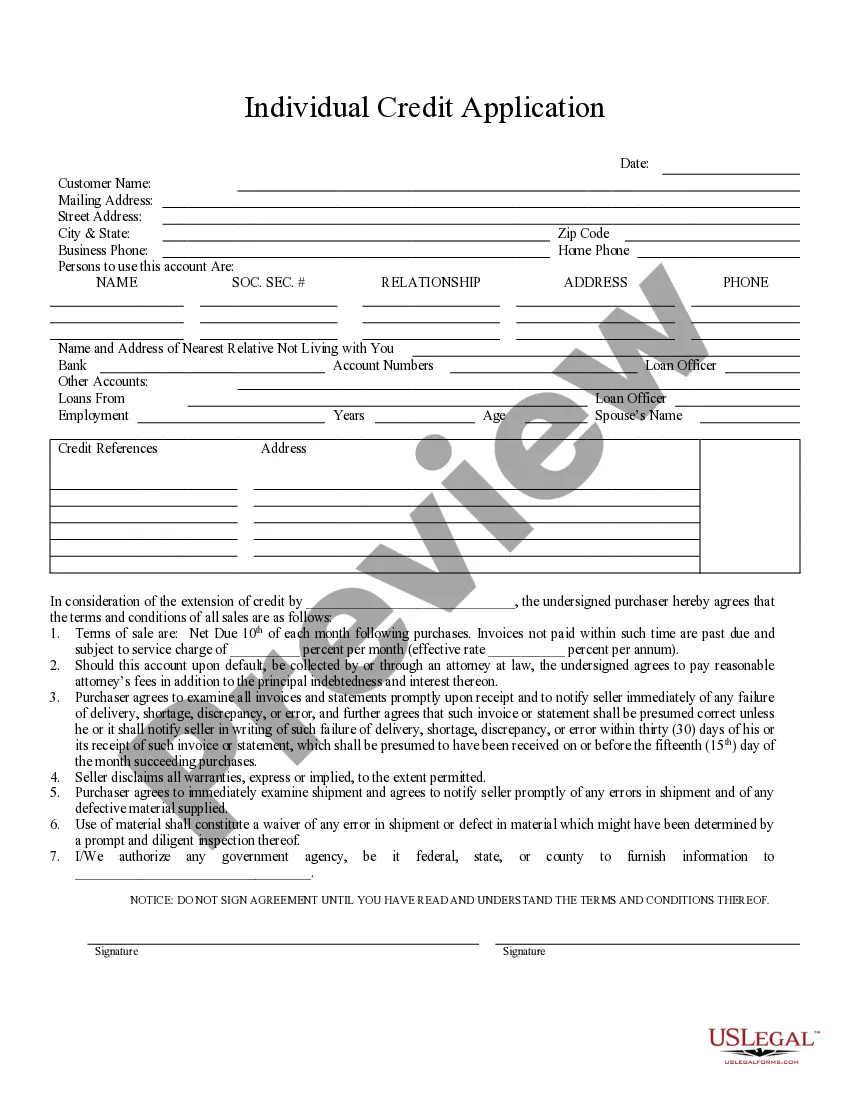

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Gresham, Oregon Individual Credit Application is a formal document that individuals residing in Gresham, Oregon, can use to apply for credit from financial institutions or lenders within the city. This application allows individuals to request loans, credit cards, or other credit-based services by providing their personal and financial details. The Gresham, Oregon Individual Credit Application typically includes important information such as the applicant's full name, residential address, contact details, social security number, date of birth, employment status, current income, and previous credit history. These details are crucial for lenders to assess an individual's creditworthiness and determine their eligibility for various credit offerings. Additionally, individuals may have the option to specify the purpose of the credit they are applying for. Whether it is for home improvement, purchasing a vehicle, education, or any other specific need, mentioning the purpose in the application can help lenders provide tailored credit options that best suit the individual's requirements. Moreover, Gresham, Oregon may have different types of Individual Credit Applications depending on the specific credit products being applied for. Some common types may include: 1. Personal Loan Application: This application is utilized when individuals seek credit in the form of a fixed amount of money to meet personal expenses, consolidate debt, or handle emergencies. 2. Credit Card Application: This type of application is used when individuals wish to obtain a credit card that allows them to make purchases on credit, with a predefined credit limit and interest rates. 3. Mortgage Loan Application: Individuals interested in purchasing a property or refinancing an existing mortgage can utilize this application to request a housing loan. Such loans often have longer repayment terms and involve specific requirements like property appraisals. 4. Auto Loan Application: This application is designed for individuals seeking credit for purchasing a vehicle. Lenders evaluate factors such as the vehicle's value, individual's income, and credit history to determine loan terms and interest rates. 5. Student Loan Application: Those pursuing higher education can use this application to seek financial assistance for tuition fees, books, and other educational expenses. Student loans often provide lower interest rates compared to other forms of credit. In conclusion, the Gresham, Oregon Individual Credit Application is a comprehensive form that allows individuals to apply for credit-based services in Gresham, Oregon. Different types of applications cater to specific credit needs, including personal loans, credit cards, mortgage loans, auto loans, and student loans. Providing accurate and complete information in these applications increases the chances of obtaining credit approval from financial institutions or lenders.