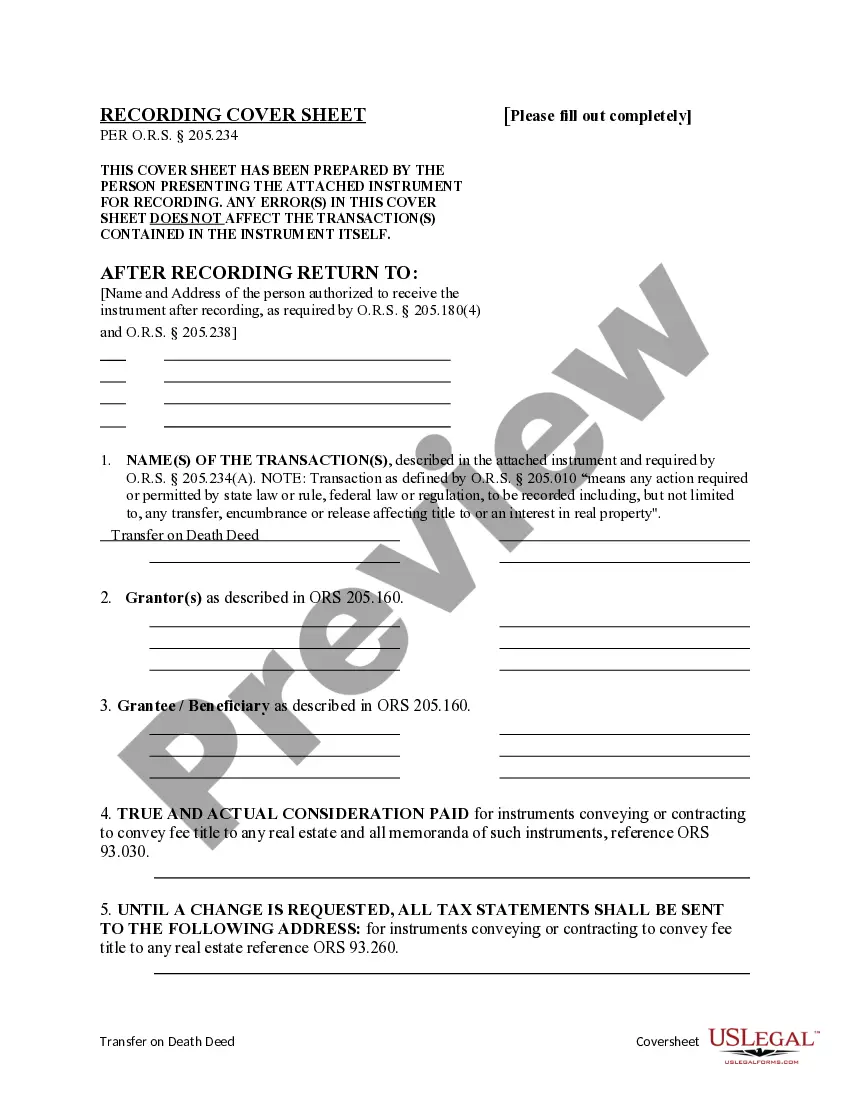

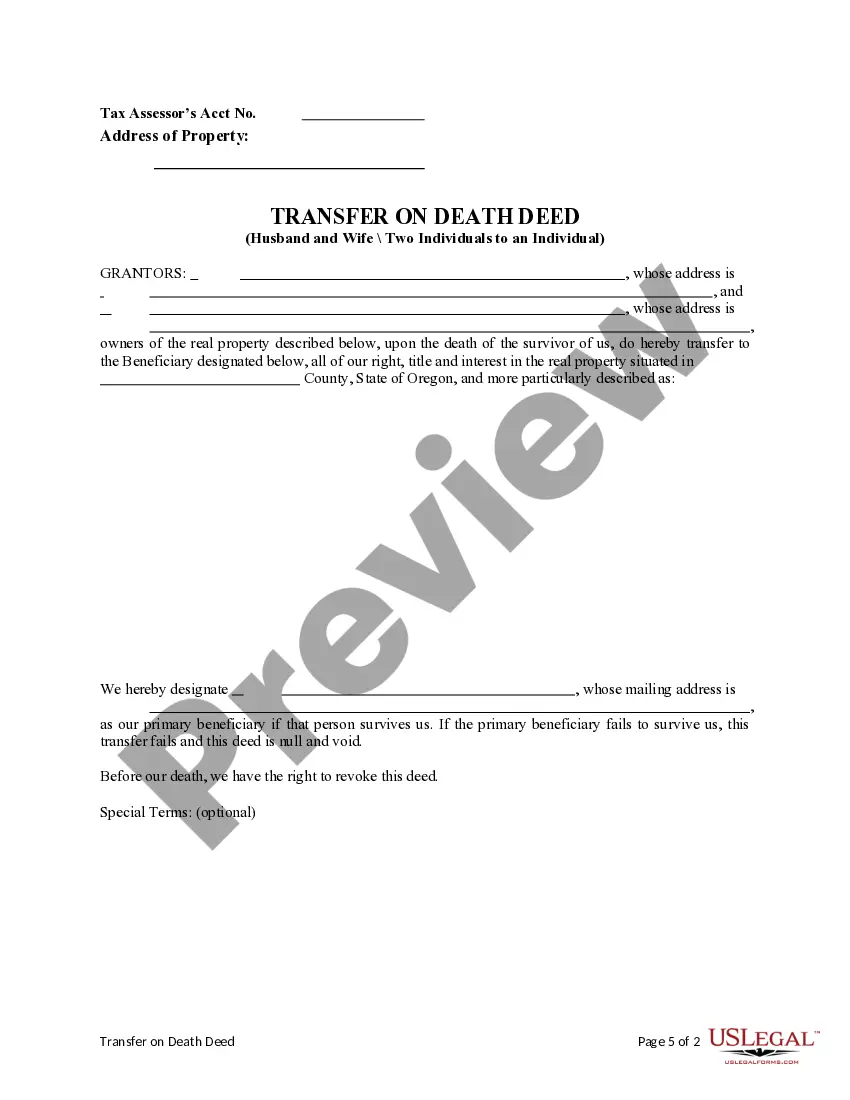

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantee / Beneficiary is an individual. This transfer is revocable until Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary / Grantee takes the property if the primary beneficiary survives the Grantors. There is no provision for an alternate beneficiary. If the primary beneficiary does not qualify, the deed is null and void. This deed complies with all state statutory laws.

A Transfer on Death (TOD) Deed in Bend, Oregon allows two individuals or a husband and wife to transfer their real estate property to an individual beneficiary without provision for the appointment of an alternative beneficiary. This type of deed enables the seamless transfer of ownership upon the death of the property owners, bypassing the need for probate court. The Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary has two variations based on the type of property ownership: 1. Joint Tenancy with Right of Survivorship (TWOS): This type of TOD Deed allows two individuals to co-own a property as joint tenants with the right of survivorship. In the event of the death of one owner, the surviving joint tenant automatically inherits the deceased's share of the property. 2. Tenancy in Common: This variation permits two individuals or a husband and wife to own a property as tenants in common. Each co-owner has a separate and distinct share of the property, and upon death, the deceased's share will not automatically transfer to the surviving owner, but instead be passed to the designated individual beneficiary through the TOD Deed. Using the Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary ensures a straightforward and efficient transfer process, eliminating the need for probate, reducing costs, and minimizing potential conflicts among heirs. This legal instrument allows the owners to enjoy sole ownership of their property during their lifetime and provides reassurance that their intended beneficiary will inherit the property seamlessly upon their passing, all while complying with Oregon's specific laws and regulations regarding transfer on death deeds.A Transfer on Death (TOD) Deed in Bend, Oregon allows two individuals or a husband and wife to transfer their real estate property to an individual beneficiary without provision for the appointment of an alternative beneficiary. This type of deed enables the seamless transfer of ownership upon the death of the property owners, bypassing the need for probate court. The Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary has two variations based on the type of property ownership: 1. Joint Tenancy with Right of Survivorship (TWOS): This type of TOD Deed allows two individuals to co-own a property as joint tenants with the right of survivorship. In the event of the death of one owner, the surviving joint tenant automatically inherits the deceased's share of the property. 2. Tenancy in Common: This variation permits two individuals or a husband and wife to own a property as tenants in common. Each co-owner has a separate and distinct share of the property, and upon death, the deceased's share will not automatically transfer to the surviving owner, but instead be passed to the designated individual beneficiary through the TOD Deed. Using the Bend Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary ensures a straightforward and efficient transfer process, eliminating the need for probate, reducing costs, and minimizing potential conflicts among heirs. This legal instrument allows the owners to enjoy sole ownership of their property during their lifetime and provides reassurance that their intended beneficiary will inherit the property seamlessly upon their passing, all while complying with Oregon's specific laws and regulations regarding transfer on death deeds.