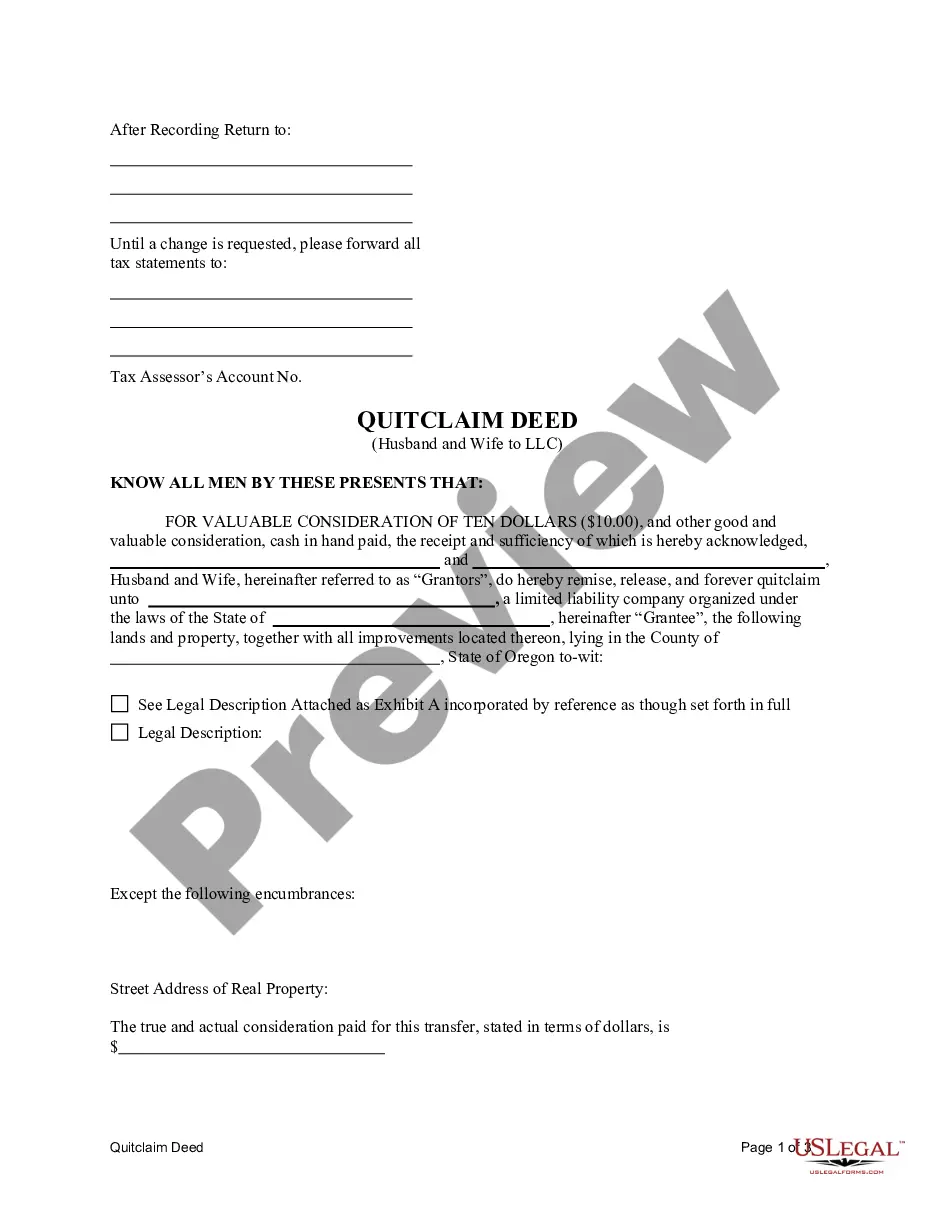

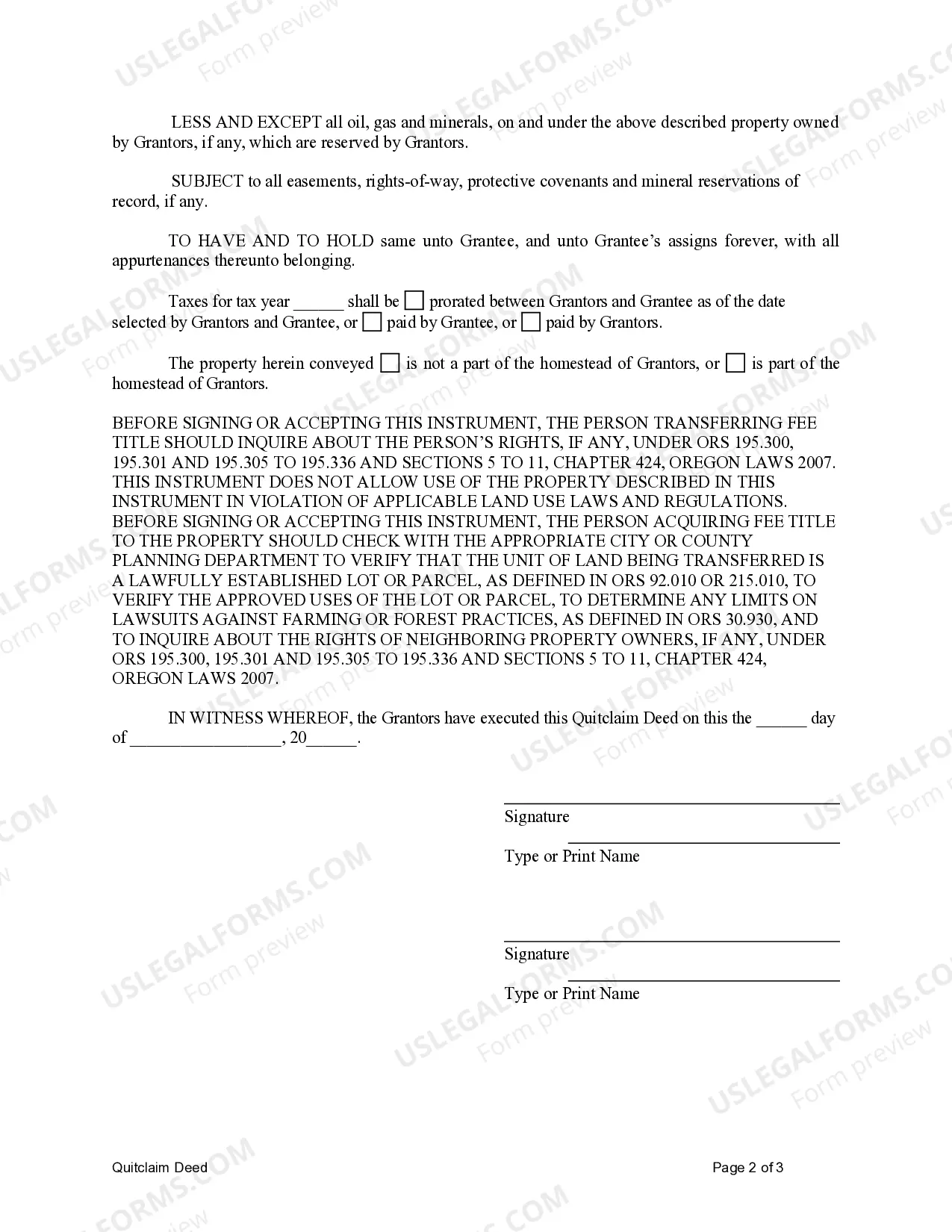

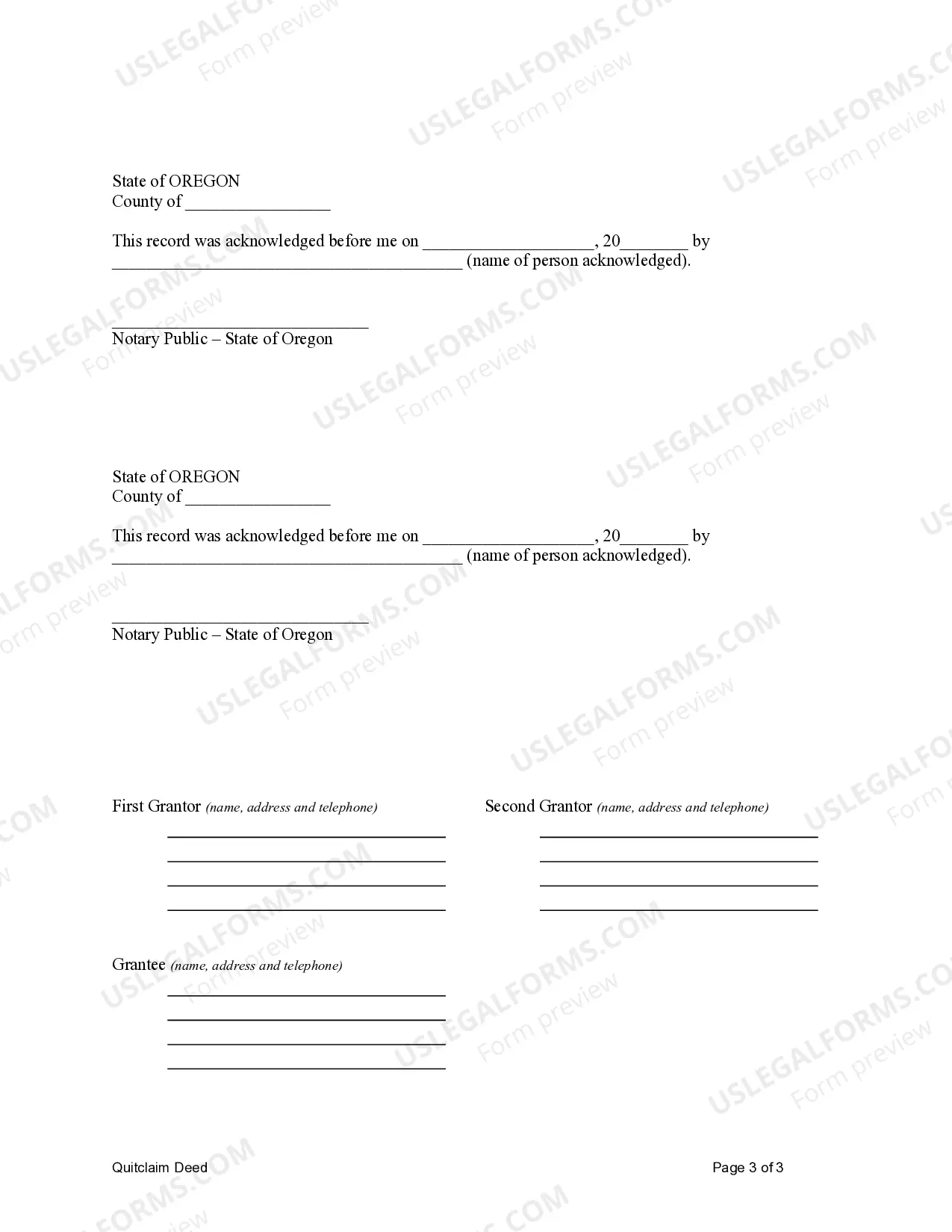

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Bend Oregon Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer an ownership interest in a property located in Bend, Oregon, from a married couple to a Limited Liability Company (LLC) operated by them or that they own. This type of conveyance is commonly utilized for estate planning, asset protection, or business purposes. When executing a Bend Oregon Quitclaim Deed from Husband and Wife to LLC, the couple essentially transfers their rights, title, and interest in the property to the LLC, relinquishing any claim to its ownership. Once the transfer is complete, the property legally becomes an asset of the LLC, providing various benefits and advantages in terms of liability protection, tax planning, and business structuring. One significant benefit of this transfer is the limited liability protection provided by the LLC structure. By placing the property under the LLC's ownership, the personal assets of the husband and wife are shielded from potential legal claims or judgments that may arise from the property. This separation helps safeguard personal savings, investments, and other assets against lawsuits or liabilities related to the property. Additionally, using a Bend Oregon Quitclaim Deed from Husband and Wife to LLC can help streamline business operations. For those who own an LLC engaged in real estate activities, consolidating multiple properties under a single entity makes managing and accounting for the assets more efficient. It also simplifies record-keeping and tax reporting. It is important to note that various types of Bend Oregon Quitclaim Deeds from Husband and Wife to LLC exist, categorized based on specific circumstances or objectives. These may include: 1. Standard Quitclaim Deed from Husband and Wife to LLC: This type of deed is a straightforward transfer of property ownership from a married couple to an LLC they own. It signifies the intention to transfer the couple's ownership interest without any warranties or guarantees. 2. Joint Tenancy Quitclaim Deed from Husband and Wife to LLC: This deed is used when the couple jointly holds the property in a joint tenancy arrangement. It allows them to transfer their joint ownership interest to the LLC, maintaining the same ownership structure. 3. Tenants in Common Quitclaim Deed from Husband and Wife to LLC: When the couple holds the property as tenants in common, this deed type is used to transfer their individual shares to the LLC. This allows them to convert separate ownership interests into a joint ownership within the LLC. 4. Community Property Quitclaim Deed from Husband and Wife to LLC: If the property is classified as community property, this deed is used to transfer the property to the LLC. In community property states like Oregon, assets acquired during marriage are generally considered jointly owned. In conclusion, a Bend Oregon Quitclaim Deed from Husband and Wife to LLC is a legal instrument used when a married couple wishes to transfer their ownership interest in a property to an LLC they own. This type of transfer offers liability protection, efficient asset management, and potential tax advantages for the couple. The specific type of deed used may vary depending on the property's ownership structure and the couple's objectives.A Bend Oregon Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer an ownership interest in a property located in Bend, Oregon, from a married couple to a Limited Liability Company (LLC) operated by them or that they own. This type of conveyance is commonly utilized for estate planning, asset protection, or business purposes. When executing a Bend Oregon Quitclaim Deed from Husband and Wife to LLC, the couple essentially transfers their rights, title, and interest in the property to the LLC, relinquishing any claim to its ownership. Once the transfer is complete, the property legally becomes an asset of the LLC, providing various benefits and advantages in terms of liability protection, tax planning, and business structuring. One significant benefit of this transfer is the limited liability protection provided by the LLC structure. By placing the property under the LLC's ownership, the personal assets of the husband and wife are shielded from potential legal claims or judgments that may arise from the property. This separation helps safeguard personal savings, investments, and other assets against lawsuits or liabilities related to the property. Additionally, using a Bend Oregon Quitclaim Deed from Husband and Wife to LLC can help streamline business operations. For those who own an LLC engaged in real estate activities, consolidating multiple properties under a single entity makes managing and accounting for the assets more efficient. It also simplifies record-keeping and tax reporting. It is important to note that various types of Bend Oregon Quitclaim Deeds from Husband and Wife to LLC exist, categorized based on specific circumstances or objectives. These may include: 1. Standard Quitclaim Deed from Husband and Wife to LLC: This type of deed is a straightforward transfer of property ownership from a married couple to an LLC they own. It signifies the intention to transfer the couple's ownership interest without any warranties or guarantees. 2. Joint Tenancy Quitclaim Deed from Husband and Wife to LLC: This deed is used when the couple jointly holds the property in a joint tenancy arrangement. It allows them to transfer their joint ownership interest to the LLC, maintaining the same ownership structure. 3. Tenants in Common Quitclaim Deed from Husband and Wife to LLC: When the couple holds the property as tenants in common, this deed type is used to transfer their individual shares to the LLC. This allows them to convert separate ownership interests into a joint ownership within the LLC. 4. Community Property Quitclaim Deed from Husband and Wife to LLC: If the property is classified as community property, this deed is used to transfer the property to the LLC. In community property states like Oregon, assets acquired during marriage are generally considered jointly owned. In conclusion, a Bend Oregon Quitclaim Deed from Husband and Wife to LLC is a legal instrument used when a married couple wishes to transfer their ownership interest in a property to an LLC they own. This type of transfer offers liability protection, efficient asset management, and potential tax advantages for the couple. The specific type of deed used may vary depending on the property's ownership structure and the couple's objectives.