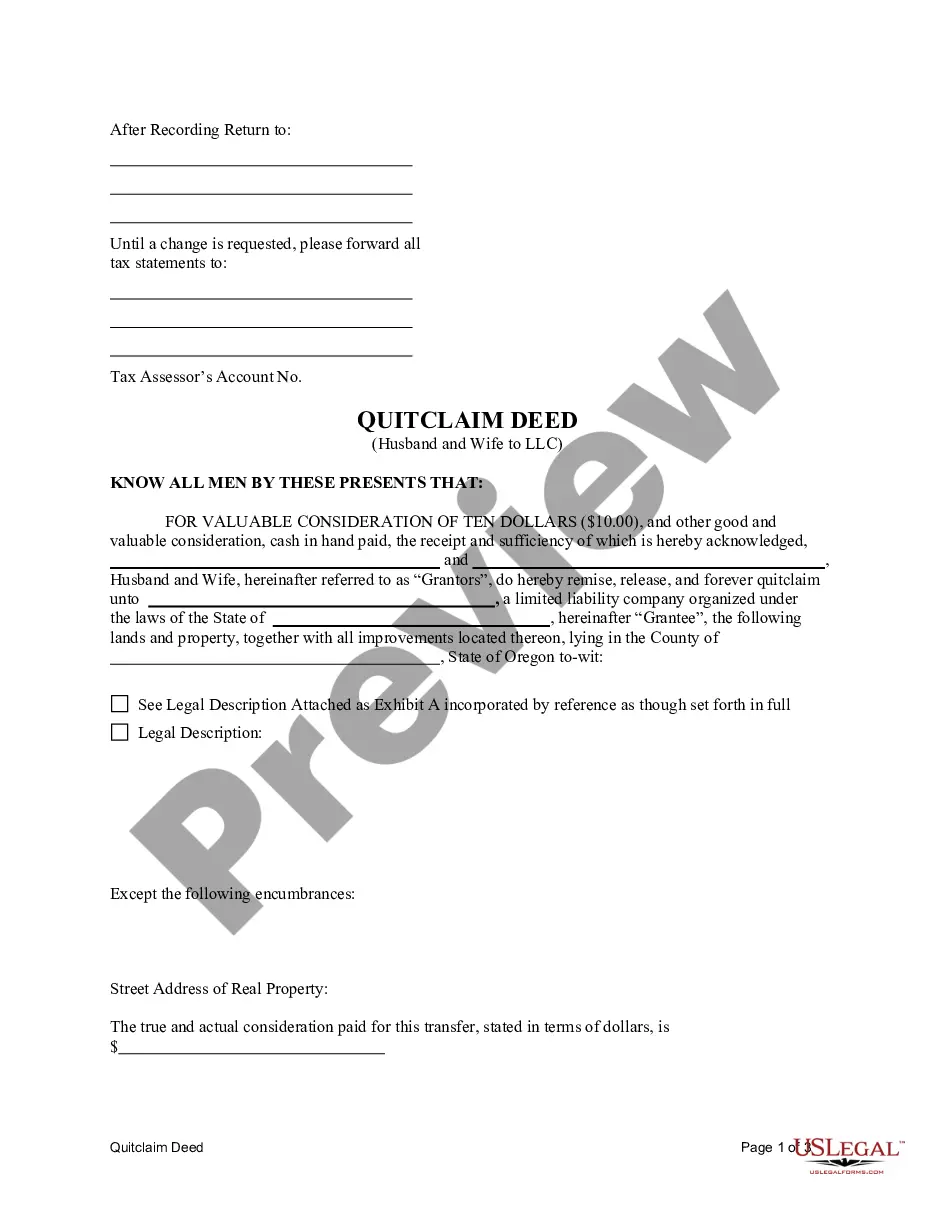

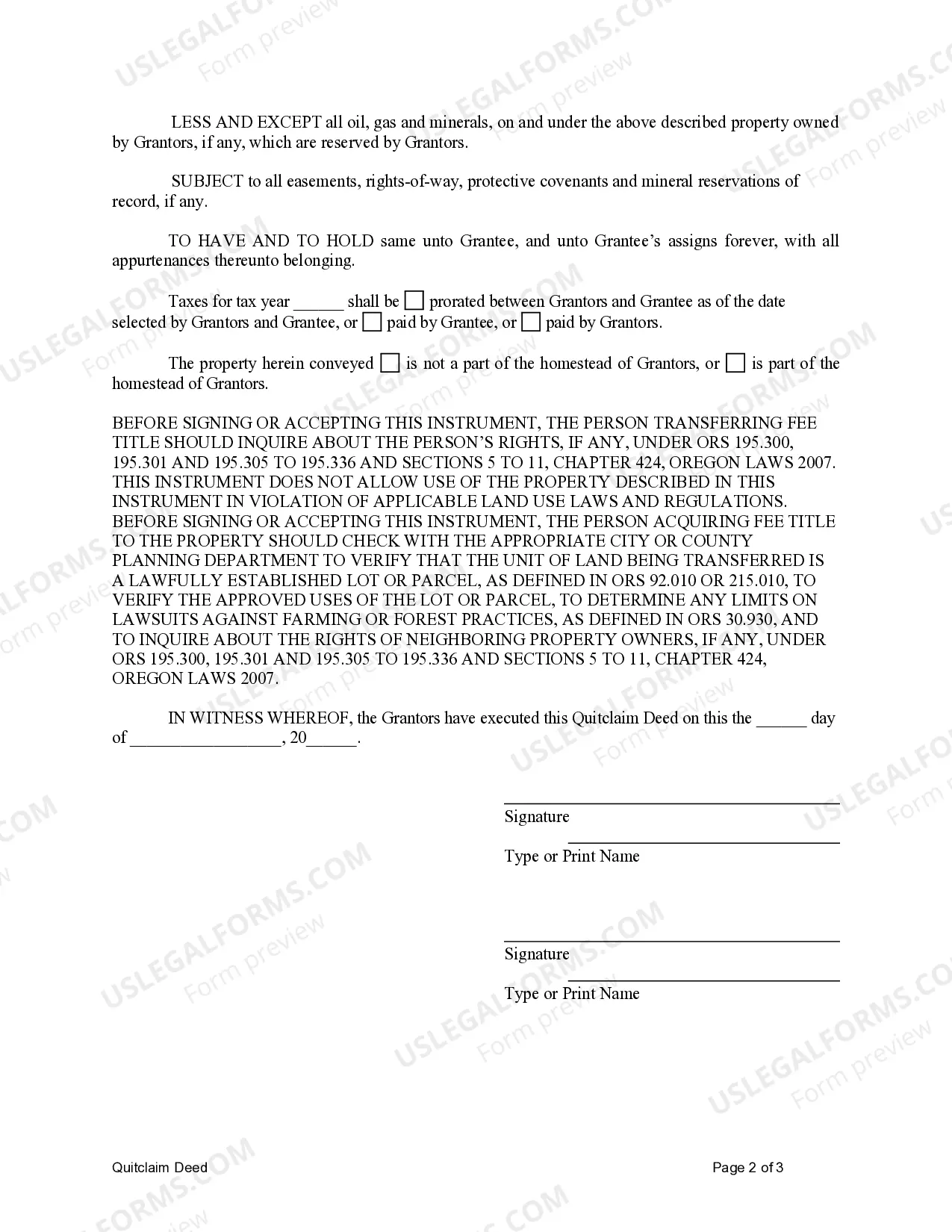

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

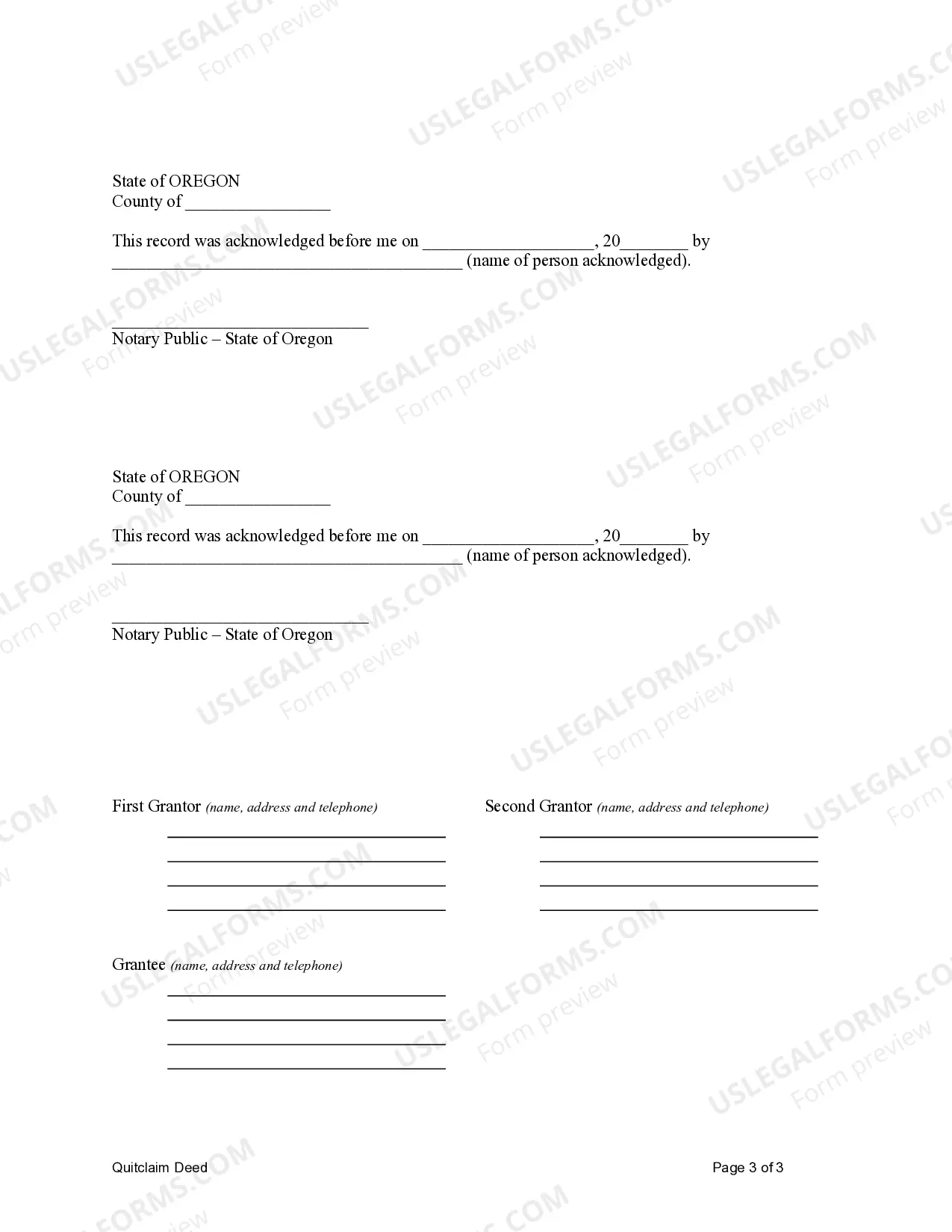

A Gresham Oregon Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a piece of real estate from a married couple to their Limited Liability Company (LLC) using a quitclaim deed. This type of transfer is common when individuals want to protect their personal assets by transferring them to a business entity. During this process, the husband and wife who jointly own the property are referred to as the granters, while the LLC is called the grantee. The term "quitclaim" indicates that the granters are transferring their rights, title, and interest in the property to the grantee without any warranties or guarantees. However, it is important to note that quitclaim deeds provide limited legal protection compared to other types of deeds. There are different types of Gresham Oregon Quitclaim Deeds from Husband and Wife to LLC, including: 1. General Gresham Oregon Quitclaim Deed: This is the most common type of quitclaim deed used to transfer ownership from a married couple to their LLC. It conveys all the property rights and interests held by the husband and wife to the LLC. 2. Tenancy by the Entirety Gresham Oregon Quitclaim Deed: In some cases, a married couple may hold the property as tenants by the entirety, meaning they each have an undivided interest in the entire property. This type of quitclaim deed allows them to transfer their joint interest to the LLC. 3. Joint Tenancy Gresham Oregon Quitclaim Deed: If the married couple holds the property as joint tenants, it means they have an equal and undivided interest in the property. This quitclaim deed enables them to transfer their ownership rights to the LLC. By using a Gresham Oregon Quitclaim Deed from Husband and Wife to LLC, the couple can protect their personal assets by creating a legal separation between their personal and business holdings. This type of transfer may have various benefits, including liability protection, tax advantages, and simplified management of the property within the LLC structure. It is crucial to consult with a qualified legal professional or a real estate attorney to ensure compliance with all applicable laws and regulations during the preparation and execution of the Gresham Oregon Quitclaim Deed from Husband and Wife to LLC.A Gresham Oregon Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a piece of real estate from a married couple to their Limited Liability Company (LLC) using a quitclaim deed. This type of transfer is common when individuals want to protect their personal assets by transferring them to a business entity. During this process, the husband and wife who jointly own the property are referred to as the granters, while the LLC is called the grantee. The term "quitclaim" indicates that the granters are transferring their rights, title, and interest in the property to the grantee without any warranties or guarantees. However, it is important to note that quitclaim deeds provide limited legal protection compared to other types of deeds. There are different types of Gresham Oregon Quitclaim Deeds from Husband and Wife to LLC, including: 1. General Gresham Oregon Quitclaim Deed: This is the most common type of quitclaim deed used to transfer ownership from a married couple to their LLC. It conveys all the property rights and interests held by the husband and wife to the LLC. 2. Tenancy by the Entirety Gresham Oregon Quitclaim Deed: In some cases, a married couple may hold the property as tenants by the entirety, meaning they each have an undivided interest in the entire property. This type of quitclaim deed allows them to transfer their joint interest to the LLC. 3. Joint Tenancy Gresham Oregon Quitclaim Deed: If the married couple holds the property as joint tenants, it means they have an equal and undivided interest in the property. This quitclaim deed enables them to transfer their ownership rights to the LLC. By using a Gresham Oregon Quitclaim Deed from Husband and Wife to LLC, the couple can protect their personal assets by creating a legal separation between their personal and business holdings. This type of transfer may have various benefits, including liability protection, tax advantages, and simplified management of the property within the LLC structure. It is crucial to consult with a qualified legal professional or a real estate attorney to ensure compliance with all applicable laws and regulations during the preparation and execution of the Gresham Oregon Quitclaim Deed from Husband and Wife to LLC.