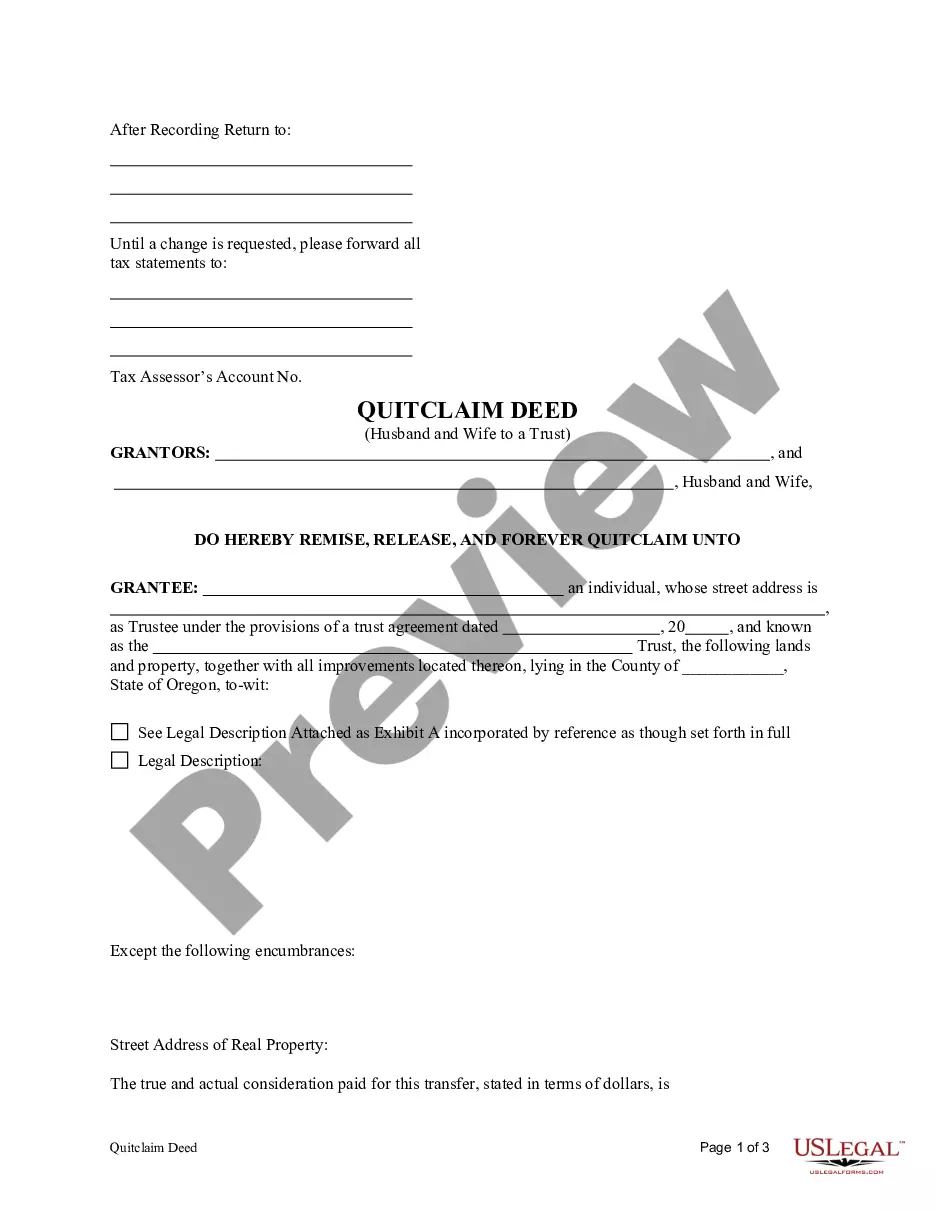

This form is a Quitclaim Deed where the Grantors are Husband and Wife and the Grantee is a Trust. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

Hillsboro Oregon Quitclaim Deed from Husband and Wife to Trust is a legal document that transfers ownership of a property from a married couple to a trust. This type of deed is commonly used for estate planning and asset protection purposes. By executing this deed, the couple relinquishes their ownership rights to the property, making the trust the new legal owner. There are a few different types of Hillsboro Oregon Quitclaim Deed from Husband and Wife to Trust that may be used based on specific circumstances. These include: 1. Hillsboro Oregon Revocable Living Trust Quitclaim Deed: This type of deed is utilized when a husband and wife want to transfer the ownership of their property to a revocable living trust, which they can modify or terminate during their lifetime. This trust structure allows individuals to avoid probate and have greater control over their assets. 2. Hillsboro Oregon Irrevocable Living Trust Quitclaim Deed: In contrast to a revocable living trust, an irrevocable living trust cannot be modified or terminated by the trust creators. With this type of deed, the husband and wife transfer property ownership to an irrevocable living trust, typically to provide asset protection or eligibility for certain government benefits. 3. Hillsboro Oregon Medicaid Trust Quitclaim Deed: This deed is specifically used by couples who want to establish a Medicaid trust. By transferring ownership of their property to this trust, they can protect the assets from potential nursing home costs and still qualify for Medicaid benefits. 4. Hillsboro Oregon Family Trust Quitclaim Deed: This type of deed is commonly utilized by a husband and wife to transfer ownership of their property to a family trust. The purpose can vary, including estate planning, managing assets for future generations, and avoiding probate. It is essential to consult with an experienced attorney when considering the creation or execution of a Hillsboro Oregon Quitclaim Deed from Husband and Wife to Trust. They can guide you through the legal requirements, potential tax implications, and ensure the document aligns with your specific goals and objectives.