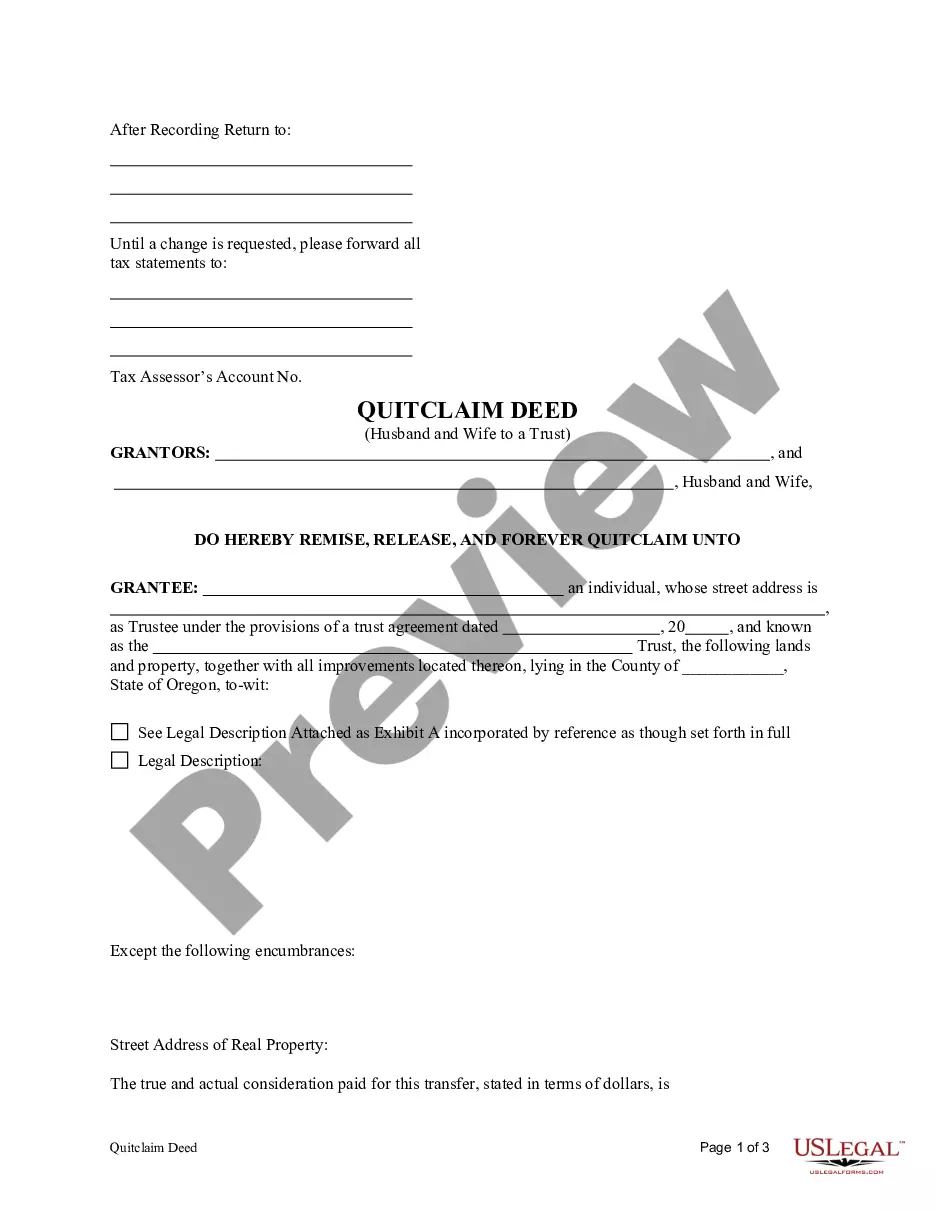

This form is a Quitclaim Deed where the Grantors are Husband and Wife and the Grantee is a Trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Gresham Oregon Quitclaim Deed from Husband and Wife to Trust

Description

How to fill out Oregon Quitclaim Deed From Husband And Wife To Trust?

We consistently endeavor to minimize or avert legal liability when engaging with intricate legal or financial issues.

To achieve this, we enlist the help of legal services that are generally quite costly.

Nevertheless, not every legal concern is equally complicated. A majority of them can be addressed independently.

US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for termination.

Simply Log In to your account and click the Get button adjacent to it. If you misplace the document, you can continuously download it again from the My documents section. The procedure is equally straightforward if you’re a newcomer to the website! You can establish your account in a matter of minutes. Ensure to verify if the Gresham Oregon Quitclaim Deed from Husband and Wife to Trust complies with the statutes and regulations of your state and area. Additionally, it is essential that you review the form’s description (if available), and if you observe any inconsistencies with what you initially sought, look for an alternative form. After confirming that the Gresham Oregon Quitclaim Deed from Husband and Wife to Trust is suitable for your circumstances, you can choose the subscription plan and move forward to payment. Subsequently, you can download the document in any appropriate file format. For over 24 years in the industry, we’ve assisted millions of individuals by supplying ready-to-customize and current legal documents. Take advantage of US Legal Forms now to conserve time and resources!

- Our library enables you to take control of your affairs without requiring a lawyer.

- We offer access to legal document templates that are not always readily available.

- Our templates are specific to states and areas, significantly simplifying the search process.

- Benefit from US Legal Forms whenever you need to obtain and download the Gresham Oregon Quitclaim Deed from Husband and Wife to Trust or any other document easily and securely.

Form popularity

FAQ

A spouse may choose to execute a quitclaim deed to clarify ownership or to facilitate the transfer of property into a trust. This can be especially relevant during divorce proceedings or estate planning, ensuring assets are properly managed. In summary, the Gresham Oregon Quitclaim Deed from Husband and Wife to Trust is an effective tool for such situations, providing peace of mind for both parties.

Yes, a quitclaim deed can be used to transfer property from a trust, allowing the designated trustee to convey property rights to another party. This process allows for flexible management of property assets within the trust. When utilizing the Gresham Oregon Quitclaim Deed from Husband and Wife to Trust, it's crucial to ensure all documentation aligns with trust regulations to avoid complications.

Typically, individuals who seek to transfer property easily benefit the most from a quitclaim deed. This method is particularly advantageous for married couples who want to place property in a trust or resolve ownership issues. Hence, utilizing the Gresham Oregon Quitclaim Deed from Husband and Wife to Trust can effectively streamline such transactions.

A quitclaim deed for a married couple serves as a straightforward way to transfer ownership without warranties. This deed allows one spouse to relinquish any claim to property, making it useful during estate planning or divorce situations. Utilizing the Gresham Oregon Quitclaim Deed from Husband and Wife to Trust can help a couple smoothly transition property into a more secure arrangement.

For most married couples, a quitclaim deed is often sufficient when transferring property between themselves or into a trust. This is especially true if the couple wishes to simplify ownership details and maintain flexibility. The Gresham Oregon Quitclaim Deed from Husband and Wife to Trust serves as an effective method to achieve this while ensuring proper legal protections.

To fill out a quit claim deed in Oregon, start by gathering the required information, including the names of the grantors and grantees, the property's legal description, and the consideration amount. Next, ensure that the document follows the state's formatting requirements, which can include specific language and signature lines. You can simplify the process by utilizing the US Legal Forms platform, which provides templates and guidance tailored for a Gresham Oregon Quitclaim Deed from Husband and Wife to Trust. Remember to notarize the document before recording it with your local county clerk’s office to ensure it is legally effective.

Preparing a quitclaim deed often requires legal expertise to ensure its validity and effectiveness, especially in complex situations. While anyone can draft a quitclaim deed, it is advisable to seek the assistance of a qualified attorney or a professional service like US Legal Forms. They can provide you with the necessary templates and guidance to create a Gresham Oregon Quitclaim Deed from Husband and Wife to Trust that meets legal requirements and accurately reflects your intentions. This helps to avoid potential pitfalls in the property transfer process.

A quitclaim deed does not supersede a trust; rather, it serves as a method of transferring property into a trust. Once you execute a Gresham Oregon Quitclaim Deed from Husband and Wife to Trust, the trust holds the title of the property. Therefore, the trust's terms and conditions will govern the property, and any deed must comply with those terms. Understanding this dynamic ensures effective estate planning and property management.

Transferring property out of an irrevocable trust can be quite complex. Generally, once property is placed in an irrevocable trust, the grantor cannot change the terms, including transferring property out of the trust. However, if specific provisions allow for such action or if all beneficiaries agree, it may be possible. Always consult with a legal expert when dealing with a Gresham Oregon Quitclaim Deed from Husband and Wife to Trust to understand your options.

A quitclaim deed is not suitable for transferring property when there are existing liens, claims, or mortgages on the property that need to be addressed. This type of deed offers no guarantees about the title's validity, so if you require a clear title, you should consider a warranty deed instead. Additionally, it cannot be used to transfer property in the event of an ongoing divorce or litigation involving the property. Thus, carefully assess the circumstances before proceeding with a Gresham Oregon Quitclaim Deed from Husband and Wife to Trust.