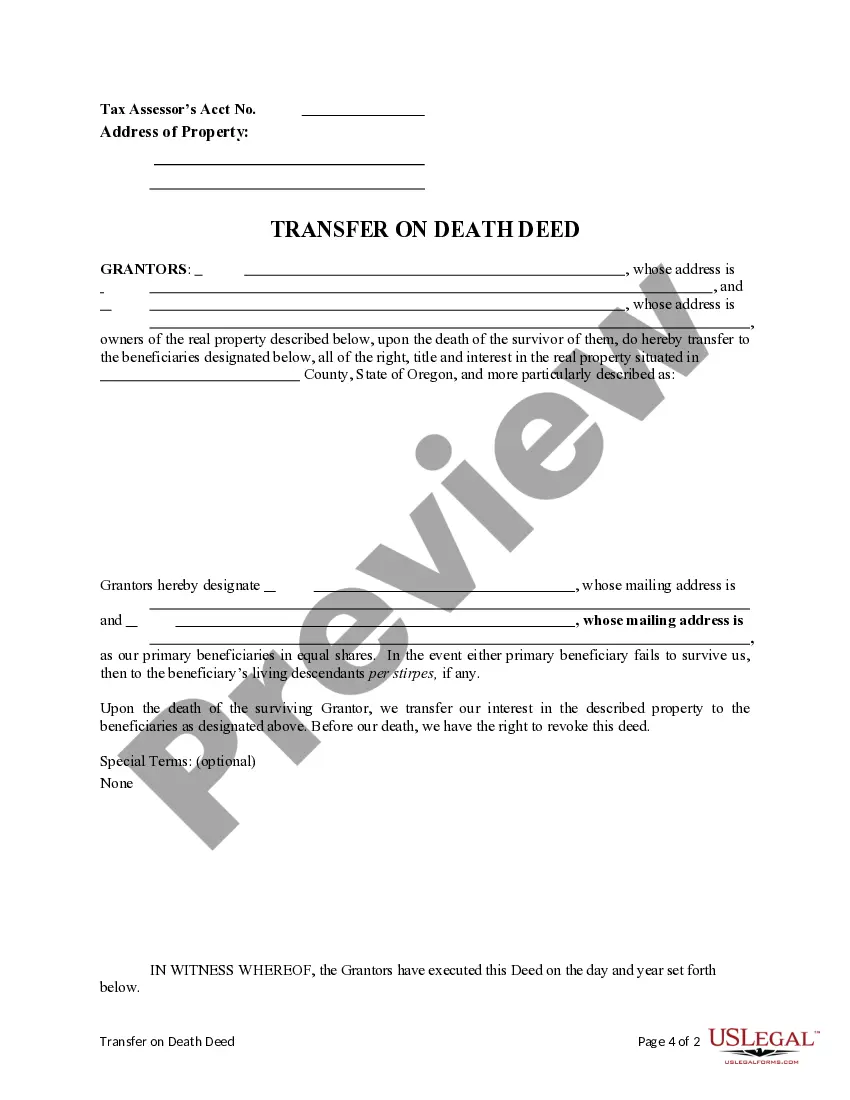

This form is a Transfer on Death Deed where the Grantors are husband and wife, or two individuals, and the Grantee Beneficiaries are two individuals, or Husband and Wife. This transfer is revocable until the last Grantor's death and effective only upon the death of the last surviving Grantor. The primary beneficiary Grantees takes the property in equal shares if the primary beneficiaries survive the Grantors. If a primary beneficiary fails to survive Grantors, their interest in the property would go to their descendants per stirpes, if any.

Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries.

Description

How to fill out Oregon Transfer On Death Deed From Two Individuals Or Husband And Wife To Two Individuals With Provision For Successor Beneficiaries.?

Regardless of social or occupational rank, finalizing legal documents is a regrettable requirement in today’s society.

Too frequently, it’s nearly unfeasible for an individual lacking any legal expertise to generate such documents from the beginning, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms comes to the aid.

However, if you are new to our platform, make sure to follow these steps before acquiring the Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provisions for Successor Beneficiaries.

Ensure the template you have located is appropriate for your region since the laws of one state or county do not apply to another.

- Our platform provides a vast assortment of over 85,000 ready-to-utilize state-specific documents applicable to virtually any legal circumstance.

- US Legal Forms is also an excellent tool for partners or legal advisors looking to save time by using our DIY forms.

- Whether you require the Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provisions for Successor Beneficiaries.

- or any other document that will be accepted in your state or county, with US Legal Forms, everything is readily available.

- Here’s how to obtain the Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries quickly using our reliable platform.

- If you are already a member, please proceed to Log In to your account to retrieve the relevant document.

Form popularity

FAQ

One issue with transfer on death accounts is that they may not cover all asset types, leading to potential gaps in estate planning. Additionally, the Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries may not account for future changes in your wishes or family dynamics. Regularly reviewing and updating your estate plan is crucial to ensure it accurately reflects your intentions. Working with legal specialists can help identify and mitigate these issues.

Yes, the Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries helps avoid probate in Oregon. This deed allows the property to transfer directly to the designated beneficiaries upon death, eliminating the lengthy probate process. This means your heirs can access the property more rapidly. Utilizing this deed can greatly simplify estate management.

Typically, a transfer on death deed does not inherently avoid inheritance tax in Oregon. However, it does simplify the transfer process and can prevent probate delays. The Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries streamlines asset transfer, making it easier for heirs. To understand the tax implications fully, consider seeking advice from a tax professional.

Choosing between a transfer on death deed and naming a beneficiary varies based on your needs. The Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries can provide immediate benefits by avoiding probate, while direct beneficiary designations may offer flexibility in other asset distribution. Evaluating your personal circumstances and long-term goals is essential. Consulting with a legal expert can help you make the best decision.

Many states, including Oregon, recognize transfers on death deeds. The Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries is accepted in Oregon and allows you to pass real estate without going through probate. It is important to check your state’s specific laws as recognition of these deeds can vary. Always consult with a real estate attorney or an expert in estate planning to ensure compliance.

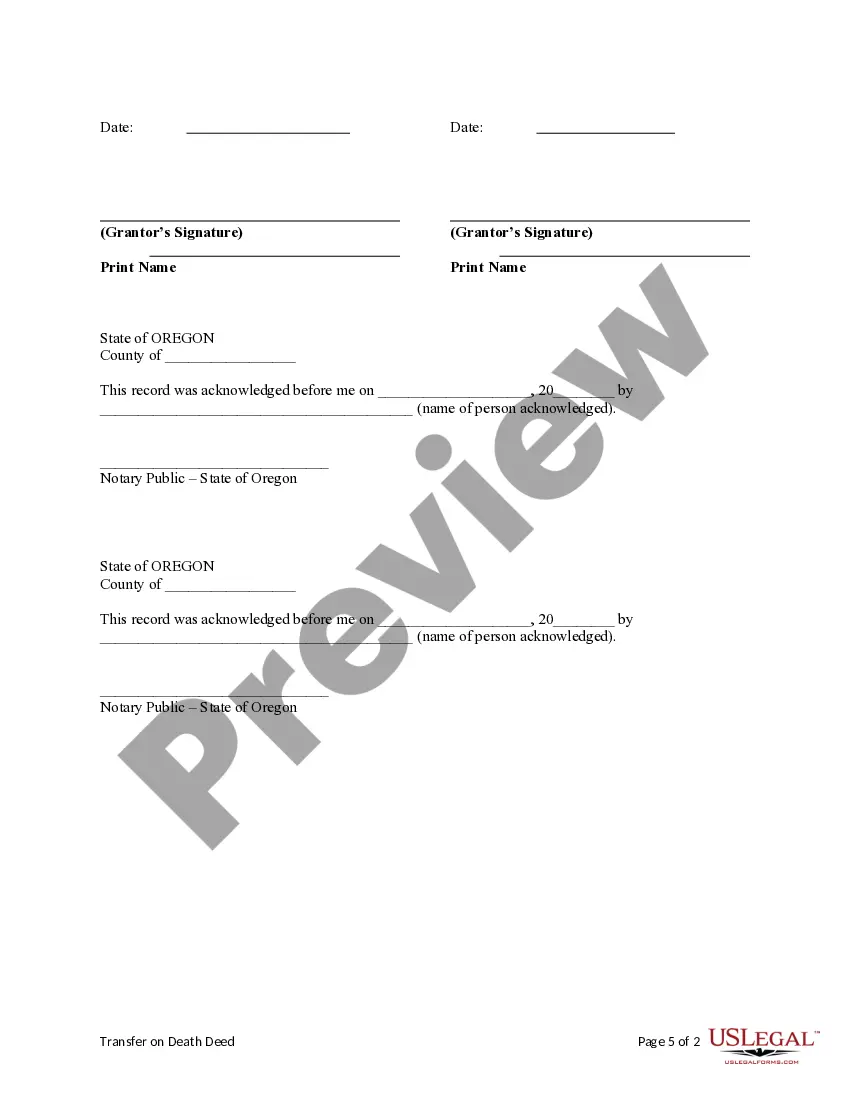

To create a valid Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries, you need to complete a specific form that includes essential information about the property and the beneficiaries. The deed must be signed by the owners and recorded with the county's clerk office. Also, beneficiaries need to be designated clearly to avoid any ambiguity in the future. Using US Legal Forms can streamline this process by providing you with the necessary documents and instructions.

While it's not legally required to hire an attorney for a Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries, consulting one can be beneficial. An attorney can ensure the deed complies with state laws and addresses your specific needs. Additionally, they can help navigate any complex family situations. By using a platform like US Legal Forms, you can simplify the process of creating this deed and gain access to valuable resources.

To file a Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries, you must first complete the necessary form accurately. Then, sign the deed before a notary public, and it must be recorded at your local county clerk's office. Following these steps ensures that your intended beneficiaries inherit your property as per your wishes. If you prefer assistance, platforms like USLegalForms can guide you through the filing process seamlessly.

Yes, Oregon allows residents to create a Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries. This type of deed permits property owners to transfer real estate directly to their chosen beneficiaries without the need for probate. Because of this, many individuals find it an effective estate planning tool, ensuring a smooth transition of assets.

One primary disadvantage of a Hillsboro Oregon Transfer on Death Deed from Two Individuals or Husband and Wife to Two Individuals with provision for Successor Beneficiaries is the potential for disputes among beneficiaries. If the property must be sold or a beneficiary wishes to occupy it, conflicts may arise. Additionally, this deed does not avoid estate taxes, which could affect the overall value passed to your beneficiaries. Understanding these issues can help you plan accordingly.