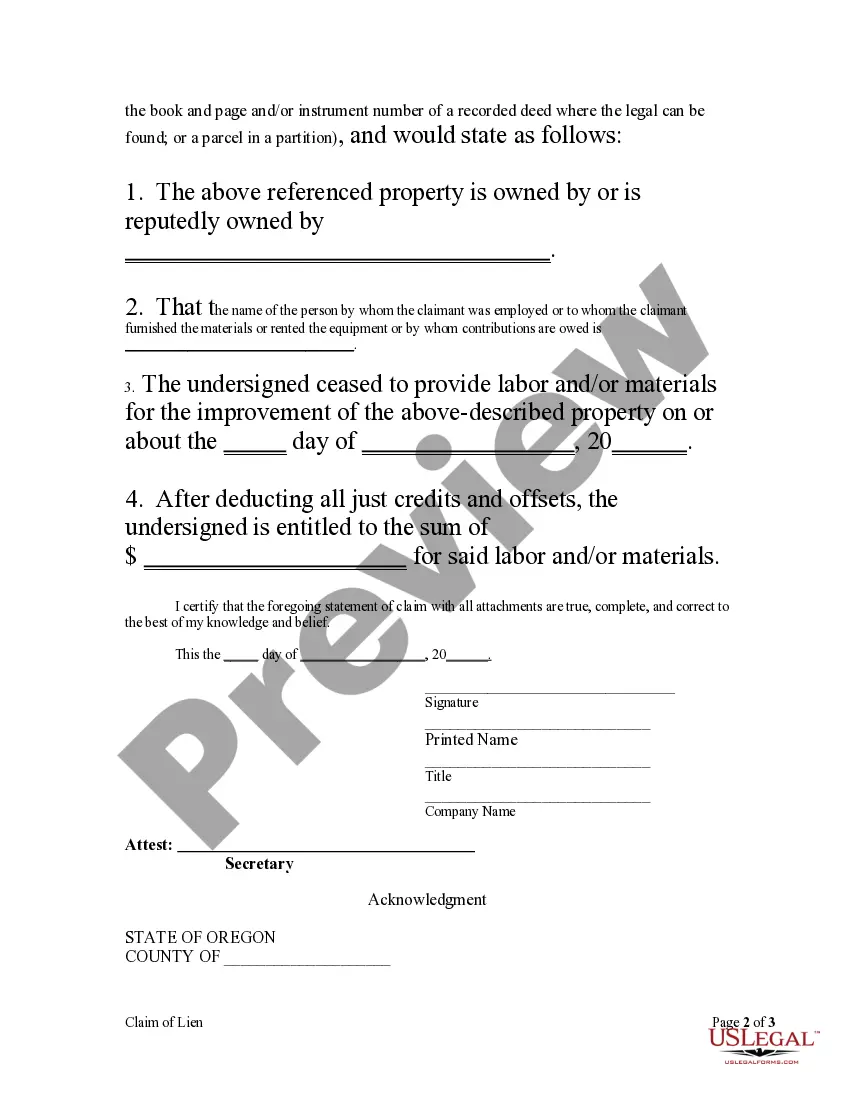

Every person claiming a lien created under ORS 87.010 (1) or (2) shall perfect the lien no later than 75 days after the person has ceased to provide labor, rent equipment or furnish materials or 75 days after completion of construction, whichever is earlier. Every other person claiming a lien created under ORS 87.010 shall perfect the lien not later than 75 days after the completion of construction. All liens claimed shall be perfected as provided by subsections (2) to (4) of this section. A lien created under ORS 87.010 shall be perfected by filing a claim of lien with the recording officer of the county or counties in which the improvement, or some part thereof, is situated.

A Claim of Lien by Corporation or LLC in Eugene, Oregon refers to the legal process used by a corporation or limited liability company (LLC) to secure a lien on a property for unpaid debts or obligations. This mechanism allows the corporation or LLC to assert its rights and protect its interests by placing a claim against the property in question. One example of a Eugene Oregon Claim of Lien by Corporation or LLC is related to construction projects. If a corporation or LLC provides labor, materials, or services for a construction project in Eugene, Oregon, and is not paid in full, they have the right to file a claim of lien against the property to secure payment for their work. This ensures that they have a legal right to the property that can be enforced through foreclosure if necessary. Another type of Eugene Oregon Claim of Lien by Corporation or LLC can arise in the context of personal property. For instance, if a corporation or LLC enters into a financing or leasing arrangement where they lend money or provide equipment to an individual or another business entity, and the borrower defaults on their payments, the corporation or LLC can file a claim of lien to assert their rights and potentially repossess the property involved. The Eugene Oregon Claim of Lien by Corporation or LLC is a formal legal document that must comply with specific requirements set forth by Oregon state law. It typically includes details regarding the name and address of the corporation or LLC asserting the lien, the property owner's information, a description of the property subject to the lien, the amount owed, and the date the debt became due. To file a Claim of Lien by Corporation or LLC in Eugene, Oregon, the claimant must follow the appropriate legal procedures outlined by the state. This generally involves preparing the claim document, recording it with the county clerk's office in the county where the property is located, and then sending a copy of the claim to the property owner and any other relevant parties involved. It is essential to note that filing a claim of lien does not guarantee immediate payment. It serves as a legal notice to the property owner and other interested parties that the corporation or LLC has a valid and enforceable claim against the property. In some cases, negotiations or legal proceedings may be necessary to resolve the outstanding debt or dispute. If the debt remains unpaid after a reasonable period, the corporation or LLC can initiate a foreclosure process to satisfy the debt by selling the property. However, foreclosure is a complex legal process that requires further legal action, and it is advisable for the claimant to consult with an attorney specializing in lien laws to ensure compliance with all applicable regulations. In summary, a Eugene Oregon Claim of Lien by Corporation or LLC is a legal tool used by corporations and LCS to secure a lien on a property for unpaid debts or obligations. This ensures that they have a legal right to the property and can seek recovery of the outstanding debt. By fulfilling specific legal requirements, filing a claim of lien allows the claimants to assert their rights and protect their interests in Eugene, Oregon.