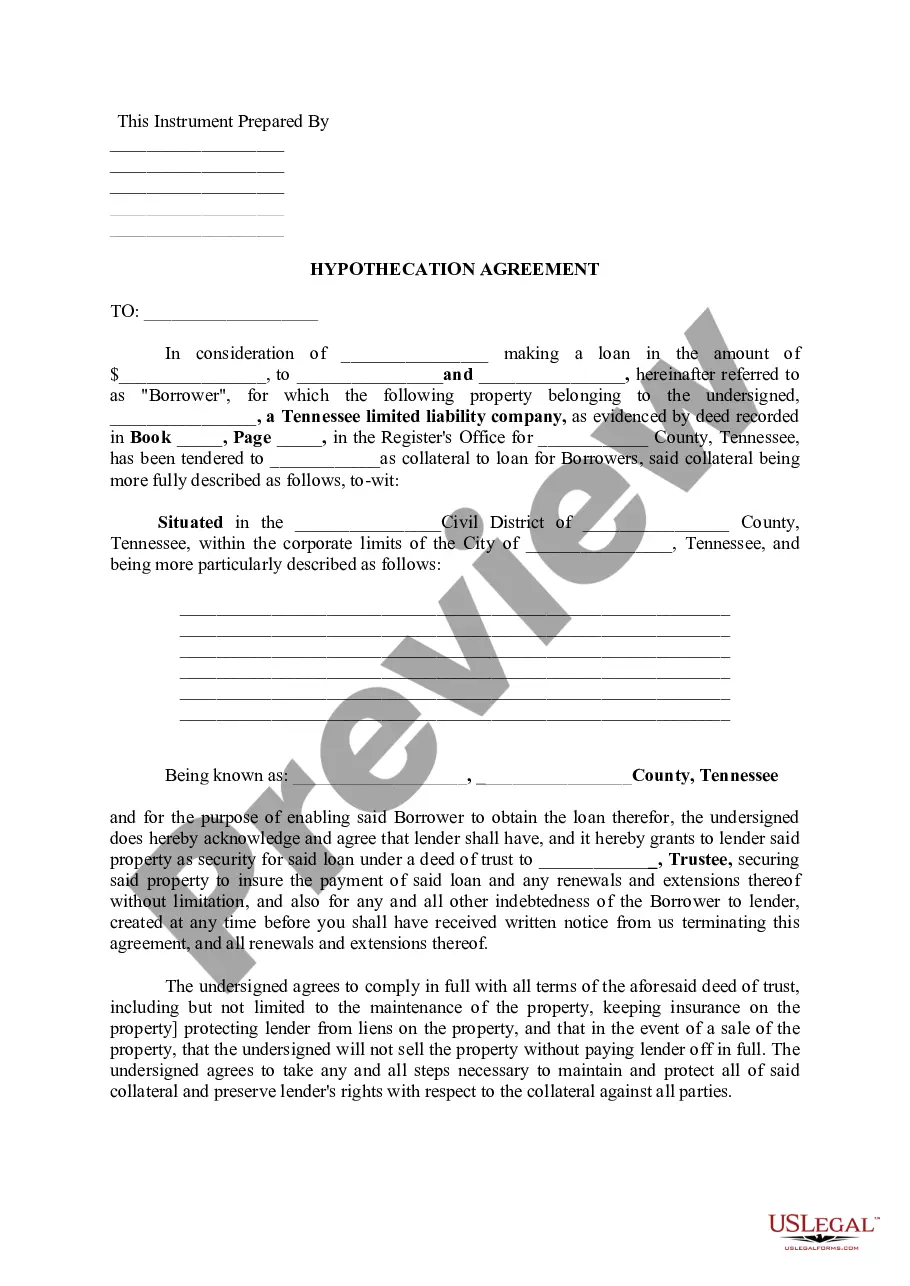

Hillsboro Oregon Report of Gross Annual Income is a vital document that assists individuals in accurately declaring their total yearly earnings to the concerned authorities. By submitting this report, residents of Hillsboro, Oregon can ensure compliance with tax regulations and contribute to the progress of their community. The Hillsboro Oregon Report of Gross Annual Income encompasses various aspects related to an individual's income. It classifies earnings from diverse sources, such as employment, self-employment, rental properties, investments, and any other income-generating activities. This comprehensive report aids in assessing an individual's financial situation while determining tax liabilities and eligibility for certain government programs. Understanding the variety of income sources, the Hillsboro Oregon Report of Gross Annual Income covers the following types: 1. Employment Income Report: This section captures income received from salary, wages, bonuses, tips, commissions, and any other compensation related to employment. It is crucial to report income accurately to reflect both earned and taxable amounts. 2. Self-Employment Income Report: If individuals work independently or operate their businesses, they need to provide a detailed breakdown of their self-employment earnings. This includes income from freelancing, consulting, sole proprietorship, partnerships, or any other form of self-employment. 3. Rental Income Report: Individuals who own rental properties within Hillsboro, Oregon, must furnish information about the income generated from those properties. This would include rental payments received, security deposits, and any additional revenue obtained from the rented property. 4. Investment Income Report: This section deals with income generated from investments, such as dividends, interest, capital gains, or any other earnings obtained from stocks, bonds, mutual funds, or real estate holdings. 5. Other Income Sources Report: To ensure comprehensive reporting, this category covers all income sources that might not fit into the previously mentioned sections. It includes but is not limited to income from royalties, lottery winnings, inheritances, pensions, alimony, and social security benefits. Accurately reporting these different types of income in the Hillsboro Oregon Report of Gross Annual Income allows individuals to fulfill their tax obligations appropriately and remain in compliance with local regulations. It is essential to provide precise and detailed information to facilitate accurate tax assessments and contribute to the continued development of the vibrant community of Hillsboro, Oregon.

Hillsboro Oregon Report of Gross Annual Income

Description

How to fill out Hillsboro Oregon Report Of Gross Annual Income?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Hillsboro Oregon Report of Gross Annual Income becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Hillsboro Oregon Report of Gross Annual Income takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Hillsboro Oregon Report of Gross Annual Income. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!