A trust involves any arrangement by which legal title to property is transferred from one person to be administered by a trustee for another person's benefit. The elements of a valid trust are:

" A designated beneficiary.

" A designated trustee.

" A fund identified to enable title to pass to the trustee.

" Delivery by the settlor or grantor to the trustee with the intent of passing title.

A trustor executes a living trust during his or her lifetime. It can be revocable or irrevocable.

Anyone legally capable of holding title to, and dealing in, property can be a trustee. If a trustor does not name a trustee, or if a named trustee cannot or will not serve, a court can appoint one. A trustor may prescribe the trustee's powers and performance. State law applies only in the absence of such terms. A trustee must act with honesty, good faith, and prudence, and exercise loyalty toward the beneficiary. A trustee must keep clear, accurate accounts and furnish complete information to the beneficiary while keeping trust assets separate. A trustee pays an income beneficiary the net income of the trust. A trustee must distribute the risk of loss of the trust assets through diversified "prudent investments."

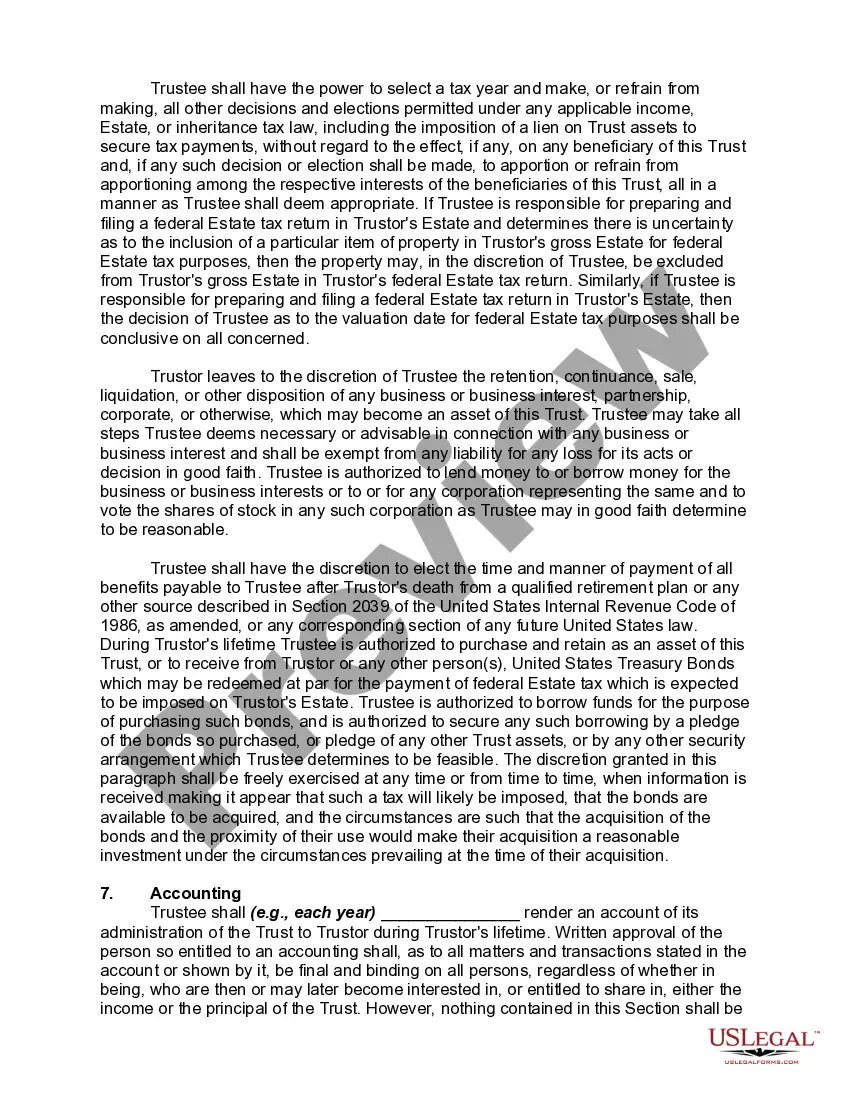

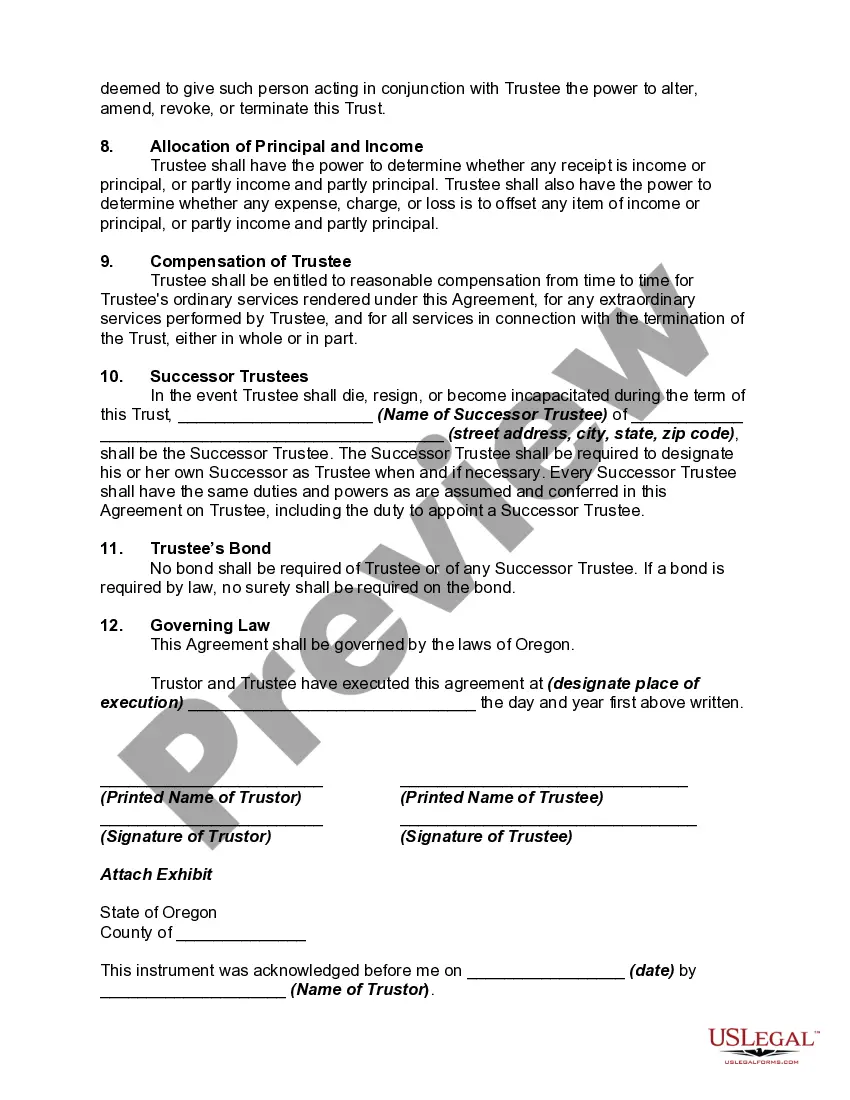

A Bend Oregon Irrevocable Trust for Lifetime Benefit of Disabled Trust or with Power of Invasion in Trust or is a legal instrument designed to provide ongoing financial support and protection for individuals with disabilities. This type of trust is often established by trustees or parents of disabled individuals to ensure that their loved ones receive continuous care, while also protecting their eligibility for government benefits such as Medicaid or Supplemental Security Income (SSI). The primary purpose of a Bend Oregon Irrevocable Trust for Lifetime Benefit of Disabled Trust or with Power of Invasion in Trust or is to supplement the disabled person's needs beyond what government benefits could otherwise provide. It allows the trust or to contribute assets, such as cash, property, or investments, with the assurance that these funds will be used exclusively for the benefit of the disabled individual during their lifetime. One notable feature of this trust is the power of invasion given to the trust or. This power allows the trust or to withdraw assets from the trust during their lifetime, if necessary, to address emergencies, unmet needs, or unexpected expenses that may arise for the disabled beneficiary. This capability provides the trust or with flexibility and control over the trust assets, ensuring that the disabled person's changing needs can be adequately addressed. In Bend Oregon, there may be different types or variations of the Irrevocable Trust for Lifetime Benefit of Disabled Trust or with Power of Invasion in Trust or. Some common subtypes or variations of this trust include: 1. Special Needs Trust: This subtype of trust is specifically designed to preserve the disabled individual's eligibility for means-tested government benefits while supplementing their quality of life. The trust assets are managed by a trustee, who is responsible for investing the funds and disbursing them for the beneficiary's special needs, which may include personal care attendants, therapies, housing, transportation, or education expenses. 2. Pooled Trust: A Pooled Trust is a collective investment vehicle managed by a nonprofit organization. In this type of trust, multiple disabled individuals' funds are pooled together for investment purposes. The trustee then disburses the funds on behalf of each beneficiary, ensuring they continue to receive necessary financial support while maintaining eligibility for government benefits. 3. Third-Party Trust: Unlike other variations of this trust, a Third-Party Trust is an estate planning tool created and funded by someone other than the disabled individual or their parents. It allows family members, friends, or even charitable organizations to contribute funds to support the needs of the disabled individual while ensuring the assets are protected and properly managed by a trustee. Overall, a Bend Oregon Irrevocable Trust for Lifetime Benefit of Disabled Trust or with Power of Invasion in Trust or serves as a vital tool to provide financial stability, independence, and a higher quality of life for disabled individuals. By carefully crafting and implementing such a trust, trustees can ensure their loved ones receive the essential care and support they need, while also safeguarding their financial well-being.A Bend Oregon Irrevocable Trust for Lifetime Benefit of Disabled Trust or with Power of Invasion in Trust or is a legal instrument designed to provide ongoing financial support and protection for individuals with disabilities. This type of trust is often established by trustees or parents of disabled individuals to ensure that their loved ones receive continuous care, while also protecting their eligibility for government benefits such as Medicaid or Supplemental Security Income (SSI). The primary purpose of a Bend Oregon Irrevocable Trust for Lifetime Benefit of Disabled Trust or with Power of Invasion in Trust or is to supplement the disabled person's needs beyond what government benefits could otherwise provide. It allows the trust or to contribute assets, such as cash, property, or investments, with the assurance that these funds will be used exclusively for the benefit of the disabled individual during their lifetime. One notable feature of this trust is the power of invasion given to the trust or. This power allows the trust or to withdraw assets from the trust during their lifetime, if necessary, to address emergencies, unmet needs, or unexpected expenses that may arise for the disabled beneficiary. This capability provides the trust or with flexibility and control over the trust assets, ensuring that the disabled person's changing needs can be adequately addressed. In Bend Oregon, there may be different types or variations of the Irrevocable Trust for Lifetime Benefit of Disabled Trust or with Power of Invasion in Trust or. Some common subtypes or variations of this trust include: 1. Special Needs Trust: This subtype of trust is specifically designed to preserve the disabled individual's eligibility for means-tested government benefits while supplementing their quality of life. The trust assets are managed by a trustee, who is responsible for investing the funds and disbursing them for the beneficiary's special needs, which may include personal care attendants, therapies, housing, transportation, or education expenses. 2. Pooled Trust: A Pooled Trust is a collective investment vehicle managed by a nonprofit organization. In this type of trust, multiple disabled individuals' funds are pooled together for investment purposes. The trustee then disburses the funds on behalf of each beneficiary, ensuring they continue to receive necessary financial support while maintaining eligibility for government benefits. 3. Third-Party Trust: Unlike other variations of this trust, a Third-Party Trust is an estate planning tool created and funded by someone other than the disabled individual or their parents. It allows family members, friends, or even charitable organizations to contribute funds to support the needs of the disabled individual while ensuring the assets are protected and properly managed by a trustee. Overall, a Bend Oregon Irrevocable Trust for Lifetime Benefit of Disabled Trust or with Power of Invasion in Trust or serves as a vital tool to provide financial stability, independence, and a higher quality of life for disabled individuals. By carefully crafting and implementing such a trust, trustees can ensure their loved ones receive the essential care and support they need, while also safeguarding their financial well-being.