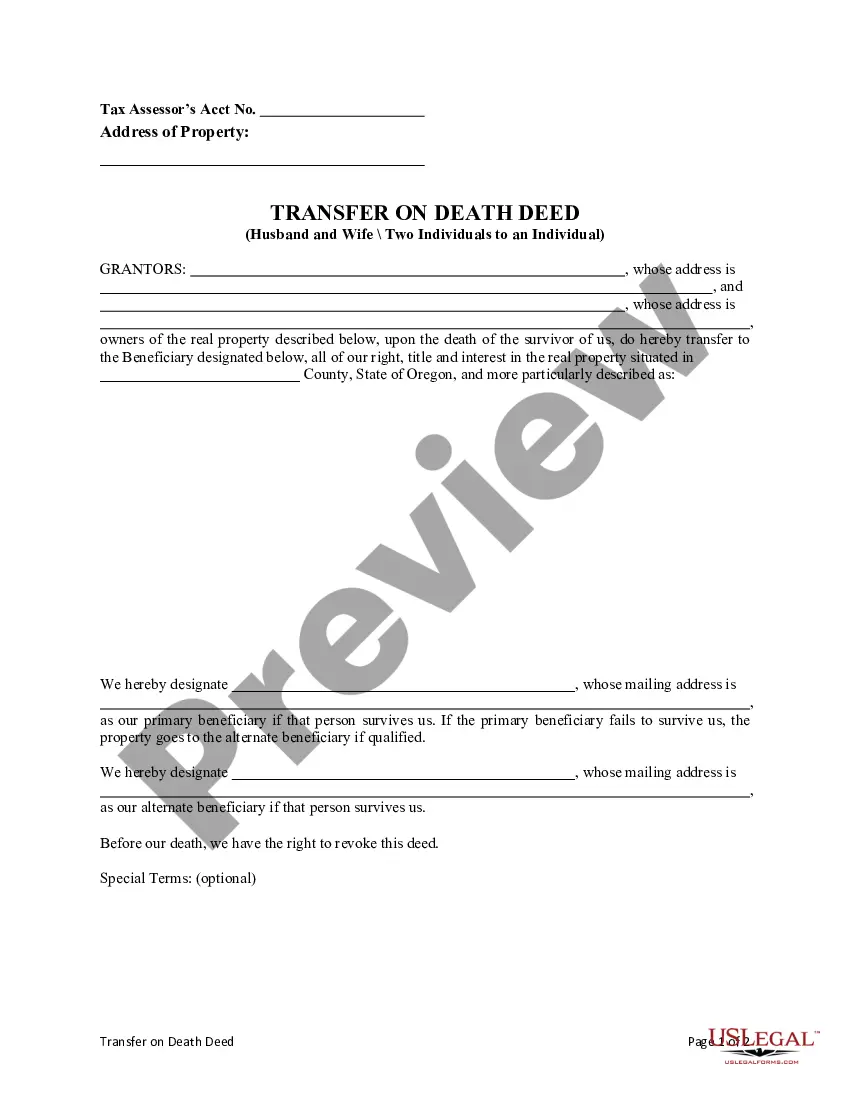

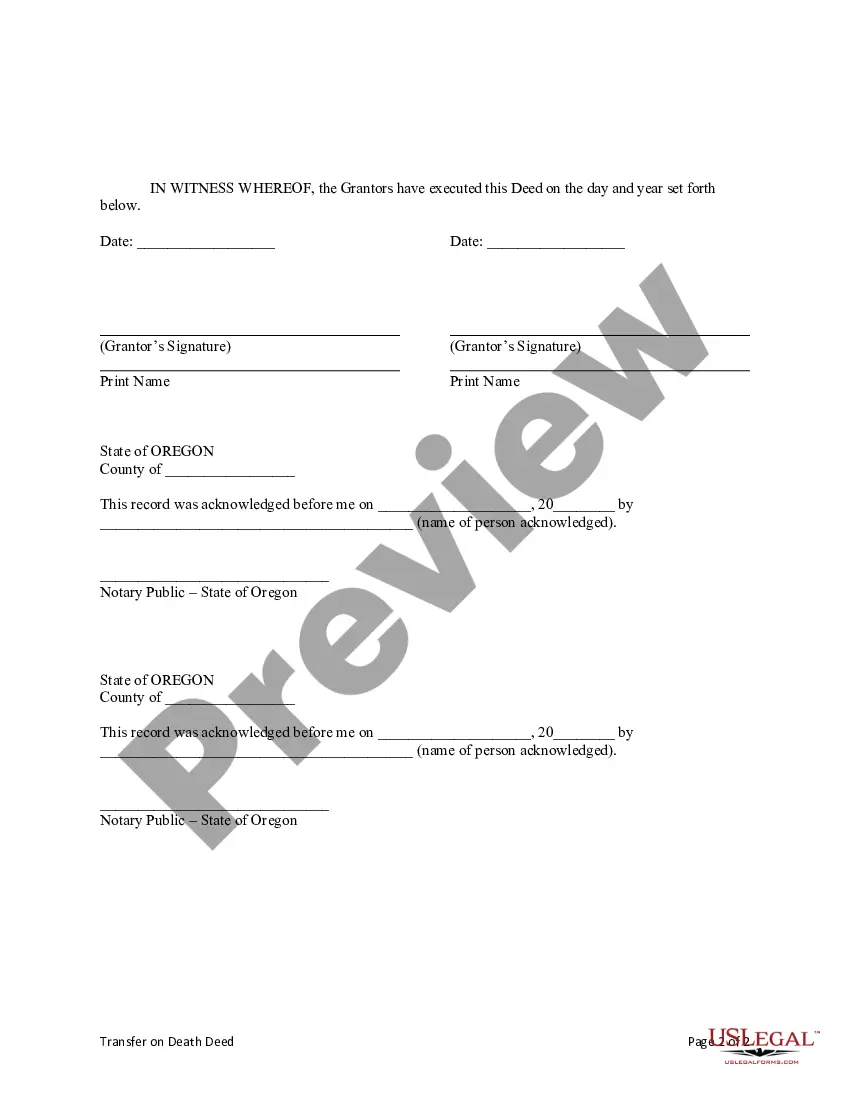

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantee / Beneficiary is an individual. This transfer is revocable until Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary / Grantee takes the property if the primary beneficiary survives the Grantors. If the primary beneficiary fails to survive Grantors, the property would go to the secondary beneficiary if qualified. This deed complies with all state statutory laws.

The Gresham Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary is a legal document that enables individuals or married couples to transfer their real property to a designated individual upon their death. This type of deed is governed by specific laws in the state of Oregon and offers an efficient and simple method to transfer ownership without the need for probate. There are two main types of Gresham Oregon Transfer on Death Deeds from Two Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary: 1. Standard Transfer on Death Deed: This type of deed allows two individuals or a married couple to designate a specific individual as the primary beneficiary. The property ownership is automatically transferred to the designated individual upon the death of the property owner(s) without the need for probate. 2. Transfer on Death Deed with provision for appointment of Alternative Beneficiary: In addition to the primary beneficiary, this type of deed allows the property owner(s) to name an alternative beneficiary. If the primary beneficiary is unable or unwilling to accept the property, it will automatically transfer to the alternative beneficiary. The Gresham Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary offers several advantages. Firstly, it allows property owners to have control over who will receive their property upon their death. This can be beneficial in situations where the property owner(s) want to provide for a specific individual or ensure that the property remains within the family. Secondly, this type of deed avoids the need for probate, which can be a costly and time-consuming process. By using a Transfer on Death Deed, the property transfer is streamlined and can be completed with minimal paperwork and legal fees. It is important to consult with a qualified attorney or legal professional to ensure that the Gresham Oregon Transfer on Death Deed complies with all legal requirements and properly reflects the property owner(s)' intentions. Additionally, it is advisable to review and update the deed periodically to reflect any changes in circumstances or desired beneficiaries. Overall, the Gresham Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary is a valuable tool for property owners to transfer their real estate efficiently and conveniently while maintaining control over their assets and avoiding probate.The Gresham Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary is a legal document that enables individuals or married couples to transfer their real property to a designated individual upon their death. This type of deed is governed by specific laws in the state of Oregon and offers an efficient and simple method to transfer ownership without the need for probate. There are two main types of Gresham Oregon Transfer on Death Deeds from Two Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary: 1. Standard Transfer on Death Deed: This type of deed allows two individuals or a married couple to designate a specific individual as the primary beneficiary. The property ownership is automatically transferred to the designated individual upon the death of the property owner(s) without the need for probate. 2. Transfer on Death Deed with provision for appointment of Alternative Beneficiary: In addition to the primary beneficiary, this type of deed allows the property owner(s) to name an alternative beneficiary. If the primary beneficiary is unable or unwilling to accept the property, it will automatically transfer to the alternative beneficiary. The Gresham Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary offers several advantages. Firstly, it allows property owners to have control over who will receive their property upon their death. This can be beneficial in situations where the property owner(s) want to provide for a specific individual or ensure that the property remains within the family. Secondly, this type of deed avoids the need for probate, which can be a costly and time-consuming process. By using a Transfer on Death Deed, the property transfer is streamlined and can be completed with minimal paperwork and legal fees. It is important to consult with a qualified attorney or legal professional to ensure that the Gresham Oregon Transfer on Death Deed complies with all legal requirements and properly reflects the property owner(s)' intentions. Additionally, it is advisable to review and update the deed periodically to reflect any changes in circumstances or desired beneficiaries. Overall, the Gresham Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary is a valuable tool for property owners to transfer their real estate efficiently and conveniently while maintaining control over their assets and avoiding probate.