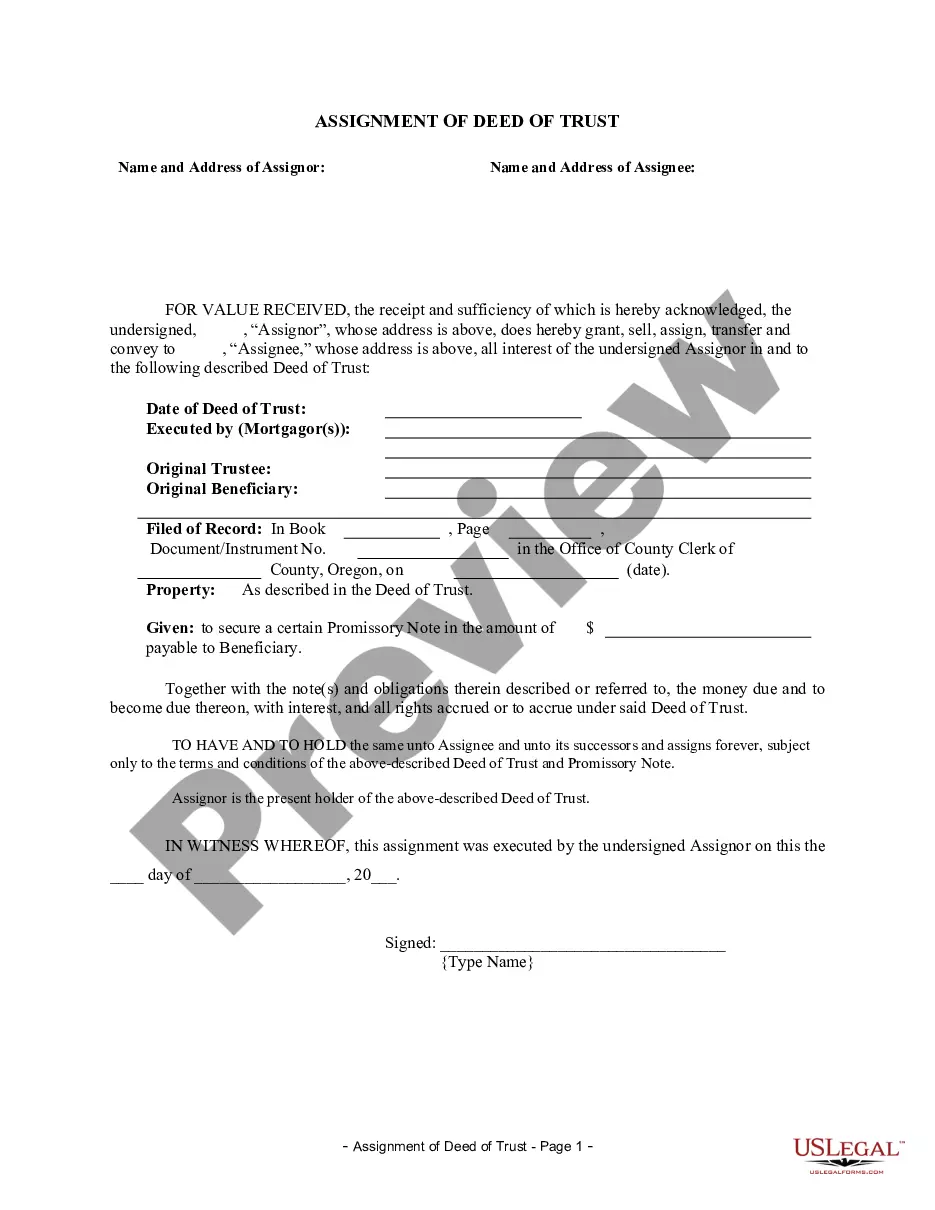

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Portland Oregon Assignment of Deed of Trust by Individual Mortgage Holder

Description

How to fill out Oregon Assignment Of Deed Of Trust By Individual Mortgage Holder?

If you are looking for a legitimate form template, it’s difficult to select a superior platform than the US Legal Forms website – likely the most extensive online libraries.

Here you can discover a vast array of document samples for business and personal purposes categorized by types and states, or keywords.

With our top-notch search feature, finding the latest Portland Oregon Assignment of Deed of Trust by Individual Mortgage Holder is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration steps.

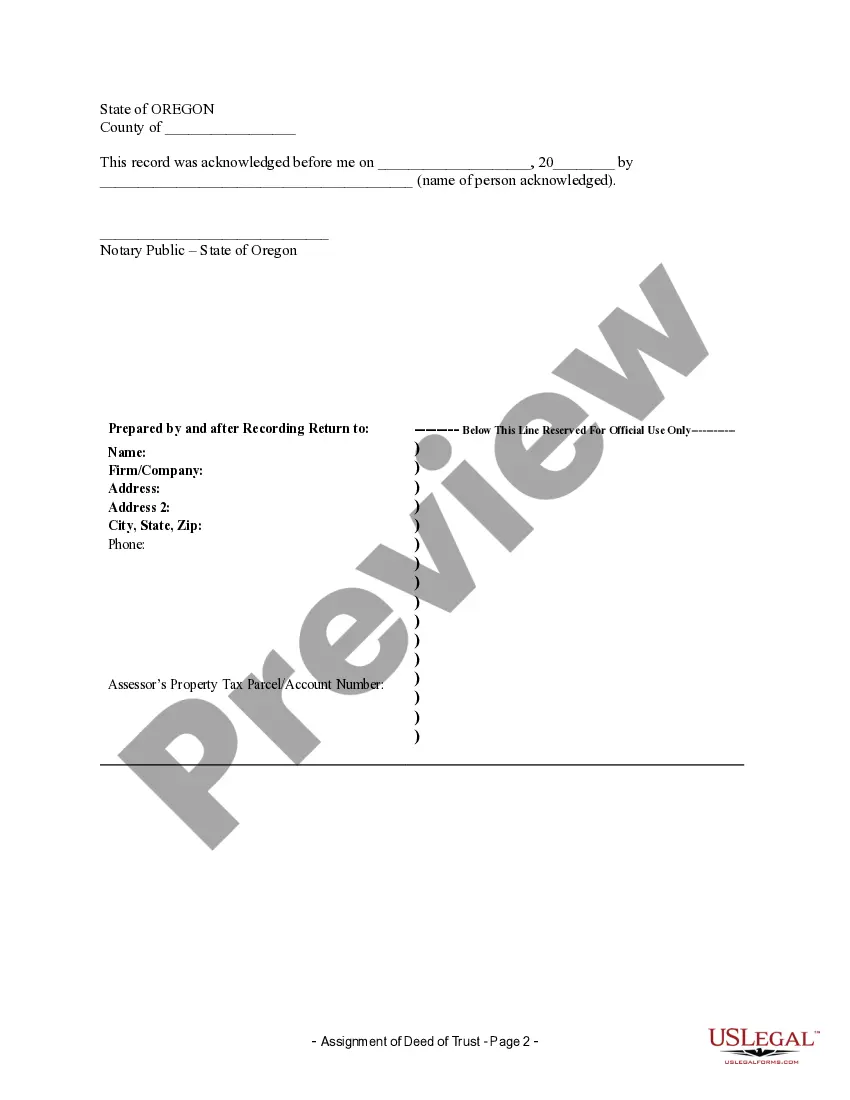

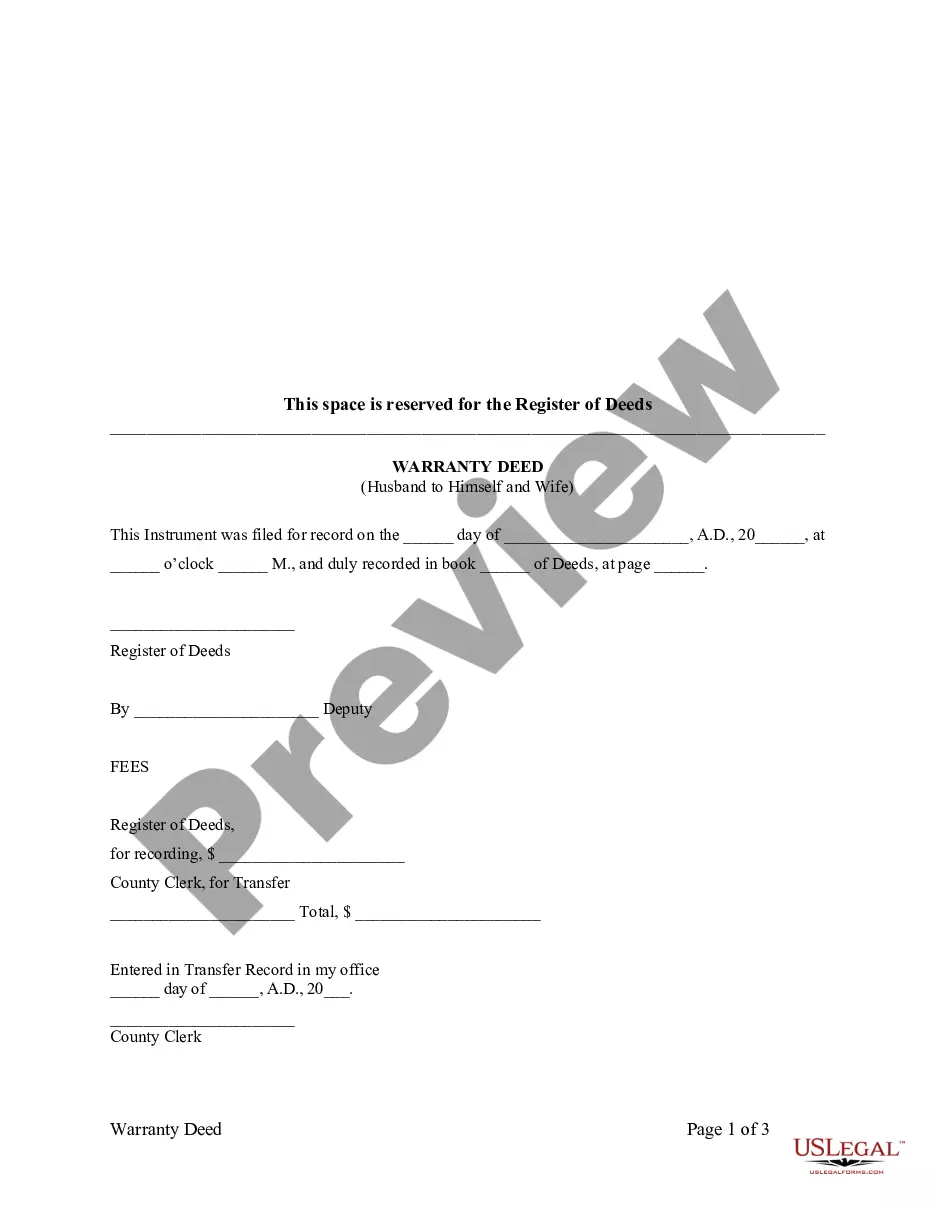

Obtain the form. Choose the file format and download it to your device. Edit the form. Complete, modify, print, and sign the acquired Portland Oregon Assignment of Deed of Trust by Individual Mortgage Holder.

- Additionally, the validity of each document is verified by a team of professional attorneys who regularly evaluate the templates on our site and update them in accordance with the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Portland Oregon Assignment of Deed of Trust by Individual Mortgage Holder is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions detailed below.

- Ensure you have accessed the sample you desire. Review its details and use the Preview function (if available) to check its contents. If it does not meet your requirements, utilize the Search box positioned near the top of the screen to locate the desired record.

- Validate your choice. Click the Buy now button. Following that, select the preferred subscription plan and enter details to create an account.

Form popularity

FAQ

In Florida, an assignment of mortgage: Transfers the assignor's rights under the mortgage to the assignee. Permits the assignee to pursue the same remedies, including foreclosure, as the original lender. Generally retains priority of the mortgage that is assigned for the benefit of the assignee.

An assignee is a person, company, or entity who receives the transfer of property, title, or rights from another according to the terms of a contract. The assignee receives the transfer from the assignor. For example, an assignee may receive the title to a piece of real estate from an assignor.

A mortgage is a legal agreement designed for purchasing homes. In a mortgage, the bank or another creditor lends a borrower money at interest to take the title of the borrower's property....Lien Theory States 2022. StateMortgage TheoryOregonTitleSouth DakotaTitleTennesseeTitleTexasTitle46 more rows

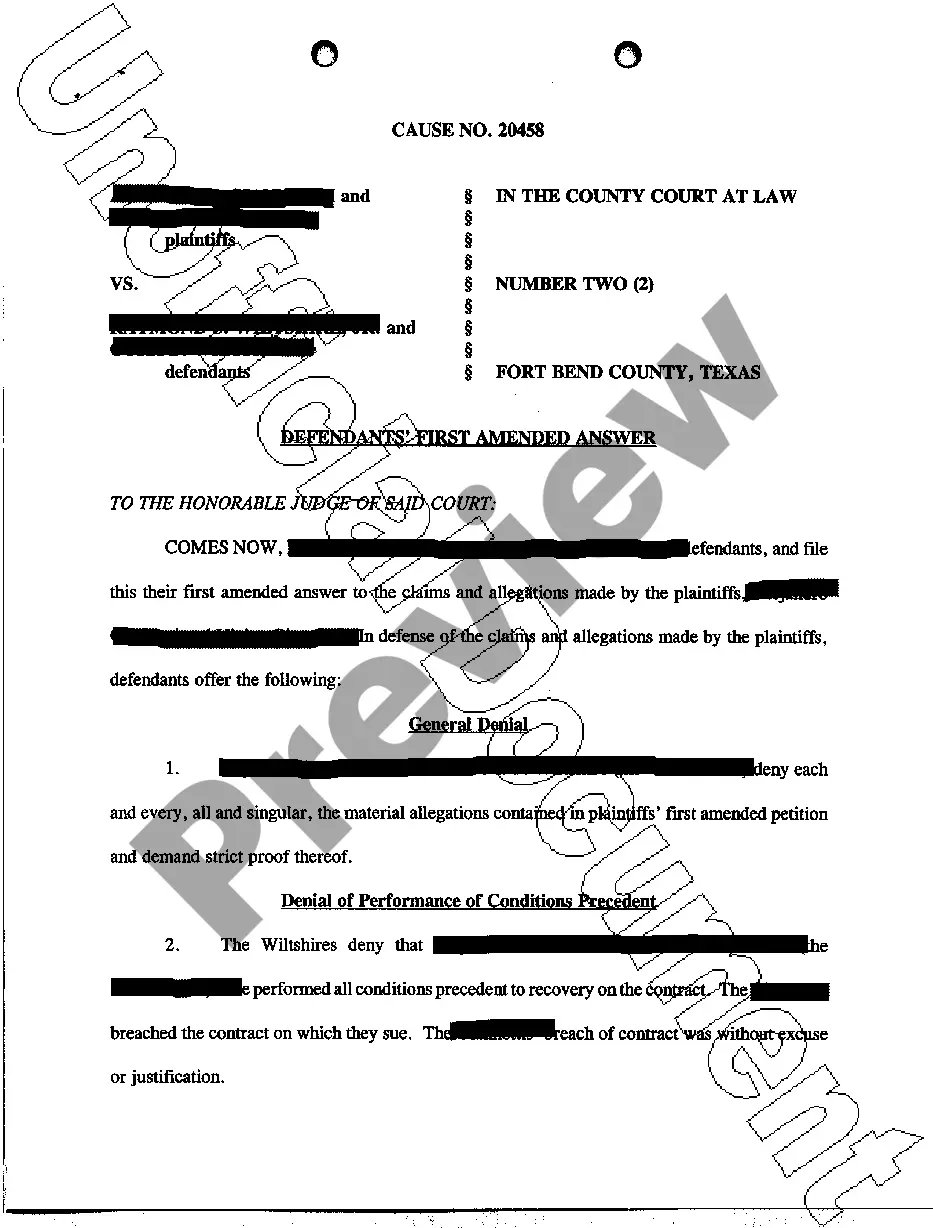

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

Start Deed of Trust StateMortgage allowedDeed of trust allowedOregonYPennsylvaniaYRhode IslandYSouth CarolinaY47 more rows

Both are dictated by state laws. In some states, only a mortgage is legal. In others, lenders can only use a deed of trust. A few states (like Alabama and Michigan) allow both. If your state allows both types of contracts, it's up to your lender to choose which type you receive.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia,