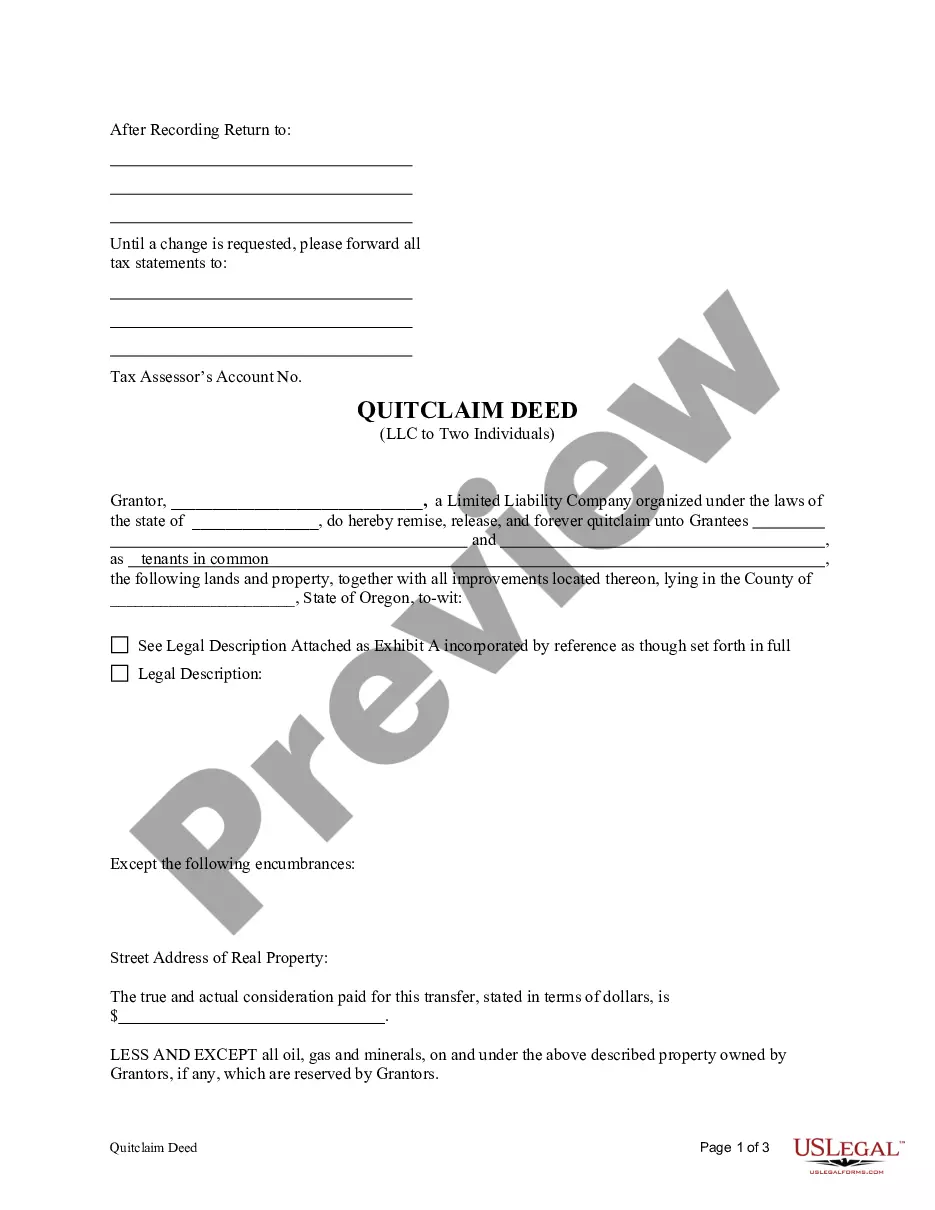

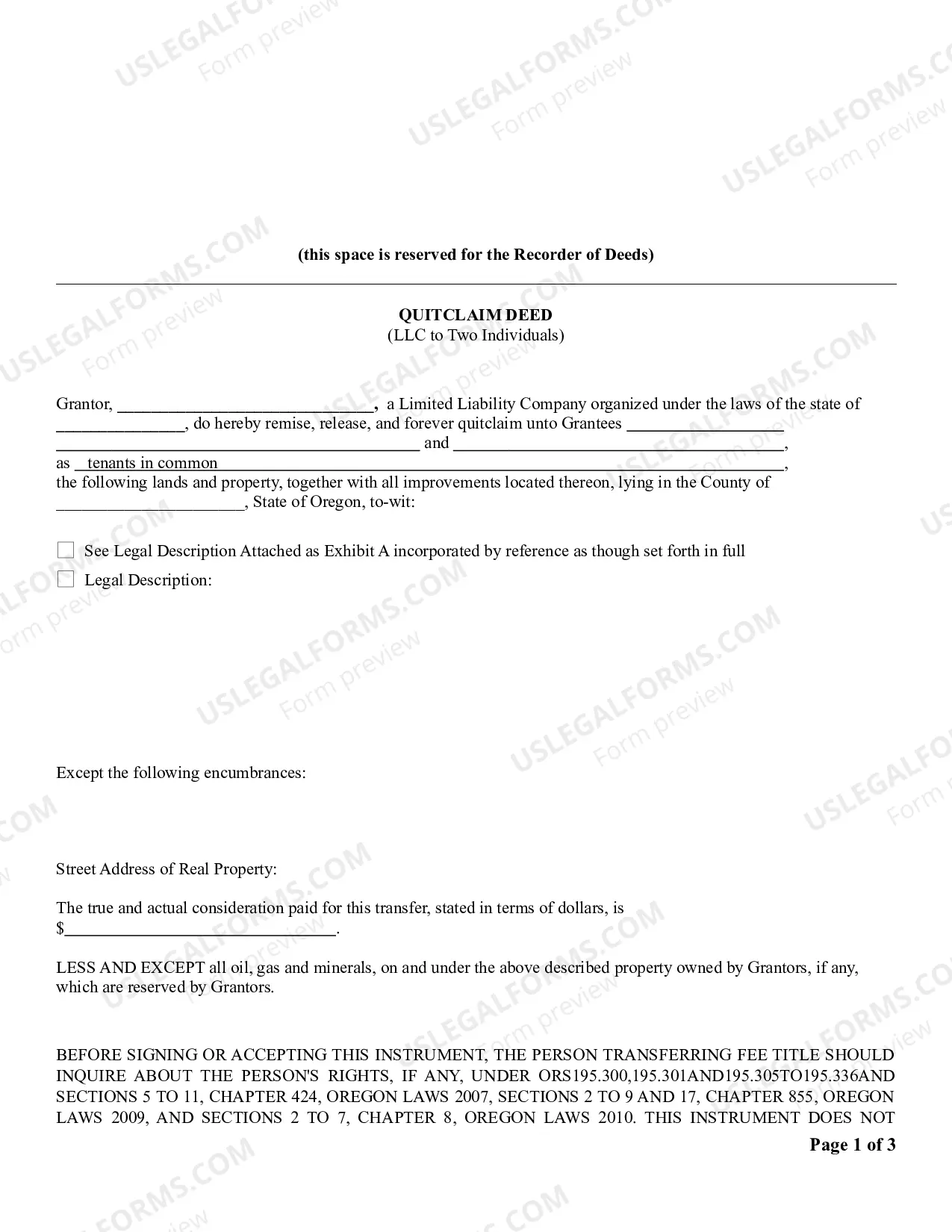

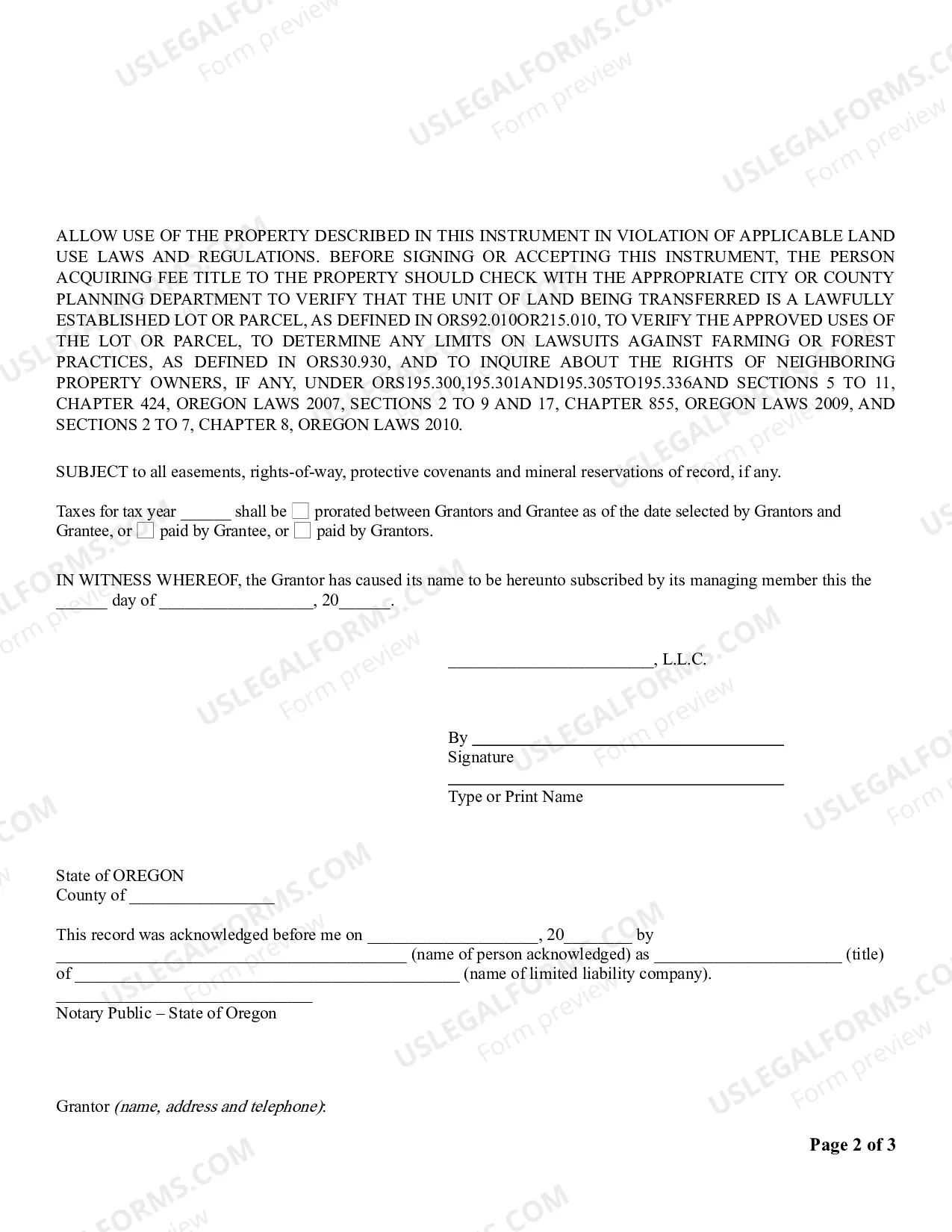

This form is a Quitclaim Deed where the Grantor is a LLC and the Grantees are two individuals. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

Title: Understanding the Various Types of Hillsboro Oregon Quitclaim Deeds from a Limited Liability Company to Two Individuals Meta Description: Explore the intricacies of Hillsboro Oregon quitclaim deeds, specifically those transferring ownership from a limited liability company to two individuals. Learn about different types and their significance in property transactions. Introduction: A Hillsboro Oregon quitclaim deed is a legally binding document that transfers property ownership rights from one party to another, specifically from a limited liability company (LLC) to two individuals. It is crucial to understand the various types of quitclaim deeds involved in these transactions to ensure a smooth transfer of property rights. This comprehensive guide outlines the different types of Hillsboro Oregon quitclaim deeds and highlights their significance in property transfers. 1. Individual Ownership Quitclaim Deed: This type of quitclaim deed involves the transfer of property ownership from an LLC to two individuals, with each individual receiving an equal share of the property rights. It is essential to clearly define the ownership percentages and responsibilities of each individual to avoid future disputes. 2. Joint Tenancy Quitclaim Deed: In this Hillsboro Oregon quitclaim deed, the LLC transfers the property into a joint tenancy between the two individuals. Joint tenancy means that both individuals share an undivided interest in the property, and if one party passes away, their share automatically transfers to the surviving tenant. It is important to understand the legal implications and potential tax consequences associated with joint tenancy. 3. Tenants in Common Quitclaim Deed: With a tenants in common quitclaim deed, the LLC transfers the property to the two individuals as tenants in common. Unlike joint tenancy, tenants in common have separate and distinct shares of the property, which can be divided and passed down to heirs in their estate plan. This type of quitclaim deed is ideal when the parties wish to maintain their individual rights and shares of the property. 4. Fractional Ownership Quitclaim Deed: This type of quitclaim deed relates to situations where the LLC transfers the property to two individuals, but their ownership percentages are unequal. Fractional ownership allows for the distribution of property rights based on individual investments or ownership contributions. It is crucial to explicitly state the exact ownership percentages and rights in this type of quitclaim deed. Conclusion: Understanding the different types of Hillsboro Oregon quitclaim deeds from a limited liability company to two individuals is vital when engaging in property transactions. Whether it involves individual ownership, joint tenancy, tenants in common, or fractional ownership, selecting the right quitclaim deed option is essential to ensure a clear and unambiguous transfer of property rights. Consulting with a reputable real estate attorney or professional is highly recommended for guidance throughout the process.Title: Understanding the Various Types of Hillsboro Oregon Quitclaim Deeds from a Limited Liability Company to Two Individuals Meta Description: Explore the intricacies of Hillsboro Oregon quitclaim deeds, specifically those transferring ownership from a limited liability company to two individuals. Learn about different types and their significance in property transactions. Introduction: A Hillsboro Oregon quitclaim deed is a legally binding document that transfers property ownership rights from one party to another, specifically from a limited liability company (LLC) to two individuals. It is crucial to understand the various types of quitclaim deeds involved in these transactions to ensure a smooth transfer of property rights. This comprehensive guide outlines the different types of Hillsboro Oregon quitclaim deeds and highlights their significance in property transfers. 1. Individual Ownership Quitclaim Deed: This type of quitclaim deed involves the transfer of property ownership from an LLC to two individuals, with each individual receiving an equal share of the property rights. It is essential to clearly define the ownership percentages and responsibilities of each individual to avoid future disputes. 2. Joint Tenancy Quitclaim Deed: In this Hillsboro Oregon quitclaim deed, the LLC transfers the property into a joint tenancy between the two individuals. Joint tenancy means that both individuals share an undivided interest in the property, and if one party passes away, their share automatically transfers to the surviving tenant. It is important to understand the legal implications and potential tax consequences associated with joint tenancy. 3. Tenants in Common Quitclaim Deed: With a tenants in common quitclaim deed, the LLC transfers the property to the two individuals as tenants in common. Unlike joint tenancy, tenants in common have separate and distinct shares of the property, which can be divided and passed down to heirs in their estate plan. This type of quitclaim deed is ideal when the parties wish to maintain their individual rights and shares of the property. 4. Fractional Ownership Quitclaim Deed: This type of quitclaim deed relates to situations where the LLC transfers the property to two individuals, but their ownership percentages are unequal. Fractional ownership allows for the distribution of property rights based on individual investments or ownership contributions. It is crucial to explicitly state the exact ownership percentages and rights in this type of quitclaim deed. Conclusion: Understanding the different types of Hillsboro Oregon quitclaim deeds from a limited liability company to two individuals is vital when engaging in property transactions. Whether it involves individual ownership, joint tenancy, tenants in common, or fractional ownership, selecting the right quitclaim deed option is essential to ensure a clear and unambiguous transfer of property rights. Consulting with a reputable real estate attorney or professional is highly recommended for guidance throughout the process.