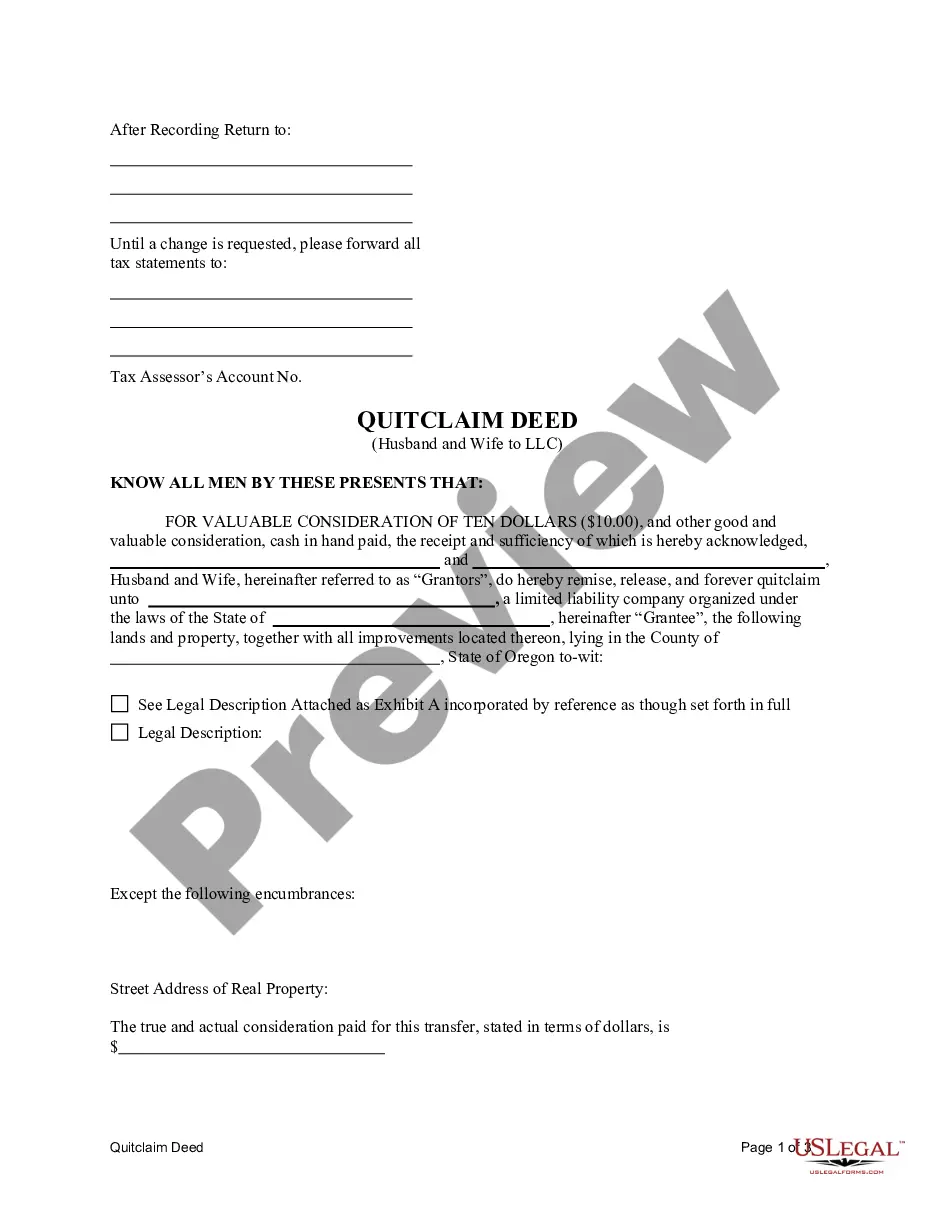

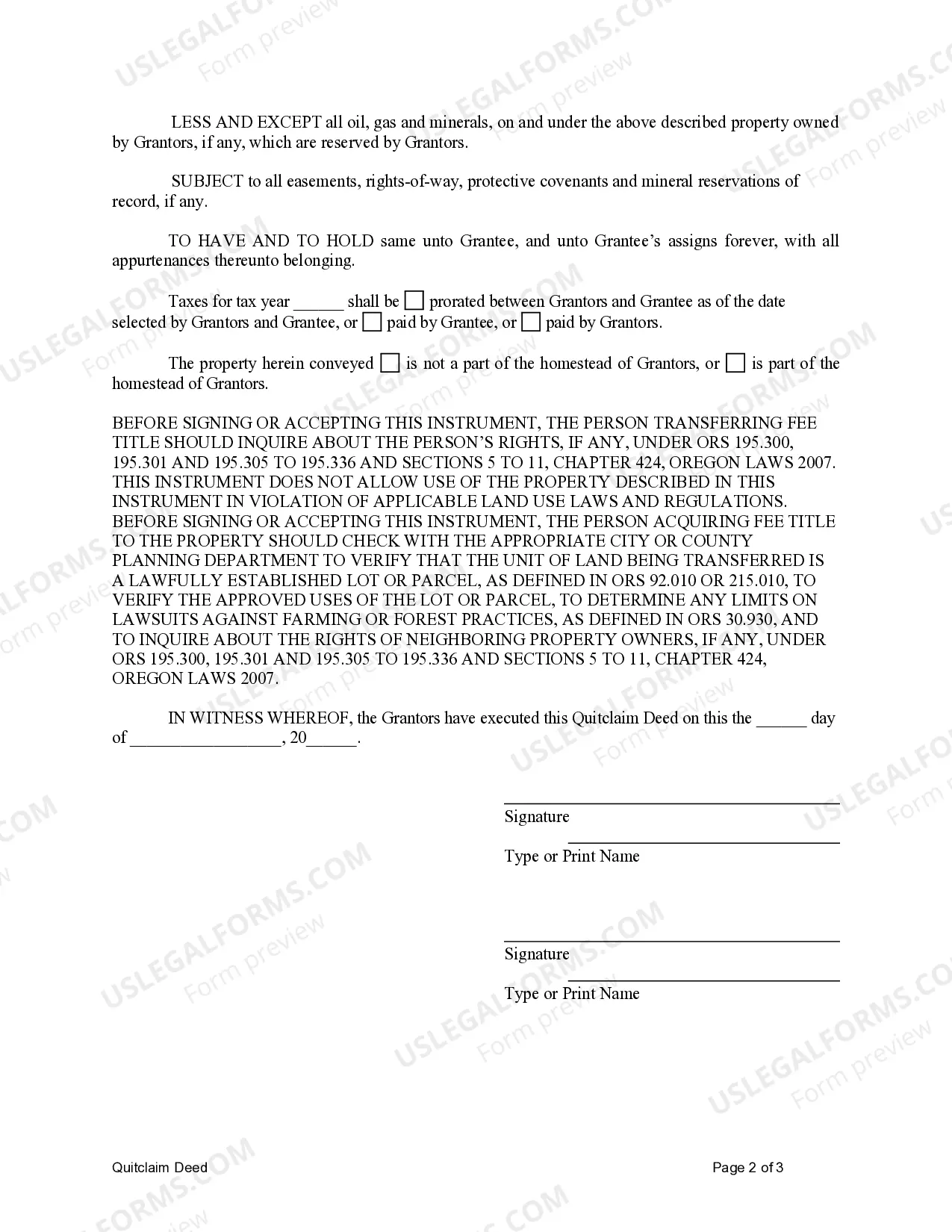

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

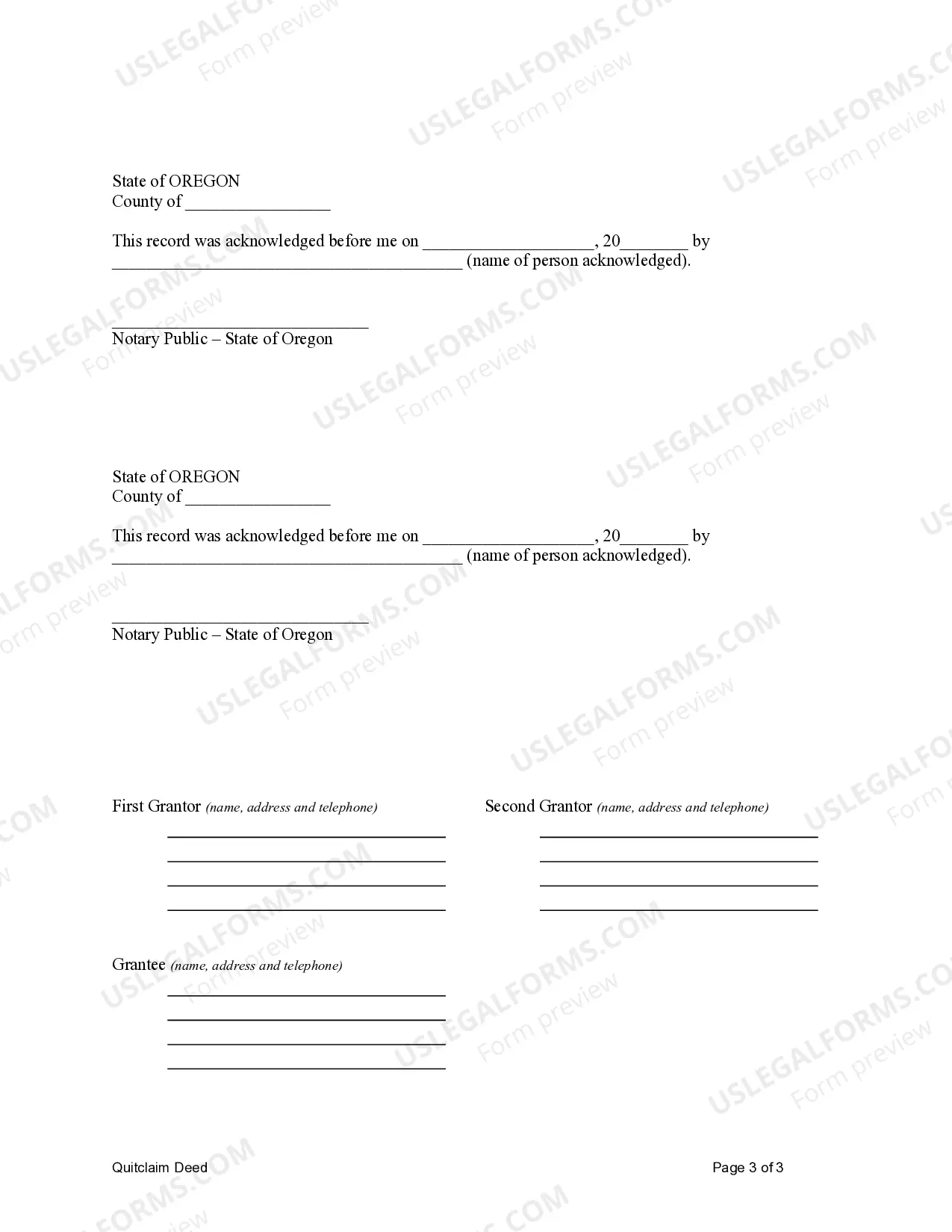

As an AI language model, I can provide you with a detailed description of a Eugene Oregon Quitclaim Deed from Husband and Wife to an LLC, along with relevant keywords. Here is a comprehensive description: A Eugene Oregon Quitclaim Deed from Husband and Wife to an LLC is a legal document used to transfer ownership of real estate or property from a married couple to a limited liability company (LLC) in Eugene, Oregon. This type of transfer is commonly chosen when individuals want to protect their personal assets by placing the property under the ownership and liability protection of an LLC. Keywords: Eugene Oregon, Quitclaim Deed, Husband and Wife, LLC A quitclaim deed is a legal instrument used for the transfer of property ownership where the seller (granter) releases their claim or interest in the property to the buyer (grantee). In this case, the granters are a husband and wife, while the grantee is an LLC. The Eugene Oregon Quitclaim Deed from Husband and Wife to LLC typically includes the following key information: 1. Parties Involved: The document will clearly identify the husband and wife, referred to as the granters, who currently hold the ownership of the property. The LLC, referred to as the grantee, will also be specified. 2. Property Description: A detailed description of the real estate being transferred is included, such as the legal description, address, and tax identification number. This information ensures precise identification of the property being conveyed. 3. Consideration: The quitclaim deed may state the amount of consideration, which is typically nominal in cases where the transfer is between family members or for asset protection purposes. However, since a quitclaim deed does not guarantee ownership, an actual purchase price may not be necessary. 4. Covenants and Warranties: A quitclaim deed provides no warranties or covenants of title. This means that the granters make no guarantees regarding the state of title, liens, or encumbrances that may exist on the property. The LLC accepts the property in its current condition. 5. Signatures and Notarization: The granters must sign the quitclaim deed in the presence of a notary public who will acknowledge their signatures. This notarization is crucial for the document's validity and ensures its recording with the county clerk's office. Different types of Eugene Oregon Quitclaim Deed from Husband and Wife to LLC may vary based on specific clauses or additional terms included, depending on the circumstances or legal requirements of the property transfer. However, the standard quitclaim deed format typically remains the same. It is advisable to seek legal counsel or consult with a real estate attorney to ensure compliance with all relevant laws and regulations when preparing a Eugene Oregon Quitclaim Deed from Husband and Wife to LLC. This will help ensure a smooth transfer of property while protecting the interests of all parties involved.