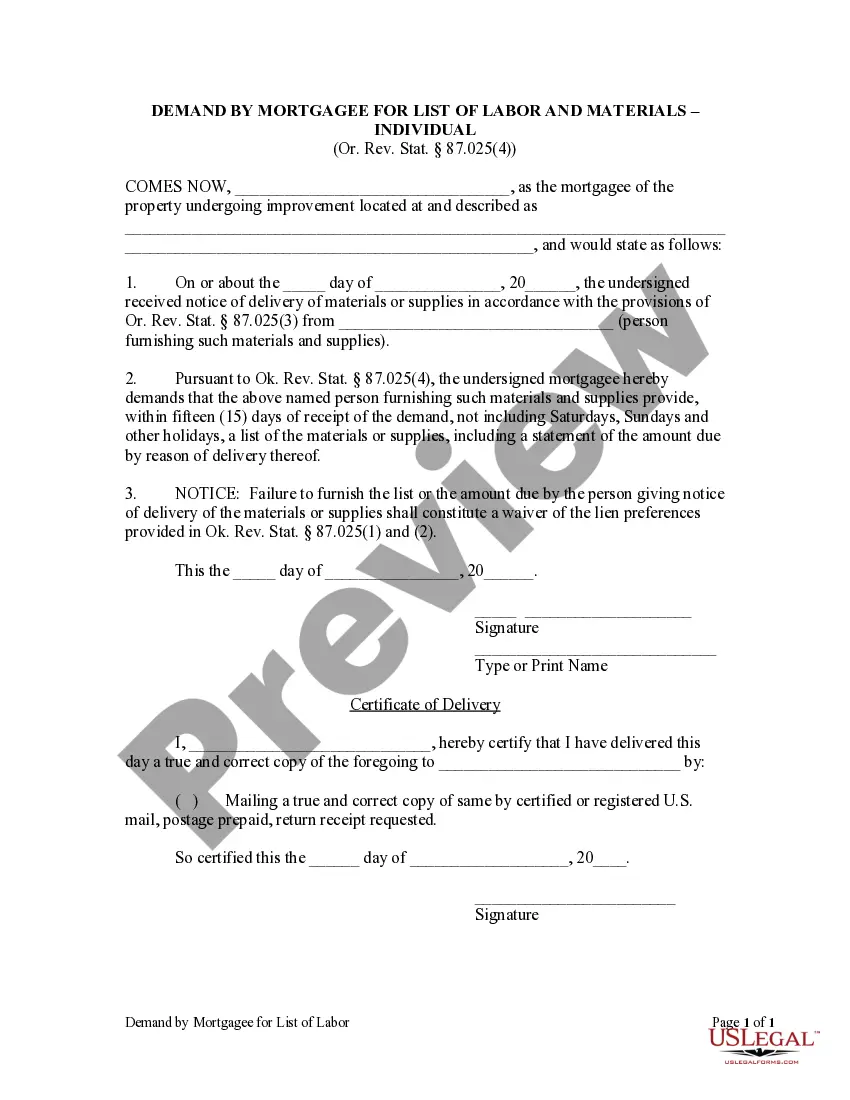

This Demand by Mortgagee For List of Labor and Materials is for use by an individual mortgagee of property undergoing improvements to state that he or she received notice of the delivery of materials or supplies on a particular date and to demand that the person furnishing such materials and supplies provide, within 15 days of receipt of the demand, a list of the materials or supplies, including a statement of the amount due by reason of delivery thereof.

Gresham Oregon Demand by Mortgagee For List of Labor and Materials — Individual Gresham, Oregon, is a city located in Multnomah County and is known for its vibrant community and growing real estate market. When it comes to mortgages, mortgagees play a crucial role in the property ownership process. In certain situations, a mortgagee may issue a demand for a list of labor and materials from an individual. This demand is typically related to the maintenance, repair, or improvement of a property securing the mortgage. There are different types of Gresham Oregon Demand by Mortgagee For List of Labor and Materials — Individual, including: 1. Repairs and Maintenance: In cases where the property securing the mortgage requires repairs or ongoing maintenance, a mortgagee may issue a demand to the individual homeowner for a comprehensive list of labor and materials required. This ensures that the property is kept in good condition, which helps protect the mortgagee's investment. 2. Property Improvement: If the homeowner intends to make significant improvements to the property that could impact its value, the mortgagee may request a detailed list of labor and materials. This helps mortgagees assess the potential increase in property value and ensure that the improvements comply with any applicable regulations. 3. Foreclosure Precaution: A Gresham Oregon Demand by Mortgagee For List of Labor and Materials — Individual may also be issued as a precautionary measure in anticipation of a potential foreclosure. By obtaining an inventory of the labor and materials required for both repairs and maintenance, the mortgagee can accurately estimate the costs associated with the property's upkeep in case it must be taken over due to non-payment. Regardless of the specific type of demand, the purpose is to protect the mortgagee's interests in the property. It allows the mortgagee to have a clear understanding of the work and expenses involved, ensuring transparency and accountability between the mortgagee and the individual homeowner. When receiving such a demand, it is crucial for the individual homeowner to provide a comprehensive and accurate list of labor and materials. This helps establish trust and cooperation between all parties involved in maintaining and preserving the property's value. In conclusion, Gresham Oregon Demand by Mortgagee For List of Labor and Materials — Individual is a process where mortgagees request detailed information about labor and materials needed for repairs, maintenance, or property improvements. This demand can be issued in various scenarios, including routine property upkeep, significant renovations, or even as a precautionary measure before a potential foreclosure. By fulfilling this demand, individuals can promote transparency and protect the interests of both themselves and the mortgagees involved in their property ownership.Gresham Oregon Demand by Mortgagee For List of Labor and Materials — Individual Gresham, Oregon, is a city located in Multnomah County and is known for its vibrant community and growing real estate market. When it comes to mortgages, mortgagees play a crucial role in the property ownership process. In certain situations, a mortgagee may issue a demand for a list of labor and materials from an individual. This demand is typically related to the maintenance, repair, or improvement of a property securing the mortgage. There are different types of Gresham Oregon Demand by Mortgagee For List of Labor and Materials — Individual, including: 1. Repairs and Maintenance: In cases where the property securing the mortgage requires repairs or ongoing maintenance, a mortgagee may issue a demand to the individual homeowner for a comprehensive list of labor and materials required. This ensures that the property is kept in good condition, which helps protect the mortgagee's investment. 2. Property Improvement: If the homeowner intends to make significant improvements to the property that could impact its value, the mortgagee may request a detailed list of labor and materials. This helps mortgagees assess the potential increase in property value and ensure that the improvements comply with any applicable regulations. 3. Foreclosure Precaution: A Gresham Oregon Demand by Mortgagee For List of Labor and Materials — Individual may also be issued as a precautionary measure in anticipation of a potential foreclosure. By obtaining an inventory of the labor and materials required for both repairs and maintenance, the mortgagee can accurately estimate the costs associated with the property's upkeep in case it must be taken over due to non-payment. Regardless of the specific type of demand, the purpose is to protect the mortgagee's interests in the property. It allows the mortgagee to have a clear understanding of the work and expenses involved, ensuring transparency and accountability between the mortgagee and the individual homeowner. When receiving such a demand, it is crucial for the individual homeowner to provide a comprehensive and accurate list of labor and materials. This helps establish trust and cooperation between all parties involved in maintaining and preserving the property's value. In conclusion, Gresham Oregon Demand by Mortgagee For List of Labor and Materials — Individual is a process where mortgagees request detailed information about labor and materials needed for repairs, maintenance, or property improvements. This demand can be issued in various scenarios, including routine property upkeep, significant renovations, or even as a precautionary measure before a potential foreclosure. By fulfilling this demand, individuals can promote transparency and protect the interests of both themselves and the mortgagees involved in their property ownership.