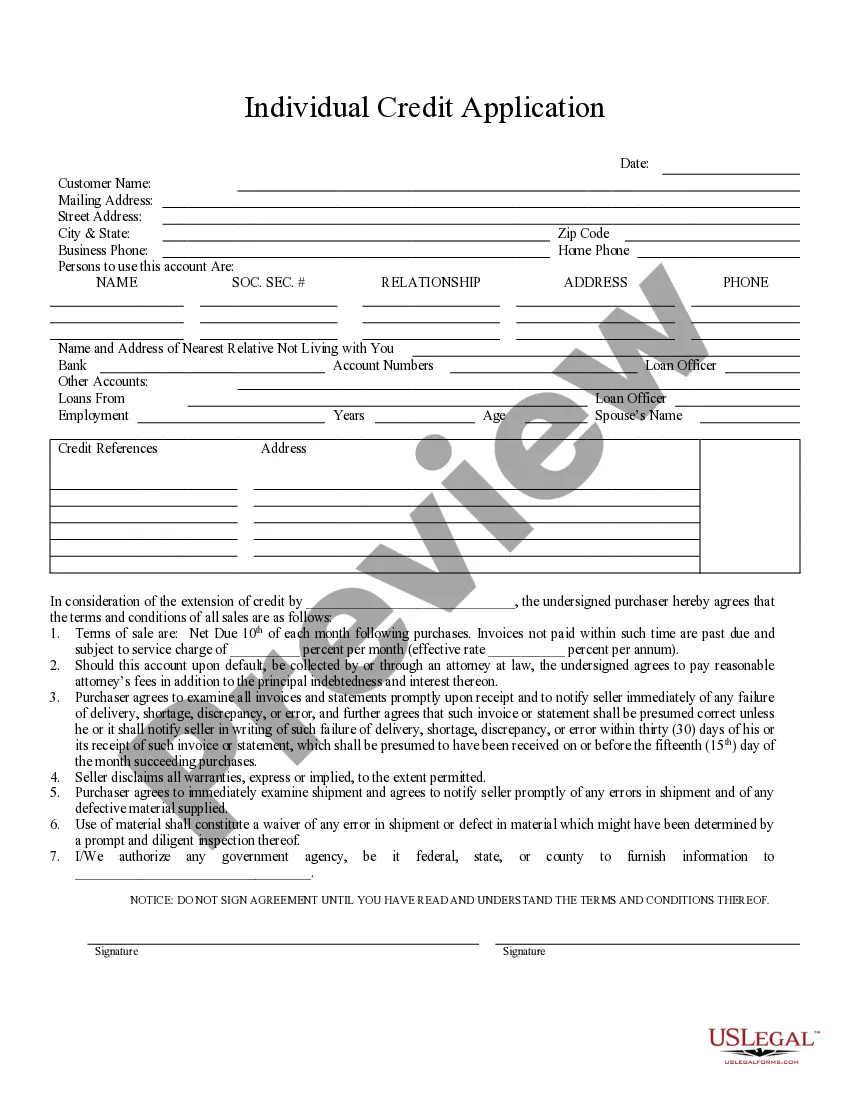

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Bend Oregon Individual Credit Application is a comprehensive document used by individuals residing in or around Bend, Oregon, to apply for credit from various financial institutions, such as banks, credit unions, or lenders. This credit application serves as a formal request to obtain credit facilities, including loans, credit cards, or other forms of credit. The Bend Oregon Individual Credit Application captures crucial personal and financial information required by creditors to assess an applicant's creditworthiness. The application form typically includes fields for relevant details such as the applicant's full name, contact information (address, phone number, email), social security number, date of birth, and information about their employment, income, and current financial obligations. Additionally, the Bend Oregon Individual Credit Application may also require disclosure of an applicant's banking information, such as account numbers and balances, to provide a comprehensive view of their financial situation. This data aids financial institutions in evaluating an individual's repayment capacity. To ensure a thorough evaluation, the Bend Oregon Individual Credit Application often calls for information on the purpose of the credit, whether it be for financing a home, a vehicle purchase, educational expenses, or other personal needs. The applicant may also need to specify the desired loan amount or credit limit they are seeking. It is important to note that there may be different types of Bend Oregon Individual Credit Applications available, depending on the specific financial institution or type of credit being sought. For instance, there might be separate application forms for mortgage loans, auto loans, personal loans, or credit cards. These specialized applications often request additional information pertinent to the respective type of credit, such as property details for mortgage loans or vehicle specifications for auto loans. By accurately completing the Bend Oregon Individual Credit Application with the relevant information and supporting documents, applicants increase their chances of securing credit approvals with favorable terms and conditions. The application's thoroughness and completeness play a crucial role in enabling financial institutions to make informed decisions and extend credit responsibly.

Bend Oregon Individual Credit Application is a comprehensive document used by individuals residing in or around Bend, Oregon, to apply for credit from various financial institutions, such as banks, credit unions, or lenders. This credit application serves as a formal request to obtain credit facilities, including loans, credit cards, or other forms of credit. The Bend Oregon Individual Credit Application captures crucial personal and financial information required by creditors to assess an applicant's creditworthiness. The application form typically includes fields for relevant details such as the applicant's full name, contact information (address, phone number, email), social security number, date of birth, and information about their employment, income, and current financial obligations. Additionally, the Bend Oregon Individual Credit Application may also require disclosure of an applicant's banking information, such as account numbers and balances, to provide a comprehensive view of their financial situation. This data aids financial institutions in evaluating an individual's repayment capacity. To ensure a thorough evaluation, the Bend Oregon Individual Credit Application often calls for information on the purpose of the credit, whether it be for financing a home, a vehicle purchase, educational expenses, or other personal needs. The applicant may also need to specify the desired loan amount or credit limit they are seeking. It is important to note that there may be different types of Bend Oregon Individual Credit Applications available, depending on the specific financial institution or type of credit being sought. For instance, there might be separate application forms for mortgage loans, auto loans, personal loans, or credit cards. These specialized applications often request additional information pertinent to the respective type of credit, such as property details for mortgage loans or vehicle specifications for auto loans. By accurately completing the Bend Oregon Individual Credit Application with the relevant information and supporting documents, applicants increase their chances of securing credit approvals with favorable terms and conditions. The application's thoroughness and completeness play a crucial role in enabling financial institutions to make informed decisions and extend credit responsibly.