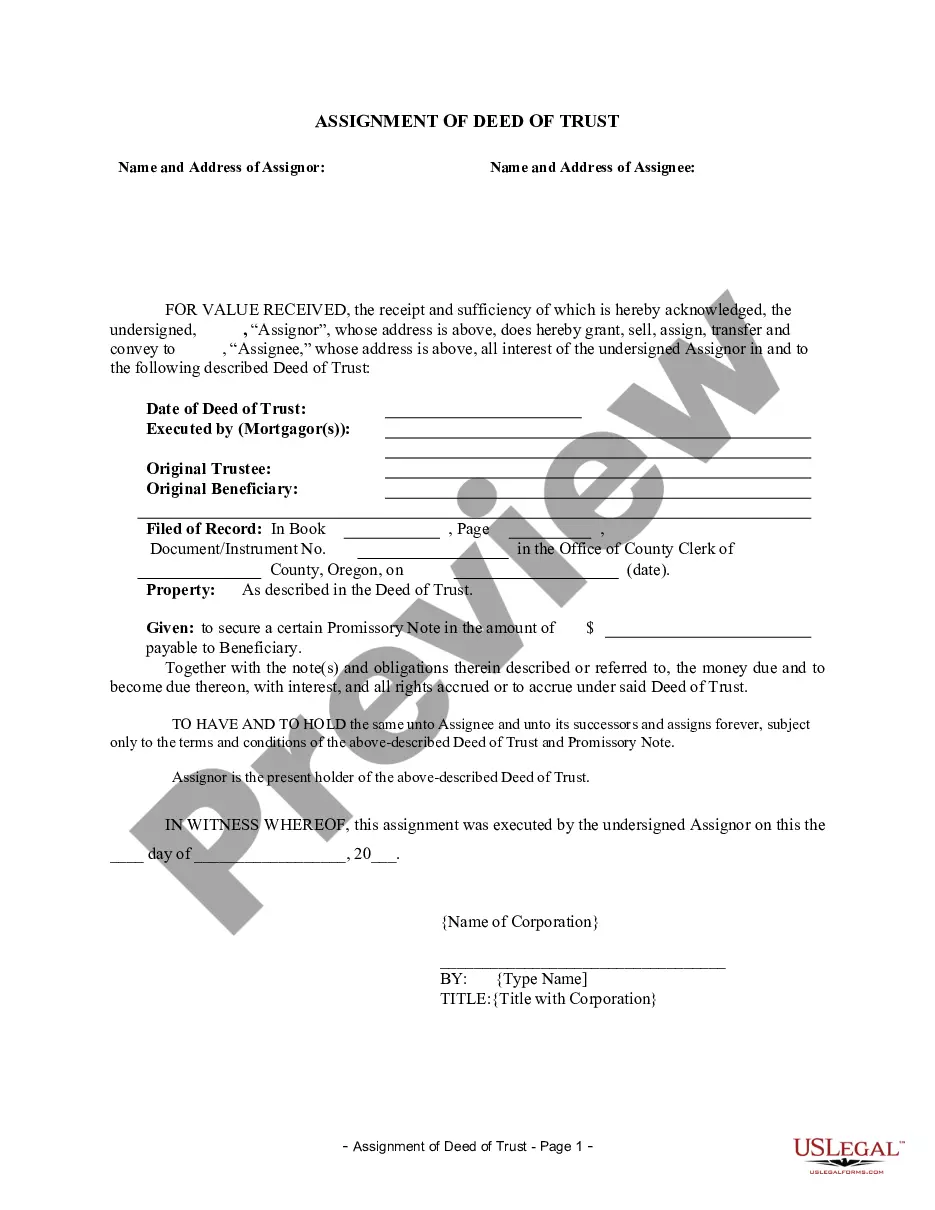

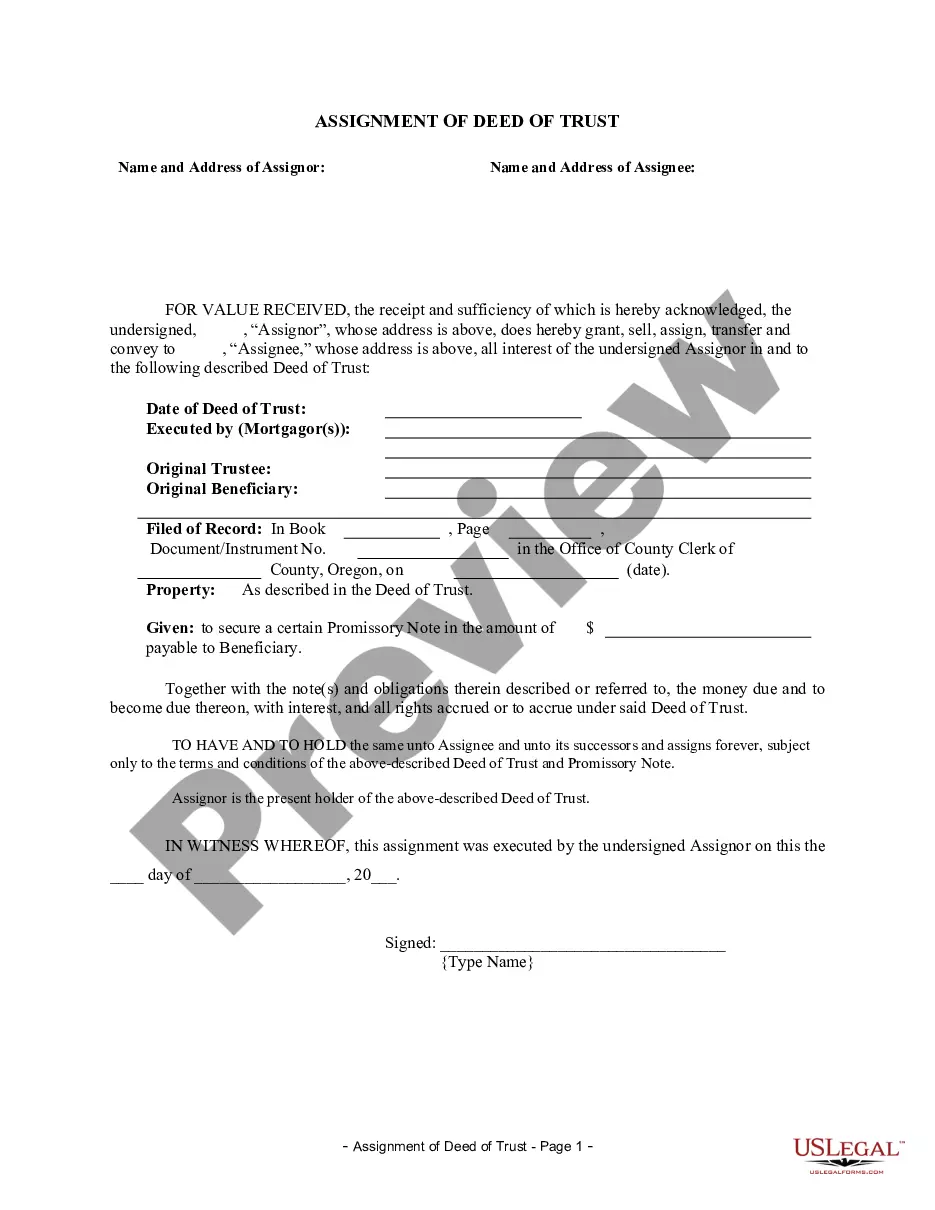

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Title: Understanding Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: In Bend, Oregon, Assignment of Deed of Trust by Corporate Mortgage Holder refers to the legal transfer of a mortgage holder's rights and interests to another entity. This process allows a corporate mortgage holder to assign their rights and obligations to a new party, ensuring the smooth transition of mortgage servicing. This article provides a comprehensive overview of Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder, explaining its importance and a few common types that exist. 1. Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder: The Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder is a legal instrument that formally transfers the mortgage holder's power, benefits, and obligations to another entity. This process typically occurs due to various reasons, including investment strategies, mergers, acquisitions, or changes in servicing arrangements. 2. Importance of Bend Oregon Assignment of Deed of Trust: Assigning a deed of trust can have significant implications for all parties involved, including the corporate mortgage holder, the new lender, and the borrower. This process helps facilitate the proper transfer of mortgage servicing rights, ensuring efficient communication, payment handling, and property title management. It also provides transparency to the borrower, as they are made aware of any changes in their mortgage holder. 3. Types of Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder: a) Partial Assignment: This type of assignment involves transferring only a portion of the mortgage holder's interest to a new entity. It may occur when the original mortgage holder wants to retain some control over the loan while involving a different party for servicing purposes. b) Full Assignment: In this scenario, the entire mortgage holder's interest, including rights, obligations, and benefits, is transferred to a different entity. This type of assignment may happen when a corporate mortgage holder wishes to completely divest itself from a loan or have it serviced by another party. c) Assignment to a Servicing Company: Sometimes, corporate mortgage holders choose to partner with specialized loan servicing companies to manage their portfolios efficiently. This type of assignment ensures that the servicing entity takes over responsibilities such as collecting payments, handling escrow accounts, and managing borrowers' communication. Conclusion: Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder plays a crucial role in the mortgage servicing landscape. It involves the legal transfer of mortgage rights and obligations from one corporate entity to another, promoting efficient loan management and better borrower experience. Whether it be a partial assignment, full assignment, or assignment to a servicing company, understanding this process fosters transparency, ensuring that all parties involved are well-informed about any changes in their mortgage holder.Title: Understanding Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: In Bend, Oregon, Assignment of Deed of Trust by Corporate Mortgage Holder refers to the legal transfer of a mortgage holder's rights and interests to another entity. This process allows a corporate mortgage holder to assign their rights and obligations to a new party, ensuring the smooth transition of mortgage servicing. This article provides a comprehensive overview of Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder, explaining its importance and a few common types that exist. 1. Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder: The Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder is a legal instrument that formally transfers the mortgage holder's power, benefits, and obligations to another entity. This process typically occurs due to various reasons, including investment strategies, mergers, acquisitions, or changes in servicing arrangements. 2. Importance of Bend Oregon Assignment of Deed of Trust: Assigning a deed of trust can have significant implications for all parties involved, including the corporate mortgage holder, the new lender, and the borrower. This process helps facilitate the proper transfer of mortgage servicing rights, ensuring efficient communication, payment handling, and property title management. It also provides transparency to the borrower, as they are made aware of any changes in their mortgage holder. 3. Types of Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder: a) Partial Assignment: This type of assignment involves transferring only a portion of the mortgage holder's interest to a new entity. It may occur when the original mortgage holder wants to retain some control over the loan while involving a different party for servicing purposes. b) Full Assignment: In this scenario, the entire mortgage holder's interest, including rights, obligations, and benefits, is transferred to a different entity. This type of assignment may happen when a corporate mortgage holder wishes to completely divest itself from a loan or have it serviced by another party. c) Assignment to a Servicing Company: Sometimes, corporate mortgage holders choose to partner with specialized loan servicing companies to manage their portfolios efficiently. This type of assignment ensures that the servicing entity takes over responsibilities such as collecting payments, handling escrow accounts, and managing borrowers' communication. Conclusion: Bend Oregon Assignment of Deed of Trust by Corporate Mortgage Holder plays a crucial role in the mortgage servicing landscape. It involves the legal transfer of mortgage rights and obligations from one corporate entity to another, promoting efficient loan management and better borrower experience. Whether it be a partial assignment, full assignment, or assignment to a servicing company, understanding this process fosters transparency, ensuring that all parties involved are well-informed about any changes in their mortgage holder.