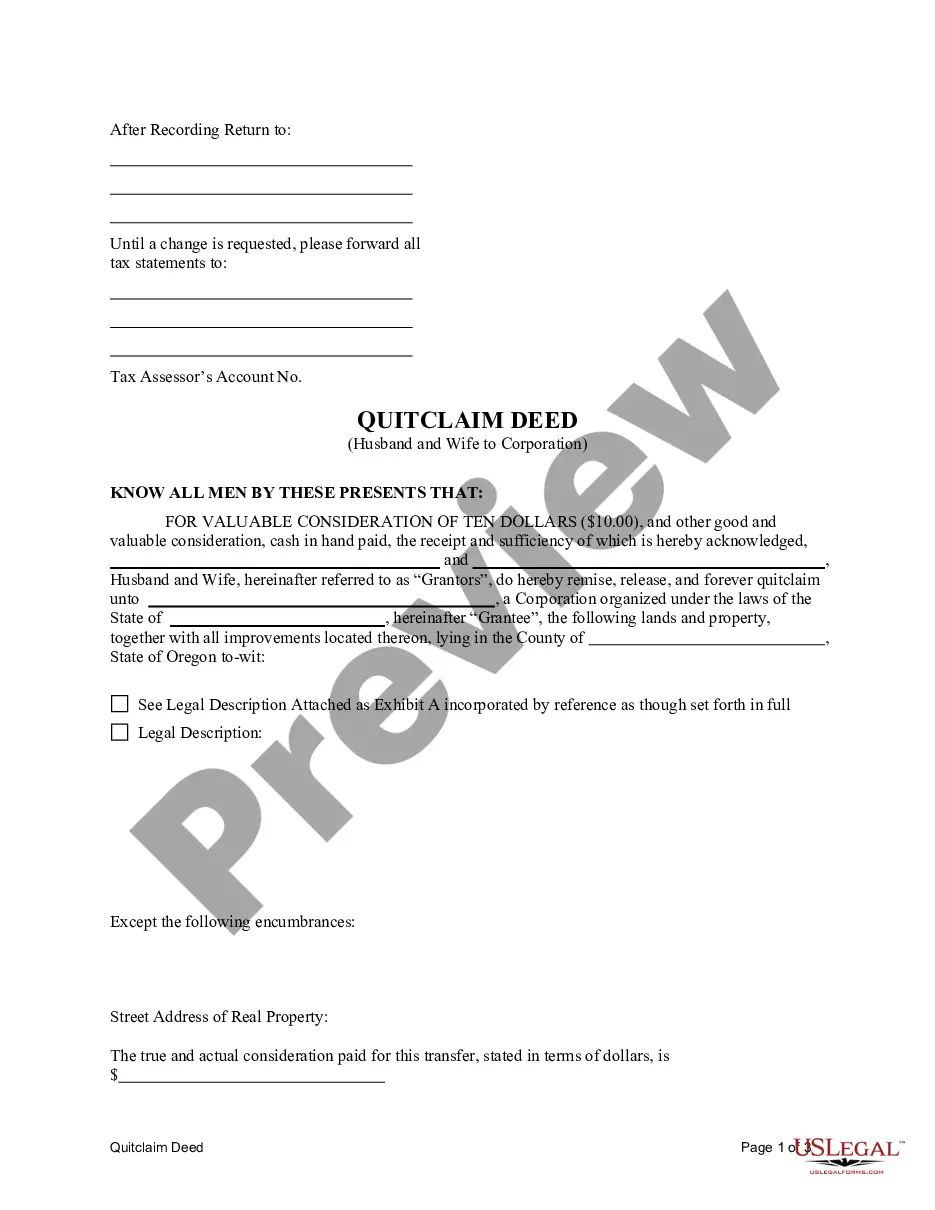

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Quitclaim Deed is a legal document used to transfer property ownership from one party to another. Specifically, a "Eugene Oregon Quitclaim Deed from Husband and Wife to Corporation" refers to a quitclaim deed involving a married couple who wish to transfer their property's ownership to a corporation entity. This type of deed relinquishes the couple's rights and interest in the property, resulting in the corporation becoming the new titleholder. In Eugene, Oregon, there are different variations of Quitclaim Deeds from Husband and Wife to Corporation, each serving a specific purpose. Some common types include: 1. "Full Ownership Transfer Quitclaim Deed": This type of quitclaim deed allows the married couple to transfer the complete ownership rights and interests in the property to the corporation. By executing this deed, the corporation becomes the sole owner of the property, while the couple no longer holds any legal claim to it. 2. "Partial Ownership Transfer Quitclaim Deed": In certain cases, the husband and wife may choose to retain some interest in the property while transferring a portion of their ownership to the corporation. This type of quitclaim deed outlines the specific percentage or portion of their ownership being transferred, allowing the corporation to obtain a partial stake in the property. 3. "Transfer for Business or Tax Purposes Quitclaim Deed": Husband and wife may decide to transfer their property to a corporation for business-related reasons or to gain certain tax benefits. This type of quitclaim deed outlines the intention of utilizing the corporation for business operations or as a tax-planning strategy. 4. "Transfer for Estate Planning Purposes Quitclaim Deed": This quitclaim deed may be employed when a husband and wife want to transfer their property to a corporation as part of their estate planning. It can help ensure the orderly distribution of assets or streamline estate administration processes. The Eugene Oregon Quitclaim Deed from Husband and Wife to Corporation is an effective legal tool often used when couples desire to transfer their property's ownership to a corporation. It is crucial to consult with a qualified attorney or real estate professional specializing in Eugene, Oregon's property laws to accurately draft and execute the appropriate quitclaim deed, ensuring all legal requirements are met and the transfer is valid.