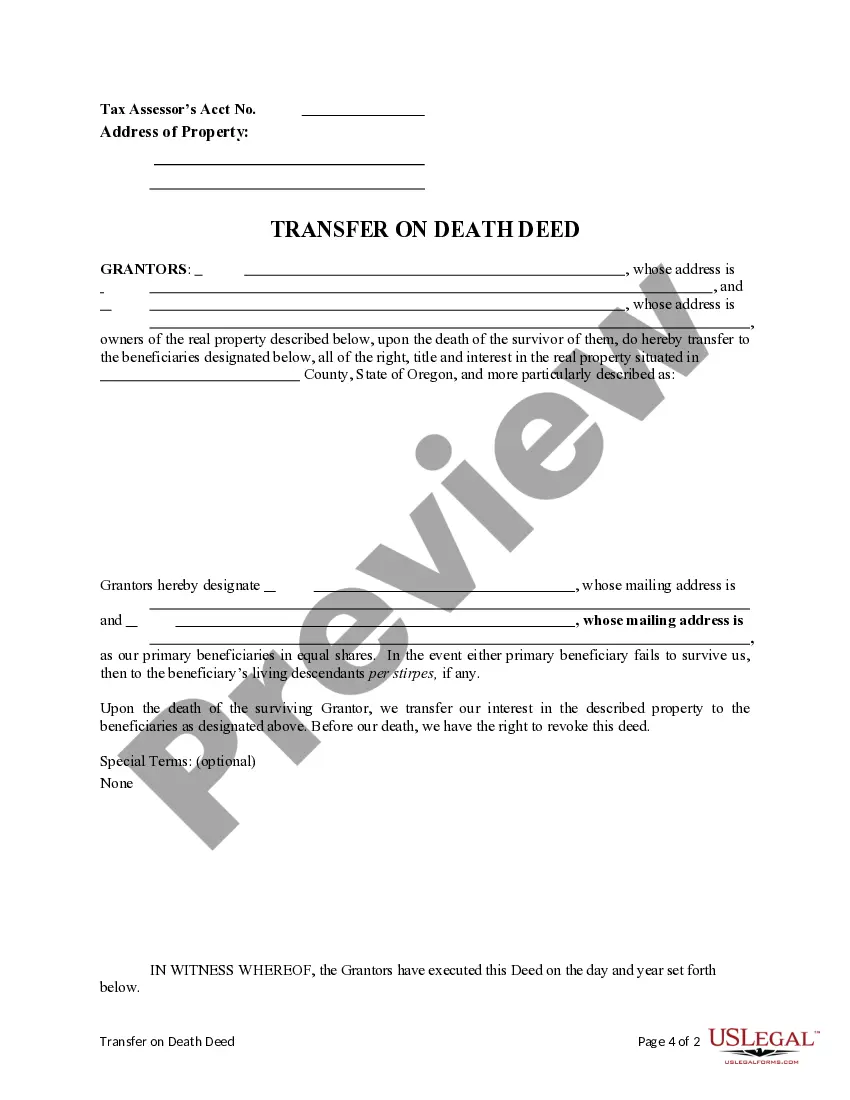

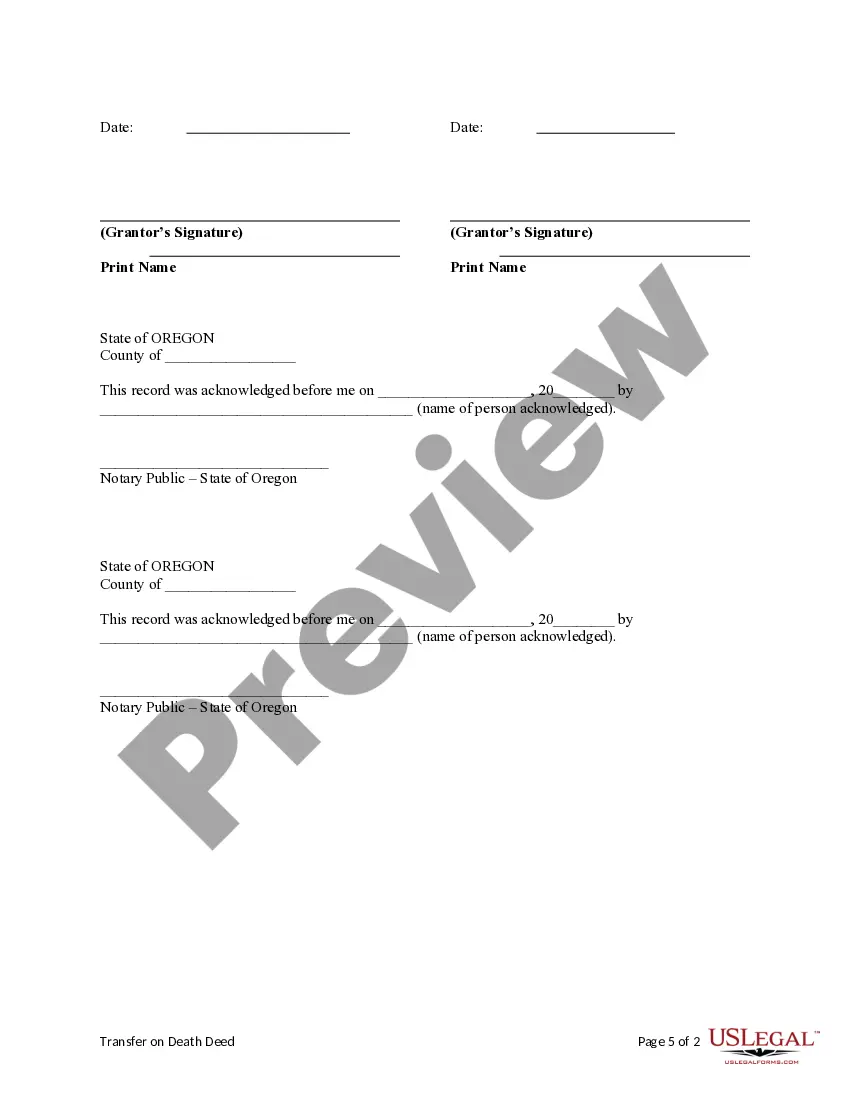

This form is a Transfer on Death Deed where the Grantors are husband and wife, or two individuals, and the Grantee Beneficiaries are two individuals, or Husband and Wife. This transfer is revocable until the last Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary Grantees takes the property in equal shares if the primary beneficiaries survive the Grantors. If a primary beneficiary fails to survive Grantors, their interest in the property would go to their descendants per stirpes, if any.

Eugene Oregon Transfer on Death Deed, also known as TODD deed, allows for the transfer of real estate property from two individuals or a husband and wife to two individuals with provisions for successor beneficiaries. This type of deed provides a straightforward and efficient way for property owners to designate who will inherit their property upon their passing, without the need for probate. There are two main types of Eugene Oregon Transfer on Death Deeds from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries: 1. Revocable Transfer on Death Deed: This type of deed allows the property owners to change or revoke the designated beneficiaries during their lifetime. It provides flexibility and ensures that the property will pass to the intended beneficiaries upon the owners' death. 2. Irrevocable Transfer on Death Deed: Unlike the revocable deed, the irrevocable TODD deed cannot be changed or revoked by the property owners once it has been executed. This type of deed provides certainty and security, ensuring that the property will pass directly to the designated beneficiaries without the possibility of alteration. By utilizing the Eugene Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries, property owners can enjoy several benefits: — Avoidance of Probate: The TODD deed bypasses probate, which can be time-consuming and costly. It allows for a seamless transfer of property to the designated beneficiaries without court intervention. — Minimized Tax Consequences: The transfer of property through a TODD deed may be subject to fewer tax implications compared to other methods of property transfer, such as wills or trusts. Consulting with a tax professional can provide clarity on the specific tax implications. — Flexibility to Designate Successor Beneficiaries: This type of deed allows property owners to designate primary beneficiaries, as well as successor beneficiaries who will inherit the property if the primary beneficiaries are deceased. This provision ensures that the property passes to the desired individuals or entities. — Property Owner Retains Control During Lifetime: Until the property owners' passing, they maintain full control and ownership rights over the property. They can continue to use, sell, or mortgage the property without any restrictions that come with other estate planning methods. When considering a Eugene Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries, it is crucial to consult with an attorney specializing in estate planning to ensure all legal requirements are met and the deed accurately reflects the property owners' intentions.