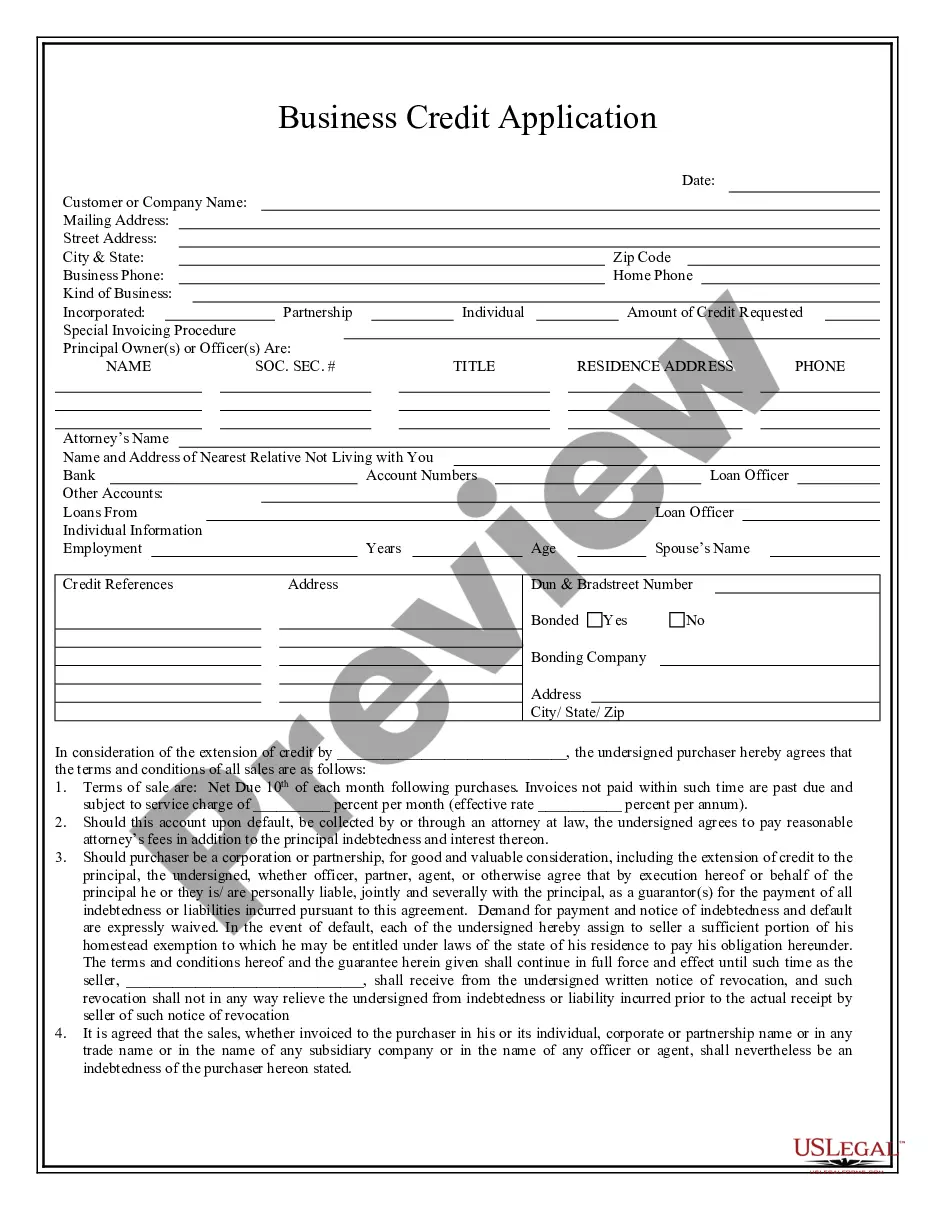

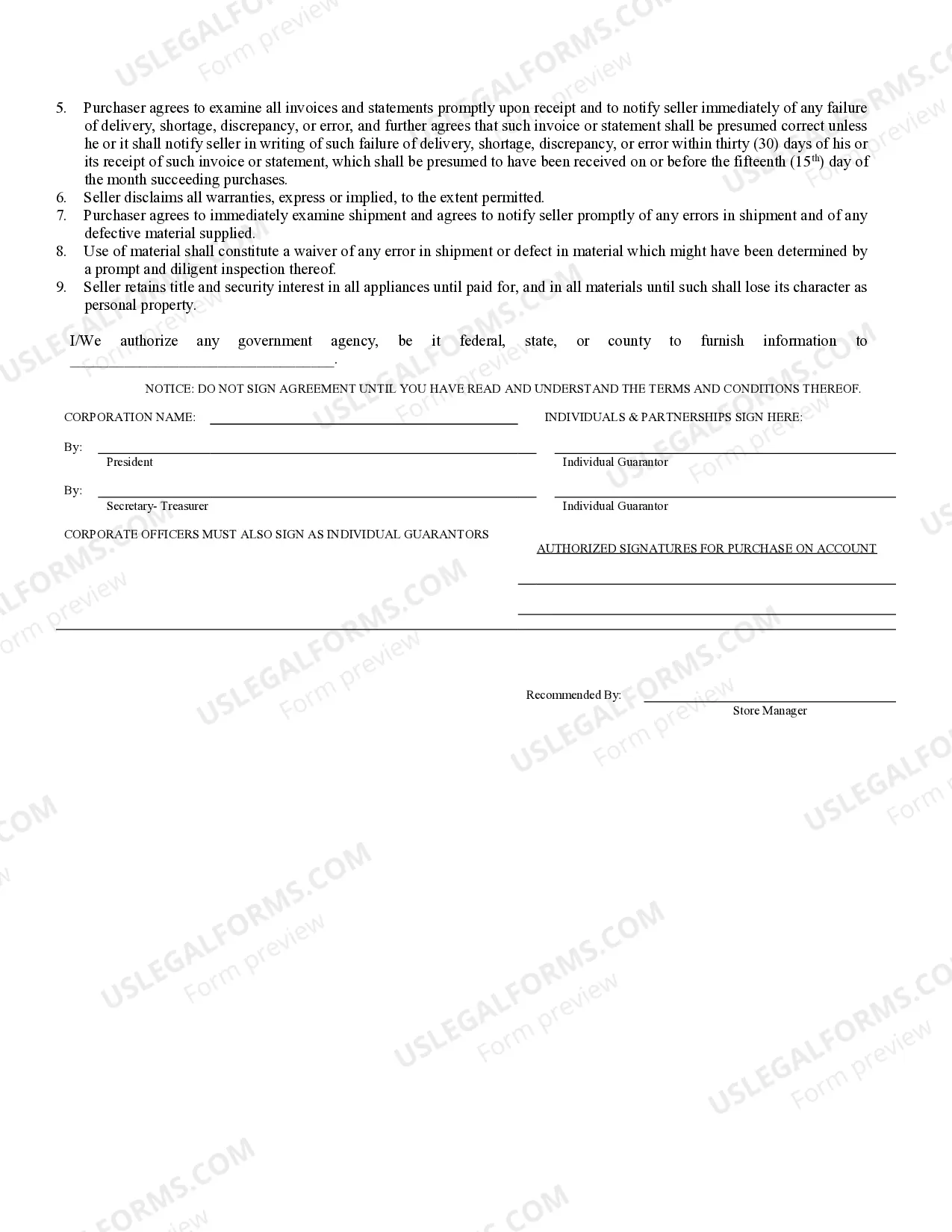

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Gresham, Oregon Business Credit Application is a formal document that local businesses in Gresham, Oregon can use to apply for credit services provided by financial institutions, lenders, or vendors. This application serves as a crucial step in establishing a credit relationship, enabling businesses to access capital for various purposes such as expanding operations, purchasing inventory, or meeting short-term financial needs. The Gresham, Oregon Business Credit Application collects essential information about the business, its owners, financial history, and creditworthiness. Required details typically include the business's legal name, address, contact information, Social Security Numbers or Employer Identification Numbers (EIN) of owners, nature of the business, years in operation, annual revenue, and number of employees. Additionally, the application may ask for bank account details, tax identification numbers, and financial statements to assess the applicant's financial health. Keywords: Gresham, Oregon, business, credit application, formal document, local businesses, credit services, financial institutions, lenders, vendors, establishing, credit relationship, access capital, expanding operations, purchasing inventory, short-term financial needs, owners, financial history, creditworthiness, legal name, address, contact information, Social Security Numbers, Employer Identification Numbers, nature of business, years in operation, annual revenue, number of employees, bank account details, tax identification numbers, financial statements, financial health. There may be various types of Gresham, Oregon Business Credit Applications, catering to different credit needs and preferences. Some types may include: 1. Small Business Credit Application: Specifically designed for startups, small businesses, or sole proprietors seeking to establish credit and access financial resources. 2. Trade Credit Application: Geared towards businesses looking for credit from specific vendors or suppliers, allowing them to purchase goods or services on credit terms. 3. Line of Credit Application: For businesses requiring a pre-approved credit limit to draw upon as needed, providing flexibility in managing fluctuations in cash flow or unforeseen expenses. 4. Term Loan Application: Suited for businesses seeking a fixed amount of credit to fund larger investments or long-term projects with specified repayment terms. 5. Business Credit Card Application: Tailored for businesses interested in obtaining a credit card for making purchases, tracking expenses, and building credit history. These different types of Gresham, Oregon Business Credit Applications cater to the diverse needs of local businesses, ensuring they can access the appropriate credit services that align with their specific requirements.Gresham, Oregon Business Credit Application is a formal document that local businesses in Gresham, Oregon can use to apply for credit services provided by financial institutions, lenders, or vendors. This application serves as a crucial step in establishing a credit relationship, enabling businesses to access capital for various purposes such as expanding operations, purchasing inventory, or meeting short-term financial needs. The Gresham, Oregon Business Credit Application collects essential information about the business, its owners, financial history, and creditworthiness. Required details typically include the business's legal name, address, contact information, Social Security Numbers or Employer Identification Numbers (EIN) of owners, nature of the business, years in operation, annual revenue, and number of employees. Additionally, the application may ask for bank account details, tax identification numbers, and financial statements to assess the applicant's financial health. Keywords: Gresham, Oregon, business, credit application, formal document, local businesses, credit services, financial institutions, lenders, vendors, establishing, credit relationship, access capital, expanding operations, purchasing inventory, short-term financial needs, owners, financial history, creditworthiness, legal name, address, contact information, Social Security Numbers, Employer Identification Numbers, nature of business, years in operation, annual revenue, number of employees, bank account details, tax identification numbers, financial statements, financial health. There may be various types of Gresham, Oregon Business Credit Applications, catering to different credit needs and preferences. Some types may include: 1. Small Business Credit Application: Specifically designed for startups, small businesses, or sole proprietors seeking to establish credit and access financial resources. 2. Trade Credit Application: Geared towards businesses looking for credit from specific vendors or suppliers, allowing them to purchase goods or services on credit terms. 3. Line of Credit Application: For businesses requiring a pre-approved credit limit to draw upon as needed, providing flexibility in managing fluctuations in cash flow or unforeseen expenses. 4. Term Loan Application: Suited for businesses seeking a fixed amount of credit to fund larger investments or long-term projects with specified repayment terms. 5. Business Credit Card Application: Tailored for businesses interested in obtaining a credit card for making purchases, tracking expenses, and building credit history. These different types of Gresham, Oregon Business Credit Applications cater to the diverse needs of local businesses, ensuring they can access the appropriate credit services that align with their specific requirements.