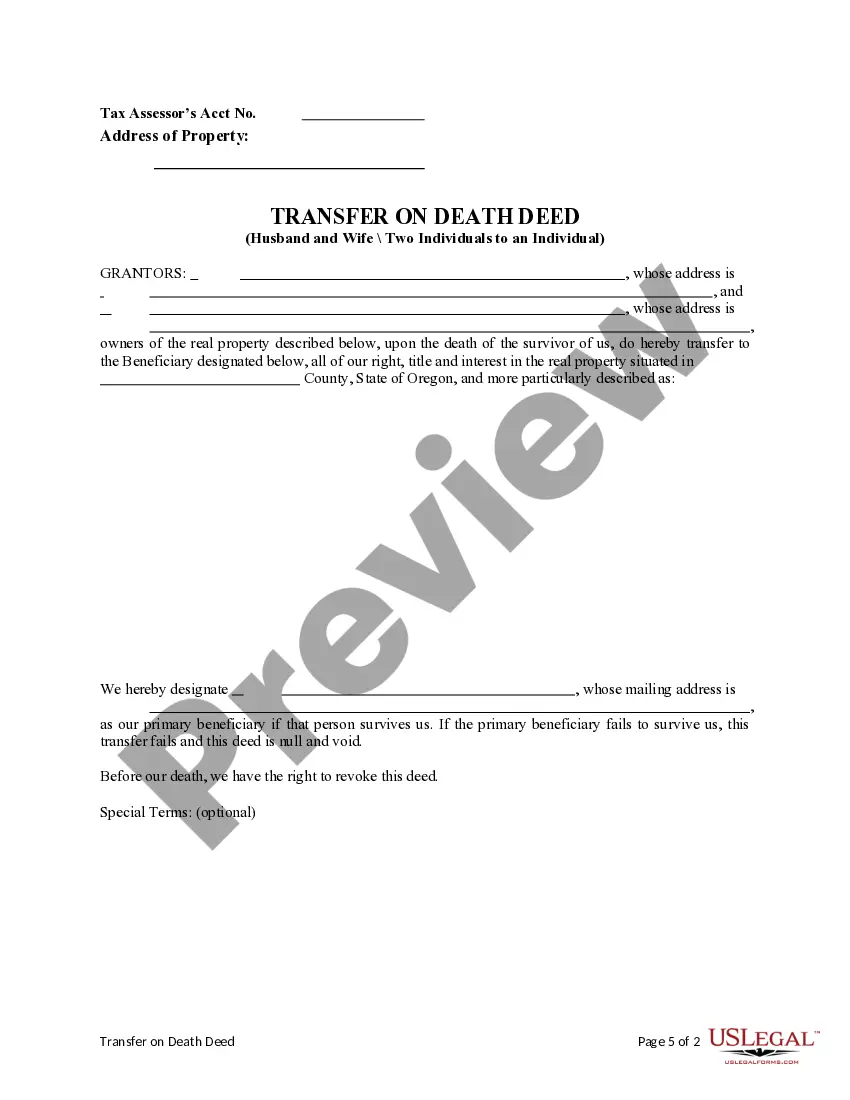

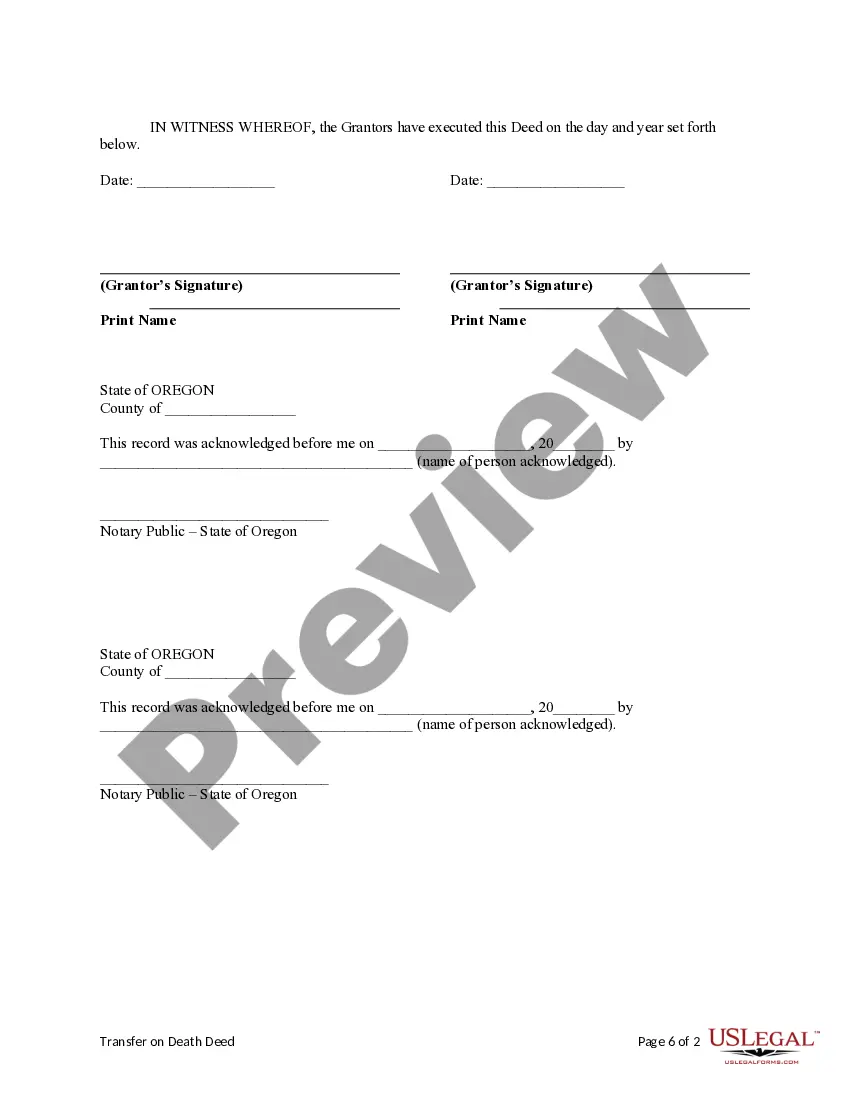

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantee / Beneficiary is an individual. This transfer is revocable until Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary / Grantee takes the property if the primary beneficiary survives the Grantors. There is no provision for an alternate beneficiary. If the primary beneficiary does not qualify, the deed is null and void. This deed complies with all state statutory laws.

The Eugene Oregon Transfer on Death Deed from Two (2) Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary is a legal document that allows property owners in Eugene, Oregon, to designate a specific individual as the beneficiary of their property upon their death. This type of deed is commonly used to transfer real estate to a chosen heir without requiring probate. The standard Eugene Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary is designed for situations where two property owners or a married couple jointly own a property and wish to leave it to a single individual as the primary beneficiary. In this deed, there is no provision for appointing an alternate beneficiary in case the primary beneficiary predeceases the property owners. This type of deed can be especially beneficial for individuals or couples who wish to avoid probate, as it allows for a streamlined transfer of ownership upon their passing. By naming a specific individual as the beneficiary, the property owners have control over who will inherit their property without the need for court involvement. It's important to note that the Eugene Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary is a customizable legal document in order to suit individual preferences and circumstances. The deed can be tailored to address specific ownership arrangements, unique property considerations, or alternative beneficiary scenarios if desired. If property owners wish to include provisions for an alternate beneficiary or create more complex arrangements, there may be other types of transfer on death deeds available in Eugene, Oregon, such as those that allow for contingent beneficiaries or other forms of ownership. It is advisable to consult with a qualified attorney or real estate professional to ensure all legal requirements are met and the desired outcomes are achieved. In conclusion, the Eugene Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to an Individual WITHOUT provision for appointment of Alternate Beneficiary is a valuable tool for property owners who want to control the inheritance of their real estate while avoiding probate. Customizable and flexible, this type of deed allows for a smooth transfer of ownership to a chosen heir, providing peace of mind for property owners in Eugene, Oregon.