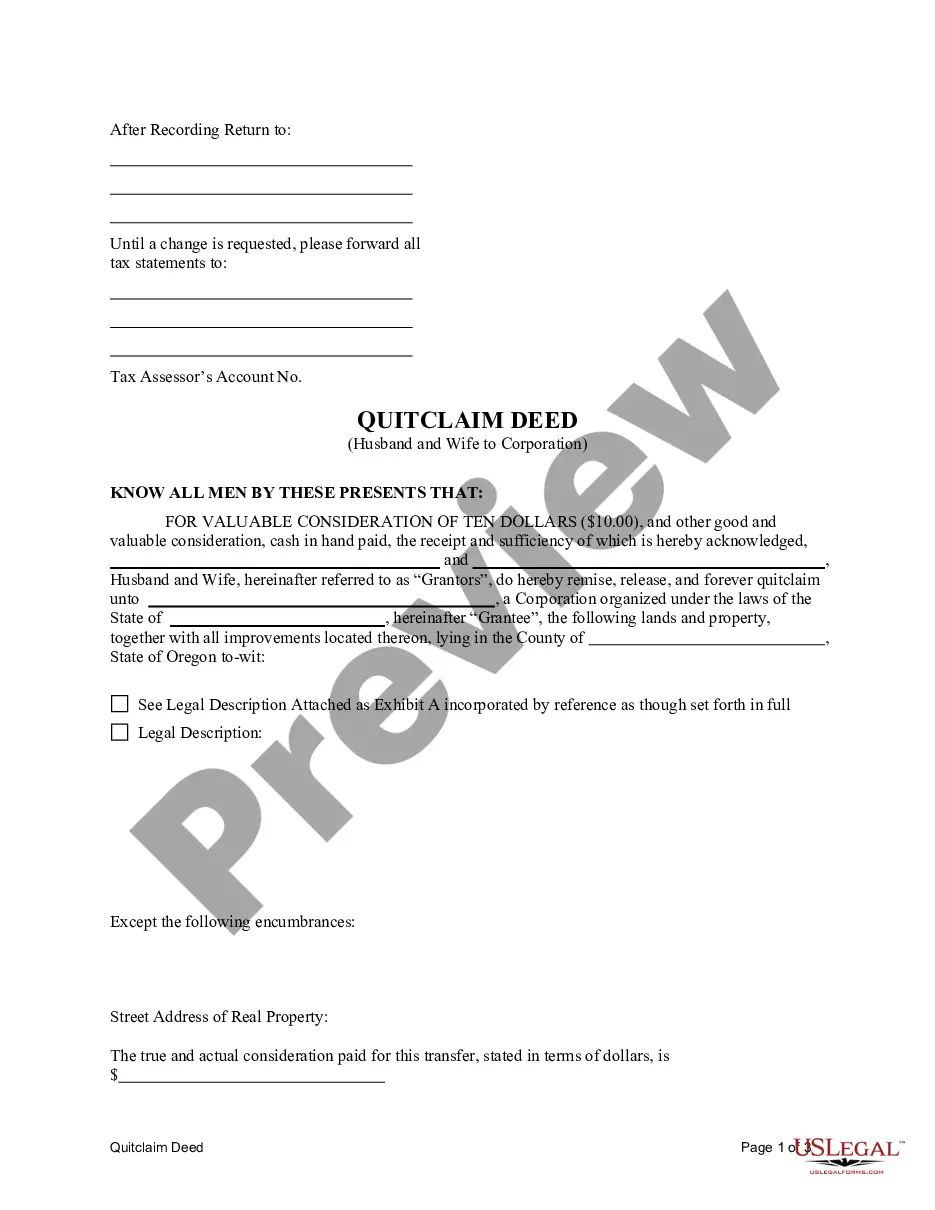

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A quitclaim deed is a legal document used to transfer property ownership from one party to another without providing any warranty or guarantee of title. In the case of a Gresham Oregon quitclaim deed from husband and wife to a corporation, the property ownership is being transferred from a married couple to a corporation. The process of executing a Gresham Oregon quitclaim deed from husband and wife to a corporation involves several essential steps. Firstly, the husband and wife, as granters, must draft a legally binding deed stating their intention to transfer the property to the corporation. This document must include the names and contact information of all parties involved, a description of the property being transferred, and a clear statement of the transfer's purpose. The Gresham Oregon quitclaim deed from husband and wife to a corporation must then be notarized to ensure its legal validity. This step ensures that the identities of the parties involved are verified, and the document is signed voluntarily without any coercion or fraud. Furthermore, it is crucial to record the quitclaim deed with the County Recorder's office in Gresham, Oregon. This recording serves as a public notice of the transfer and protects the corporation's ownership rights, making it clear to any future potential buyers or lenders that the property is held by the corporation. Different types of Gresham Oregon quitclaim deed from husband and wife to a corporation can be categorized based on the corporation's purpose and usage of the transferred property. Some common variations include: 1. Quitclaim Deed for Business Expansion: This type of quitclaim deed may be used when a husband and wife own a property that they wish to transfer to a corporation they establish for expanding their existing business. It allows for the separation of personal and business assets while maintaining control and ownership within the family. 2. Quitclaim Deed for Asset Protection: In some cases, a husband and wife may decide to transfer their property to a corporation to protect it from potential creditors or legal liabilities. This type of quitclaim deed helps safeguard the property by placing it under the corporation's ownership, shielding it from individual financial risks. 3. Quitclaim Deed for Estate Planning: As part of estate planning and succession goals, a husband and wife may choose to transfer their property to a corporation to facilitate the transfer to future generations. This type of quitclaim deed ensures the smooth transition of ownership, optimizing tax benefits and protecting the property's continuity. When executing a Gresham Oregon quitclaim deed from husband and wife to a corporation, it is always advisable to seek legal advice from a qualified attorney experienced in property transfers and local regulations. This ensures compliance with specific legal requirements, protects the parties involved, and ensures a smooth and legally binding transfer of property ownership.