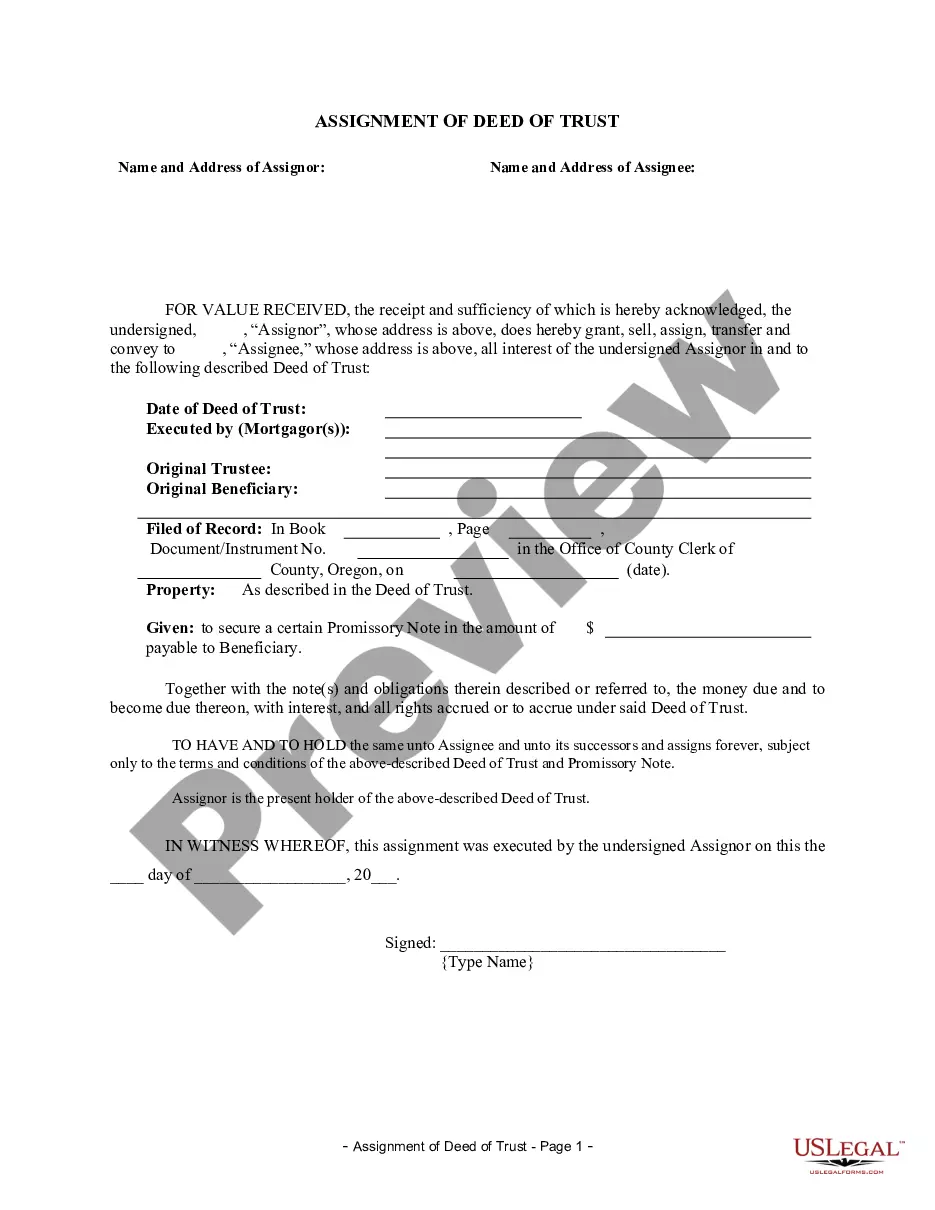

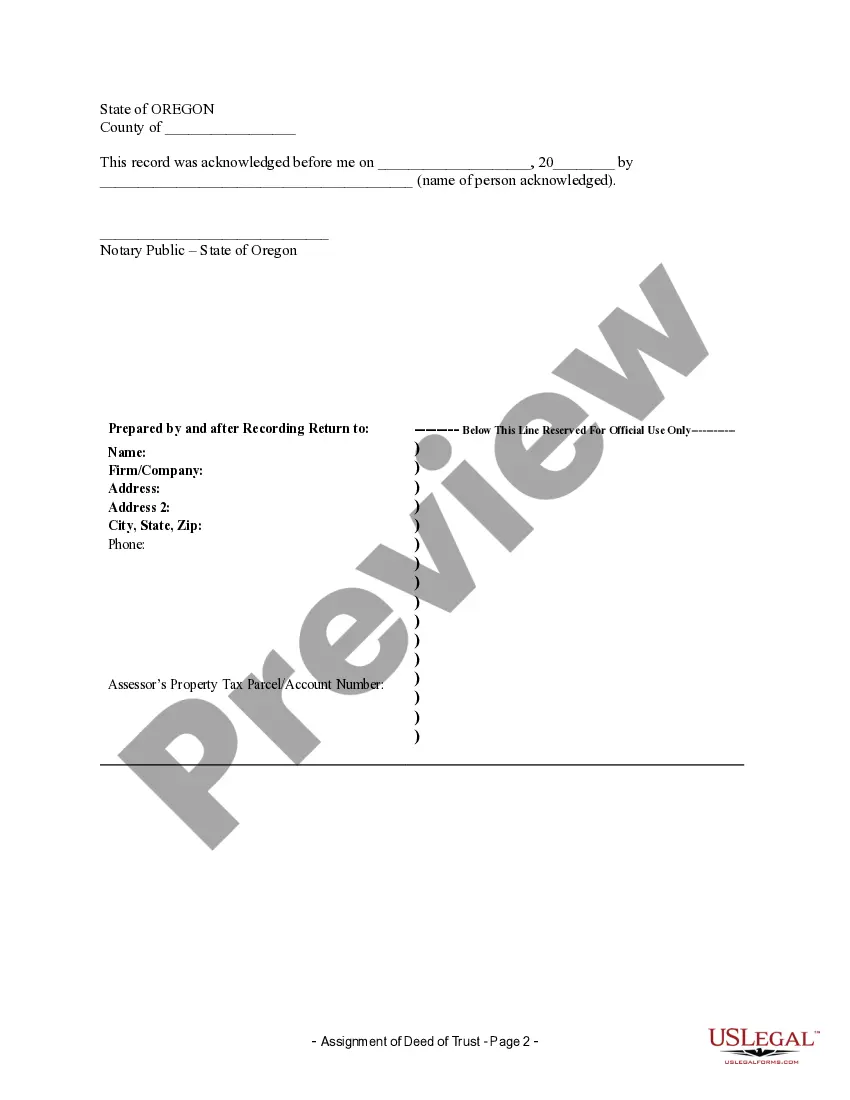

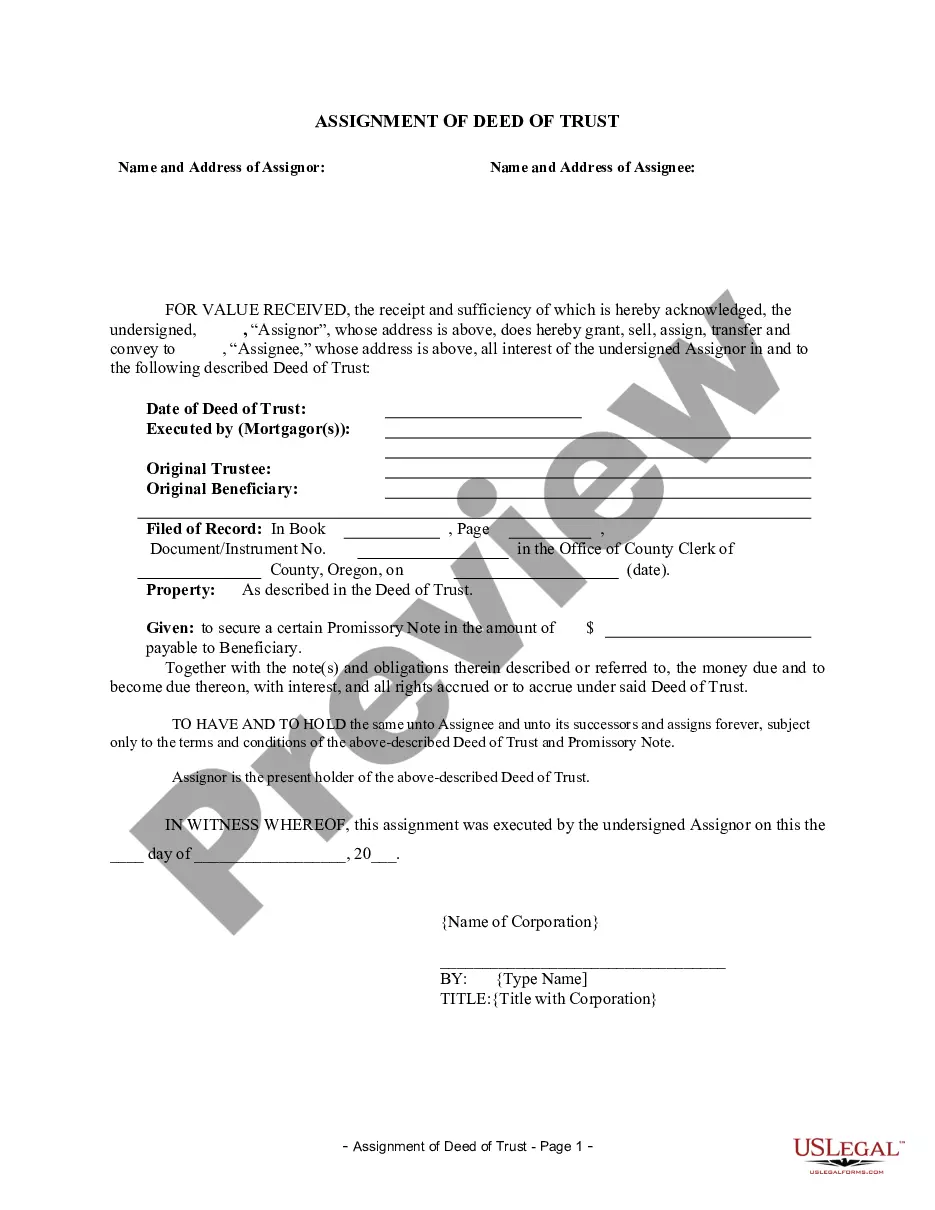

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

An Assignment of Deed of Trust by an Individual Mortgage Holder refers to a legal document that transfers the rights and interests of a mortgage holder to another party. In the context of Eugene, Oregon, this assignment is a common practice in real estate transactions. In Eugene, there are various types of Assignments of Deed of Trust that can be carried out by an individual mortgage holder. These variations depend on the specific situation and requirements of the parties involved. Here are three common types: 1. Partial Assignment of Deed of Trust: This type of assignment occurs when a mortgage holder transfers only a portion of their interest in the deed of trust to another party. This commonly happens when the mortgage holder wants to divide the risk or share the benefits with another individual or entity. 2. Full Assignment of Deed of Trust: A full assignment takes place when a mortgage holder transfers their entire interest in the deed of trust to a new individual or entity. This effectively transfers the rights and obligations associated with the mortgage to the assignee, who becomes the new mortgage holder. 3. Assignment of Deed of Trust with Additional Terms: This type of assignment involves the inclusion of additional terms or conditions along with the transfer of the deed of trust. These terms can encompass various provisions such as specific performance requirements, indemnification clauses, or contractual obligations, depending on the agreement between the parties. Regardless of the type, an Assignment of Deed of Trust by an Individual Mortgage Holder typically involves a written document to ensure legal validity. The assignment document outlines the necessary details, including the names of the assignor (original mortgage holder) and assignee (new mortgage holder), property details, the principal amount of the mortgage, interest rates, and any additional terms agreed upon by the parties. In Eugene, Oregon, these assignments must adhere to the state's specific laws and regulations surrounding mortgages, real estate, and property transfers. It is advisable for all parties involved in an Assignment of Deed of Trust to seek legal advice and consult with professionals to ensure compliance with local laws and to protect their interests. Overall, an Assignment of Deed of Trust by an Individual Mortgage Holder in Eugene, Oregon, is a legal process that allows for the transfer of mortgage rights and interests between parties. By executing an assignment, mortgage holders can effectively transfer their obligations and benefits to a new assignee, facilitating the smooth transfer of property ownership and repayment responsibilities.