Every person claiming a lien created under ORS 87.010 (1) or (2) shall perfect the lien no later than 75 days after the person has ceased to provide labor, rent equipment or furnish materials or 75 days after completion of construction, whichever is earlier. Every other person claiming a lien created under ORS 87.010 shall perfect the lien not later than 75 days after the completion of construction. All liens claimed shall be perfected as provided by subsections (2) to (4) of this section. A lien created under ORS 87.010 shall be perfected by filing a claim of lien with the recording officer of the county or counties in which the improvement, or some part thereof, is situated.

Bend Oregon Claim of Lien by Corporation

Description

How to fill out Oregon Claim Of Lien By Corporation?

We consistently aim to reduce or avert legal harm when navigating intricate legal or financial matters.

To achieve this, we engage attorney services that are typically quite expensive.

However, not every legal predicament is this intricate; many can be addressed independently.

US Legal Forms is an online repository of current DIY legal documents including wills, powers of attorney, articles of incorporation, and petitions for dissolution.

If you need to re-download a lost form, you can easily retrieve it from the My documents tab.

- This library enables you to manage your affairs independently without relying on attorney services.

- We offer access to legal form templates that may not always be readily available.

- Our templates are specific to states and regions, significantly easing the search process.

- Take advantage of US Legal Forms whenever you need to locate and download the Bend Oregon Claim of Lien by Corporation or LLC or any other form swiftly and securely.

Form popularity

FAQ

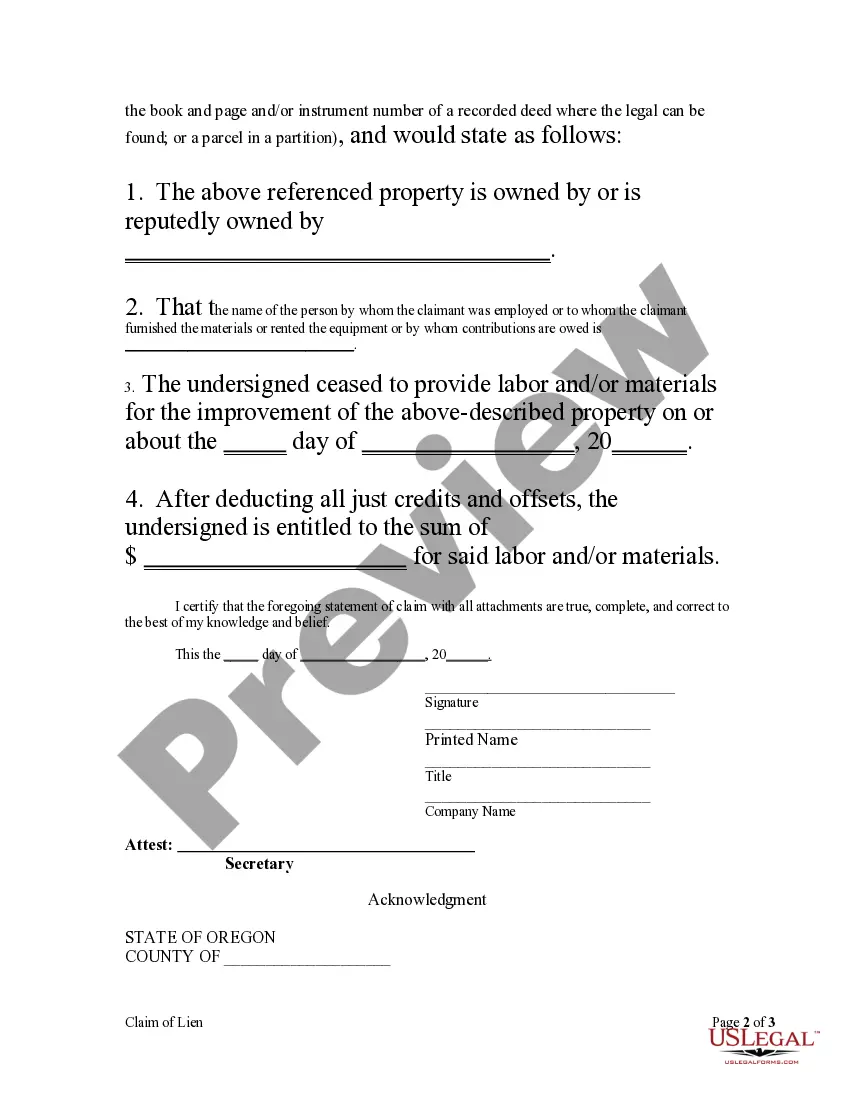

To fill out a lien affidavit for a Bend Oregon Claim of Lien by Corporation, start by gathering necessary information about the property and the debt. Clearly state your corporation's name, the property owner's name, and the amount owed. Be sure to include the legal description of the property. Finally, sign the affidavit before a notary public to ensure its validity.

To file a lien against a corporation, you should gather all relevant documents that support your claim. Next, complete a Bend Oregon Claim of Lien by Corporation form, ensuring that all details are accurate, and file it with the appropriate county office. Using platforms like US Legal Forms can simplify the process, providing you with the necessary forms and guidance to file correctly.

You can find liens on property in Oregon by searching the county recorder’s office or using online databases that provide public records. In many cases, a Bend Oregon Claim of Lien by Corporation will be recorded in the county where the property is located. It’s always advisable to check for liens before purchasing property to avoid unexpected financial responsibilities.

Oregon law outlines specific rules for a Bend Oregon Claim of Lien by Corporation. Liens must generally be filed within a particular time frame after the work is completed or materials are supplied. Proper notification must also be provided to the property owner, following state regulations to ensure the lien is enforceable.

To file a Bend Oregon Claim of Lien by Corporation, you typically need a completed lien form, evidence of the debt, and any relevant contracts or invoices. Additionally, it’s essential to include the property owner's information and a description of the property being liened. Proper documentation is crucial to ensure the lien is valid and enforceable in Oregon.

How to File Lien? Step 1: Preliminary Notice. Depending on your state laws, you may be required to notify the debtor that a lien will be filed if nonpayment persists.Step 2: Review Deadlines.Step 3: Research the Property.Step 4: Draft a Lien.Step 5: File the Lien.Step 6: Notifying Parties.Step 7: Enforcement.

No, Oregon does not provide or require statutory forms for lien waivers.

File a Claim of Lien with the county recorder's office located in the Oregon county where the property is situated. This must be provided within 75 days after the work is complete. Provide the owner with a notice indicating the Claim of Lien was filed. This notice must be provided within 20 days after filing.

Oregon law states that the party filing a Right to Lien / Intent to Lien form must send it certified mail or personal delivery with a return receipt. This shows proof of delivery so one party cannot come back later and say they never received the form.

How to File a Mechanic's Lien in Oregon ? Step-By-Step Guide Step 1: Determine if you have the right to file a lien. Step 2: Send notice of right to lien. Step 3: Prepare the lien document. Step 4: File the lien. Step 5: Send notice of lien. Step 6: Secure payment. Step 7: Release the lien.