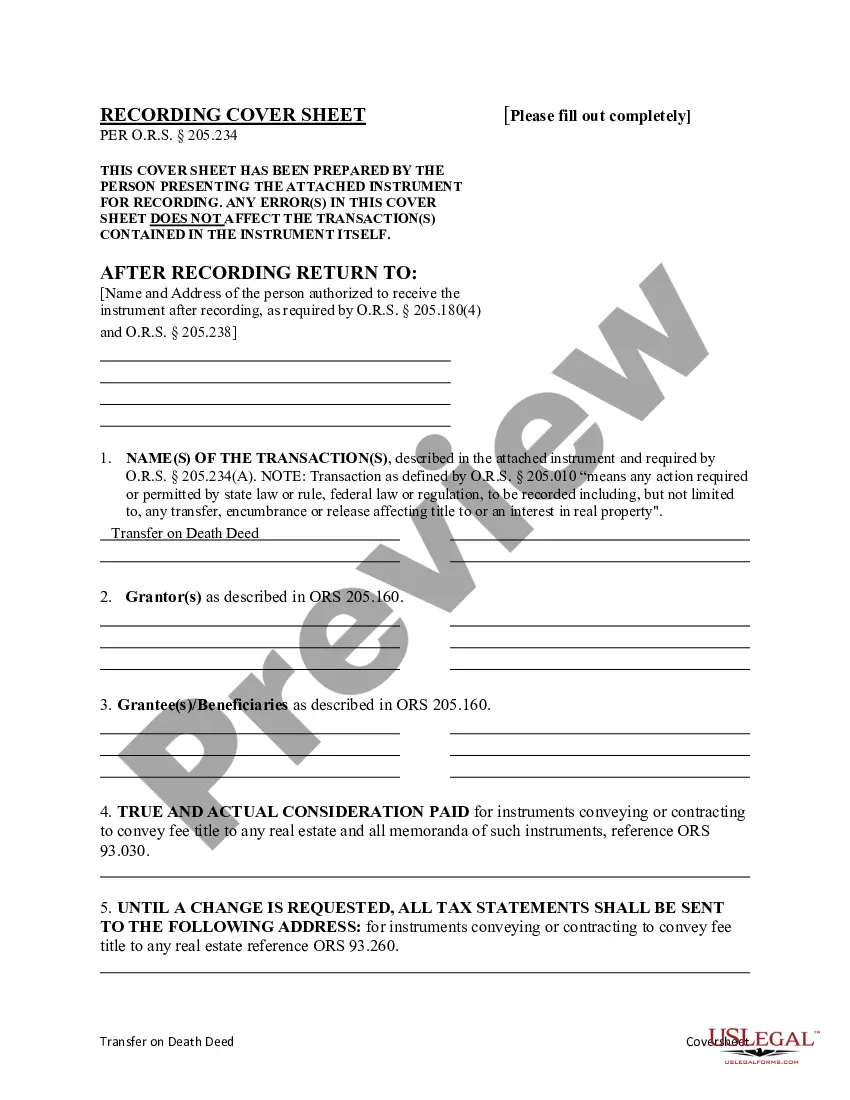

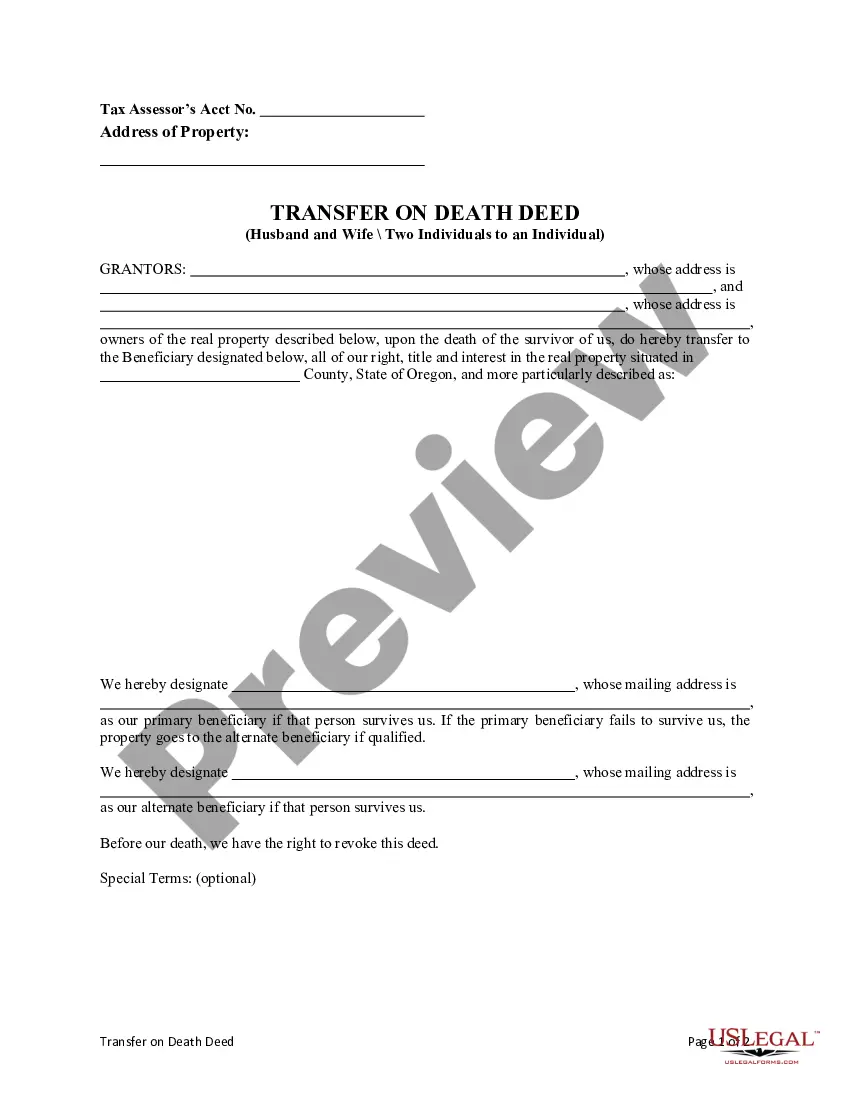

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantee / Beneficiary is an individual. This transfer is revocable until Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary / Grantee takes the property if the primary beneficiary survives the Grantors. If the primary beneficiary fails to survive Grantors, the property would go to the secondary beneficiary if qualified. This deed complies with all state statutory laws.

Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary.

Description

How to fill out Oregon Transfer On Death Deed From Two (2) Individuals Or Husband And Wife To An Individual With Provision For Appointment Of Alternative Beneficiary.?

Locating verified templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world scenarios.

All the files are meticulously organized by category of use and jurisdiction, making it straightforward and quick to find the Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary.

Acquire the document. Click on the Buy Now button and select the subscription plan you prefer. You must create an account to gain access to the library’s resources.

- For those already acquainted with our service and have previously utilized it, acquiring the Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary takes merely a few clicks.

- Simply Log In to your account, select the document, and click Download to save it on your device.

- This procedure will require only a few more steps for new users.

- Review the Preview mode and form details. Ensure you've selected the correct one that aligns with your requirements and adheres to your local jurisdiction standards.

- Search for another template, if necessary. If you notice any discrepancies, use the Search tab above to find the correct one. If it meets your criteria, proceed to the next step.

Form popularity

FAQ

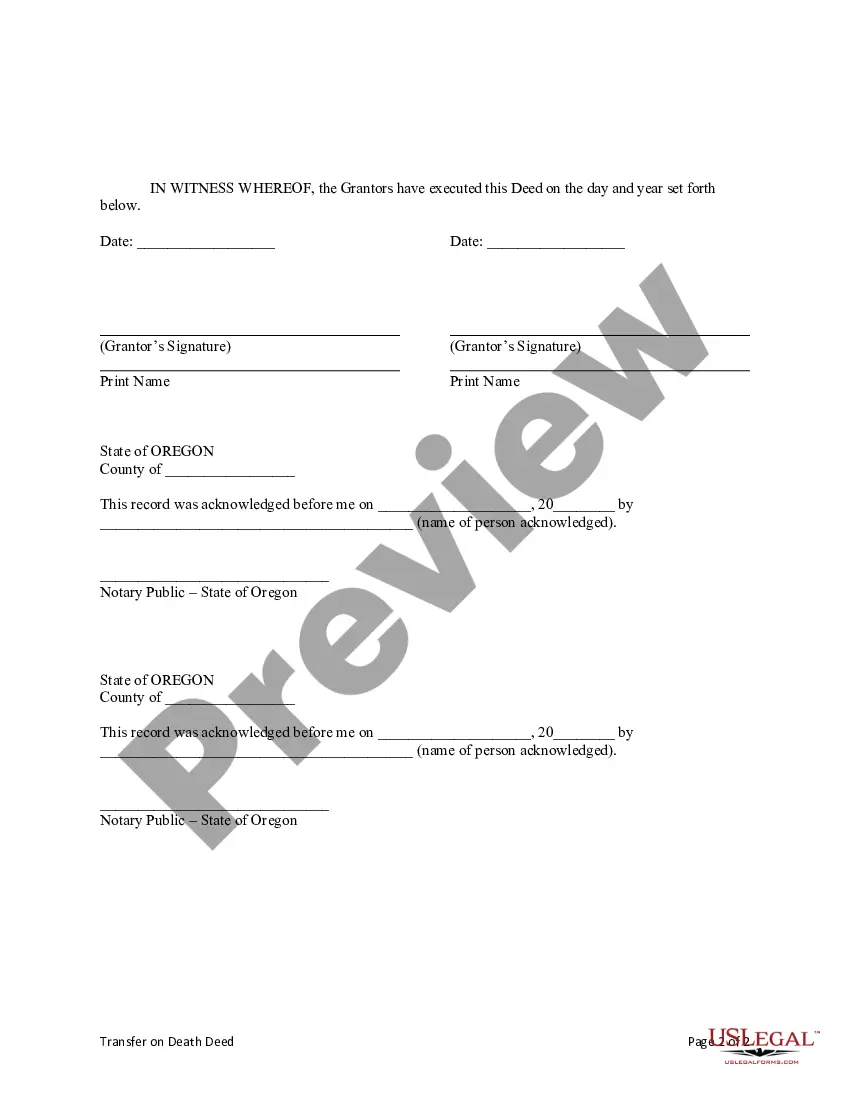

To initiate a transfer on death deed in Oregon, begin by completing the form that designates the property and the beneficiary. Ensure that the Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary is signed in front of a notary public. Afterward, you must record the deed with the county clerk's office to make it legally binding. For assistance and guidance throughout this process, consider utilizing the resources available on the US Legal Forms platform.

One significant disadvantage of a Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary is that it does not provide for the immediate distribution of assets. Instead, the beneficiaries must wait until the death of the grantor. Additionally, this deed may not override a will, as it can sometimes lead to conflicts when managing estates. Therefore, it is essential to consider both documents when planning your estate.

While a Transfer on Death (TOD) offers many benefits, there are some downsides to consider. One potential issue with a Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary is that it does not offer protection from creditors; your beneficiaries may be liable for any debts. Additionally, a TOD does not typically go through probate, which can simplify the asset transfer process but may lead to disputes if not clearly defined. It is essential to understand these aspects when deciding whether this option is right for you.

A Transfer on Death (TOD) designation typically applies to individual accounts rather than joint accounts. However, in the context of a Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary, both parties can establish separate deeds that cater to their individual wishes. This approach ensures that each individual's assets transfer as intended upon death, while still respecting the joint ownership. Consulting with a legal expert can provide further clarity on your specific situation.

Yes, you can designate multiple beneficiaries on a Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary. This allows you to distribute your assets according to your wishes among several parties after your passing. However, it is essential to clearly outline the proportions each beneficiary will receive to avoid any confusion. Consider consulting with a legal professional to ensure all details are appropriately documented.

To transfer a Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary to two beneficiaries, you need to state their names in the deed clearly. The deed must indicate how the property is shared upon the owner's death. It's advisable to consult with uslegalforms for guidance and to ensure compliance with all legal standards during this transfer.

Absolutely, you can include more than one person on a Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary. This enables multiple people to inherit the property upon your passing. Each person's share should be outlined in the deed to clarify ownership interest. For a smooth process, consider using uslegalforms.

Yes, you can designate two beneficiaries on a Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary. This option allows both beneficiaries to receive the property upon the death of the owner. It's essential to ensure that the deed clearly states the division of the property between the beneficiaries. Using uslegalforms can simplify this process and ensure all legal requirements are met.

A transfer on death deed typically does not directly avoid inheritance tax, as the property is still part of the estate. However, in some cases, the tax implications might be less complicated than traditional inheritance proceedings. The Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary could result in favorable outcomes since it streamlines the process. It's important to consult financial and tax professionals to fully understand your obligations.

While a transfer on death deed provides many benefits, there are some potential disadvantages to consider. It may not be appropriate for all property types, and it might limit certain estate planning options. The Hillsboro Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual with provision for appointment of Alternative Beneficiary does not address debts associated with the property, which can complicate matters if there are outstanding financial obligations. Being aware of these limitations can help you make informed decisions.